Recently, an article from the Washington Post grabbed headlines with a bold statement about the euro and the dollar. The title declared, “This is historic: The dollar will soon be worth more than the euro.” Accompanying this headline was a graph illustrating a sharp decline in the euro’s value against the dollar, leading many to believe this was an unprecedented event.

Graph from Washington Post Article Showing Euro Value Decline

Graph from Washington Post Article Showing Euro Value Decline

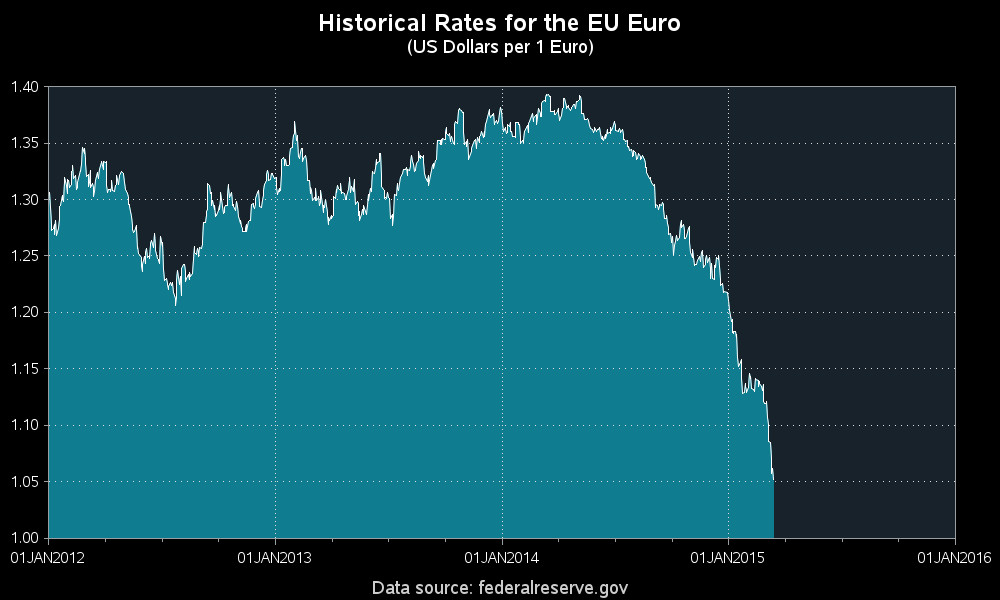

Initially, viewing the headline and the graph in isolation, one might assume the euro’s exchange rate had consistently hovered around 1.25 and was only recently plummeting towards 1.00, signaling a truly “historic” shift. However, digging deeper into the details of the Washington Post article prompted a more skeptical perspective. To verify the claim and understand the full context, I decided to analyze the raw data myself.

Examining the Data: A Deeper Dive into Euro vs. Dollar Exchange Rates

To get to the bottom of this “historic” claim, I turned to the Federal Reserve website, a reliable source for financial data. There, I accessed the historical data for the euro to dollar exchange rate.

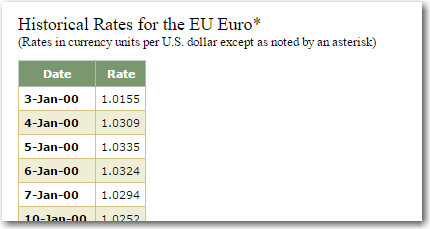

Table of Euro to Dollar Exchange Rate Data from Federal Reserve Website

Table of Euro to Dollar Exchange Rate Data from Federal Reserve Website

The data was presented in an HTML table, which I then processed using SAS code to extract the relevant values. Using this data, I recreated a graph mirroring the one in the Washington Post article, covering a similar timeframe. Indeed, my graph confirmed the same trend: the euro’s exchange rate had been relatively stable around 1.25 before experiencing a recent drop towards 1.00.

Graph Replicating Washington Post Data Showing Recent Euro Drop Against Dollar

Graph Replicating Washington Post Data Showing Recent Euro Drop Against Dollar

Beyond the Recent Drop: A Historical Perspective on the Euro and Dollar

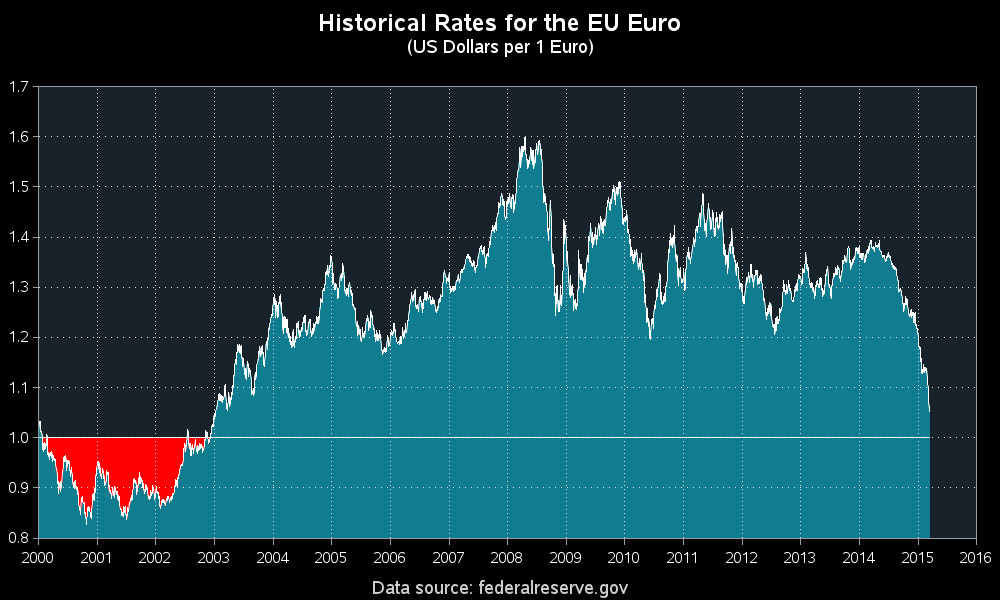

However, curiosity led me to explore the data beyond the timeframe highlighted in the Washington Post article. The Federal Reserve data extended back to the year 2000, offering a broader historical view of the euro vs dollar exchange rate. By adjusting my analysis to include this extended period, a more complete picture emerged.

The analysis revealed a significant insight: the euro was actually worth less than the dollar in the early 2000s, specifically from 2000 to 2003. This historical context changes the narrative significantly. While the rate of the recent drop might be considered noteworthy or even “historic” in its speed, the idea of the euro being worth less than the dollar is far from unprecedented.

Historical Graph of Euro vs Dollar Exchange Rate from 2000 Onward

Historical Graph of Euro vs Dollar Exchange Rate from 2000 Onward

Economic Implications: Who Benefits from a Weaker Euro?

This analysis raises an important question for economists and anyone following the euro vs dollar exchange rate: who benefits and who is disadvantaged when the euro’s value declines relative to the dollar? Understanding these economic implications is crucial for a comprehensive understanding of the currency dynamics at play.