The relationship between the euro and the US dollar is one of the most closely watched in global finance. Whether you’re planning a European vacation, investing in international markets, or simply curious about global economics, understanding the euro to dollar exchange rate is essential. Today, we’ll delve into the dynamics of this crucial currency pair, exploring not just the answer to “what is 19 Euros In Dollars?” but also the factors that influence its value and how events like global pandemics can cause significant shifts.

Let’s start with the most immediate question: How much is 19 euros worth in US dollars right now?

As currency exchange rates are constantly fluctuating, the exact dollar amount for 19 euros changes in real-time. To find the most up-to-date conversion, you can use a reliable online currency converter. Simply enter “EUR” as the source currency, “USD” as the target currency, and “19” as the amount. This will give you the current value of 19 euros in dollars based on the latest exchange rates.

Why Does the Euro to Dollar Exchange Rate Matter?

The EUR/USD exchange rate is more than just a number for travelers. It’s a critical indicator of the economic health of both the Eurozone and the United States, and it reflects a complex interplay of economic forces. Understanding these forces can provide valuable insights into global financial markets and the broader economic landscape.

Factors That Influence the EUR/USD Exchange Rate

Several key factors drive the fluctuations in the euro to dollar exchange rate. These can be broadly categorized into:

- Economic Indicators: The relative economic performance of the Eurozone and the US plays a significant role. Indicators like GDP growth, inflation rates, employment figures, and trade balances can all influence currency values. For example, if the US economy is perceived as stronger than the Eurozone economy, the dollar may strengthen against the euro.

- Interest Rates: Central banks, like the European Central Bank (ECB) and the US Federal Reserve (FED), set interest rates to manage inflation and stimulate economic growth. Higher interest rates in a country can attract foreign investment, increasing demand for its currency and potentially strengthening its exchange rate.

- Geopolitical Events: Political instability, major elections, trade disputes, and global events can create volatility in currency markets. Uncertainty often leads investors to seek “safe-haven” currencies, impacting exchange rates.

- Market Sentiment: Speculation and investor sentiment can also drive short-term exchange rate movements. News, rumors, and shifts in market confidence can all contribute to fluctuations.

The Impact of Global Events: A Look at the COVID-19 Pandemic

Recent history has shown us just how profoundly global events can impact currency exchange rates. The COVID-19 pandemic, for example, introduced unprecedented levels of economic uncertainty and volatility into financial markets worldwide.

COVID-19 Impact on Global Economy

COVID-19 Impact on Global Economy

The pandemic led to widespread lockdowns, disruptions to global trade, and significant shifts in financial markets. These events had a direct and measurable impact on the dynamics of the euro to dollar exchange rate. Research has shown that the pandemic significantly altered the factors that typically determine the EUR/USD rate and increased market volatility.

Shifting Determinants of the EUR/USD Rate During Crisis

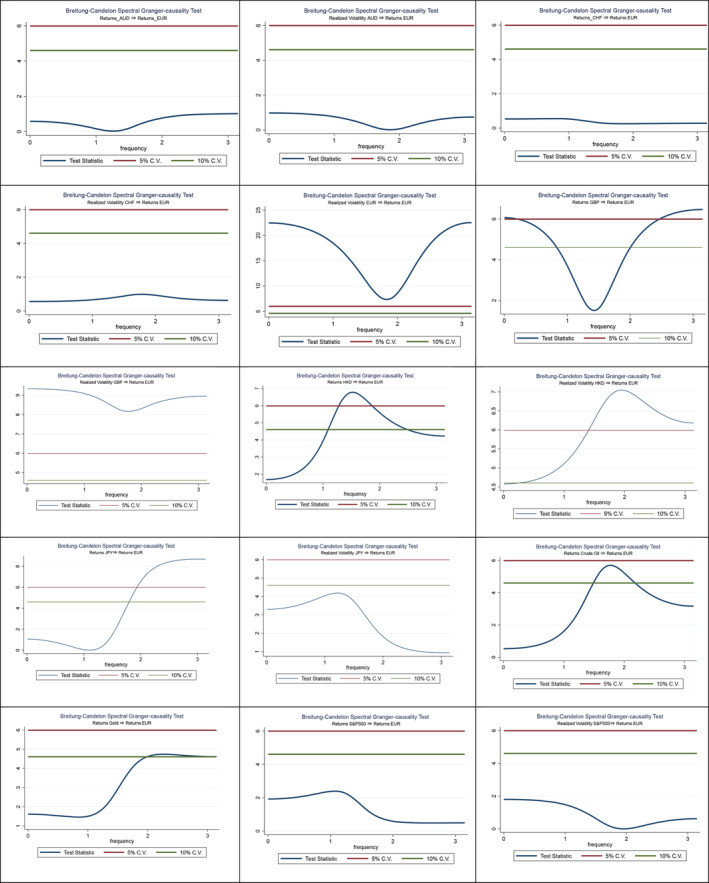

Before the pandemic, the euro to dollar exchange rate was influenced by a specific set of factors. Analysis reveals that these included the realized volatility of the euro itself, the British pound, and the Hong Kong dollar, along with the returns on the Hong Kong dollar, Japanese yen, British pound, crude oil, and gold.

