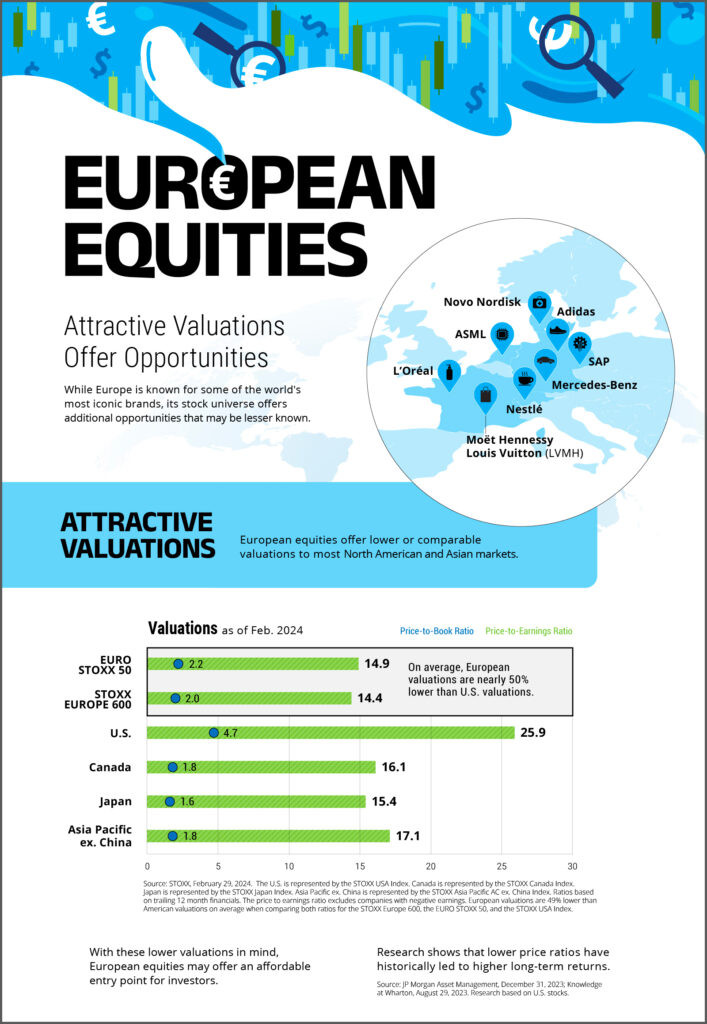

The EURO STOXX 50® index stands as a cornerstone of the Eurozone economy, representing the leading blue-chip companies within the region. For investors globally, including those in the United States, grasping the significance of this index is crucial. When considering international investments, particularly in European markets, one of the first steps is often understanding currency exchange, such as the value of 50 Euro In Usd. This conversion provides a relatable benchmark for US investors to assess the scale and value associated with Eurozone assets like the EURO STOXX 50.

The EURO STOXX 50 is meticulously designed to track the supersector leaders across the Eurozone. This methodology results in a portfolio that is not only diversified but also highly liquid, making it an attractive underlying asset for various financial instruments. The index operates on a free-float market capitalization weighting system, ensuring that the largest and most influential companies have a proportionate impact, with a cap of 10 percent weight for any single constituent. This balanced approach helps to mitigate concentration risk and provides a broad representation of the Eurozone’s economic landscape.

For those familiar with the scale of financial markets, it’s noteworthy that the EURO STOXX 50 underpins over 25 billion euros in Exchange Traded Fund (ETF) assets. Furthermore, the futures and options contracts linked to this index are the most actively traded equity index derivatives on Eurex, a leading European derivatives exchange. The widespread use of the EURO STOXX 50 extends beyond ETFs and derivatives; it is also linked to over 160,000 structured products, highlighting its importance in the global financial ecosystem. Thinking about these figures in terms of US dollars, understanding the current 50 euro in usd conversion rate helps to contextualize the substantial financial volumes associated with this index.

The benefits of the EURO STOXX 50 are manifold. Its tradeable nature, driven by a liquidity-focused index composition, makes it ideal for designing financial products and serving as a reliable benchmark. The index is also balanced, offering diversified representation across various Industry Classification Benchmark (ICB) supersectors, reducing sector-specific risks. Its current relevance is maintained through quarterly rebalancing, annual reviews, and a fast-exit rule, ensuring it reflects up-to-date market developments. For investors requiring specific exposures, the EURO STOXX 50 also offers precise sub-indices, including ex-financials or single-country derivatives. Reflecting modern investment priorities, a sustainable option is available through the EURO STOXX 50® ESG Index. Finally, its accessibility is a key advantage, with a wide range of existing financial products already tracking the index, making it easy for investors to gain exposure.

In conclusion, the EURO STOXX 50 is a critical index for understanding the Eurozone’s leading companies. For US investors considering diversifying their portfolios internationally, particularly into European equities, understanding benchmarks like the EURO STOXX 50 is essential. While starting with a simple conversion like 50 euro in usd provides a basic currency context, delving deeper into the index’s composition, benefits, and performance offers a more comprehensive understanding of the opportunities within the Eurozone market. The EURO STOXX 50’s robust design and widespread adoption solidify its position as a key indicator for both European and global investors.