In a sweeping international law enforcement action, Operation HAECHI IV, authorities across 34 nations have dismantled a vast network of online financial crime, resulting in nearly 3,500 arrests and the seizure of assets worth USD 300 million, equivalent to approximately EUR 273 million. This coordinated effort underscores the escalating threat of cyber-enabled scams and the critical need for global cooperation to combat these illicit activities. To put the scale of these crimes into perspective, while operations like HAECHI IV deal with sums in the millions of dollars, even smaller amounts, such as understanding the conversion of 3500 Euros To Usd, become crucial when tracking the flow of illicit funds across borders and individual victims.

Operation HAECHI IV, spanning six months from July to December 2023, specifically targeted seven prevalent types of cyber scams. These included deceptive voice phishing schemes designed to trick victims into revealing personal or financial information, emotionally manipulative romance scams, and online sextortion, where individuals are coerced through threats related to sexual material. Investment fraud, a particularly damaging type of scam, was also a key focus, alongside the intricate financial networks of money laundering associated with illegal online gambling operations. Business email compromise fraud, targeting businesses through email manipulation, and e-commerce fraud, affecting online shoppers and sellers, rounded out the list of targeted cybercrimes.

A crucial element of Operation HAECHI IV’s success was the utilization of INTERPOL’s Global Rapid Intervention of Payments (I-GRIP). This mechanism facilitated real-time cooperation between international investigators, enabling them to swiftly detect fraudulent online activities and freeze bank accounts and virtual asset service provider (VASP) accounts linked to criminal operations. This rapid response capability is essential in the fast-paced world of cybercrime, where funds can be moved across borders in moments, often making recovery difficult.

A significant success story of international collaboration within HAECHI IV was the joint effort between Filipino and Korean authorities. This partnership culminated in the arrest in Manila of a high-profile online gambling criminal who had been evading capture for two years under a Korea’s National Police Agency manhunt. This arrest demonstrates the effectiveness of cross-border cooperation in bringing even elusive cybercriminals to justice.

The operation’s impact is further highlighted by the sheer volume of financial disruption. Authorities successfully blocked a staggering 82,112 suspicious bank accounts. From these accounts and related investigations, they seized a total of USD 199 million in traditional hard currency and an additional USD 101 million in virtual assets. This substantial recovery underscores the immense financial scale of cybercrime and the potential for significant asset recovery through coordinated international efforts.

Stephen Kavanagh, INTERPOL’s Executive Director of Police Services, emphasized the gravity of these financial seizures: “The seizure of USD 300 million represents a staggering sum and clearly illustrates the incentive behind today’s explosive growth of transnational organized crime. This represents the savings and hard-earned cash of victims. This vast accumulation of unlawful wealth is a serious threat to global security and weakens the economic stability of nations worldwide.” His statement highlights the far-reaching consequences of cyber financial crime, extending beyond individual victims to impact global economic stability.

Operation HAECHI IV dismantled a large illegal gambling network, leading to significant arrests and asset seizures.

Operation HAECHI IV dismantled a large illegal gambling network, leading to significant arrests and asset seizures.

The success of HAECHI IV, with a “200 per cent surge in arrests,” as noted by INTERPOL, also points to the evolving and persistent nature of cyber-enabled crime. This increase serves as a reminder of the constant need for vigilance and the refinement of strategies to combat online fraud. INTERPOL operations like HAECHI IV are crucial in this ongoing battle, providing a framework for international cooperation and the sharing of best practices.

Analysis of the cases investigated during HAECHI IV reveals that investment fraud, business email compromise, and e-commerce fraud constituted a significant 75 per cent of the total. This concentration highlights the areas where cybercriminals are most active and potentially where preventative measures and public awareness campaigns should be focused.

