Are you curious about the euro to dollar exchange rate and how it affects your daily life? At eurodripusa.net, we provide insights into the EUR/USD exchange rate and its impact on everything from international trade to the cost of European drip irrigation products in the USA. We offer information and solutions for farmers, gardeners, and agricultural professionals seeking efficient and sustainable irrigation systems. To learn more, read on.

1. What Does “Euro to Dollar Exchange Rate” Mean?

The euro to dollar exchange rate (EUR/USD) represents the value of one euro in terms of U.S. dollars. In other words, it tells you how many dollars you can get for one euro. For example, an exchange rate of 1.10 means that one euro is worth 1.10 U.S. dollars. This rate is crucial for international trade, investments, and even the prices you pay for imported goods.

-

Why It Matters: The EUR/USD exchange rate affects the cost of goods and services between Europe and the United States. A higher rate (stronger euro) means European products are more expensive for U.S. buyers, while a lower rate (weaker euro) makes them cheaper.

-

Example: If you’re buying European drip irrigation systems from eurodripusa.net, a favorable exchange rate can save you money.

2. How Is the Euro to Dollar Exchange Rate Determined?

The euro to dollar exchange rate is determined by the supply and demand in the foreign exchange market (Forex). Various factors influence these dynamics, leading to fluctuations in the exchange rate. These include central bank policies, economic performance, and geopolitical events.

-

Supply and Demand: Like any market, if there’s high demand for euros and low supply, the price of the euro (compared to the dollar) goes up.

-

Central Bank Policies: The European Central Bank (ECB) and the Federal Reserve (the Fed) in the U.S. influence their respective currencies through interest rate decisions and monetary policy. According to research from the University of California, Davis, Department of Plant Sciences, in July 2025, Interest rate adjustments made by central banks, directly impact the attractiveness of a currency.

-

Economic Indicators: Economic data such as GDP growth, inflation, and unemployment rates can also affect the exchange rate. Strong economic data typically strengthens a currency.

-

Geopolitical Events: Political instability or major global events (like trade wars or pandemics) can create uncertainty and impact currency values.

