Are you wondering if you can pay euros into your UK bank account? The answer is yes, you can definitely pay euros into your UK bank account, and eurodripusa.net is here to guide you through the best options for efficient and cost-effective international transactions, including innovative drip irrigation solutions from Europe. Discover how to navigate the process, minimize fees, and explore alternatives like multi-currency accounts for seamless financial management, optimizing your resources for both financial transactions and efficient water management. Learn about drip irrigation and European products.

1. What Are the Key Ways to Receive Euros, Dollars, and Other Currencies in the UK?

There are primarily three methods for receiving funds in different currencies through bank transfers:

- A GBP account with your bank

- A foreign currency account with your bank

- A non-bank multi-currency account

Let’s explore each of these options in more detail to understand their benefits and drawbacks.

2. How Can I Receive Foreign Currency to My Existing GBP Account?

You can receive foreign currency into your existing GBP account by simply providing your bank account details in the IBAN format (e.g., GB11DYPY00989547773591) to the sender. The sender’s bank will likely convert the money to GBP and then send it through the SWIFT network to your bank.

2.1 What Are the Advantages of Using My Existing Account?

- Simplicity: The most significant advantage is that it is the easiest and most straightforward option available.

2.2 What Are the Disadvantages of Using My Existing Account?

- High Costs: This option can be costly for both you and the sender, involving substantial fees such as outgoing fees, currency exchange charges, and payment processing fees.

- Long Delivery: Foreign currency payments sent through traditional banks usually take from 1 to 7 days.

2.3 When Should I Opt for Receiving to My Existing Account?

Choose this option when dealing with one-time individual payments where minimal effort is required and you are willing to accept higher costs.

3. What is a Foreign Currency Account and Its Benefits?

Many high street banks offer separate accounts in major currencies, mostly EUR and USD, with debit cards that allow purchases or cash withdrawals in the account’s currency. However, this service is typically reserved for large businesses and high-net-worth individuals.

3.1 What Are the Advantages of a Special Foreign Currency Account?

- Currency Control: Specialised foreign currency accounts allow better control over foreign currencies and faster receipt of money in the same currency it was sent, avoiding unnecessary exchange.

- Potentially Lower Fees: Banks may offer lower fees and better exchange rates for foreign currency transactions compared to standard accounts.

- Faster Delivery: Foreign currency accounts usually support local payment channels such as ACH in the US or SEPA and Target2 for the European Union, which are much faster than SWIFT.

3.2 What Are the Disadvantages of a Special Foreign Currency Account?

- Eligibility Criteria: Banks often favor larger business clients. For example, at Lloyds Bank, your company needs to have a minimum business turnover between £3-25 million to be eligible.

- Limited Currency Options: The range of supported currencies might be limited compared to multi-currency accounts offered by e-money institutions.

- Maintenance Fees: Banks charge account maintenance fees, which are typically applicable for each separate account.

- Limited Support: Getting assistance from traditional banks can be challenging, making simple tasks like a phone call nearly impossible.

3.3 When Should I Consider Opening a Special Foreign Currency Account?

Consider opening a special foreign currency account with a bank when dealing with one foreign currency, e.g., regular or recurring foreign currency transactions, to take advantage of potentially lower fees and better currency control.

4. What is a Multi-Currency Account and How Does It Work?

Multi-currency accounts are growing in popularity and are primarily offered by non-bank payment providers – fintech companies and e-money institutions (EMI). By collaborating with various banks and payment service providers worldwide, these entities integrate functionality to gain access to local accounts and payment options in foreign markets. This integration enables users to make local payments, avoid traditional currency conversion processes, and receive and hold funds in multiple currencies.

4.1 What Are the Benefits of Using a Multi-Currency Account?

- Diverse Currency Support: E-money institutions often offer a wide range of supported currencies, allowing you to hold multiple currencies in a single account. For example, MultiPass supports payments in 70+ currencies.

- Competitive Exchange Rate: These institutions may provide more competitive exchange rates, saving you money on currency conversion.

- Lower Fees: E-money institutions tend to have lower transaction fees compared to traditional banks.

