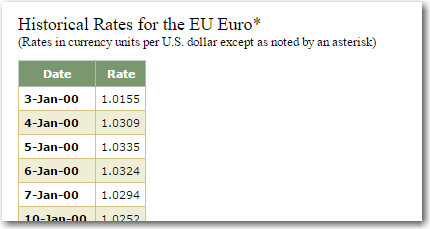

Recent headlines have proclaimed a significant shift in currency values, specifically highlighting the dollar potentially becoming stronger than the euro. One Washington Post article even boldly stated, “This is historic: The dollar will soon be worth more than the euro,” accompanied by a graph illustrating the euro’s decline. At first glance, this seems like an unprecedented event, suggesting a dramatic change in the euro-dollar exchange rate. But is this truly a historic anomaly, or is there more to the story? Let’s delve into the data and analyze the dynamics of the Euros Vs Dollar exchange rate to separate fact from hype.

Initially, the Washington Post’s presentation, focusing on a recent drop in the euro’s value, creates a strong impression. Their graph effectively visualizes this downward trend:

Graph from Washington Post article showing euro value dropping

Graph from Washington Post article showing euro value dropping

This visual, combined with the sensational headline, might lead many to believe that the euro consistently maintained a higher value than the dollar, and a reversal is now imminent and historic. However, a closer look at historical data reveals a more nuanced picture regarding the euros vs dollar exchange rate.

To gain a clearer understanding, we need to examine the actual exchange rate data over a longer period. Reliable data is readily available from sources like the Federal Reserve. Before we proceed with data analysis, here’s a visual representation of euros and dollars, the currencies at the heart of this discussion:

Image of Euro and Dollar bills showcasing both currencies

Image of Euro and Dollar bills showcasing both currencies

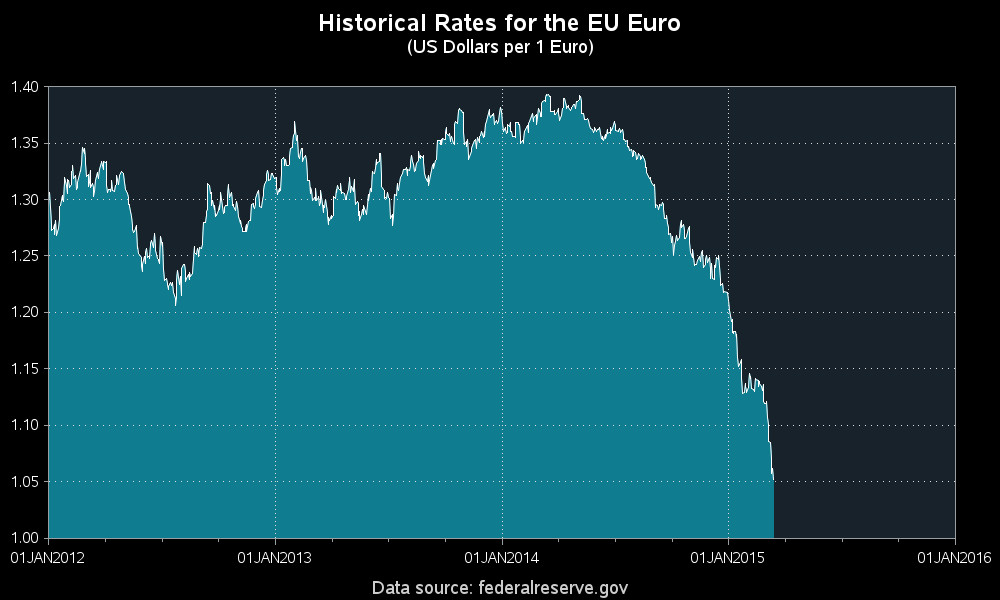

Analyzing data from the Federal Reserve provides a comprehensive view of the euro vs dollar exchange rate. Replicating the Washington Post’s analysis using data for a similar timeframe, we can indeed observe the recent decline they highlighted. The graph below mirrors the trend of the euro’s value relative to the dollar during the period emphasized in the original article:

Graph showing recent euro vs dollar exchange rate trends similar to Washington Post article

Graph showing recent euro vs dollar exchange rate trends similar to Washington Post article

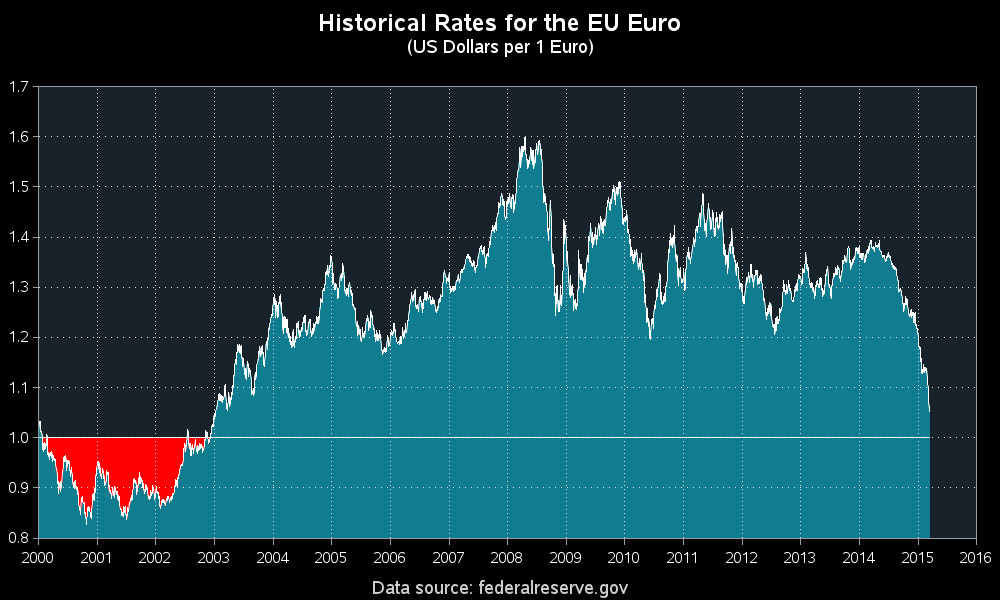

This graph validates the Washington Post’s observation of a recent drop. However, to determine if this is truly “historic,” we must broaden our scope and examine a longer historical timeline of the euros vs dollar exchange rate. Extending the analysis to include data back to the euro’s inception in 2000 reveals a significant insight: the euro was actually worth less than the dollar in its early years, from approximately 2000 to 2003.

Historical graph of euro vs dollar exchange rate from 2000 showing euro value below dollar in early 2000s

Historical graph of euro vs dollar exchange rate from 2000 showing euro value below dollar in early 2000s

This historical perspective changes the narrative. While the recent rate of decline might be noteworthy, the euro being valued lower than the dollar is not an unprecedented event. In fact, early in the euro’s history, the dollar held a stronger position.

The fluctuation in the euros vs dollar exchange rate naturally raises economic questions. Who benefits and who is disadvantaged when the euro’s value decreases relative to the dollar? Economists can offer valuable insights into the broader economic implications of these currency shifts and their impact on international trade, investment, and various economies.