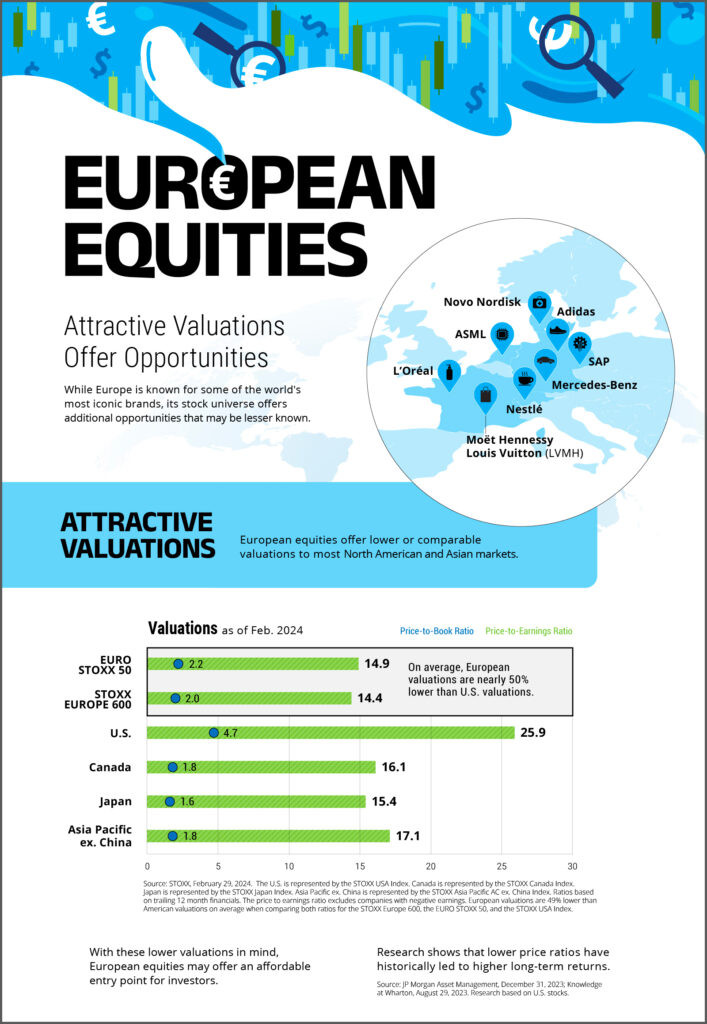

The EURO STOXX 50® index stands as the Eurozone’s premier blue-chip benchmark, representing the region’s supersector leaders. This widely recognized Index Euro Stoxx is designed to capture the performance of the 50 largest and most liquid stocks within the Eurozone, making it a crucial indicator for investors monitoring the European equity market.

This index euro stoxx is meticulously constructed, weighting its constituents based on free-float market capitalization. To ensure diversification and prevent over-concentration, a maximum weight of 10 percent is applied to each constituent. This methodology results in a balanced and liquid portfolio that accurately reflects the Eurozone’s economic landscape.

The significance of the EURO STOXX 50 extends beyond its role as a performance indicator. It serves as the underlying benchmark for over 25 billion euros in Exchange Traded Fund (ETF) assets. Furthermore, futures and options contracts based on this index euro stoxx are the most actively traded equity index derivatives on Eurex, highlighting its importance in the derivatives market. Its prominence is further underscored by the fact that over 160,000 structured products are linked to the EURO STOXX 50, making it a cornerstone of various investment strategies.

EURO STOXX 50 Performance and Composition

EURO STOXX 50 Performance and Composition

Key Advantages of the EURO STOXX 50 Index

The EURO STOXX 50 index euro stoxx offers numerous benefits for investors and financial professionals:

- Tradability: Its liquidity-driven composition ensures ease of trading, making it ideal for designing financial products and serving as a reliable benchmark for performance comparison.

- Balanced Diversification: The index provides diversified representation across various sectors as defined by the Industry Classification Benchmark (ICB) supersectors, mitigating sector-specific risks.

- Market Relevance: With quarterly rebalancing, annual reviews, and a fast-exit rule, the index euro stoxx remains current and responsive to the latest market developments, ensuring it reflects the evolving economic reality.

- Precision and Customization: Investors can access sub-indices derived from the EURO STOXX 50, such as ex-financials or single-country versions, allowing for more precise investment strategies.

- Sustainability Focus: For investors prioritizing responsible investing, the EURO STOXX 50 ESG Index offers a sustainable option, aligning with environmental, social, and governance principles.

- Accessibility: The widespread adoption of the EURO STOXX 50 means investors have access to a broad spectrum of existing financial products that track this benchmark index euro stoxx, simplifying investment implementation.

EURO STOXX 50 Index: Key Details

| Metric | Value |

|---|---|

| Symbol | SX5E |

| Calculation | Realtime |

| Dissemination Period | 09:00-18:00 CET |

| ISIN | EU0009658145 |

| Bloomberg | SX5E Index |

| Last Value (As of 05:50 pm CET) | 5,463.54 (-0.16%) |

| Week to Week Change | 0.18% |

| 52 Week Change | 11.21% |

| Year to Date Change | 11.10% |

| Daily Low | 5411.54 |

| Daily High | 5463.54 |

| 52 Week Low (5 Aug 2024) | 4571.6 |

| 52 Week High (18 Feb 2025) | 5533.84 |

Data Source | Factsheet Available

Top 10 Components of the EURO STOXX 50

The index euro stoxx is composed of leading companies across the Eurozone. The top 10 constituents exemplify the diverse sectors represented:

| Company | Country |

|---|---|

| ASML HLDG | NL |

| SAP | DE |

| LVMH MOET HENNESSY | FR |

| SIEMENS | DE |

| SCHNEIDER ELECTRIC | FR |

| TOTALENERGIES | FR |

| ALLIANZ | DE |

| DEUTSCHE TELEKOM | DE |

| SANOFI | FR |

| AIR LIQUIDE | FR |

EURO STOXX Index Family

EURO STOXX Index Family

In conclusion, the EURO STOXX 50 index euro stoxx is an essential benchmark for understanding the performance of the Eurozone’s largest companies. Its robust methodology, diverse representation, and wide range of applications solidify its position as a leading indicator and a vital tool for investors worldwide seeking exposure to the European equity market.