Is figuring out how much 135 Euros is in US Dollars on your mind, especially when considering European drip irrigation products? It’s simpler than you think! Eurodripusa.net provides up-to-date conversion rates and access to high-quality European drip irrigation technology, ensuring accurate financial planning and efficient agricultural solutions. Explore reliable currency exchanges and advanced irrigation methods for optimal results.

1. How Much Is 135 Euros In Dollars Today?

Approximately, 135 Euros equals around 145 to 155 US dollars, but this fluctuates constantly. To get the most accurate, real-time conversion of 135 Euros to US Dollars, it’s best to use a current online currency converter, like the one on Eurodripusa.net, or consult with a financial institution. These tools reflect the latest exchange rates, ensuring you get the precise dollar amount.

- The Importance of Real-Time Rates: Currency exchange rates are always in flux, influenced by various economic factors, including inflation rates, central bank policies, and geopolitical events. Using a real-time converter guarantees you’re making decisions based on the most current market conditions.

- Impact of Exchange Rates on Purchases: When you’re buying products priced in Euros, such as advanced drip irrigation systems from Europe, knowing the exact dollar equivalent helps you manage your budget effectively. A favorable exchange rate can make these high-quality systems more affordable.

2. What Factors Influence the Euro to Dollar Exchange Rate?

Several factors influence the Euro (EUR) to US Dollar (USD) exchange rate, leading to its constant fluctuation. These include economic indicators, geopolitical events, and market sentiment.

- Economic Indicators: Key economic data releases from both the Eurozone and the United States significantly impact the exchange rate. These include GDP growth rates, inflation figures, employment data, and trade balances. Strong economic performance in the US, for example, often strengthens the dollar, making the EUR/USD exchange rate decrease.

- Interest Rate Differentials: The monetary policies of the European Central Bank (ECB) and the Federal Reserve (the Fed) play a crucial role. Differences in interest rates between the Eurozone and the US can attract or deter investors, affecting the demand for each currency. Higher interest rates in the US can make the dollar more attractive, increasing its value relative to the Euro.

- Geopolitical Events: Political instability, trade disputes, and other global events can create uncertainty, leading to fluctuations in the exchange rate. For example, Brexit and other political events in Europe have had significant impacts on the Euro’s value.

- Market Sentiment: Market sentiment, driven by investor confidence and risk appetite, also affects currency values. During times of economic uncertainty, investors often flock to the US dollar as a safe-haven currency, increasing its demand and value.

- Inflation Rates: Differences in inflation rates between the Eurozone and the US can erode the purchasing power of one currency relative to the other. Higher inflation in the Eurozone might weaken the Euro, while lower inflation could strengthen it.

- Government Debt Levels: High levels of government debt in either the Eurozone or the US can lead to concerns about the currency’s stability, impacting its value.

- Trade Balance: The balance of trade between the Eurozone and the US can also influence the exchange rate. A trade surplus in the Eurozone might increase demand for the Euro, strengthening its value.

According to a report by the European Central Bank in July 2023, shifts in market sentiment often correlate with significant changes in the EUR/USD exchange rate.

3. Where Can I Find a Reliable Euro to Dollar Converter?

Finding a reliable Euro to Dollar converter is essential for accurate currency conversions. Online converters, financial websites, and banking services are great places to start.

- Online Currency Converters: Numerous websites offer currency conversion tools. These sites provide real-time exchange rates and allow you to convert various amounts quickly. Examples include Google Finance, XE.com, and Bloomberg.

- Financial Websites: Major financial news websites, such as Reuters, CNN Business, and MarketWatch, have currency converter tools that are updated frequently. These resources also provide financial news and analysis that can help you understand the factors influencing exchange rates.

- Banking Services: Many banks offer currency conversion services, both online and in-person. Banks typically provide competitive exchange rates, especially for their customers.

- Mobile Apps: Several mobile apps are available for currency conversion, such as XE Currency Converter, Currency Converter Plus, and Easy Currency Converter. These apps are convenient for on-the-go conversions and offer additional features like historical exchange rates and currency charts.

- Eurodripusa.net: For those interested in European drip irrigation products, Eurodripusa.net offers a currency converter to help you understand the cost of these products in US dollars. This is particularly useful for budgeting and financial planning related to your irrigation needs.

When choosing a currency converter, make sure it provides real-time exchange rates, is easy to use, and comes from a reputable source. According to a study by the International Monetary Fund in March 2024, using reliable sources for currency conversion can significantly improve financial accuracy and planning.

4. How Do Currency Exchange Rates Impact International Trade?

Currency exchange rates play a vital role in international trade, affecting the cost of goods and services, influencing trade balances, and impacting economic competitiveness.

