In the dynamic world of Forex trading, charts are indispensable tools that visually represent historical and real-time price movements. For traders focused on the Euro and the “Euro Live Table” data, understanding how to read these charts is paramount. Whether you’re tracking EUR/USD, EUR/GBP, or any other Euro pair, mastering chart analysis will significantly enhance your trading decisions. This guide will walk you through the essentials of chart reading, focusing on how to interpret the information relevant to the Euro live table.

There are several types of charts used in financial analysis, each presenting price data in a unique way. The most common types you’ll encounter when monitoring the euro live table are line charts, bar charts, and candlestick charts.

The line chart is the simplest, displaying a continuous line that connects the closing prices over a specified period. For instance, on a one-hour line chart, each point on the line represents the closing price of the Euro pair at the end of each hour. This chart type provides a clear visual of the overall price trend but omits intraday price fluctuations.

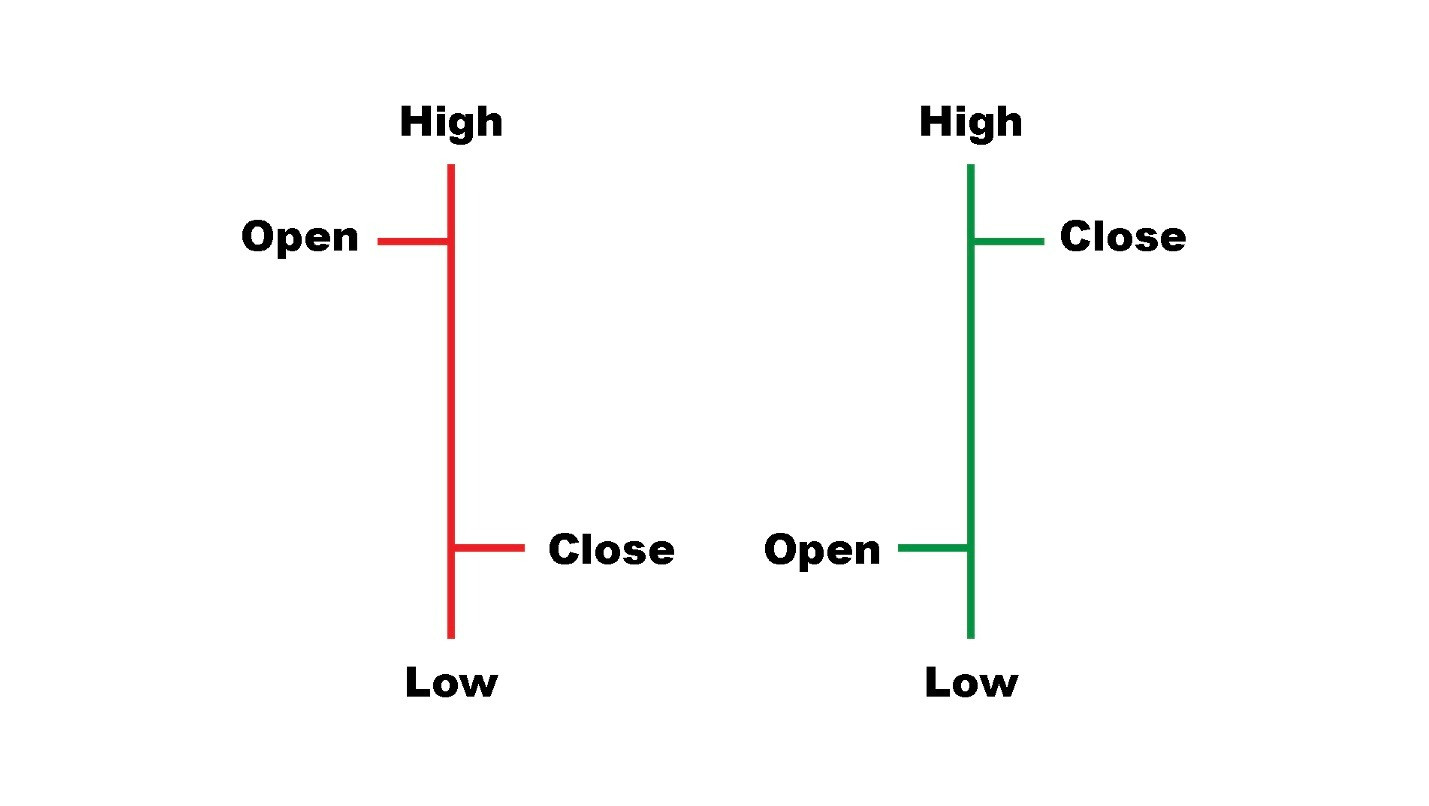

Bar charts offer a more detailed view, showing the open, high, low, and close prices for each period. A vertical bar represents the price range during a timeframe, with small horizontal lines indicating the opening price (left) and closing price (right). Analyzing a one-hour bar chart for EUR/USD reveals the opening price, the highest and lowest prices reached within that hour, and the closing price.

Example of bar candles illustrating bearish and bullish market trends.

Example of bar candles illustrating bearish and bullish market trends.

Bars are often color-coded to indicate price direction. A green bar typically signifies a bullish candle, meaning the closing price was higher than the opening price. Conversely, a red bar indicates a bearish candle, where the closing price was lower than the opening price. These visual cues are essential for quickly interpreting price movements related to the euro live table.

