Recently, while traveling in Ireland, I encountered something I hadn’t experienced in over 30 years of international travel: a predatory ATM. It was a costly lesson, and I want to share my experience so you can avoid making the same mistake, especially when you’re thinking about how to Convert 3.95 Euro To Us Dollar or any amount for your travel needs. Let’s dive into how to get cash abroad smartly.

Getting Cash from ATMs in Foreign Countries: What to Watch Out For

We were in the charming town of Killarney and needed to withdraw some euros. Our first stop was a bank ATM, but it didn’t display the “Plus” symbol, which my card requires. Spotting another ATM with the familiar symbol, I decided to use it.

Look for Recognized Network Symbols

Always check the back of your debit or credit card for network symbols like “PLUS,” “CIRRUS,” or others. Match these symbols with those displayed on the ATM to ensure compatibility.

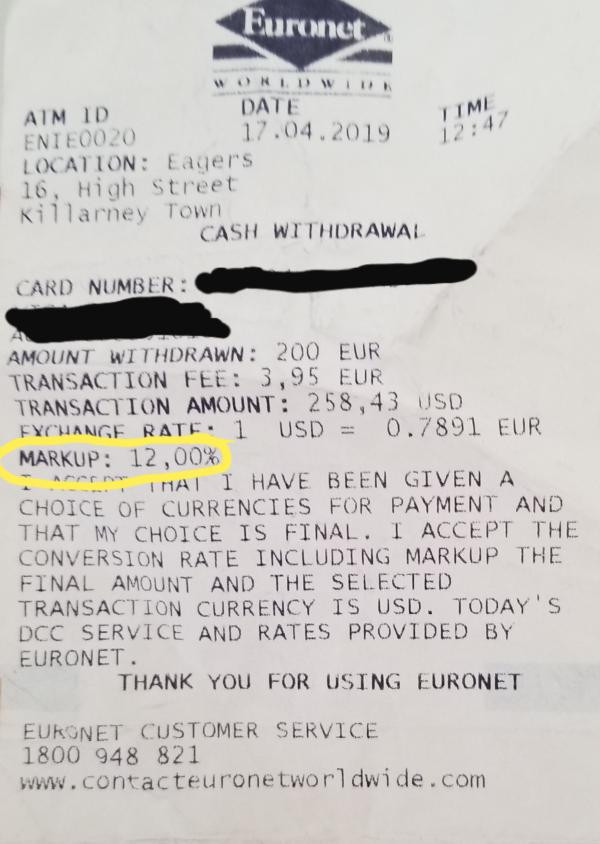

Euronet ATM Sign

Euronet ATM Sign

Alt text: Euronet ATM sign displaying logos of accepted card networks like Visa, Mastercard, and Maestro, commonly found in tourist areas but potentially with unfavorable exchange rates.

As I proceeded with the transaction, the ATM screen displayed a warning about a 3.95 euro transaction fee. This didn’t concern me much initially, as my bank reimburses ATM fees worldwide. However, the next screen showed a currency conversion rate: $1 = 0.7891 euro, asking me to “accept” this rate.

This is where the real problem began – the unfavorable exchange rate. This is crucial to understand when you convert 3.95 euro to US dollar or any larger amount.

Understanding and Being Alert to Conversion Rates

I made a critical error by not calculating the actual exchange rate in my head or realizing just how poor this offered rate was. The true exchange rate at the time was closer to 0.896 euros per dollar. While this difference might seem small, it represents a significant markup of approximately 12%. As an American, I’m used to thinking of the euro to dollar conversion in reverse (1 euro = about $1.12), and my failure to quickly reverse it in my mind cost me.

This ATM was offering a conversion rate of 1 euro = $1.26 US dollars.

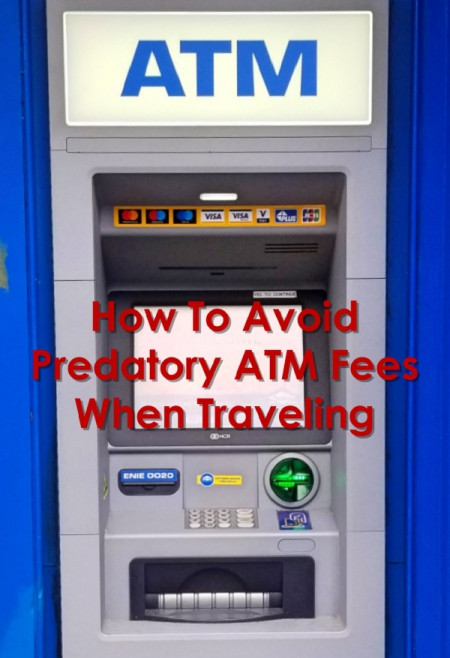

Let’s break down what this means in real terms. The 200 euros I withdrew ended up costing me $258.43. At the correct exchange rate, plus the 3.95 euro transaction fee (which is roughly $4.40 USD when you convert 3.95 euro to US dollar at a fair rate), the withdrawal should have cost around $225. This means I paid a 12% premium simply for using this particular ATM and not paying close enough attention. That 12% markup translated to about $25 US dollars on this single transaction.