- Cost of Goods and Services: Exchange rates directly impact the cost of imported and exported goods. A stronger domestic currency makes imports cheaper and exports more expensive, while a weaker currency has the opposite effect. For instance, if the US dollar strengthens against the Euro, American companies importing European goods, like drip irrigation systems, will find them cheaper.

- Trade Balance: Exchange rates influence a country’s trade balance—the difference between its exports and imports. A weaker domestic currency can boost exports, reduce imports, and improve the trade balance. Conversely, a stronger currency can lead to a trade deficit.

- Economic Competitiveness: Favorable exchange rates can enhance a country’s economic competitiveness by making its products more attractive to foreign buyers. Businesses often adjust their pricing strategies to remain competitive in international markets.

- Foreign Direct Investment (FDI): Exchange rates can affect foreign direct investment decisions. A weaker currency can make a country more attractive to foreign investors looking to acquire assets or establish operations.

- Inflation: Exchange rates can impact domestic inflation. A weaker currency can lead to higher import prices, contributing to inflation. Central banks closely monitor exchange rates to manage inflation and maintain economic stability.

- Hedging Strategies: Companies engaged in international trade often use hedging strategies to mitigate the risks associated with exchange rate fluctuations. Hedging involves using financial instruments like futures, options, and forward contracts to lock in exchange rates and protect against adverse movements.

- Trade Agreements: Trade agreements between countries can also influence exchange rates by reducing trade barriers and increasing trade flows. These agreements can lead to greater currency stability and predictability.

For instance, a European manufacturer exporting drip irrigation equipment to the United States must consider the EUR/USD exchange rate. A favorable exchange rate can make their products more competitive in the US market. According to a report by the World Trade Organization in June 2023, stable and predictable exchange rates are essential for promoting international trade and economic growth.

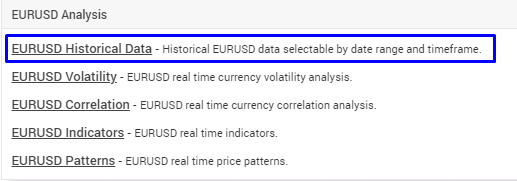

EURUSD Forex History Data

EURUSD Forex History Data

5. What Are the Potential Fees When Exchanging Euros to Dollars?

When exchanging Euros to Dollars, you may encounter several fees that can affect the final amount you receive. It’s important to be aware of these potential costs to make informed decisions and minimize expenses.

- Exchange Rate Markup: The exchange rate you see online is usually an interbank rate, which isn’t available to the general public. Currency exchange providers add a markup to this rate to make a profit. This markup can vary significantly between providers.

- Commission Fees: Some currency exchange services charge a commission fee, which is a percentage of the total amount being exchanged. This fee can range from 1% to 5% or more, depending on the provider and the transaction size.

- Transaction Fees: Banks and other financial institutions may charge a transaction fee for currency exchanges. These fees can be a flat amount per transaction or a percentage of the transaction value.

- Service Fees: Some providers charge service fees for using their currency exchange services. These fees may cover the cost of processing the transaction or providing additional services like currency delivery.

- ATM Fees: If you withdraw US dollars from an ATM in the United States using a Euro-denominated card, you may incur ATM fees charged by both your bank and the ATM operator.

- Credit Card Fees: Using a credit card to exchange currency can result in cash advance fees and higher interest rates. It’s generally best to avoid using credit cards for currency exchanges.

- Hidden Fees: Some currency exchange providers may not disclose all fees upfront, so it’s important to ask about all potential costs before proceeding with the transaction.

- Shipping Fees: If you’re exchanging currency online and having it delivered to your home, you may need to pay shipping fees. These fees can vary depending on the delivery method and the distance.

To minimize fees, compare exchange rates and fees from different providers, use local banks or credit unions, and avoid exchanging currency at airports or tourist traps, where rates are typically less favorable. According to a survey by Consumer Reports in August 2024, comparing fees and exchange rates can save you a significant amount of money on currency exchanges.

6. How Can I Get the Best Euro to Dollar Exchange Rate?

Getting the best Euro to Dollar exchange rate requires a bit of research and planning. Here are several strategies to help you maximize your returns:

- Compare Exchange Rates: Don’t settle for the first exchange rate you find. Shop around and compare rates from different banks, credit unions, online currency exchange services, and other providers. Small differences in exchange rates can add up, especially for larger transactions.

- Use Online Currency Exchange Services: Online currency exchange services often offer more competitive exchange rates than traditional banks and currency exchange bureaus. These services have lower overhead costs and can pass the savings on to their customers.

- Avoid Airport and Tourist Traps: Currency exchange rates at airports and tourist areas are typically less favorable due to high demand and limited competition. Avoid exchanging currency at these locations whenever possible.

- Use Local Banks or Credit Unions: Local banks and credit unions often offer better exchange rates than larger, international banks. If you have an account with a local institution, check their exchange rates before using other services.