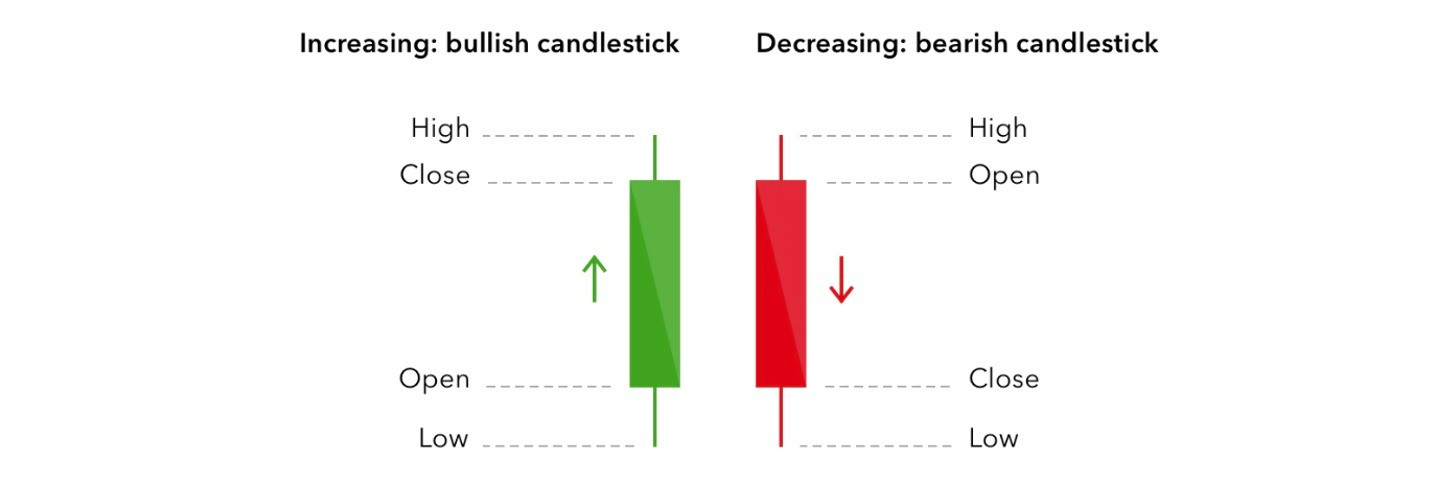

Candlestick charts are the most popular type among traders analyzing the euro live table and other financial instruments. They are an evolution of bar charts, presenting the same open, high, low, and close data in a visually clearer format. The “body” of the candlestick represents the range between the open and close prices, while the “wicks” or “shadows” extending above and below the body show the high and low prices for that period.

Candlestick chart example demonstrating bearish and bullish market sentiment with green and red candles.

Candlestick chart example demonstrating bearish and bullish market sentiment with green and red candles.

Similar to bar charts, candlestick colors denote price direction. Green candlesticks (or white/blue depending on platform settings) are bullish, indicating the closing price is above the opening price, while red candlesticks (or black) are bearish, showing the closing price is below the opening price. The candlestick chart’s visual clarity makes it particularly effective for quickly assessing price action on the euro live table.

