The STOXX® Global 1800 Index experienced a downturn for the second consecutive month in October, reflecting the resurgence of COVID-19 infections and subsequent government-imposed lockdowns. This global equity index saw a 3.2% decrease in dollar terms during October, contributing to a year-to-date decline of 0.7% in 2020. For investors monitoring international markets and currency exchange rates, understanding these shifts in dollar valuations is crucial, especially when considering figures like 1800 Euros In Dollars.

The pan-European STOXX® Europe 600 Index also faced significant losses, dropping 5.1% when measured in euros. The Eurozone’s EURO STOXX 50® Index fared even worse, with a 7.3% decrease, marking their poorest monthly performance since the onset of the COVID-19 crisis in March 2020. Similarly, the STOXX® North America 600 Index fell by 2.8% in dollars, and the STOXX® USA 500 Index declined by 2.9%. In Asia/Pacific markets, the STOXX® Asia/Pacific 600 Index showed a smaller decrease of 1.2% in dollars.

Volatility in the Eurozone market also surged, with the EURO STOXX 50® Volatility Index (VSTOXX®) reaching 40 on October 29, its highest point since June. This spike in volatility underscores the uncertainty and risk aversion prevalent in the markets during this period.

Global Growth Under Threat and Currency Considerations

The re-implementation of stringent restrictions in major European economies like France and Germany to combat the escalating COVID-19 pandemic significantly impacted economic forecasts. These measures cast a shadow over anticipated economic and earnings growth for the remainder of 2020, as many companies indicated during their third-quarter earnings reports in October. The global economic landscape was further complicated by the US presidential election in November, adding another layer of uncertainty for investors worldwide.

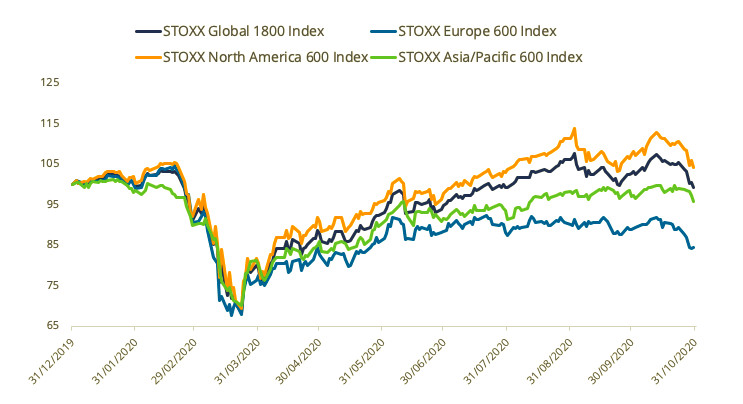

Exhibit 1 – Returns since start of 2020

Chart Description automatically generated

Chart Description automatically generated

Source: Qontigo index data, gross returns in dollars except for STOXX Europe 600 Index, which is in euros; Dec. 31, 2019 – Oct. 31, 2020.

For individuals and businesses dealing with currency conversions, such as understanding 1800 euros in dollars, these market fluctuations are vital. A decrease in index values in dollar terms directly affects the dollar equivalent of euro-denominated assets. For instance, if an investment portfolio was valued at 1800 euros, its equivalent value in US dollars would not only depend on the euro to dollar exchange rate but also on the performance of the underlying European indices when translated into dollar terms.

Exhibit 2 – Benchmark indices’ October risk and return characteristics

Source: Qontigo. Gross Returns. Data as of Oct. 31, 2020.

Performance Across Developed and Emerging Markets in Dollar Terms

In October, the majority of developed markets experienced declines when measured in dollars. The STOXX® Poland Total Market Index led the downturn for the second consecutive month, plummeting by 14.5%. The broader STOXX® Developed Markets 2400 Index also decreased, falling 2.9% in dollar terms.

Conversely, emerging markets showed some resilience. The STOXX® Emerging Markets 1500 Index actually increased by 0.7% in dollars. A subset of national developing markets, led by the STOXX® Indonesia Total Market Index with a 9.1% gain, achieved positive returns. However, not all emerging markets were in positive territory, with the STOXX® Greece Total Market Index experiencing the most significant drop, declining by 11.5%.

This mixed performance highlights the complexity of global markets and the varying impacts of economic events and currency exchange rates on different regions. When considering amounts like 1800 euros in dollars in the context of international investments, the geographical diversification of portfolios and the currency denominations become critical factors.

Sector Performance within the STOXX Global 1800 Index

Analyzing sector performance within the STOXX Global 1800 Index reveals that nearly all sectors experienced losses in October. The STOXX® Global 1800 Energy Index saw the largest decrease at 5.2%, followed by the Healthcare (-5%) and Food, Beverage and Tobacco (-4.9%) sectors. The exceptions were the STOXX® Global 1800 Utilities Index and the STOXX® Global 1800 Banks Index, which recorded gains of 1.3% and 1.2% respectively.

These sector-specific movements are important for investors holding diversified portfolios that include European and global equities. For someone assessing the dollar value of assets originally denominated in euros, such as 1800 euros in dollars, understanding sector performance can provide deeper insights into the factors driving overall market changes and currency impacts on investment values.

Factor-Based and Thematic Investment Strategies

Within factor-based strategies, the STOXX® Global 1800 Ax Size Index outperformed in October, decreasing only by 0.3%. In Europe, the STOXX® Europe 600 Ax Momentum Index showed relative strength, while the STOXX® Europe 600 Ax Low Risk Index lagged. ESG-X Factor indices also showed varied performance, with the STOXX® Global 1800 ESG-X Ax Size Index outperforming others in its category, despite a 1% loss.

Thematic indices, which target disruptive global megatrends, presented a mixed picture. While some revenue-based thematic indices outperformed the STOXX Global 1800 Index, others, like the STOXX® Global Fintech Index, experienced significant declines. However, certain thematic indices like the STOXX® Global Electric Vehicles & Driving Technology Index and the STOXX® Global Smart Cities Index demonstrated positive year-to-date performance, even with October pullbacks.

For investors interested in specialized strategies or those tracking specific market themes, understanding these nuanced performances is as crucial as monitoring broad market indices. And for international investors converting currencies, like tracking 1800 euros in dollars, these specialized index performances in dollar terms provide a detailed view of how different investment approaches are affected by currency fluctuations and market dynamics.

Conclusion: Navigating Global Markets and Currency Conversion

In conclusion, the October 2020 market downturn, as reflected in the STOXX Global 1800 Index and its regional and sector components, highlights the importance of understanding global market trends and currency conversion, especially for international investors. The fluctuations in indices when measured in dollars directly impact the value of euro-denominated assets when converted to US dollars. For anyone concerned with figures like 1800 euros in dollars in an investment context, keeping abreast of these global market dynamics and currency exchange rates is essential for informed financial decision-making. The market’s reaction to events like the COVID-19 pandemic and geopolitical uncertainties underscores the interconnectedness of global finance and the need for a comprehensive understanding of both market performance and currency impacts.