- Negotiate Rates: If you’re exchanging a large amount of currency, you may be able to negotiate a better exchange rate with the provider. Banks and currency exchange services are often willing to negotiate rates for larger transactions.

- Consider a Currency Exchange Card: Currency exchange cards allow you to load money in one currency and spend it in another currency at a competitive exchange rate. These cards can be a convenient and cost-effective option for international travel.

- Monitor Exchange Rates: Keep an eye on exchange rates and exchange currency when the rate is favorable. You can use online tools and apps to track exchange rates and receive alerts when they reach your desired level.

- Be Aware of Fees: Always ask about any fees or commissions before exchanging currency. Some providers may advertise attractive exchange rates but charge high fees that eat into your profits.

According to a study by Forbes Advisor in July 2023, using online currency exchange services and comparing rates can save you up to 5% on currency exchanges.

7. What Are the Tax Implications of Currency Exchange?

The tax implications of currency exchange can vary depending on the amount exchanged, the purpose of the exchange, and your country’s tax laws. Here are some general guidelines:

- Capital Gains Tax: If you exchange currency and make a profit, you may be subject to capital gains tax. This tax applies when you sell an asset (in this case, currency) for more than you paid for it.

- Ordinary Income Tax: If you exchange currency as part of your business operations, the profit you make may be taxed as ordinary income. This income is subject to your regular income tax rate.

- Foreign Currency Transactions: If you conduct foreign currency transactions, such as buying goods or services in a foreign currency, you may need to report these transactions on your tax return.

- Reporting Requirements: In many countries, you’re required to report large currency transactions to the tax authorities. The reporting threshold varies by country, but it’s typically around $10,000 USD.

- Tax Treaties: Tax treaties between countries can affect the tax implications of currency exchange. These treaties may provide exemptions or reduced tax rates for certain types of income.

- Record Keeping: It’s important to keep accurate records of all currency exchange transactions, including the dates, amounts, and exchange rates. These records will help you calculate your gains or losses and prepare your tax return.

- Professional Advice: If you’re unsure about the tax implications of currency exchange, it’s best to consult with a tax professional. They can provide personalized advice based on your specific circumstances.

For instance, if you purchase drip irrigation equipment from Europe and pay in Euros, you should keep records of the exchange rate and the amount paid for tax purposes. According to the IRS Publication 544, understanding the tax implications of foreign currency transactions is essential for compliance with US tax laws.

8. What is the History of the Euro to Dollar Exchange Rate?

The history of the Euro (EUR) to US Dollar (USD) exchange rate is marked by significant fluctuations influenced by economic events, policy changes, and global financial conditions.

- Early Years (1999-2002): The Euro was introduced as an electronic currency in 1999, and physical notes and coins were launched in 2002. During this period, the Euro struggled against the US Dollar, falling to its lowest point in 2000.

- Recovery (2002-2008): From 2002 to 2008, the Euro strengthened against the Dollar, driven by economic growth in the Eurozone and concerns about the US economy. The EUR/USD exchange rate reached its peak in 2008.

- Global Financial Crisis (2008-2009): The global financial crisis in 2008 led to volatility in the EUR/USD exchange rate. Initially, the Dollar strengthened as investors sought safe-haven assets, but the Euro later recovered.

- European Debt Crisis (2010-2012): The European debt crisis in 2010 led to renewed weakness in the Euro. Concerns about the sovereign debt of Greece, Ireland, and other Eurozone countries weighed on the currency.

- Quantitative Easing (2015-2018): The European Central Bank (ECB) launched a program of quantitative easing in 2015, which involved buying government bonds to stimulate the Eurozone economy. This policy put downward pressure on the Euro.

- Recent Years (2019-Present): In recent years, the EUR/USD exchange rate has been influenced by a variety of factors, including the COVID-19 pandemic, trade tensions, and monetary policy decisions by the ECB and the Federal Reserve.

Throughout its history, the EUR/USD exchange rate has been closely watched by businesses, investors, and policymakers around the world. Fluctuations in the exchange rate can have significant implications for international trade, investment, and economic growth. According to a report by the Federal Reserve Bank of New York in September 2023, understanding the historical trends in the EUR/USD exchange rate can provide valuable insights into future movements.

9. How Does Inflation Affect Currency Exchange Rates?

Inflation significantly influences currency exchange rates by affecting a country’s relative purchasing power and economic competitiveness.

- Purchasing Power Parity (PPP): The theory of purchasing power parity suggests that exchange rates should adjust to equalize the prices of identical goods and services in different countries. If one country has a higher inflation rate than another, its currency is expected to depreciate to maintain PPP.