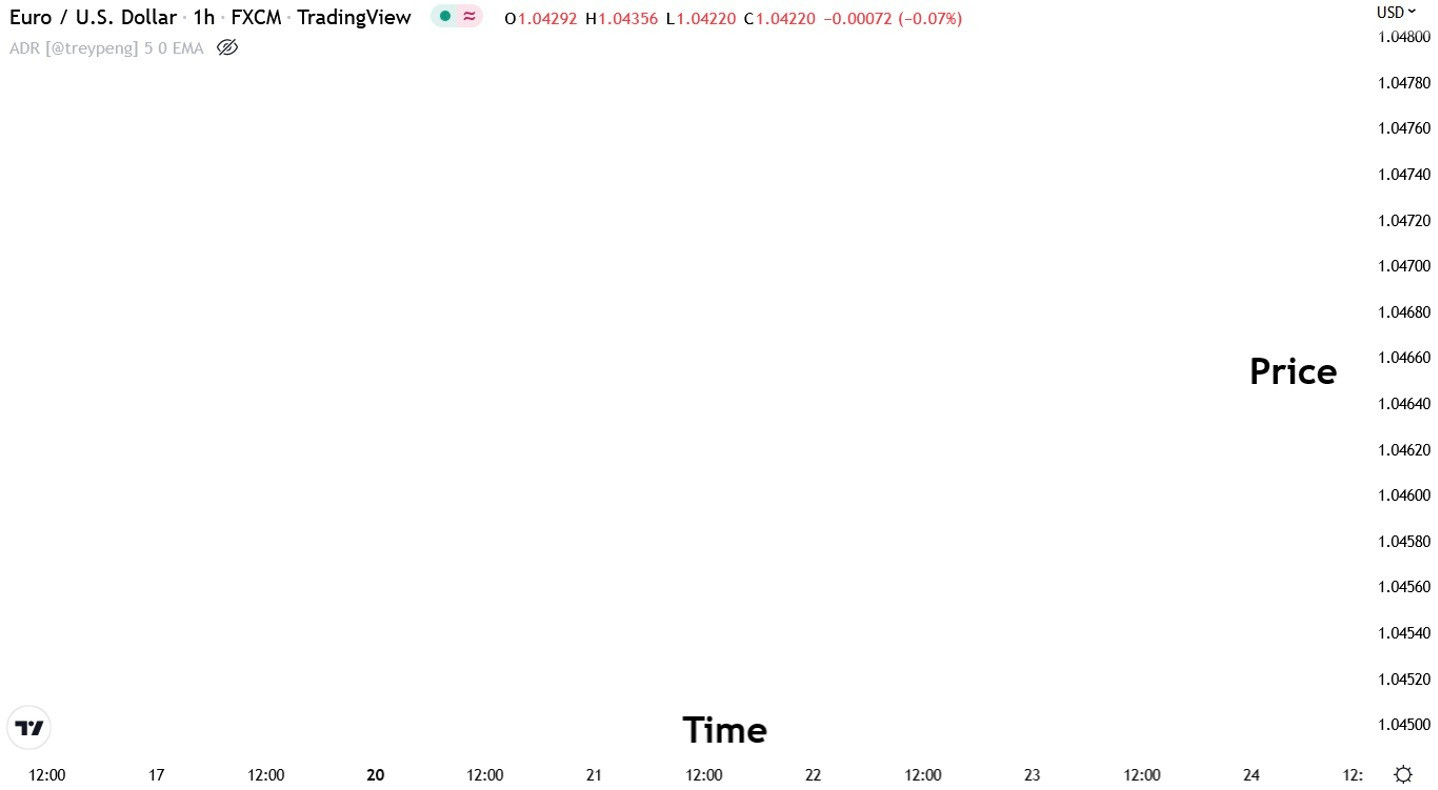

All charts, including those for the euro live table, are plotted on two axes. The horizontal axis represents time, moving from left to right, while the vertical axis displays the price. Price data unfolds chronologically from left to right. Upward price movement is considered bullish, while downward movement is bearish.

EURUSD chart example illustrating time and price axes in Forex trading.

EURUSD chart example illustrating time and price axes in Forex trading.

Selecting the Right Timeframe for Euro Live Table Analysis

When analyzing the euro live table using charts, choosing the appropriate timeframe is crucial and depends on your trading style and objectives. Timeframes range from one-minute charts to monthly charts, each providing a different perspective on price action.

For short-term trading strategies based on the euro live table, faster timeframes like 5-minute, 15-minute, or 1-hour charts are typically preferred. These shorter timeframes offer a more granular view of immediate price fluctuations, reflecting real-time market reactions to news and economic data impacting Euro pairs.

If you have less time for active monitoring or prefer a longer-term approach to trading Euro pairs, timeframes from 1-hour to daily charts may be more suitable. These higher timeframes smooth out short-term volatility and provide a clearer picture of broader trends influencing Euro pairs.

Lower timeframes are often more susceptible to “noise,” reflecting rapid price changes driven by immediate events like news releases, economic announcements, or geopolitical developments. While these events can create short-term trading opportunities within the euro live table context, they also require nimble trading and heightened awareness of market volatility.

Higher timeframes, in contrast, are less affected by short-term noise. Each candlestick or bar represents a longer period, averaging out fleeting price fluctuations and allowing traders to focus on overarching market trends and more substantial price movements related to the Euro.