3. What Historical Events Have Influenced the Euro to Dollar Exchange Rate?

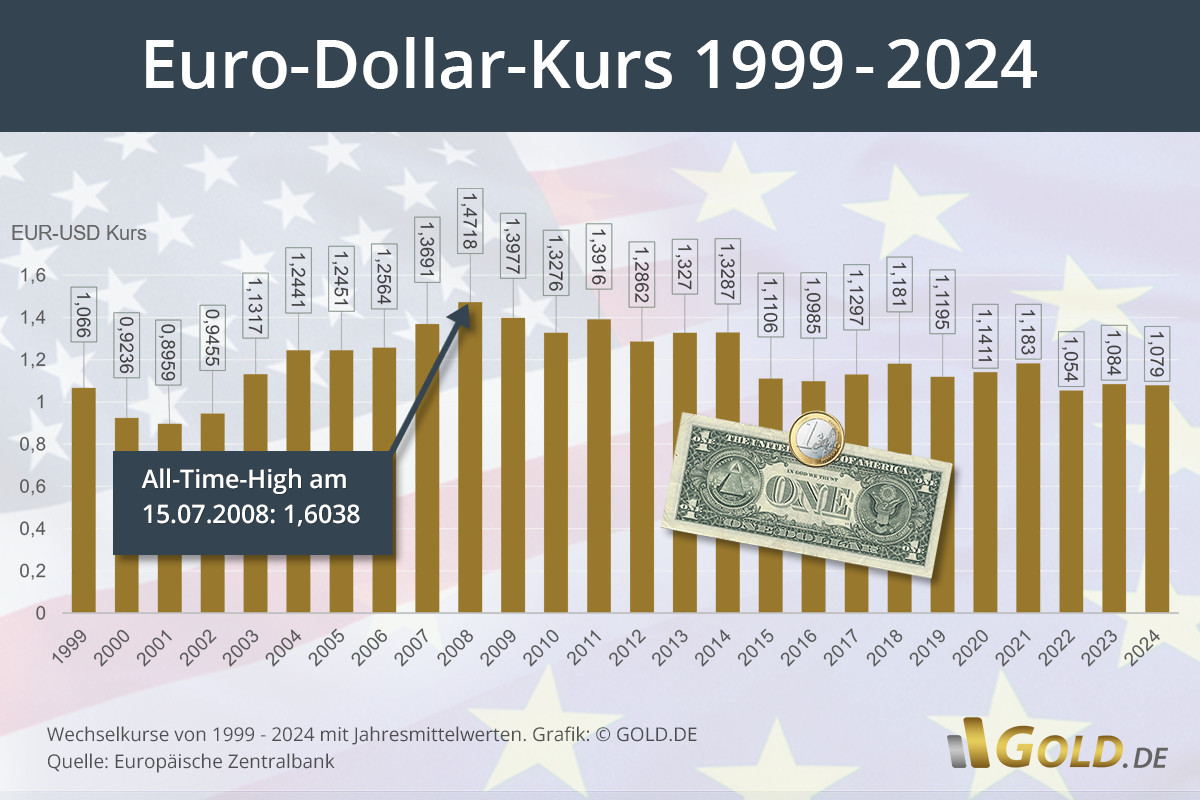

The EUR/USD exchange rate has seen significant fluctuations since the euro was introduced in 1999. Several key events have shaped its trajectory.

-

Introduction of the Euro (1999): The euro was launched as a virtual currency in 1999, and physical notes and coins were introduced in 2002. The initial exchange rate was around 1.17 USD per EUR.

-

Early Years (1999-2002): The euro struggled in its early years, falling below parity (1:1) with the dollar in 2000.

-

Financial Crisis (2008): The global financial crisis of 2008 significantly impacted the exchange rate. In July 2008, the euro reached its all-time high against the dollar, trading at over 1.60 USD.

-

European Debt Crisis (2010-2012): The European debt crisis put downward pressure on the euro as concerns about the stability of the Eurozone increased.

-

Recent Years (2015-Present): More recently, events like Brexit and the COVID-19 pandemic have caused volatility in the EUR/USD exchange rate.

4. How Does the Euro to Dollar Exchange Rate Affect International Trade?

The EUR/USD exchange rate plays a crucial role in international trade, particularly between Europe and the United States. It affects the competitiveness of exports and imports, influencing trade balances and economic growth.

-

Exports: A strong euro makes European goods more expensive for U.S. buyers, potentially reducing export volumes. Conversely, a weak euro makes European exports more competitive.

-

Imports: A strong euro makes U.S. goods cheaper for European buyers, increasing import volumes. A weak euro makes U.S. imports more expensive.

-

Trade Balance: Fluctuations in the exchange rate can impact a country’s trade balance (the difference between exports and imports). A weaker currency can help improve a trade deficit by boosting exports.

5. How Does the Euro to Dollar Exchange Rate Affect Drip Irrigation Systems from Europe?

If you are in the market for drip irrigation systems from Europe, understanding the EUR/USD exchange rate is essential. These systems, known for their quality and efficiency, are often priced in euros, and the exchange rate affects the final cost in U.S. dollars.

- Pricing: When the euro is strong compared to the dollar, these systems will be more expensive for U.S. buyers. When the euro is weak, they become more affordable.

- Planning: By monitoring the exchange rate, you can time your purchases to take advantage of favorable rates. This can significantly reduce your investment in irrigation technology.

- Budgeting: Keep the exchange rate in mind when budgeting for agricultural or gardening projects. Fluctuations can impact overall expenses.

6. How Does the Euro to Dollar Exchange Rate Impact the Cost of Gold?

Yes, the euro to dollar exchange rate has a direct impact on private gold investors, as the gold price is quoted worldwide in U.S. dollars. Simply put, gold purchases and sales always involve a currency exchange between the euro and the dollar.

The prevailing exchange rate between the euro and the dollar is decisive because it affects the final amount. A strong euro has a beneficial effect because fewer euros are needed to buy gold in dollars. Conversely, a weak euro can make buying gold more expensive.

- Gold purchases: If the euro is strong (= weak dollar) it is cheaper: You get more gold for your euros. If the euro is weak (= strong dollar) it is more expensive: You get less gold for your euros.

- Existing investment: If the euro is strong (= weak dollar) the investment loses relative value because the gold price in euros falls. If the euro is weak (= strong dollar) the investment increases in relative value because the gold price in euros rises.

- Selling gold: If the euro is strong (= weak dollar) it is disadvantageous: You get fewer euros for your gold. If the euro is weak (= strong dollar) it is advantageous: You get more euros for your gold.

