For investors looking to diversify their portfolios and tap into the European market, understanding key indices is crucial. The EURO STOXX 50® stands out as the Eurozone’s leading blue-chip index, representing a collection of 50 of the largest and most liquid stocks in the Eurozone. For those thinking in US Dollars (USD), it’s essential to consider how indices like the EURO STOXX 50, denominated in Euros (EUR), translate into dollar terms. Let’s delve into what makes this index a significant benchmark and how it relates to your investment strategy when viewed from a USD perspective.

EURO STOXX 50 Index displayed on a screen, showcasing its performance and market data.

EURO STOXX 50 Index displayed on a screen, showcasing its performance and market data.

What is the EURO STOXX 50?

The EURO STOXX 50 index is designed to reflect the performance of supersector leaders within the Eurozone. This results in a portfolio that is both diversified across various industries and highly liquid, making it a robust benchmark for the European equity market. The index operates on a free-float market capitalization weighting methodology, which means that the weight of each constituent is determined by its market capitalization adjusted for the proportion of shares available for public trading. To ensure diversification and prevent over-concentration, a maximum weight of 10 percent is applied to any single constituent within the index.

This blue-chip benchmark is not just a theoretical measure; it underpins a substantial financial ecosystem. Over 25 billion euros in Exchange Traded Fund (ETF) assets are benchmarked against the EURO STOXX 50. Furthermore, the futures and options contracts based on this index are the most actively traded equity index derivatives on Eurex, a leading European derivatives exchange. Its influence extends to structured products, with more than 160,000 products linked to the EURO STOXX 50, highlighting its importance in the financial landscape.

Key Benefits of the EURO STOXX 50

The EURO STOXX 50 offers several key advantages for investors and financial product designers:

- Tradeable: The index’s composition is driven by liquidity, making it ideal for creating financial products and serving as a reliable benchmark.

- Balanced: It provides diversified representation across various Industry Classification Benchmark (ICB) supersectors, reducing sector-specific risk.

- Current: With quarterly rebalancing, an annual review, and a fast-exit rule, the index remains up-to-date with market developments. This ensures it accurately reflects the current market conditions.

- Precise: Beyond the main index, there are derived sub-indices, such as ex-financials or single-country versions, offering more specific market exposure.

- Sustainable Option: For environmentally and socially conscious investors, the EURO STOXX 50® ESG Index provides a responsible investment approach.

- Accessible: A wide range of existing financial products already track this index, providing easy access for investors looking to gain exposure to Eurozone blue-chips.

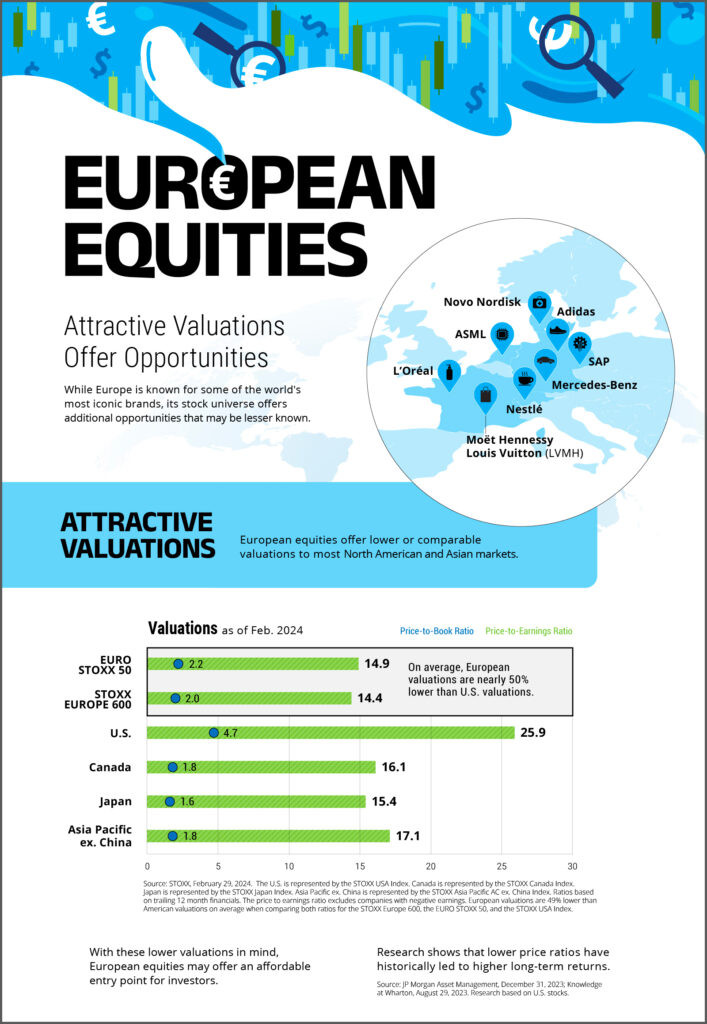

Infographic highlighting the key features and benefits of the EURO STOXX 50 index for potential investors.

Infographic highlighting the key features and benefits of the EURO STOXX 50 index for potential investors.

EURO STOXX 50 Details and Performance

For those tracking the index closely, key details include:

| Metric | Value |

|---|---|

| Symbol | SX5E |

| Calculation | Realtime |

| Dissemination Period | 09:00-18:00 CET |

| ISIN | EU0009658145 |

| Bloomberg | SX5E Index |

| Last Value | 5,463.54 (-0.16%) |

| Week to Week Change | 0.18% |

| 52 Week Change | 11.21% |

| Year to Date Change | 11.10% |

| Daily Low | 5411.54 |

| Daily High | 5463.54 |

| 52 Week Low | 4571.6 (5 Aug 2024) |

| 52 Week High | 5533.84 (18 Feb 2025) |

Data as of recent update.

Top Components and Sector Representation

The EURO STOXX 50 is composed of leading companies from across the Eurozone. The top 10 components give an insight into the index’s sectorial balance, featuring giants like ASML Holding (Technology), SAP and Siemens (Industrials), LVMH and Schneider Electric (Consumer and Industrials), TotalEnergies (Energy), Allianz (Insurance), Deutsche Telekom (Telecommunications), Sanofi (Healthcare), and Air Liquide (Basic Materials). This diverse mix ensures that the index is not overly reliant on any single sector, providing a more stable and representative view of the Eurozone economy.

EUR 50 to USD Conversion Context for US Investors

When considering investments tied to the EURO STOXX 50 from a US investor’s perspective, the EUR to USD exchange rate becomes a crucial factor. While the index performance is measured in Euros, the actual return for a USD-based investor will be influenced by currency fluctuations. For example, if the EURO STOXX 50 increases by 10%, but the Euro weakens against the US Dollar by 5% during the same period, the net gain for a US investor, when converted back to USD, will be less than 10%. Conversely, if the Euro strengthens against the USD, it can amplify returns. Therefore, understanding currency movements and their potential impact is vital when investing in European indices like the EURO STOXX 50.

Conclusion

The EURO STOXX 50 index is an essential benchmark for anyone looking at the Eurozone equity market. Its diversified composition, liquidity, and representation of leading companies make it a cornerstone for investment products and a key indicator of European economic health. For US-based investors, while the index provides access to a significant portion of the global market, it’s important to factor in the EUR to USD exchange rate dynamics to fully understand the potential returns and risks associated with investments linked to this leading European index.