Identifying Trends on Euro Live Table Charts

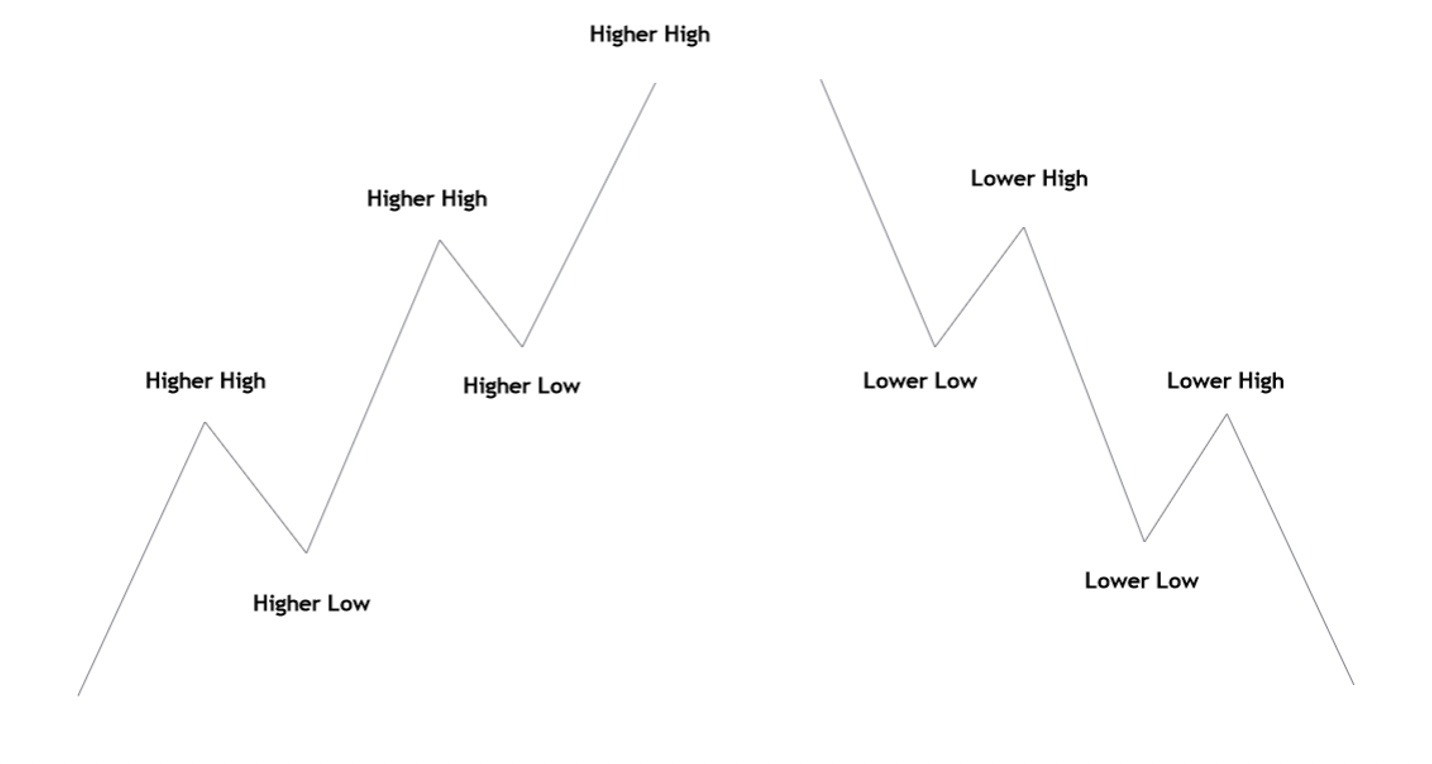

Trend identification is a fundamental aspect of technical analysis when using charts to analyze the euro live table. A trend signifies the general direction of price movement. In technical analysis, trends are defined by swing highs and swing lows.

An uptrend is characterized by successively higher swing highs and higher swing lows. Conversely, a downtrend is marked by lower swing lows and lower highs. Visually identifying these patterns on a euro live table chart helps determine the prevailing market direction for Euro pairs.

Price trend examples showing swing highs and swing lows in uptrend and downtrend scenarios.

Price trend examples showing swing highs and swing lows in uptrend and downtrend scenarios.

Identifying swing highs and lows can sometimes be subjective, and trends can vary across different timeframes. For example, a 5-minute chart for EUR/USD might show an uptrend, while a 1-hour chart might indicate a downtrend. Generally, trends on higher timeframes are considered more significant. In cases of conflicting trends across timeframes, analysts often prioritize the higher timeframe trend.

Moving averages are another valuable tool for trend identification on euro live table charts. A moving average smooths price action by calculating the average closing price over a specific number of periods, displayed as a line on the chart.

Popular moving averages include the 20-period Exponential Moving Average (EMA), and the 20, 50, 100, and 200-period Simple Moving Averages (SMA). When the price is above a moving average, it generally indicates an uptrend; when below, a downtrend. Traders often use moving averages in conjunction with swing high/low analysis for robust trend confirmation on euro live table charts.

Utilizing Indicators for Enhanced Euro Live Table Analysis

Technical indicators are mathematical calculations based on price and volume data, providing additional insights into market conditions. For euro live table analysis, indicators can help filter noise and identify potential trading opportunities.

Indicators should be used as supplementary tools, not in isolation. Popular indicators include moving averages (discussed earlier) and oscillators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD).

Moving averages, beyond trend identification, can also act as dynamic support and resistance levels. In an uptrend, for instance, a moving average might serve as a support level, where price may pullback to and subsequently bounce higher.

Oscillators, such as the RSI and MACD, are momentum indicators used to identify overbought or oversold conditions and potential turning points in price. The RSI measures the speed and change of price movements on a scale from 0 to 100, typically using 14 periods.

An RSI reading above 70 is considered overbought, suggesting the Euro pair may be due for a pullback or reversal. Conversely, an RSI below 30 is considered oversold, potentially signaling a possible price increase. While overbought/oversold levels can indicate potential turning points, they are not definitive buy or sell signals.

Example live chart showing USDJPY and the RSI (Relative Strength Index) oscillator.

Example live chart showing USDJPY and the RSI (Relative Strength Index) oscillator.

The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a price. It consists of the MACD line, signal line, and histogram. The signal line is a moving average of the MACD line.

Crossovers between the MACD line and signal line can suggest changes in momentum. A MACD line crossing above the signal line is considered a bullish signal, while a cross below is bearish. The histogram visually represents the difference between the MACD line and signal line, providing further insight into momentum strength and potential overbought/oversold conditions.

Recognizing Chart Patterns in Euro Live Table Data

Chart patterns are distinctive formations on price charts that traders use to anticipate future price movements. These patterns, formed by trendlines and support/resistance levels, can signal trend continuations or reversals in Euro pairs and other assets reflected in the euro live table.

Chart patterns are not always textbook perfect due to market noise and volatility. It’s important to approach pattern recognition with flexibility and consider them as reflections of market sentiment rather than rigid rules.