The printed receipt clearly stated “Markup: 12%,” but this crucial information was not prominently displayed on the screen when I was prompted to accept the terms. Had I seen “12% markup” on the screen, it would have immediately raised red flags.

ATM receipt with 12%

ATM receipt with 12%

Alt text: ATM receipt highlighting a “Markup: 12%” charge, illustrating hidden fees associated with unfavorable exchange rates at certain ATMs.

In contrast, just a few days later, using a bank-affiliated ATM, withdrawing 100 euros cost me a reasonable $112 with no hidden “markup fees.” This experience was a stark reminder to be much more vigilant in the future.

Practical Tips to Avoid Excessive International ATM Fees

To prevent falling victim to similar predatory ATM practices, especially when you need to convert 3.95 euro to US dollar or larger sums, consider these strategies:

- Be wary of standalone ATMs, particularly those branded “Euronet” or similar. These are often found in convenient locations like airports, tourist hotspots, convenience stores, and hotels – precisely where unsuspecting travelers might be in need of quick cash.

- Prioritize ATMs affiliated with established banks. These usually offer fairer exchange rates and transparent fees.

- Carefully read all on-screen disclaimers before proceeding with any ATM transaction. If anything seems unclear or suspicious, don’t hesitate to cancel the transaction.

- Pay close attention to any listed fees and exchange rates. This is where the crucial information lies, especially when you’re trying to convert 3.95 euro to US dollar and want to know the exact cost.

- Familiarize yourself with the current exchange rate between your home currency and the local currency before you travel. Know both directions: how much of your currency equals one unit of the foreign currency and vice versa. For example, understand both 1 euro = $X USD and $1 USD = Y euros.

- Check with your bank to understand if they impose any foreign transaction fees on top of ATM charges.

The Pitfall of Buying Currency in Advance

Many travelers believe it’s wise to arrive in a foreign country with some local currency in hand. While convenient, pre-purchasing currency from your bank before departure can also be costly.

Banks typically build a markup (their profit margin) into the exchange rate they offer. For instance, I heard of someone who purchased 1000 euros from their bank and paid $1212. This translates to an exchange rate of $1.21 per euro. While there might be no explicit “fees,” the effective cost per euro is significantly higher than what you’d get using a regular bank ATM abroad. For some, the convenience might justify this extra cost. However, for larger amounts or budget-conscious travelers, it’s less economical. In this example, pre-purchasing currency cost an extra $92 compared to potentially better rates available upon arrival.

Similarly, exchanging cash at airport currency exchange counters upon arrival usually results in unfavorable exchange rates.

The Smarter Approach: Using Credit Cards and Bank ATMs

While ATMs remain a useful way to obtain local currency, using a credit card with no foreign transaction fees is often the most advantageous and convenient option for most expenses. During my eight-day trip to Ireland, we used cash for only about 300 euros worth of expenses, putting the rest on a credit card that doesn’t charge foreign transaction fees. This card offered the same favorable exchange rate as the bank ATMs, and we even earned reward points on every purchase – a win-win situation!

TRAVEL TIP: When paying with a credit card abroad, if you are given the option to pay in the local currency or your home currency, always choose the local currency. Selecting your home currency triggers Dynamic Currency Conversion (DCC). This allows the merchant or payment processor to perform the currency conversion, often at a less favorable exchange rate, and usually includes hidden fees. This article provides a more detailed explanation of Dynamic Currency Conversion.

Save this Advice for Later!

How to avoid ATMs with predatory fees

How to avoid ATMs with predatory fees

Alt text: Pinterest-style image with text overlay “How to avoid ATMs with predatory fees,” encouraging readers to save and share travel tips on avoiding hidden ATM charges.

Have you ever been caught out by an ATM with hidden fees? Do you have any additional tips for avoiding international ATM fees? Share your experiences in the comments below!

Looking for more travel advice? Explore these posts.

This site may contain affiliate links. Thank you for supporting wired2theworld by using our links for shopping, hotel bookings, or tour arrangements. Using them costs you nothing extra, but we may earn a small commission that helps us provide valuable and free content.

Share this article:

Like this post?

Like Loading…