In the year to date, the Federal Reserve (FED) has injected nearly three trillion dollars directly into the US economy with decisive action and has another trillion dollars on standby.

Conversely, the European Central Bank’s (ECB) efforts have barely reached half that amount. Their interventions have primarily focused on supporting banks, seemingly diverging from the path taken by the FED.

What implications might these contrasting economic strategies hold for Europe’s economic future, particularly concerning the euro to dollar exchange rate?

Growth vs. Inflation: A Tale of Two Central Banks

At the beginning of 2020, both central banks were in a relatively similar starting position. The FED held $4 trillion in assets, while the ECB possessed €4.6 trillion.

Between March and May 2020, the FED’s balance sheet surged to $7.1 trillion. Part of this economic stimulus reached American citizens as direct checks of $1,200. Having acted decisively then, another trillion-dollar stimulus package, potentially including further direct checks, is anticipated.

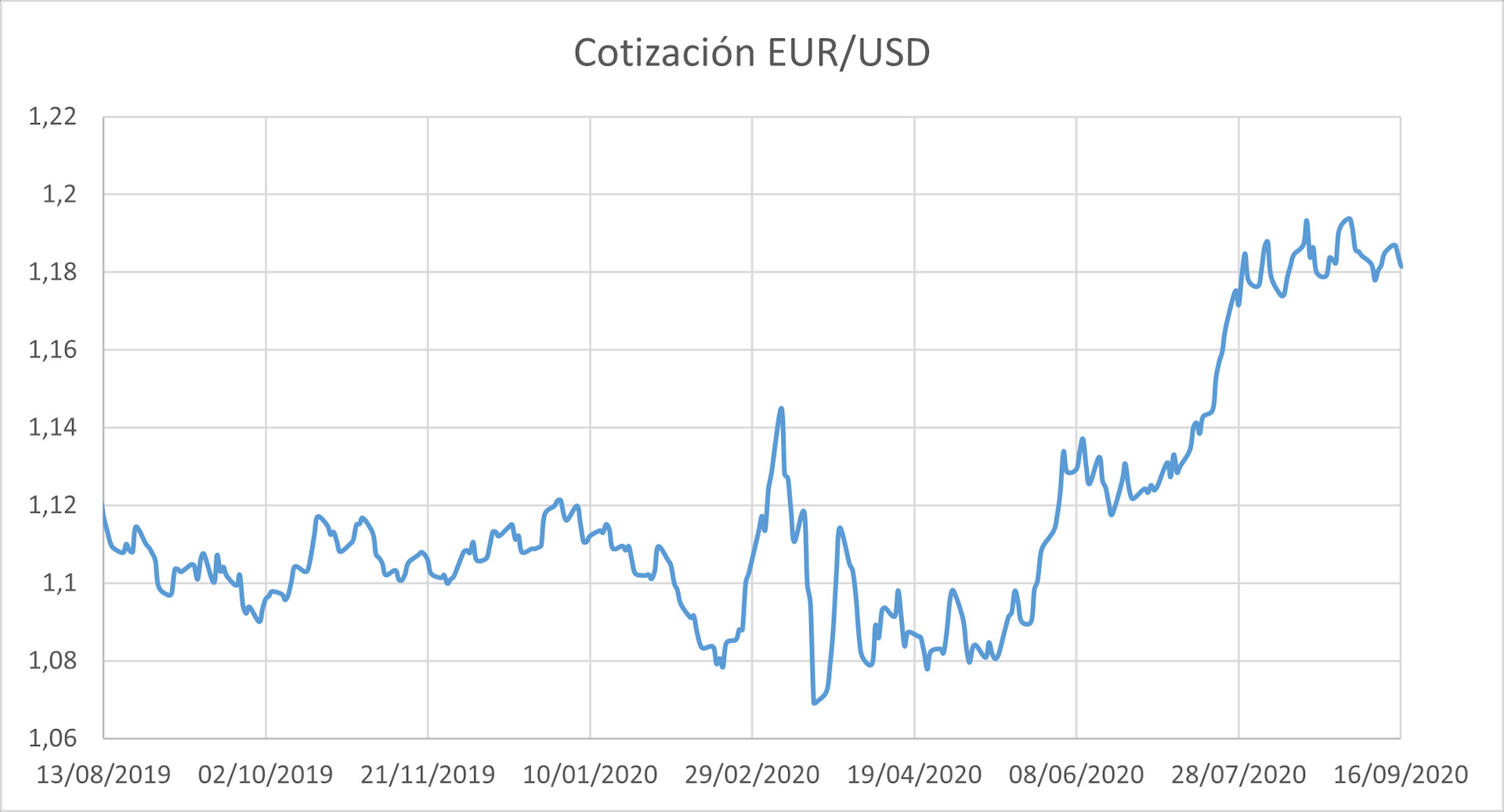

Euro to Dollar Exchange Rate Fluctuation: Chart illustrating the euro to dollar exchange rate between August 13th and September 16th, 2020, highlighting currency valuation shifts.

In stark contrast, the ECB remains anchored to its primary—and seemingly sole—objective: ensuring price stability, essentially controlling inflation. While the ECB injected €1.3 trillion into European banks, this capital appears to be used for damage control rather than building a future or securing the present for citizens struggling to make ends meet.

Europe appears willing to risk economic disintegration rather than tolerate inflation. Is the memory of interwar hyperinflation so deeply ingrained? What benefit is controlled inflation to a struggling populace?

“Whatever it Takes”? A Question of Urgency

Following the 2008 crisis, the ECB took four years to react with Draghi’s famous “Whatever it takes” declaration. This commitment to do “whatever it takes” translated into virtually unlimited public debt purchases, granting Eurozone countries a grace period that could have been used for structural reforms—reforms that, largely, were not implemented.

Could Germany have sold so many automobiles in recent years without the substantial, semi-captive market of Southern Europe? What has been the real impact of the hundreds of billions spent by European governments on bank bailouts? How long has Spain been aware of the unsustainability of its pension system and the imbalances within its public administration? Europe deludes itself if it believes its economy is truly comparable to that of the United States. The diverging approaches of the FED and ECB highlight fundamental differences in economic philosophy and priorities.

Two Central Banks, Two Perspectives on the Euro to Dollar Rate

The relative increase in the number of dollars compared to euros is a significant factor behind the euro’s recent appreciation against the dollar. From February to September 2020, the euro to dollar exchange rate shifted from €1.08 to €1.18 per dollar. This movement in the euro dollar rate has considerable implications.

A strong euro makes European products relatively more expensive compared to American goods. This dynamic favors imports of US products while disadvantaging European exporters. Consequently, this situation pushes the Eurozone further away from inflationary pressures but also harbors dangerous pitfalls. Consumption declines, average wages decrease, and unemployment rises. What is the point of strengthening the euro if EU citizens lack the euros to benefit from it?

Jerome Powell, Chairman of the FED, announced weeks ago the continuation of economic stimulus policies in the United States. In his address, he emphasized that inflation is not as critical as the necessity for reforms to secure long-term economic health.

The global landscape has shifted, social inequality is growing, and decisive action is required. Last week, Christine Lagarde, President of the ECB, adopted a more cautious stance: the ECB is still considering easing its inflation target. This divergence in approach between the FED and ECB continues to influence the euro to dollar exchange rate and the broader global economic outlook.