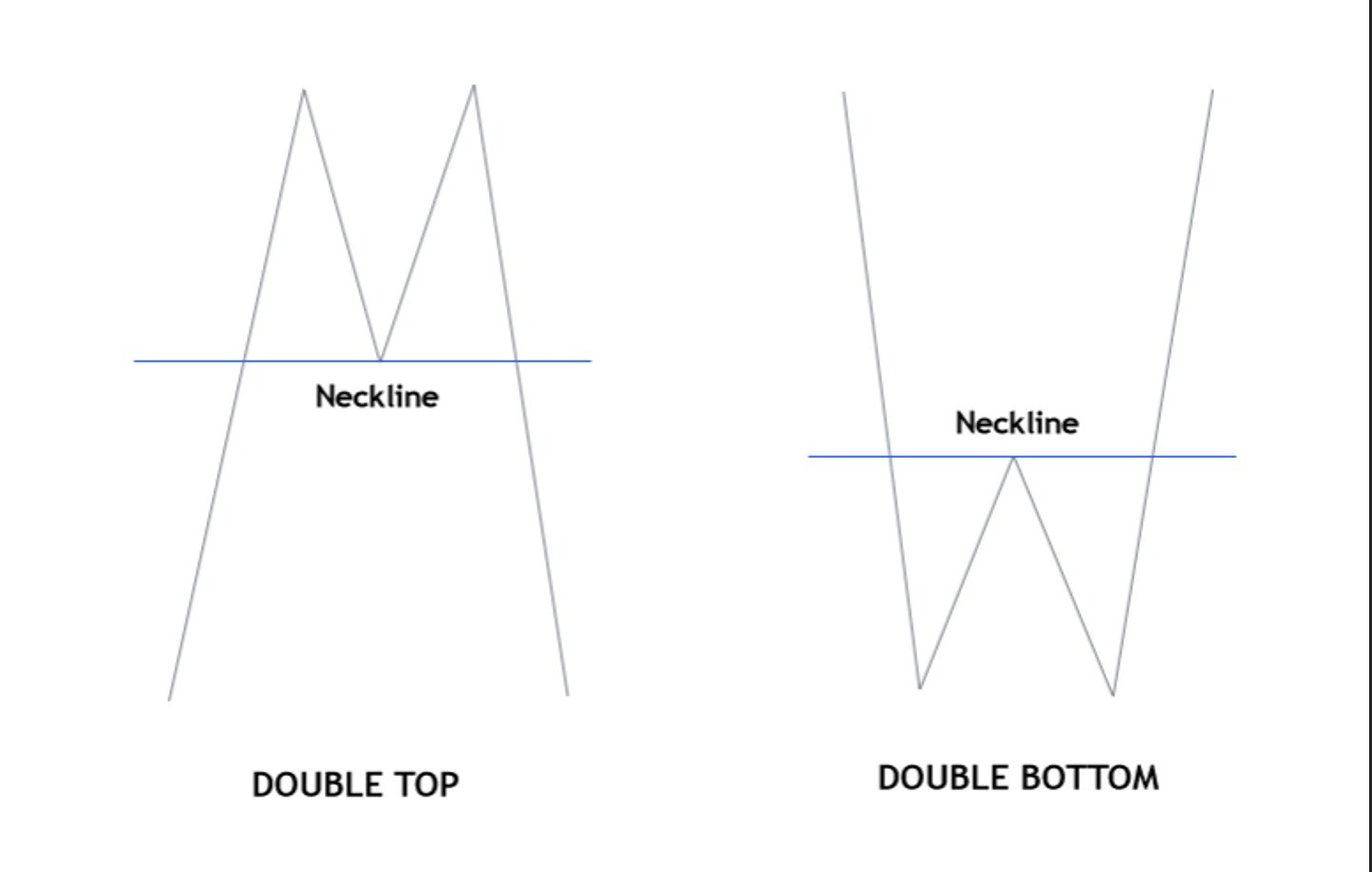

Double Top and Double Bottom Patterns: These reversal patterns indicate areas where the market has made two unsuccessful attempts to break through a price level. A double top resembles an “M” shape and suggests a potential trend reversal from bullish to bearish. A double bottom looks like a “W” and signals a possible reversal from bearish to bullish. The “neckline” of these patterns is a key support or resistance level. A break of the neckline often confirms the pattern and suggests further price movement in the direction of the reversal.

Candlestick patterns illustrating double top and double bottom formations with necklines.

Candlestick patterns illustrating double top and double bottom formations with necklines.