7. How Does the Euro to Dollar Exchange Rate Impact Your Travel Plans?

If you’re planning a trip to Europe, the EUR/USD exchange rate will affect your spending power. A favorable exchange rate means your dollars will go further, while an unfavorable rate will make your trip more expensive.

-

Budgeting: Estimate your travel expenses in euros and convert them to dollars using the current exchange rate to get an accurate picture of your costs.

-

Timing: If possible, monitor the exchange rate and buy euros when the rate is favorable.

-

Spending: Keep the exchange rate in mind when making purchases in Europe. Even small fluctuations can add up over the course of your trip.

8. How Can You Stay Updated on the Euro to Dollar Exchange Rate?

Staying informed about the EUR/USD exchange rate is easier than you might think. There are numerous resources available to provide you with real-time updates and historical data.

- Financial Websites: Websites like Bloomberg, Reuters, and Yahoo Finance provide real-time exchange rates and financial news.

- Currency Converter Tools: Online currency converters can quickly show you the current exchange rate and convert amounts between euros and dollars.

- Mobile Apps: Many financial apps offer currency tracking and alerts, so you can stay informed on the go.

- Financial News Outlets: Keep an eye on major financial news outlets for expert analysis and forecasts on the EUR/USD exchange rate.

- eurodripusa.net: Check our website for updates and insights related to how the exchange rate affects the cost of European drip irrigation products.

9. What Are the Risks of Ignoring the Euro to Dollar Exchange Rate?

Ignoring the EUR/USD exchange rate can lead to several financial risks, particularly for businesses involved in international trade or individuals planning to make significant purchases in euros.

- Increased Costs: Paying more than necessary for goods or services priced in euros.

- Reduced Profit Margins: For businesses, unfavorable exchange rates can erode profit margins on exports.

- Budgeting Inaccuracies: For individuals, failing to account for exchange rate fluctuations can lead to inaccurate budgeting for travel or purchases.

- Investment Losses: Exchange rate movements can impact the value of investments denominated in euros.

10. How Can Eurodrip USA Help You Navigate the Euro to Dollar Exchange Rate?

At eurodripusa.net, we understand the importance of the EUR/USD exchange rate for our customers. We are committed to providing you with high-quality European drip irrigation systems at competitive prices.

- Expert Advice: Our team can provide insights into how the exchange rate affects the cost of our products and help you make informed purchasing decisions.

- Flexible Pricing: We offer flexible pricing options to accommodate exchange rate fluctuations, ensuring you get the best possible value.

- Transparency: We are transparent about our pricing and will keep you informed of any changes due to exchange rate movements.

- Quality Products: We source our drip irrigation systems from top European manufacturers, ensuring you get reliable and efficient products.

Irrigation system

Irrigation system

11. How Does the Euro to Dollar Exchange Rate Impact Agriculture and Gardening?

The euro to dollar exchange rate has specific implications for the agriculture and gardening sectors, especially when it comes to importing equipment and products from Europe.

-

Cost of Imported Equipment: Many advanced agricultural technologies and gardening tools are manufactured in Europe. A strong euro can increase the cost of importing these items, affecting farmers’ and gardeners’ budgets.

-

Drip Irrigation Systems: Drip irrigation systems from European companies like Eurodrip are known for their quality and efficiency. The exchange rate impacts the affordability of these systems for U.S. growers.

-

Fertilizers and Chemicals: Some specialized fertilizers and chemicals used in agriculture and gardening are imported from Europe. The exchange rate can affect the cost of these inputs, influencing production costs.

-

Market Competitiveness: Fluctuations in the exchange rate can affect the competitiveness of U.S. agricultural products in international markets. A weak euro can make European products more competitive, while a strong euro can give U.S. products an advantage.

12. How Can Farmers and Gardeners Mitigate the Impact of Exchange Rate Fluctuations?

Farmers and gardeners can take several steps to mitigate the impact of EUR/USD exchange rate fluctuations on their businesses.

- Plan Purchases in Advance: Monitor the exchange rate and plan your purchases of European equipment and products when the euro is relatively weak.

- Consider Forward Contracts: Some financial institutions offer forward contracts that allow you to lock in an exchange rate for future purchases.

- Diversify Suppliers: Consider diversifying your suppliers to include domestic options, reducing your reliance on European imports.

- Improve Efficiency: Invest in efficient irrigation and production practices to reduce overall costs and offset the impact of exchange rate fluctuations.

