For individuals and businesses needing to convert £5000 GBP to EUR, understanding the costs and efficiency of different money transfer platforms is crucial. This article provides a detailed comparison between two popular services, Skrill and CurrencyFair, focusing on exchange rates, fees, and transfer times to help you make an informed decision when you need to convert 5000 gbp to eur.

Skrill vs CurrencyFair: Exchange Rates for Converting GBP to EUR

When converting 5000 gbp to eur, the exchange rate you receive significantly impacts the final amount in Euros. As of January 15, 2020, a comparison was conducted to illustrate the differences between Skrill and CurrencyFair.

CurrencyFair vs Skrill 5000 GBP to EUR Comparison: Exchange Rates and Fees

CurrencyFair vs Skrill 5000 GBP to EUR Comparison: Exchange Rates and Fees

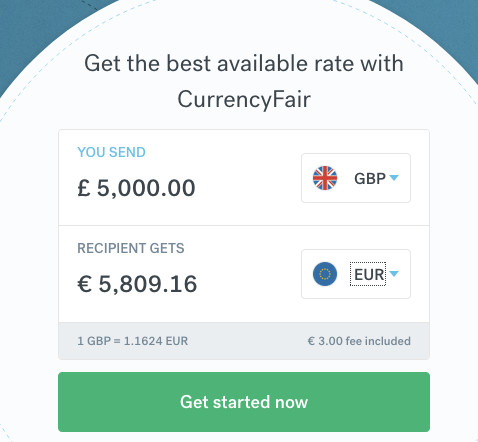

According to data gathered on this date, when sending £5000 to Ireland via bank transfer, Skrill provided the recipient with €5,777.21 after charging a £50 fee. This means the total cost with Skrill amounted to £5,050. In contrast, CurrencyFair, for the same £5000 transfer to Ireland, delivered €5,809.16 to the recipient with a significantly lower €3 transfer fee. The total cost with CurrencyFair was £5002.50 (including the approximate £2.50 equivalent of the €3 fee). This comparison reveals that using CurrencyFair to convert 5000 gbp to eur resulted in receiving approximately €32 more than Skrill, with a fee saving of £47.50.

Breakdown of Exchange Rate Margins

Skrill’s exchange rate policy, as of January 2020, involves adding a 3.9% fee on top of the currency market rate. While the base exchange rate might mirror what you find on Google, this added percentage significantly increases the overall cost of converting 5000 gbp to eur.

CurrencyFair operates differently by adding a margin to the exchange rates offered to customers. This margin is typically around just 0.45% away from the live currency market rate, offering a much more competitive exchange rate compared to Skrill’s approach when you convert 5000 gbp to eur.

Fee Structures Compared

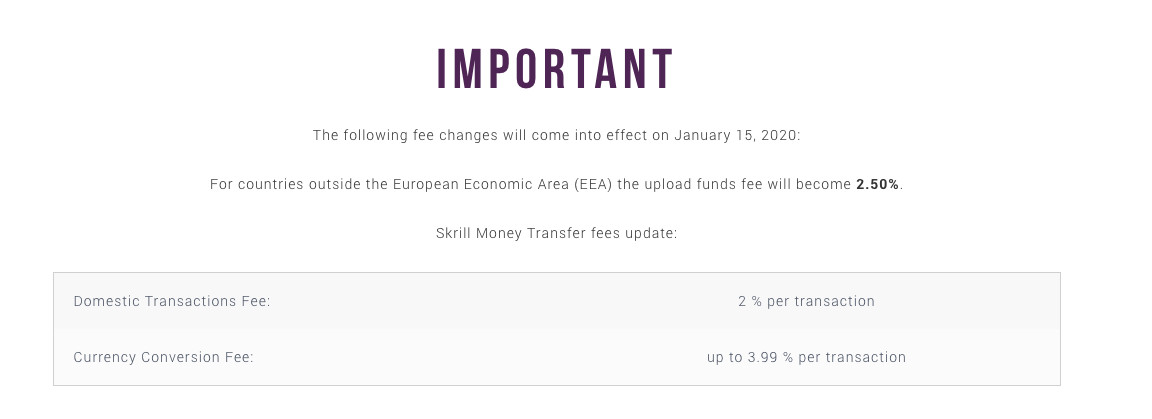

Understanding the fee structures is vital when choosing between Skrill and CurrencyFair to convert 5000 gbp to eur. Skrill offers various deposit methods, including bank transfers, debit cards, and credit cards. Notably, Skrill introduced a currency conversion charge of up to 3.99% for money transfers requiring currency conversion after January 15, 2020.

Skrill Fee Changes January 2020: New Conversion Charges and Deposit Fees

Skrill Fee Changes January 2020: New Conversion Charges and Deposit Fees

Furthermore, depositing funds into Skrill from outside the European Economic Area (EEA) incurs a 2.50% fee. These fees can accumulate, especially when converting larger amounts like 5000 gbp to eur.

CurrencyFair, on the other hand, maintains a transparent and low transfer fee of €3 (or currency equivalent) for most transfers. Depositing funds into a CurrencyFair account via bank transfer is free. CurrencyFair also offers an Express Deposits feature for verified accounts, which allows faster deposits for certain currencies for a small percentage-based fee (e.g., 0.25% for GBP, EUR). However, even with this express fee, it often remains more cost-effective than Skrill, particularly for converting 5000 gbp to eur.

Transfer Times: Skrill vs CurrencyFair

Transfer times are another important factor to consider. Skrill facilitates transfers to 45 countries, while CurrencyFair extends its reach to over 150 destinations.

Skrill’s estimated transfer times for GBP transfers via bank transfer include:

- Up to 4 days to Australia

- Up to 3 days to Ireland

CurrencyFair provides generally faster transfer times. Using Faster Payments, GBP transfers within CurrencyFair can be completed in under an hour. Example transfer times for CurrencyFair include:

- 1-2 business days to Australia (plus 0-1 business day for deposit)

- 1-2 business days to Ireland (plus 0-1 business day for deposit)

CurrencyFair generally offers quicker processing, especially for GBP to EUR transfers within Europe, making it a potentially faster option for converting 5000 gbp to eur.

Conclusion: Choosing the Right Platform for Your 5000 GBP to EUR Conversion

When deciding how to convert 5000 gbp to eur, comparing Skrill and CurrencyFair reveals significant differences in cost and efficiency. CurrencyFair demonstrates a clear advantage in this comparison, offering better exchange rates and lower fees, particularly when considering the hidden percentage fees Skrill applies. While specific needs may vary, for a 5000 gbp to eur conversion, CurrencyFair appears to be a more cost-effective and potentially faster solution based on the data from January 2020. Always compare the latest rates and fees before making a transfer, but this comparison highlights the potential savings and benefits of choosing CurrencyFair for your international money transfers.