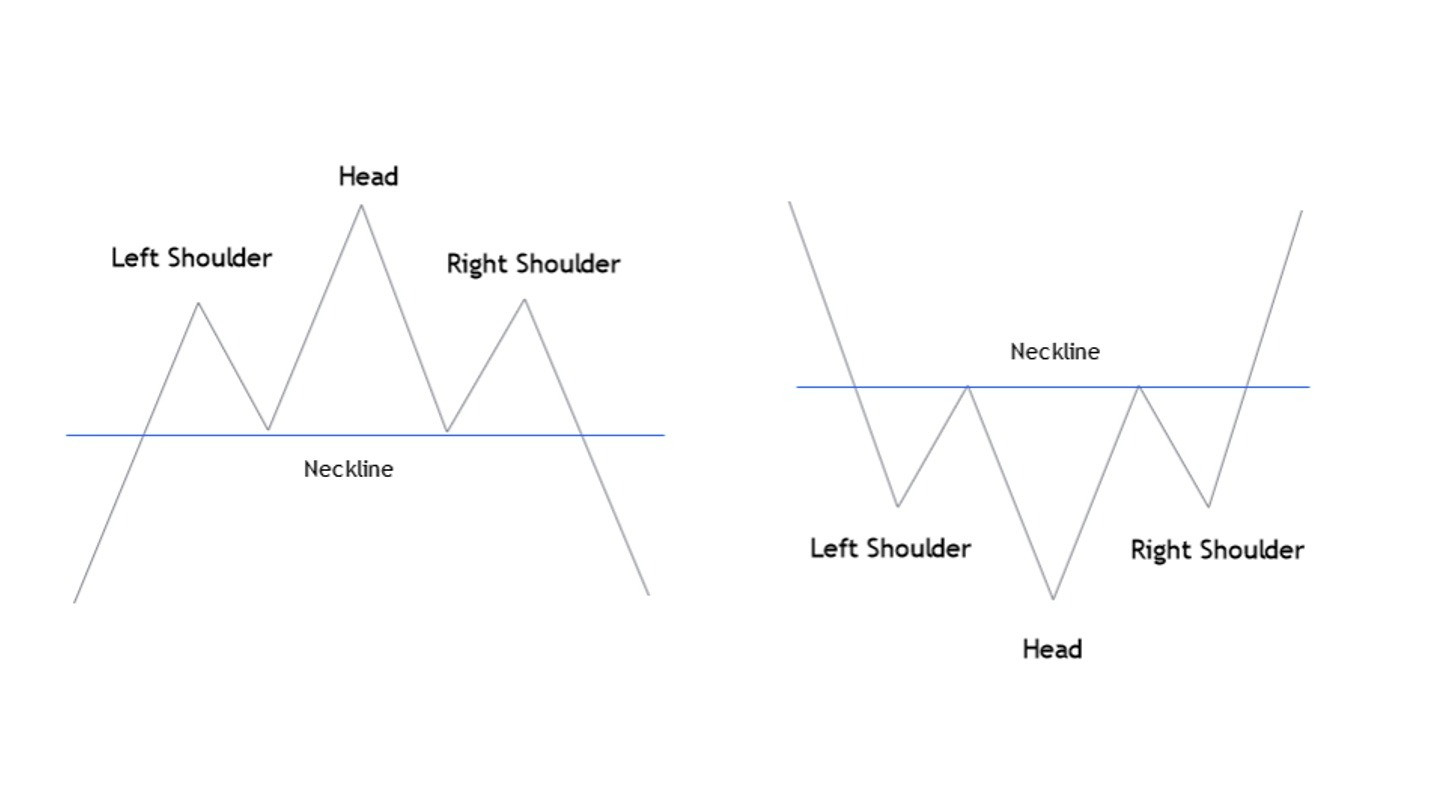

Head and Shoulders Pattern: This is another reversal pattern signaling weakening bullish momentum. It features three peaks, with the middle peak (head) being the highest and two shoulders on either side. The neckline connects the lows between the peaks. A break below the neckline confirms the pattern and suggests a potential downtrend.

Head and shoulders and inverse head and shoulders chart patterns showing neckline and peaks.

Head and shoulders and inverse head and shoulders chart patterns showing neckline and peaks.