13. What Role Do Central Banks Play in Influencing the Euro to Dollar Exchange Rate?

Central banks, such as the European Central Bank (ECB) and the Federal Reserve (Fed) in the United States, play a significant role in influencing the EUR/USD exchange rate.

-

Interest Rates: Central banks set interest rates, which affect the attractiveness of their currencies to investors. Higher interest rates tend to attract foreign investment, increasing demand for the currency and strengthening its value.

-

Monetary Policy: Central banks use various tools, such as quantitative easing (QE) and forward guidance, to influence economic conditions and currency values.

-

Intervention: Central banks can intervene directly in the foreign exchange market by buying or selling their currency to influence its value. However, this is less common.

14. How Does the Euro to Dollar Exchange Rate Affect Small Businesses?

Small businesses engaged in international trade are particularly vulnerable to EUR/USD exchange rate fluctuations.

-

Import Costs: Small businesses that import goods from Europe face higher costs when the euro is strong, potentially squeezing profit margins.

-

Export Revenues: Small businesses that export to Europe may see reduced revenues when the euro is weak, as their products become more expensive for European buyers.

-

Cash Flow: Exchange rate fluctuations can impact cash flow, making it difficult for small businesses to manage their finances.

-

Pricing Strategies: Small businesses need to adjust their pricing strategies to account for exchange rate movements, which can be challenging.

15. What Are the Key Economic Indicators That Influence the Euro to Dollar Exchange Rate?

Several key economic indicators can influence the EUR/USD exchange rate.

- GDP Growth: Strong GDP growth in the Eurozone or the United States can strengthen their respective currencies.

- Inflation: Higher inflation can weaken a currency as it erodes purchasing power.

- Unemployment: Low unemployment rates can strengthen a currency as they indicate a healthy economy.

- Trade Balance: A trade surplus (exports exceeding imports) can strengthen a currency, while a trade deficit can weaken it.

- Government Debt: High levels of government debt can weaken a currency as they raise concerns about fiscal stability.

16. How Can You Use Forward Contracts to Hedge Against Exchange Rate Risk?

Forward contracts are a financial tool that allows you to lock in an exchange rate for a future transaction, providing protection against exchange rate risk.

- How They Work: You agree to buy or sell a specific amount of currency at a predetermined exchange rate on a future date.

- Benefits: Forward contracts provide certainty, allowing you to budget and plan your finances with confidence.

- Risks: If the actual exchange rate moves in your favor, you won’t benefit from the more favorable rate.

- Availability: Forward contracts are typically offered by banks and financial institutions.

17. What Is Purchasing Power Parity (PPP) and How Does It Relate to the Euro to Dollar Exchange Rate?

Purchasing Power Parity (PPP) is an economic theory that suggests exchange rates should adjust to equalize the prices of identical goods and services in different countries.

- Concept: If a basket of goods costs $100 in the United States and €90 in Europe, the exchange rate should be around $1.11 per euro to achieve PPP.

- Reality: In reality, exchange rates often deviate from PPP due to various factors, such as trade barriers, transportation costs, and market inefficiencies.

- Relevance: PPP can provide a long-term benchmark for assessing whether a currency is overvalued or undervalued.

18. What Is the “Big Mac Index” and What Does It Tell Us About the Euro to Dollar Exchange Rate?

The “Big Mac Index” is a lighthearted but informative tool used by The Economist to assess whether currencies are at their “correct” level.

- Concept: It compares the price of a Big Mac hamburger in different countries to assess whether currencies are overvalued or undervalued.

- Example: If a Big Mac costs $5 in the United States and €4 in Europe, the implied exchange rate is $1.25 per euro. If the actual exchange rate is $1.10 per euro, the euro is considered undervalued.

- Limitations: The Big Mac Index is a simplified tool and doesn’t account for factors such as local taxes and production costs.

19. How Can You Profit from Euro to Dollar Exchange Rate Fluctuations?

While it’s risky, there are ways to potentially profit from EUR/USD exchange rate fluctuations.

- Forex Trading: You can trade EUR/USD on the foreign exchange market, buying euros when you expect the euro to strengthen and selling them when you expect it to weaken.

- Options: Options contracts give you the right, but not the obligation, to buy or sell euros at a specific exchange rate in the future.

- Risks: Forex trading and options trading are highly risky and can lead to significant losses.

