A massive international law enforcement operation, dubbed HAECHI IV, has successfully targeted the sprawling world of online financial crime, resulting in almost 3,500 arrests across 34 countries. This six-month initiative (July-December 2023) dismantled criminal networks and seized assets worth a staggering USD 300 million, roughly equivalent to EUR 273 million. The operation highlights the critical need for global cooperation in combating cyber-enabled scams that impact individuals and economies worldwide. Understanding the scale of these crimes, even down to sums like 3500 Euro In Dollar, reveals the pervasive threat and financial strain on victims.

Operation HAECHI IV zeroed in on seven prevalent types of cyber scams, each designed to exploit vulnerabilities and illicitly gain from unsuspecting individuals and businesses. These included:

- Voice Phishing (Vishing): Deceptive phone calls aimed at tricking victims into divulging personal or financial information.

- Romance Scams: Building fake online relationships to emotionally manipulate victims into sending money.

- Online Sextortion: Threatening to expose compromising photos or videos to extort money.

- Investment Fraud: Promising high returns on bogus investments, often leaving victims financially devastated.

- Money Laundering via Illegal Online Gambling: Using online gambling platforms to conceal the origins of illegally obtained funds.

- Business Email Compromise (BEC) Fraud: Impersonating legitimate business entities to trick employees into transferring funds to criminal accounts.

- E-commerce Fraud: Deceptive practices during online shopping, such as selling counterfeit goods or not delivering purchased items.

Investigators from participating nations collaborated closely, leveraging INTERPOL’s Global Rapid Intervention of Payments (I-GRIP) mechanism. I-GRIP is a crucial tool that allows countries to swiftly cooperate in freezing suspicious bank accounts and virtual asset service provider (VASP) accounts, effectively stopping the flow of illicit funds. This international cooperation was instrumental in disrupting criminal operations and recovering stolen assets.

A notable success of Operation HAECHI IV was the joint effort between Filipino and Korean authorities, culminating in the arrest in Manila of a high-profile online gambling criminal. This individual had been evading capture for two years, pursued by Korea’s National Police Agency, demonstrating the persistence and reach of international law enforcement when working in concert.

The operation’s impact is clearly demonstrated by the numbers: authorities successfully blocked 82,112 suspicious bank accounts and seized USD 199 million in traditional currency along with USD 101 million in virtual assets. This substantial recovery underscores the financial motivation driving transnational organized crime and the immense scale of illicit gains they accumulate.

Stephen Kavanagh, INTERPOL’s Executive Director of Police Services, emphasized the significance of these seizures: “The seizure of USD 300 million represents a staggering sum and clearly illustrates the incentive behind today’s explosive growth of transnational organized crime. This represents the savings and hard-earned cash of victims. This vast accumulation of unlawful wealth is a serious threat to global security and weakens the economic stability of nations worldwide.”

He further noted the dramatic increase in arrests compared to previous operations: “HAECHI IV’s 200 per cent surge in arrests shows the persistent challenge of cyber-enabled crime, reminding us to stay alert and keep refining our tactics against online fraud, which is why INTERPOL operations like this are so important.”

Data from HAECHI IV revealed that investment fraud, business email compromise, and e-commerce fraud collectively accounted for 75% of the investigated cases. This highlights the prevalence and financial impact of these particular types of online scams. While large sums are often associated with these crimes, it’s important to remember that cybercrime affects individuals at all financial levels. For a victim in certain regions, even losing an amount equivalent to 3500 euro in dollar, approximately $3800 USD, can represent a significant financial blow, impacting their livelihood and savings. Understanding the euro to dollar conversion in these contexts helps to grasp the real-world impact of even seemingly smaller sums in international scams.

Cooperation between Filipino and Korean authorities led to the Manila arrest of a high-profile online gambling criminal who was the subject of a Korean Red Notice

Cooperation between Filipino and Korean authorities led to the Manila arrest of a high-profile online gambling criminal who was the subject of a Korean Red Notice

The scale of Operation HAECHI IV also extended to the rapidly evolving world of virtual assets. Working with numerous VASPs, INTERPOL assisted frontline officers in identifying 367 virtual asset accounts linked to transnational organized crime. Police in member countries moved swiftly to freeze these assets, and investigations are ongoing to fully dismantle these criminal networks.

Kim Dong Kwon, INTERPOL’s Head of National Central Bureau in Korea, highlighted the proactive nature of the operation: “It is remarkable that global efforts to stay ahead of the latest criminal trends have resulted in a substantial growth in operational outcomes. Despite criminals’ endeavors to gain illicit advantages through contemporary trends, they will eventually be apprehended and face due punishment. To accomplish this, Project HAECHI will consistently evolve and expand its scope.”