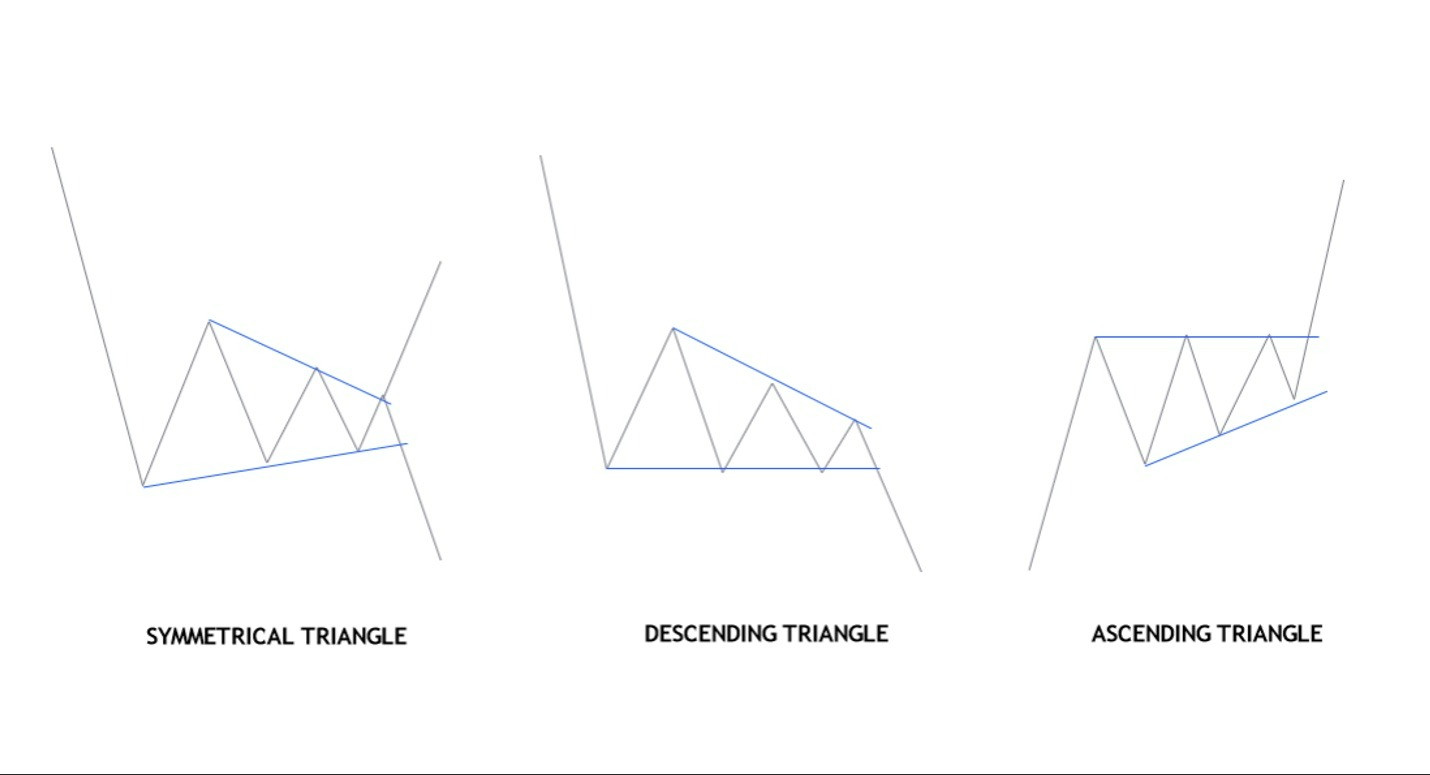

Triangle Patterns: Triangles are typically continuation patterns, indicating a consolidation period before the price resumes its prior trend. Symmetrical triangles can break in either direction, while descending triangles often break downwards, and ascending triangles tend to break upwards. However, breakouts can occur in either direction, requiring traders to be prepared for both scenarios.

Triangle chart patterns including symmetrical, descending, and ascending types as continuation patterns.

Triangle chart patterns including symmetrical, descending, and ascending types as continuation patterns.

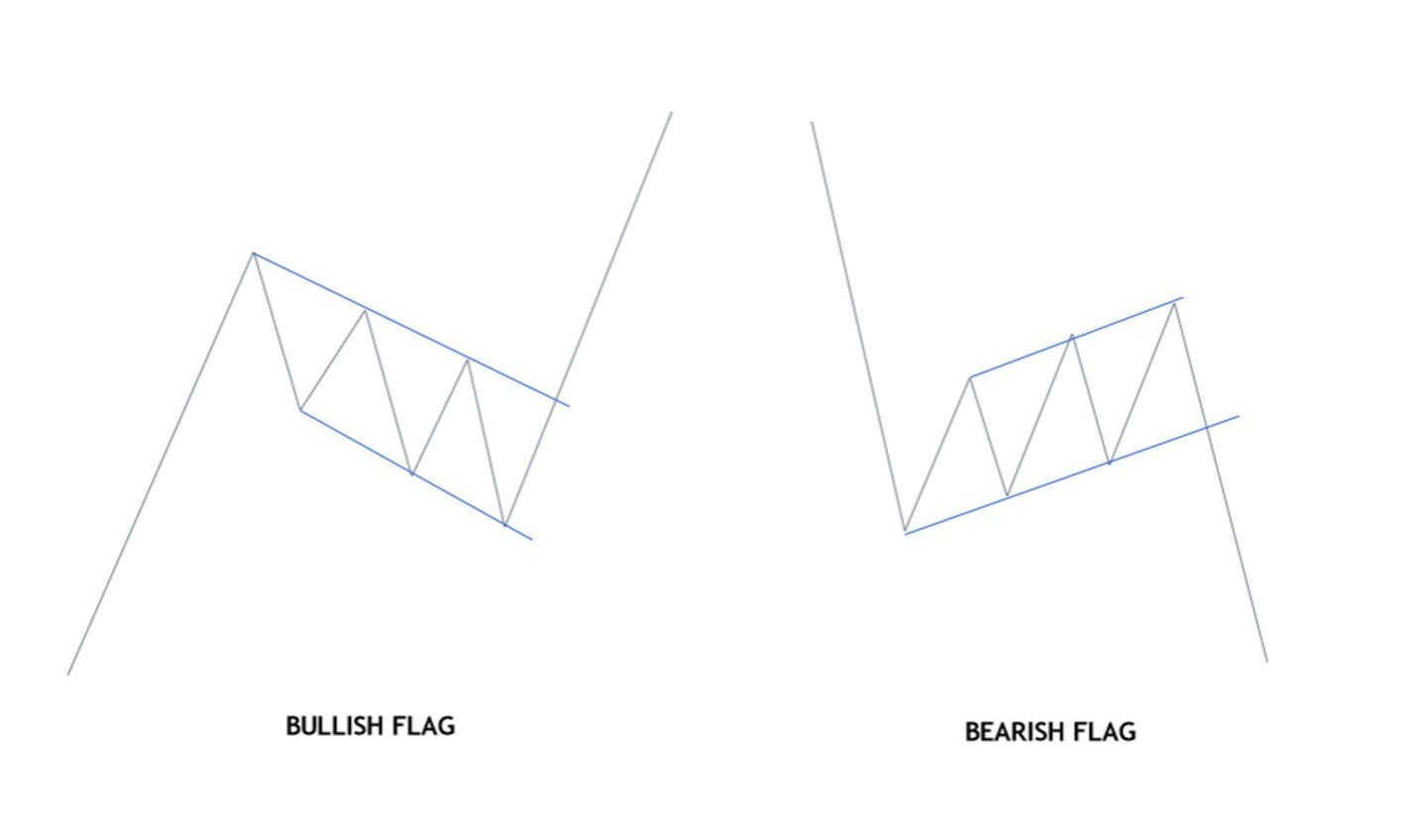

Flag Patterns: Flags are short-term continuation patterns that appear after a sharp price move. They represent a brief consolidation period before the price continues in the direction of the initial move.