20. Why Is the US Dollar Considered a Global Reserve Currency?

The US dollar is considered a global reserve currency for several reasons.

- Size of the US Economy: The United States has the world’s largest economy, making the dollar a natural choice for international transactions.

- Stability: The United States has a stable political and economic system, enhancing confidence in the dollar.

- Liquidity: The US dollar is highly liquid, meaning it’s easy to buy and sell in large quantities without affecting its value.

- History: The US dollar has a long history as a reserve currency, dating back to the Bretton Woods Agreement in 1944.

21. How Could a Shift Away from the US Dollar as a Reserve Currency Impact the Euro to Dollar Exchange Rate?

If there were a significant shift away from the US dollar as a global reserve currency, it could have profound implications for the EUR/USD exchange rate.

- Increased Demand for Euros: If countries started holding more euros in their reserves, demand for euros would increase, potentially strengthening the euro against the dollar.

- Reduced Demand for Dollars: Conversely, reduced demand for dollars could weaken the dollar against the euro.

- Volatility: The transition could lead to increased volatility in the EUR/USD exchange rate as markets adjust to the new reality.

22. How Does Brexit Impact the Euro to Dollar Exchange Rate?

Brexit, the United Kingdom’s departure from the European Union, has had several impacts on the EUR/USD exchange rate.

- Uncertainty: Brexit created uncertainty about the future of the European economy, putting downward pressure on the euro.

- Economic Impact: Brexit has negatively impacted the UK economy, leading to increased trade barriers and reduced economic growth.

- Safe Haven Flows: Some investors have sought safe haven assets, such as the US dollar, amid Brexit-related uncertainty, strengthening the dollar against the euro.

23. How Does the COVID-19 Pandemic Impact the Euro to Dollar Exchange Rate?

The COVID-19 pandemic has had a significant impact on the EUR/USD exchange rate.

- Economic Slowdown: The pandemic led to a sharp economic slowdown in both Europe and the United States, impacting currency values.

- Monetary Policy Response: Central banks responded with aggressive monetary policy measures, such as interest rate cuts and quantitative easing, influencing exchange rates.

- Safe Haven Flows: The pandemic triggered safe haven flows, with investors seeking the relative safety of the US dollar.

24. What Are the Potential Future Scenarios for the Euro to Dollar Exchange Rate?

Predicting the future of the EUR/USD exchange rate is challenging, but several potential scenarios could play out.

- Continued US Dollar Strength: If the US economy continues to outperform the Eurozone, the dollar could remain strong against the euro.

- Eurozone Recovery: If the Eurozone experiences a strong economic recovery, the euro could strengthen against the dollar.

- Geopolitical Risks: Geopolitical risks, such as trade wars or political instability, could create volatility in the EUR/USD exchange rate.

- Policy Changes: Changes in monetary policy by the ECB or the Fed could significantly impact the exchange rate.

25. How Can I Make Informed Decisions About Buying European Products Given the Exchange Rate?

To make informed decisions about buying European products, keep the following tips in mind:

- Monitor the Exchange Rate: Stay informed about the current EUR/USD exchange rate.

- Compare Prices: Compare prices from different suppliers to find the best deal.

- Consider Alternatives: Explore domestic alternatives if the exchange rate makes European products too expensive.

- Plan Ahead: Plan your purchases in advance to take advantage of favorable exchange rates.

26. How to Understand the Euro’s Performance Against the Dollar?

Understanding the euro’s performance against the dollar requires analyzing various factors, including economic indicators, central bank policies, and global events.

- Economic Data: Track key economic indicators such as GDP growth, inflation, and unemployment rates in both the Eurozone and the United States.

- Central Bank Announcements: Pay attention to announcements from the European Central Bank (ECB) and the Federal Reserve (Fed) regarding interest rates and monetary policy.

- Global Events: Monitor global events such as trade wars, political instability, and economic crises, which can impact currency values.

- Expert Analysis: Read expert analysis and forecasts from reputable financial institutions and economists.

27. What Steps Can I Take to Protect My Business from Exchange Rate Volatility?

Exchange rate volatility can pose significant risks to businesses engaged in international trade. Here are some steps you can take to protect your business:

- Hedge with Forward Contracts: Lock in exchange rates for future transactions using forward contracts.

- Diversify Markets: Reduce your reliance on a single market by diversifying your customer base.

- Price in Local Currency: Consider pricing your products in the local currency of your customers.