4.2 What Are the Drawbacks of Using a Multi-Currency Account?

- Account Setup: Opening an account with a new financial institution involves a standard “Know Your Customer” (KYC) check.

- Regulatory Considerations: Ensure that the institution is regulated and compliant with the necessary financial regulations to protect your funds. In the UK, EMIs and payment institutions have to be registered with the Financial Conduct Authority.

- Limited Banking Services: E-money institutions may not offer the full range of banking services provided by traditional banks such as loans or cash services.

4.3 When Is a Multi-Currency Account the Right Choice?

Opt for a multi-currency account in an e-money institution when dealing with frequent foreign currency transactions and diverse currencies. This is a good option for both individuals (expats, frequent travelers, freelancers) and businesses that require handling incoming payments from international clients or need to make outgoing payments in multiple currencies to suppliers, vendors, or contractors worldwide.

5. What Are the Five Key Search Intents for “Can You Pay Euros Into Your UK Bank Account”?

Understanding the search intent behind the query “Can You Pay Euros Into Your Uk Bank Account” is crucial for providing relevant and helpful information. Here are five key search intents:

- Information Seeking: Users want to understand the process and options available for depositing euros into a UK bank account.

- Cost Comparison: Users are looking to compare the costs associated with different methods of depositing euros, including fees and exchange rates.

- Convenience and Speed: Users want to find the most convenient and fastest way to deposit euros into their UK bank account.

- Account Options: Users are interested in learning about different types of accounts that facilitate euro deposits, such as foreign currency accounts or multi-currency accounts.

- Specific Bank Information: Users are looking for information on whether specific UK banks (e.g., Barclays, NatWest, Lloyds) allow euro deposits and their associated policies.

6. How Does Eurodrip USA Facilitate International Transactions and Drip Irrigation Solutions?

Eurodrip USA, a key provider of innovative drip irrigation solutions, understands the importance of seamless international transactions. Just as efficient financial management is crucial for businesses dealing with foreign currencies, efficient water management is essential for agricultural success. Eurodrip USA offers cutting-edge drip irrigation systems that help farmers and gardeners optimize water usage, reduce costs, and improve crop yields. These systems often involve transactions in multiple currencies, making the need for efficient banking solutions even more critical.

6.1 Local Account Balances

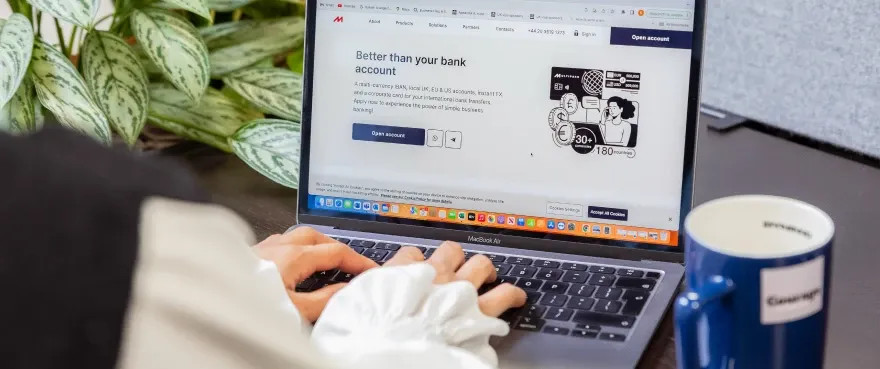

MultiPass is a bank challenger specializing in cross-border payments. MultiPass business accounts come with a set of dedicated local account details:

- a UK account & sort code,

- an IBAN for EU and global transactions,

- a US account & routing number.

These account details are identical to those of local companies, allowing your international customers to pay you in euros and US dollars as if they were paying a company in their own country. The money arrives instantly to within one business day.

6.2 Low-Cost Foreign Currency Payments

You can then choose to keep multi-currency balances or convert money into GBP at exchange rates that are at least 30% better than those offered by traditional banks. Moreover, use your MultiPass account to pay in 70+ currencies globally, and 18 of them (GBP, EUR, USD, AUD, CAD, CZK, DKK, HKD, HUF, IDR, INR, MYR, NOK, PHP, PLN, RON, SEK, SGD) – via local payment channels, from £1 per payment.

