So far this year, the Federal Reserve (FED) has injected nearly three trillion dollars directly into the U.S. economy with unwavering resolve and has another trillion dollars on standby.

In contrast, the European Central Bank’s (ECB) efforts have been less than half of that amount, primarily focused on supporting banks, and seemingly diverging from the path taken by the FED.

What implications might these differing economic strategies hold for Europe’s economic future?

Growth vs. Inflation: A Central Bank Dilemma

At the beginning of 2020, the starting positions of both central banks were relatively similar. The FED held $4 trillion in assets, while the ECB possessed €4.6 trillion.

Between March and May 2020, the FED’s balance sheet surged to $7.1 trillion. Part of this economic stimulus reached American citizens in the form of checks for $1,200. Given the FED’s decisive response then, another trillion dollars is anticipated for further direct payments.

Conversely, the ECB remains focused on its primary – and seemingly sole – objective: ensuring price stability, i.e., controlling inflation. While it has injected €1.3 trillion into European banks, this money appears to be directed towards covering deficits rather than building a future, or even securing the present, for citizens struggling to make ends meet.

Europe appears willing to risk disintegration rather than tolerate inflation. Is the memory of interwar hyperinflation so potent? What good is controlled inflation to those facing economic hardship?

“Whatever it takes”? Echoes of the Past

Following the 2008 crisis, the ECB took four years to react with Draghi’s famous phrase, “Whatever it takes.” This pledge involved purchasing public debt virtually without limit, granting Eurozone countries a respite that could have been used for structural reforms (which were largely forgone).

Could Germany have sold so many automobiles in recent years without the large, semi-captive market of Southern Europe? What has been the benefit of the hundreds of billions spent by European governments on bank bailouts? How long has Spain been aware of the unsustainability of its pension system and the imbalances in its public administration? Europe deludes itself if it believes its economy is comparable to that of the United States.

Two Central Banks, Two Perspectives on Currency

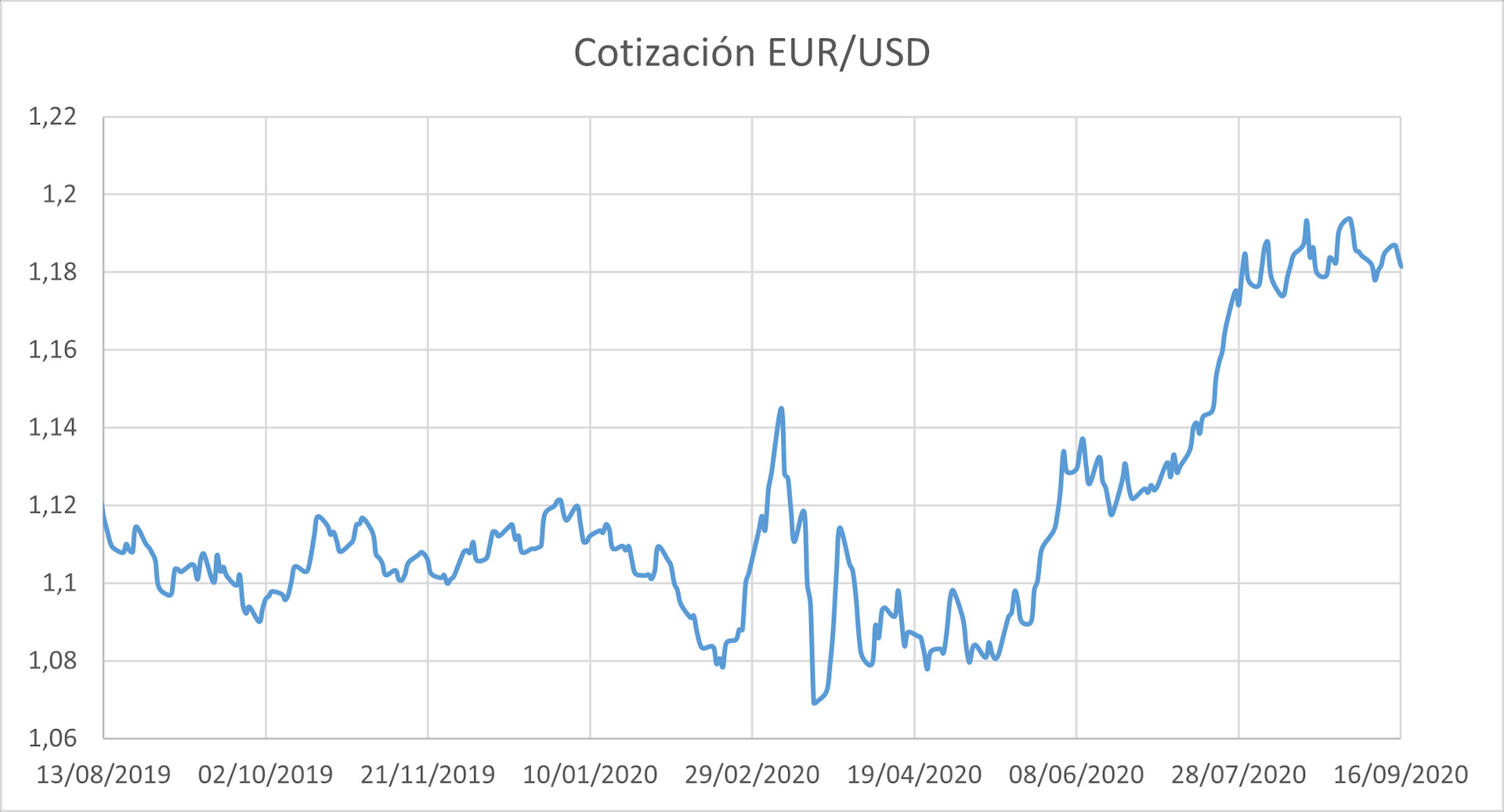

The relative increase in the number of dollars compared to euros is one reason for the recent appreciation of the euro against the dollar. From February to September 2020, the euro-dollar exchange rate moved from €1.08 to €1.18 per dollar.

Euro to Dollar exchange rate between August 13 and September 16, 2020

Euro to Dollar exchange rate between August 13 and September 16, 2020

A strong euro makes European products relatively more expensive compared to American goods, favoring imports of U.S. products and harming European exporters.

This situation pushes the Eurozone further away from inflation but harbors dangerous pitfalls. Consumption declines, average wages decrease, and unemployment rises. What is the point of strengthening the euro if EU citizens lack the euros to spend?

Jerome Powell, Chairman of the FED, announced weeks ago that the policy of economic stimulus in the United States would continue. In his address, he indicated that inflation is not as critical as the need for reforms to secure the long term.

The world has changed, social inequality is increasing, and action is necessary. Last week, his counterpart at the ECB, Christine Lagarde, appeared more cautious: the ECB is still considering adjusting its inflation target.