Bullish and bearish flag chart patterns indicating continuation of trends.

Bullish and bearish flag chart patterns indicating continuation of trends.

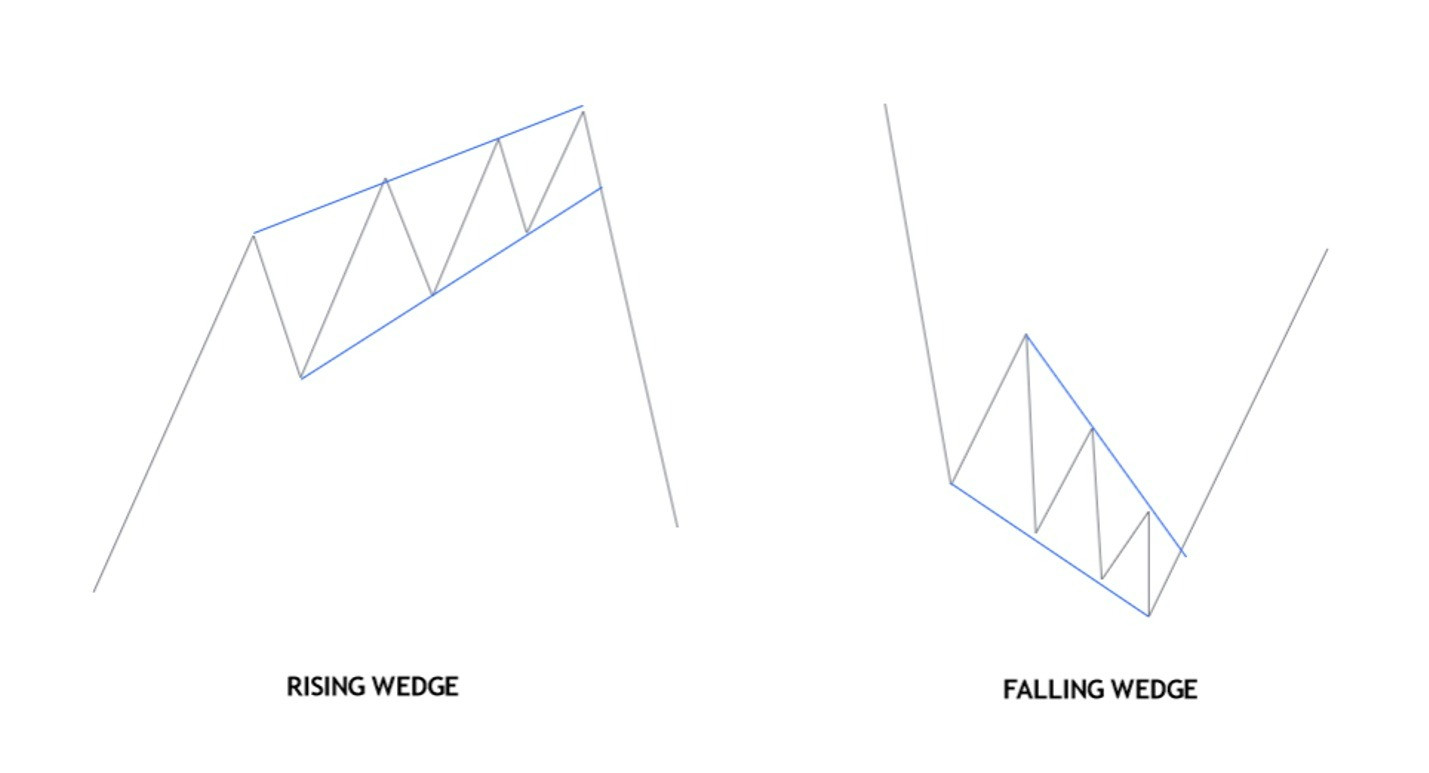

Wedge Patterns: Wedges are reversal patterns characterized by converging trendlines, indicating weakening momentum. Rising wedges often precede downtrends, while falling wedges can signal uptrends.

Rising and falling wedge chart patterns showing potential trend reversals.

Rising and falling wedge chart patterns showing potential trend reversals.

Enhancing Your Chart Analysis Skills for Euro Live Table Trading

Becoming proficient in chart analysis for the euro live table requires a probabilistic mindset. Chart analysis doesn’t guarantee future price movements but rather highlights potential scenarios based on historical price data and technical indicators.

When analyzing a chart, consider multiple possible outcomes. For instance, if the price approaches a support level, it might bounce off it or break through it. Your analysis should prepare you for both possibilities.

The confluence of multiple technical signals strengthens the probability of a particular outcome. If a support level aligns with a moving average and an oversold RSI reading, the likelihood of a price bounce increases. However, even strong confluences are not foolproof, and risk management remains crucial.

Continuous learning, practical experience, and adaptability are key to becoming a skilled chart analyst. Focus on risk management and develop strategies for various market scenarios.

For further practical learning and technical analysis examples, resources like the ForexLive.com Technical Analysis section provide valuable insights into currency, stock, and commodity markets, including Euro pairs. This can aid in your ongoing education and help you generate trading ideas (always remember to trade responsibly and at your own risk).