- Manage Costs: Control your costs to improve your ability to absorb exchange rate fluctuations.

- Insurance: Explore insurance options that can protect you against exchange rate risk.

28. Is Now a Good Time to Invest in Euros Given the Current Exchange Rate?

Whether now is a good time to invest in euros depends on your investment goals and risk tolerance.

- Investment Goals: Consider your investment timeline and objectives.

- Risk Tolerance: Assess your comfort level with risk.

- Expert Advice: Consult with a financial advisor to get personalized advice.

- Market Analysis: Conduct thorough market analysis to assess the potential for euro appreciation.

29. How Can You Use Technical Analysis to Predict the Euro to Dollar Exchange Rate?

Technical analysis involves using historical price and volume data to identify patterns and predict future price movements.

- Charting: Use charts to identify trends, support and resistance levels, and other technical indicators.

- Moving Averages: Use moving averages to smooth out price data and identify trends.

- Relative Strength Index (RSI): Use the RSI to measure the momentum of price movements and identify overbought and oversold conditions.

- Fibonacci Retracements: Use Fibonacci retracements to identify potential support and resistance levels.

30. What Resources Can I Use to Learn More About Forex Trading and the Euro to Dollar Exchange Rate?

There are numerous resources available to help you learn more about Forex trading and the EUR/USD exchange rate.

- Online Courses: Take online courses on platforms such as Coursera, Udemy, and edX.

- Books: Read books on Forex trading and currency markets.

- Websites: Visit websites such as Investopedia, BabyPips, and DailyFX.

- Brokers: Many Forex brokers offer educational resources and trading platforms.

The euro to dollar exchange rate is a dynamic and complex topic that affects various aspects of our lives, from international trade to travel plans. By understanding the factors that influence the exchange rate and staying informed about market developments, you can make more informed financial decisions. Whether you are a farmer looking to purchase European drip irrigation systems or an individual planning a trip to Europe, knowledge of the EUR/USD exchange rate can help you save money and manage risk.

Ready to explore the benefits of European drip irrigation systems? Visit eurodripusa.net today to discover our high-quality products, learn more about efficient irrigation techniques, and contact our experts for personalized advice. Let us help you optimize your irrigation practices and achieve sustainable water management.

FAQ Section

1. What exactly does the euro to dollar exchange rate tell me?

The euro to dollar exchange rate tells you how many U.S. dollars you can get for one euro. For example, if the exchange rate is 1.15, one euro is worth $1.15.

2. How often does the euro to dollar exchange rate change?

The euro to dollar exchange rate changes constantly, as it is determined by supply and demand in the foreign exchange market, which operates 24 hours a day, five days a week.

3. What factors can cause the euro to dollar exchange rate to fluctuate?

Factors that can cause fluctuations include economic indicators (like GDP growth and inflation), central bank policies, political events, and market sentiment.

4. How does a strong euro affect U.S. consumers?

A strong euro makes goods and services from Europe more expensive for U.S. consumers, which can decrease demand for those products.

5. How does a weak euro affect European businesses?

A weak euro makes European exports cheaper and more competitive in the U.S. market, potentially boosting export revenues.

6. Can I predict the euro to dollar exchange rate?

Predicting the exchange rate is challenging due to its complexity and the many factors that influence it. However, you can stay informed about market trends and economic indicators to make more informed decisions.

7. What is the best way to exchange euros for dollars when traveling?

Consider using a credit card with no foreign transaction fees or withdrawing cash from an ATM in Europe. Avoid exchanging currency at airports or tourist traps, as they often have unfavorable exchange rates.

8. How can I use the euro to dollar exchange rate to save money on online purchases from Europe?

Monitor the exchange rate and make purchases when the euro is weak relative to the dollar. Also, check for any fees or commissions charged by your bank or credit card company.

9. Are there any apps that can help me track the euro to dollar exchange rate?

Yes, many financial apps, such as Bloomberg, Reuters, and Yahoo Finance, offer currency tracking and alerts.

10. How does eurodripusa.net help me with the euro to dollar exchange rate when buying drip irrigation systems?

Eurodrip USA provides expert advice on how the exchange rate affects the cost of our products, offers flexible pricing options, and ensures transparency in our pricing, helping you make informed purchasing decisions.

Address: 1 Shields Ave, Davis, CA 95616, United States.

Phone: +1 (530) 752-1011.

Website: eurodripusa.net.