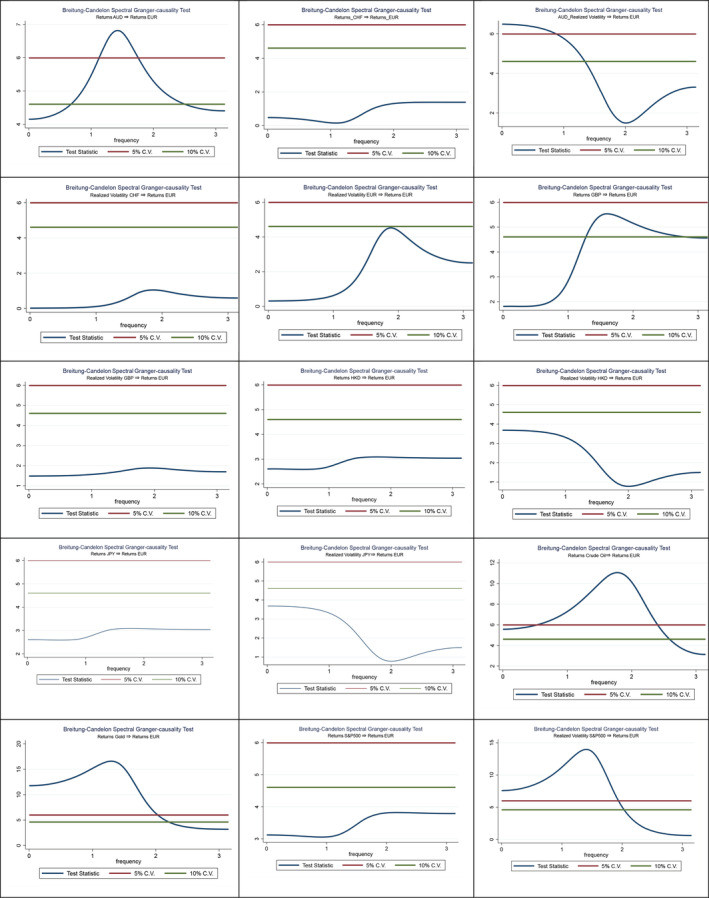

However, the COVID-19 era brought about a notable shift. The determinants of the EUR/USD exchange rate changed, with new factors becoming more influential. During the pandemic, the realized volatility of the Australian dollar and the S&P 500 stock market index, as well as the returns on the British pound, crude oil, and gold, became key drivers of the euro to dollar exchange rate.

Euro to Dollar Exchange Rate Volatility

Euro to Dollar Exchange Rate Volatility

This shift highlights how global crises can reshape the relationships between currencies and other financial assets. For instance, the increased influence of the S&P 500 volatility suggests a heightened sensitivity to overall market risk and investor sentiment during times of crisis. Similarly, the stronger impact of gold and crude oil – often seen as safe-haven assets or indicators of economic health – reflects the risk-averse behavior of investors during the pandemic.

Increased Volatility and Regime Shifts

Beyond changing the key determinants, the pandemic also led to a significant increase in the volatility of the EUR/USD exchange rate. Statistical models reveal a clear shift in the volatility regime. The duration of high volatility periods in the EUR/USD market effectively doubled during the COVID-19 pandemic compared to the pre-pandemic period. Furthermore, the intensity of volatility during these high volatility states was also significantly higher.

This increased volatility has practical implications for businesses and individuals involved in international transactions. It means greater uncertainty and risk when converting euros to dollars or vice versa, requiring more careful risk management strategies.

Practical Implications and Risk Management

For businesses engaged in international trade or investments involving the Eurozone and the United States, understanding the volatility of the EUR/USD exchange rate is crucial. Companies often use strategies like foreign exchange hedging to mitigate the risks associated with currency fluctuations. These strategies become even more critical during periods of high volatility like those experienced during the pandemic.

Conclusion: Staying Informed About EUR/USD

So, while the answer to “what is 19 euros in dollars?” is a constantly updating figure readily available through currency converters, the story behind that number is much more complex and fascinating. The EUR/USD exchange rate is a dynamic indicator influenced by a multitude of economic, political, and global factors. Events like the COVID-19 pandemic can cause significant shifts in its behavior, underscoring the importance of staying informed about these ever-changing currency dynamics.

Whether you are a traveler, investor, or simply someone interested in the global economy, keeping an eye on the euro to dollar exchange rate and the factors that influence it can provide valuable insights into the interconnected world we live in.