6.3 Dedicated Support

MultiPass provides a level of customer support that sets us apart from traditional high-street banks – with personal managers, always at reach via phone, email or messengers to assist with payment-related inquiries or any other questions you might have.

7. How Can MultiPass Help My Business With Foreign Currency Deposits?

MultiPass is a bank challenger specializing in cross-border payments. Understanding the intricacies of international financial transactions is crucial for businesses, and MultiPass offers several advantages. Let’s look at how MultiPass can help your business with foreign currency deposits.

MultiPass Cross-Border Payments

MultiPass Cross-Border Payments

7.1 What Are Local Account Balances?

MultiPass business accounts come with a set of dedicated local account details:

- A UK account & sort code

- An IBAN for EU and global transactions

- A US account & routing number

These account details are identical to those of local companies, allowing your international customers to pay you in euros and US dollars as if they were paying a company in their own country. The money arrives within one business day.

7.2 How Does MultiPass Facilitate Low-Cost Foreign Currency Payments?

With MultiPass, you can choose to keep multi-currency balances or convert money into GBP at exchange rates that are at least 30% better than those offered by traditional banks. You can use your MultiPass account to pay in 70+ currencies globally, and 18 of them (GBP, EUR, USD, AUD, CAD, CZK, DKK, HKD, HUF, IDR, INR, MYR, NOK, PHP, PLN, RON, SEK, SGD) – via local payment channels, from £1 per payment.

7.3 What Kind of Support Can I Expect From MultiPass?

MultiPass provides a level of customer support that sets it apart from traditional high-street banks – with personal managers always reachable via phone, email, or messengers to assist with payment-related inquiries or any other questions you might have.

8. How Can Drip Irrigation Optimize Water Usage and Reduce Costs?

Drip irrigation, like the systems offered by eurodripusa.net, delivers water directly to the plant roots, minimizing water waste through evaporation and runoff. According to research from the University of California, Davis, Department of Plant Sciences, in July 2023, drip irrigation can reduce water consumption by up to 60% compared to traditional methods like flood irrigation. This not only conserves water but also reduces energy costs associated with pumping water, making it a cost-effective solution for farmers and gardeners.

8.1 Precision Irrigation

Drip irrigation systems provide precise control over the amount of water delivered to each plant. This precision ensures that plants receive the optimal amount of water needed for healthy growth, preventing overwatering and underwatering, which can lead to plant stress and reduced yields. Precision irrigation also minimizes the risk of soil erosion and nutrient leaching, further enhancing the efficiency and sustainability of agricultural practices.

8.2 Uniform Water Distribution

Eurodrip USA’s drip irrigation systems are designed to provide uniform water distribution across the entire field or garden. This uniformity ensures that all plants receive the same amount of water, regardless of their location, leading to more consistent growth and higher yields. Uniform water distribution also minimizes the risk of waterlogging in some areas and drought stress in others, promoting overall plant health and productivity.

8.3 Reduced Labor Costs

Drip irrigation systems automate the watering process, reducing the need for manual labor. This automation can significantly reduce labor costs associated with irrigation, freeing up valuable time and resources for other essential tasks. According to a study by the Irrigation Association in 2024, automated drip irrigation systems can reduce labor costs by up to 50% compared to manual irrigation methods.

9. What Are the Advantages of Using European Drip Irrigation Products?

European drip irrigation products are known for their high quality, durability, and advanced technology. Many European manufacturers, like those whose products are available through eurodripusa.net, adhere to strict quality control standards and use innovative materials and designs to ensure optimal performance and longevity. According to a report by the European Irrigation Industry Association in 2025, European drip irrigation products have a lifespan that is 20% longer than products from other regions, providing better value for money in the long run.

9.1 Advanced Technology

European drip irrigation products often incorporate advanced technologies such as pressure-compensating emitters, self-flushing mechanisms, and integrated filtration systems. These technologies ensure consistent water delivery, prevent clogging, and minimize the need for maintenance, making the systems more reliable and efficient.