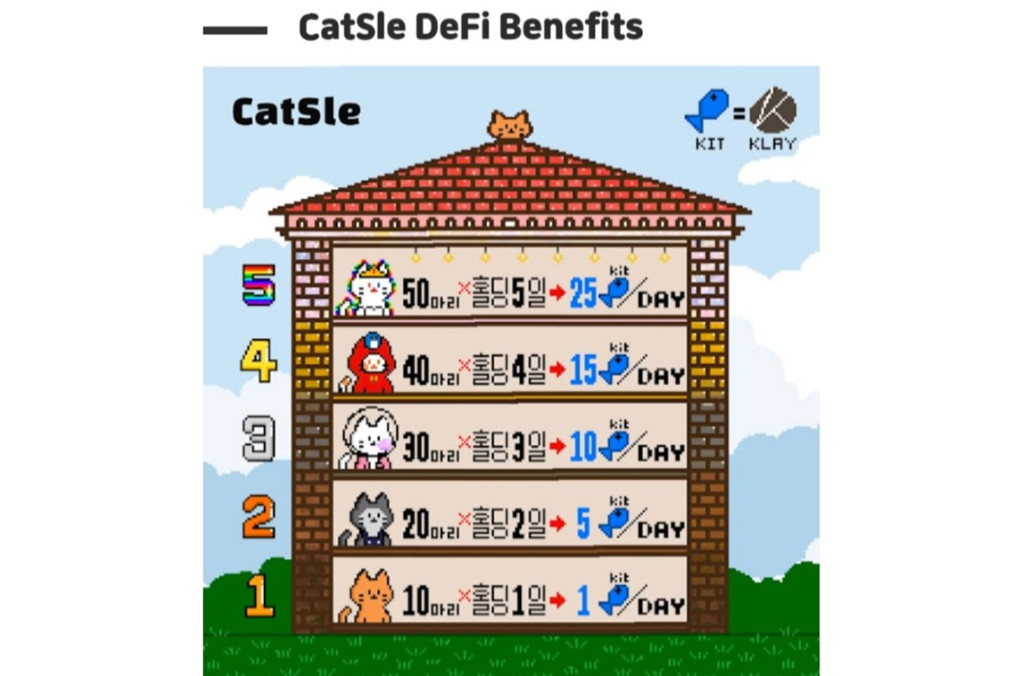

INTERPOL’s commitment to proactive measures is further demonstrated through the issuance of two Purple Notices during Operation HAECHI IV. These notices serve as alerts to member countries about emerging trends and modus operandi in cybercrime. One notice specifically warned about a new scam identified in Korea involving Non-Fungible Tokens (NFTs). These NFTs were deceptively marketed with promises of high returns, only to be revealed as a “rug pull,” a common crypto scam where developers abruptly abandon a project, leaving investors with worthless assets.

Example of a cat-themed Non-Fungible Token (NFT), illustrating the digital assets used in some investment scams.

Example of a cat-themed Non-Fungible Token (NFT), illustrating the digital assets used in some investment scams.

NFTs, including digital artwork and collectibles, are increasingly used in financial scams, highlighting the need for vigilance in the digital asset space.

NFTs, including digital artwork and collectibles, are increasingly used in financial scams, highlighting the need for vigilance in the digital asset space.

The second Purple Notice addressed the alarming trend of using Artificial Intelligence (AI) and deepfake technology to enhance the credibility of scams. Criminals are increasingly leveraging these technologies to mask their identities and impersonate trusted individuals, such as family members, friends, or romantic interests. The UK leg of Operation HAECHI IV reported multiple cases involving AI-generated synthetic content used for deception, fraud, harassment, and extortion, particularly in impersonation scams, online sexual blackmail, and investment fraud. Voice cloning technology was also used to impersonate individuals known to victims, further blurring the lines of reality and making scams more convincing.

A post-operational meeting at INTERPOL's Global Complex for Innovation in Singapore to analyze results and refine tactics against evolving cybercrime.

A post-operational meeting at INTERPOL's Global Complex for Innovation in Singapore to analyze results and refine tactics against evolving cybercrime.

Kim Dong Kwon, INTERPOL’s Head of National Central Bureau in Korea, emphasized the importance of continuous adaptation in the fight against cybercrime: “It is remarkable that global efforts to stay ahead of the latest criminal trends have resulted in a substantial growth in operational outcomes. Despite criminals’ endeavors to gain illicit advantages through contemporary trends, they will eventually be apprehended and face due punishment. To accomplish this, Project HAECHI will consistently evolve and expand its scope.”

Operation HAECHI IV, supported financially by Korea, involved a wide array of participating countries, demonstrating the global commitment to tackling cyber financial crime. These nations included Argentina, Australia, Brunei, Cambodia, Cayman Islands, Ghana, Hong Kong (China), India, Indonesia, Ireland, Japan, Kyrgyzstan, Laos, Liechtenstein, Malaysia, Maldives, Mauritius, Nigeria, Pakistan, Philippines, Poland, Korea, Romania, Seychelles, Singapore, Slovenia, South Africa, Spain, Sweden, Thailand, United Arab Emirates, United Kingdom, United States, and Viet Nam.

In conclusion, Operation HAECHI IV represents a significant stride in the ongoing battle against transnational cyber financial crime. The massive scale of arrests and asset seizures, totaling USD 300 million, underscores both the challenge and the necessity of international cooperation. As cybercriminals continue to evolve their tactics, leveraging new technologies and exploiting global financial systems, operations like HAECHI IV, with their emphasis on collaboration, rapid response, and proactive intelligence sharing, remain crucial in safeguarding individuals and the global economy from these ever-present threats. Understanding the flow of funds, from individual transactions potentially starting as small as 3500 euros to usd in scams, to the millions recovered in this operation, is key to effectively combating and preventing future cyber financial crimes.