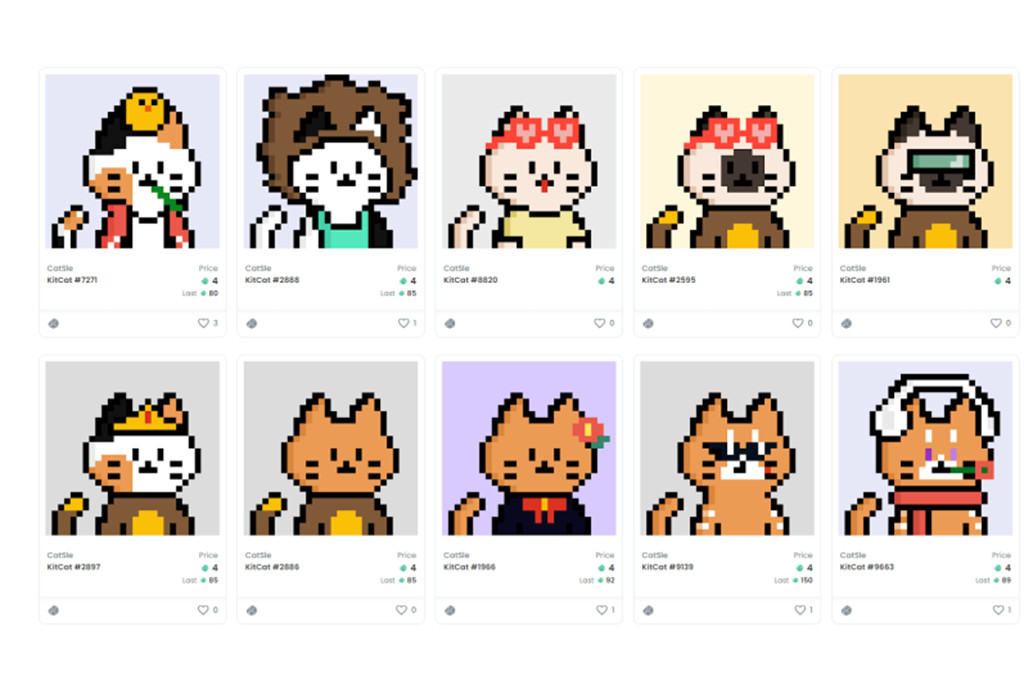

To proactively address emerging threats, Operation HAECHI IV issued two Purple Notices. These notices serve as warnings to INTERPOL member countries about new and evolving criminal tactics. One Purple Notice alerted countries to a novel investment scam originating in Korea involving Non-Fungible Tokens (NFTs). These NFTs were marketed with promises of substantial returns, but ultimately turned out to be a “rug pull,” a growing scam in the cryptocurrency space where developers abruptly abandon a project, leaving investors with worthless assets.

The second Purple Notice cautioned against the increasing use of Artificial Intelligence (AI) and deepfake technology to enhance the credibility of scams. Criminals are using these technologies to mask their identities and impersonate family members, friends, or romantic interests, making scams more convincing and harder to detect.

The UK leg of Operation HAECHI IV reported multiple cases involving AI-generated synthetic content used for deception, fraud, harassment, and extortion. Impersonation scams, online sexual blackmail, and investment fraud were all found to utilize AI, including voice cloning technology to impersonate individuals known to the victims. This underscores the sophisticated and rapidly evolving nature of cybercrime, requiring constant vigilance and adaptation from law enforcement and individuals alike.

Sample of a cat-themed non-fungible token (NFT)

Sample of a cat-themed non-fungible token (NFT)

HAECHI operations are financially supported by Korea, demonstrating their commitment to combating cybercrime on a global scale. The extensive list of participating countries in HAECHI IV, spanning across continents, highlights the truly international nature of this fight: Argentina, Australia, Brunei, Cambodia, Cayman Islands, Ghana, Hong Kong (China), India, Indonesia, Ireland, Japan, Kyrgyzstan, Laos, Liechtenstein, Malaysia, Maldives, Mauritius, Nigeria, Pakistan, Philippines, Poland, Korea, Romania, Seychelles, Singapore, Slovenia, South Africa, Spain, Sweden, Thailand, United Arab Emirates, United Kingdom, United States, and Viet Nam.

In conclusion, Operation HAECHI IV represents a significant stride in the ongoing battle against online financial crime. The nearly 3,500 arrests and the seizure of USD 300 million in assets demonstrate the effectiveness of international cooperation and the unwavering commitment of law enforcement to combat these sophisticated criminal networks. However, the increasing sophistication of scams, including the use of AI and virtual assets, necessitates continued vigilance and proactive measures. Understanding the global nature of cybercrime and its impact, from large-scale fraud to individual losses equivalent to sums like 3500 euro in dollar, is crucial for individuals, businesses, and governments to protect themselves and maintain financial security in an increasingly interconnected digital world.