9.2 Sustainable Materials

Many European manufacturers prioritize the use of sustainable materials in their drip irrigation products. These materials are often made from recycled plastics or bio-based polymers, reducing the environmental impact of the systems. By choosing European drip irrigation products, farmers and gardeners can contribute to a more sustainable agricultural sector.

9.3 Customized Solutions

European drip irrigation companies often offer customized solutions tailored to the specific needs of their customers. These solutions can include designing complete irrigation systems, providing technical support, and offering training programs to ensure optimal performance and efficiency. Eurodrip USA specializes in providing these customized solutions, ensuring that you get the most out of your drip irrigation system.

10. How Can Eurodrip USA Help You Choose the Right Drip Irrigation System?

Eurodrip USA offers a wide range of drip irrigation products and services to meet the diverse needs of farmers, gardeners, and landscapers. Their team of experts can help you choose the right system for your specific crops, soil conditions, and water sources. They can also provide guidance on installation, maintenance, and optimization to ensure that you get the most out of your investment.

10.1 Product Selection

Eurodrip USA offers a wide selection of drip irrigation products, including drip tape, drip line, micro-sprinklers, and accessories. They can help you choose the right products based on your specific needs and budget.

10.2 System Design

Eurodrip USA can design a complete drip irrigation system tailored to your specific field or garden layout. Their design services ensure that the system is efficient, effective, and easy to maintain.

10.3 Technical Support

Eurodrip USA provides ongoing technical support to help you troubleshoot any issues and optimize the performance of your drip irrigation system. Their team of experts is available to answer your questions and provide guidance on best practices.

11. How Does Efficient Irrigation Contribute to Sustainable Agriculture?

Efficient irrigation practices, such as drip irrigation, play a crucial role in promoting sustainable agriculture. By minimizing water waste, reducing energy consumption, and preventing soil degradation, efficient irrigation helps farmers and gardeners protect the environment and ensure the long-term viability of their operations.

11.1 Water Conservation

Efficient irrigation practices help conserve water resources, which are becoming increasingly scarce in many regions. By reducing water waste, drip irrigation helps ensure that water is available for other essential uses, such as drinking water and ecosystem preservation.

11.2 Energy Efficiency

Efficient irrigation practices reduce the energy needed to pump and distribute water. This energy efficiency lowers greenhouse gas emissions and helps combat climate change.

11.3 Soil Health

Efficient irrigation practices help maintain soil health by preventing soil erosion, nutrient leaching, and waterlogging. Healthy soil is essential for plant growth and productivity, as well as for carbon sequestration and other ecosystem services.

12. How Can You Convert Euros to GBP?

Converting euros to GBP can be done through various methods, each with its own advantages and disadvantages. The most common methods include using traditional banks, online currency exchange services, and multi-currency accounts.

12.1 Traditional Banks

Traditional banks offer currency exchange services, but they often charge high fees and offer less favorable exchange rates. It’s essential to compare the rates and fees offered by different banks before making a decision.

12.2 Online Currency Exchange Services

Online currency exchange services, such as Wise (formerly TransferWise) and Revolut, typically offer better exchange rates and lower fees than traditional banks. These services are often more convenient and faster, making them a popular choice for international money transfers.

12.3 Multi-Currency Accounts

Multi-currency accounts, like those offered by MultiPass, allow you to hold and convert multiple currencies in one account. These accounts often offer competitive exchange rates and low fees, making them a convenient option for businesses and individuals who frequently deal with foreign currencies.

13. What Are the Costs Involved in International Money Transfers?

International money transfers involve several types of costs, including:

- Exchange Rate Markups: The difference between the mid-market exchange rate and the rate offered by the service provider.

- Transaction Fees: A fixed fee charged for each transaction.

- Recipient Fees: Fees charged by the recipient’s bank or payment service provider.

- Intermediary Bank Fees: Fees charged by intermediary banks involved in the transfer process.

It’s important to understand all these costs before making an international money transfer to avoid unexpected charges.

14. How to Minimize Fees and Maximize Exchange Rates

To minimize fees and maximize exchange rates when transferring money internationally, consider the following tips:

- Compare Exchange Rates: Shop around for the best exchange rates from different service providers.