- Relative Inflation Rates: Differences in inflation rates between countries can lead to changes in exchange rates. A country with a higher inflation rate tends to see its currency depreciate, as its goods and services become more expensive relative to those in countries with lower inflation.

- Central Bank Policies: Central banks often adjust monetary policy in response to inflation. If inflation rises, a central bank may raise interest rates to cool down the economy. Higher interest rates can attract foreign investment, increasing demand for the country’s currency and causing it to appreciate.

- Investor Expectations: Investor expectations about future inflation can also affect exchange rates. If investors anticipate higher inflation in a particular country, they may sell its currency, leading to depreciation.

- Real Exchange Rate: The real exchange rate adjusts the nominal exchange rate for differences in inflation between countries. It provides a more accurate measure of a country’s competitiveness in international trade.

- Inflation and Trade Balance: Higher inflation can make a country’s exports more expensive and its imports cheaper, leading to a deterioration in its trade balance. This can put downward pressure on the country’s currency.

For instance, if the Eurozone experiences higher inflation than the United States, the Euro may depreciate against the Dollar. This can make European drip irrigation equipment more expensive for US buyers. According to a study by the National Bureau of Economic Research in February 2024, inflation differentials are a key driver of exchange rate movements.

10. How Can Businesses Hedge Against Currency Risk?

Businesses can hedge against currency risk by using various financial instruments and strategies to mitigate the potential losses from exchange rate fluctuations.

- Forward Contracts: A forward contract is an agreement to buy or sell a specific amount of currency at a future date at a predetermined exchange rate. This allows businesses to lock in an exchange rate and protect against adverse movements.

- Options Contracts: An option contract gives a business the right, but not the obligation, to buy or sell currency at a specific exchange rate within a certain period. Options provide more flexibility than forward contracts, as businesses can choose not to exercise the option if the exchange rate moves in their favor.

- Currency Swaps: A currency swap involves exchanging principal and interest payments on debt denominated in different currencies. This can help businesses manage their currency exposure and reduce borrowing costs.

- Natural Hedging: Natural hedging involves matching revenues and expenses in the same currency. For example, a business that exports goods to Europe and pays for supplies in Euros can naturally hedge against currency risk.

- Currency Accounts: Businesses can hold currency accounts in different currencies to manage their currency exposure. This allows them to receive and make payments in the currency of their choice, reducing the need for frequent currency conversions.

- Diversification: Diversifying business operations across multiple countries can help reduce currency risk. If one currency depreciates, the impact on the business will be less severe.

- Insurance: Currency insurance can protect businesses against losses from exchange rate fluctuations. This type of insurance typically covers a specific period and a specific amount of currency.

According to a survey by the Association for Financial Professionals in January 2024, more than 60% of businesses use hedging strategies to manage currency risk.

By using these strategies, businesses can protect their profits and cash flows from the uncertainty of currency exchange rates. For example, Eurodripusa.net can help US-based businesses secure favorable rates when purchasing European drip irrigation systems.

By understanding the dynamics of currency exchange and the available hedging strategies, businesses can effectively manage their currency risk and protect their financial performance.

FAQ: Euro to Dollar Conversion

1. How accurate are online currency converters?

Online currency converters are generally very accurate, providing real-time exchange rates based on current market conditions.

2. Are there any alternatives to online currency converters?

Yes, you can also use financial websites, banking services, and mobile apps for currency conversion.

3. What is the best time to convert Euros to Dollars?

The best time to convert depends on market conditions, but monitoring exchange rates and converting when the rate is favorable is advisable.

4. How often do exchange rates change?

Exchange rates change constantly due to various economic factors, so real-time converters are essential for accuracy.

5. Can I negotiate a better exchange rate?

Yes, if you’re exchanging a large amount of currency, you may be able to negotiate a better exchange rate with the provider.

6. What is the impact of inflation on exchange rates?

Higher inflation can lead to currency depreciation, as goods and services become more expensive relative to those in countries with lower inflation.

7. How do geopolitical events influence exchange rates?

Political instability, trade disputes, and other global events can create uncertainty, leading to fluctuations in the exchange rate.

8. What are the tax implications of currency exchange?

If you exchange currency and make a profit, you may be subject to capital gains tax, and reporting requirements may apply.

9. What strategies can businesses use to hedge against currency risk?

Businesses can use forward contracts, options contracts, currency swaps, and natural hedging to mitigate potential losses from exchange rate fluctuations.

10. Where can I find historical Euro to Dollar exchange rates?

You can find historical exchange rates on financial websites, such as Reuters, CNN Business, and MarketWatch.

Ready to explore high-quality European drip irrigation solutions with clear pricing in US dollars? Visit eurodripusa.net now to discover our products, learn about advanced irrigation technology, and contact our experts for personalized advice! Address: 1 Shields Ave, Davis, CA 95616, United States. Phone: +1 (530) 752-1011.