- Avoid Hidden Fees: Read the fine print to identify any hidden fees or charges.

- Use Local Payment Methods: Opt for local payment methods, such as bank transfers, to avoid intermediary bank fees.

- Consider Multi-Currency Accounts: Use a multi-currency account to hold and convert multiple currencies at competitive rates.

- Time Your Transfers: Monitor exchange rate fluctuations and time your transfers to take advantage of favorable rates.

15. What Are the Tax Implications of Receiving Foreign Currency?

Receiving foreign currency into your UK bank account can have tax implications, depending on the nature of the income and your tax residency status. It’s important to consult with a tax advisor to understand your tax obligations and ensure compliance with UK tax laws.

15.1 Income Tax

If the foreign currency you receive is considered income, such as earnings from overseas employment or freelance work, it’s subject to income tax in the UK. You’ll need to report this income on your tax return and pay the appropriate amount of tax.

15.2 Capital Gains Tax

If you make a profit when converting foreign currency to GBP, you may be subject to capital gains tax. This can occur if the exchange rate fluctuates between the time you receive the foreign currency and the time you convert it.

15.3 VAT

If you’re a VAT-registered business, you may need to account for VAT on transactions involving foreign currency. Consult with a tax advisor to understand your VAT obligations.

16. How Do Regulations Impact International Transactions?

Various regulations govern international transactions, including anti-money laundering (AML) laws, know your customer (KYC) requirements, and currency control regulations. These regulations aim to prevent financial crimes and ensure the integrity of the financial system.

16.1 Anti-Money Laundering (AML) Laws

AML laws require financial institutions to monitor and report suspicious transactions to prevent money laundering and terrorist financing.

16.2 Know Your Customer (KYC) Requirements

KYC requirements mandate financial institutions to verify the identity of their customers to prevent fraud and other financial crimes.

16.3 Currency Control Regulations

Currency control regulations may restrict the movement of funds across borders and require individuals and businesses to report certain international transactions to the authorities.

17. How Can You Ensure Safe and Secure International Transactions?

To ensure safe and secure international transactions, take the following precautions:

- Use Reputable Service Providers: Choose reputable financial institutions and online payment platforms with a proven track record of security.

- Protect Your Account Information: Keep your account information, such as passwords and PINs, secure and never share them with anyone.

- Be Wary of Scams: Be cautious of phishing scams and other fraudulent schemes that attempt to steal your personal and financial information.

- Monitor Your Transactions: Regularly review your account statements and transaction history to detect any unauthorized activity.

- Report Suspicious Activity: If you suspect any fraudulent activity, report it immediately to your financial institution and the appropriate authorities.

18. What Are the Alternatives to Traditional Bank Transfers?

Besides traditional bank transfers, several alternative methods are available for sending and receiving money internationally:

- Online Payment Platforms: Services like PayPal, Skrill, and Payoneer offer fast and convenient international money transfers.

- Money Transfer Apps: Mobile apps like Venmo, Cash App, and Zelle allow you to send and receive money instantly, but they may have limitations on international transfers.

- Cryptocurrencies: Cryptocurrencies like Bitcoin and Ethereum offer a decentralized alternative to traditional payment systems, but they are subject to price volatility and regulatory uncertainty.

- Money Transfer Services: Companies like Western Union and MoneyGram offer international money transfers through their network of agents, but they often charge high fees and offer less favorable exchange rates.

19. What Are the Potential Risks of Using Foreign Currency Accounts?

While foreign currency accounts offer several benefits, they also come with potential risks:

- Exchange Rate Risk: The value of foreign currency can fluctuate, leading to potential losses if you convert it back to your home currency at a less favorable rate.

- Interest Rate Risk: Interest rates on foreign currency accounts may be lower than those on domestic accounts, reducing your potential returns.

- Regulatory Risk: Foreign currency accounts may be subject to different regulations and protections than domestic accounts, which could affect your rights and recourse in case of disputes or financial losses.

- Political Risk: Political instability in the country where the foreign currency is issued could affect its value and accessibility.

20. How Do You Choose the Right Account for Your Needs?

Choosing the right account for your needs depends on several factors, including:

- Transaction Volume: If you frequently send and receive money internationally, a multi-currency account with low fees and competitive exchange rates may be the best option.

- Currency Requirements: If you primarily deal with one or two foreign currencies, a foreign currency account with a traditional bank may be sufficient.

- Convenience: If you prioritize convenience and speed, an online payment platform or money transfer app may be the most suitable choice.

- Security: If you’re concerned about security, choose a reputable financial institution with robust security measures in place.

- Cost: Compare the fees, exchange rates, and other costs associated with different accounts to find the most cost-effective option for your needs.

Ready to streamline your international payments? Apply today or contact us to discuss your business case!

21. FAQs About Paying Euros into a UK Bank Account

21.1 Will I incur currency conversion fees when depositing foreign currency?

Yes, most banks will charge currency conversion fees when you deposit foreign currency, both for cash deposits and wire transfers. The fee can come in the form of a markup on the exchange rate or a separate charge. Check with your bank for their specific policies and fees regarding foreign currency deposits and international wire transfers.

21.2 Can I pay foreign currency into my NatWest bank account?

Yes, you can send an international payment to your NatWest bank account. The money will be converted to pounds sterling by the sender bank. For regular foreign currency deposits, NatWest offers two foreign currency accounts: the International Select Account and the Cash Management Account, as well as foreign bank accounts for businesses; however, eligibility criteria apply.

21.3 Can I pay foreign currency into my Barclays bank account?

Yes, Barclays allows payments in foreign currency into its accounts; however, be wary of charges associated with international payments and currency conversion. For frequent foreign currency deposits, they offer foreign currency accounts that can be opened in euros, US dollars, and other major currencies; however, eligibility criteria apply.

21.4 Can I pay foreign currency into my Lloyds bank account?

Yes, you can receive foreign currency into your Lloyds bank account by providing the sender with your IBAN and BIC codes. However, be aware of the potential conversion costs and incoming payment charges, reducing the amount you receive.

21.5 What is the SWIFT network?

The SWIFT (Society for Worldwide Interbank Financial Telecommunication) network is a global system used by banks to securely send and receive payment instructions. It is essential for international transactions but can incur fees.

21.6 What is an IBAN?

An IBAN (International Bank Account Number) is a standardized format for bank account numbers used internationally. It helps ensure that international payments are processed accurately and efficiently.

21.7 What is a BIC code?

A BIC (Bank Identifier Code), also known as a SWIFT code, is a unique code that identifies a specific bank or financial institution. It is used to route international payments to the correct destination.

21.8 What are the advantages of using local payment channels like ACH or SEPA?

Local payment channels like ACH (Automated Clearing House) in the US and SEPA (Single Euro Payments Area) in Europe are faster and cheaper than SWIFT for domestic and intra-European transactions.

21.9 How does the KYC check impact account setup?

The Know Your Customer (KYC) check is a standard process for verifying the identity of new customers. While straightforward, it can extend the account setup process due to the complexities of cross-border activities and varying business types.

21.10 How can Eurodrip USA help with irrigation needs?

Eurodrip USA offers a range of drip irrigation products and services. Their experts can help you select the right system for your crops, soil conditions, and water sources, providing guidance on installation, maintenance, and optimization. Contact them at Address: 1 Shields Ave, Davis, CA 95616, United States. Phone: +1 (530) 752-1011. Website: eurodripusa.net.

22. Conclusion

Paying euros into a UK bank account is entirely possible, and understanding the various options—from using your existing GBP account to opening a multi-currency account—can help you make the most informed decision. Whether you’re managing international business transactions or personal finances, consider the fees, exchange rates, and convenience each method offers. For businesses looking to streamline cross-border payments, services like MultiPass can provide significant advantages.

Moreover, remember that efficient financial management goes hand in hand with efficient resource management in agriculture. Just as you seek the best solutions for international banking, explore eurodripusa.net for innovative drip irrigation systems that can optimize water usage, reduce costs, and improve crop yields. By integrating the best financial and agricultural technologies, you can ensure both your financial and environmental sustainability.