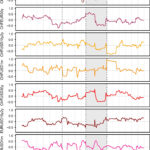

The euro experienced a rebound towards $1.05 at the beginning of March, recovering from a low of $1.036 observed the previous Friday. This upward movement was largely attributed to positive market sentiment fueled by discussions surrounding potential increases in defense spending within the Eurozone. Recent geopolitical developments, including the UK and France’s initiative to create a security plan for Ukraine, have further contributed to this sentiment. Germany’s potential commitment to significantly boost its defense budget is also being closely watched by investors.

However, the euro’s gains are being tempered by economic realities and upcoming European Central Bank (ECB) policy decisions. The market is anticipating the ECB’s upcoming policy meeting, where expectations are set for a fifth consecutive rate cut. Adding to the complexity, recent Euro Area inflation figures, while showing a slight decrease to 2.4% in February, still exceeded forecasts. Core inflation also declined to 2.6%, reaching its lowest point since January 2022, but again, slightly surpassing expectations.

On March 4th, the EURUSD exchange rate stood at 1.0482, a minor decrease of 0.04% from 1.0487 in the prior trading session. Historically, the euro has seen significant fluctuations against the US dollar, reaching a peak of 1.87 in July 1973, based on synthetic historical data predating the euro’s official introduction in 1999.

Current forecasts from Trading Economics’ global macro models and analysts anticipate a slight downward trend for the EUR/USD pair. The euro to dollar forecast projects a rate of 1.03 by the end of the current quarter and further anticipates a rate of 1.02 within 12 months. These forecasts suggest a cautious outlook for the euro against the dollar, influenced by a combination of factors including economic data and central bank policies.

In conclusion, the Euro Versus Us Dollar Forecast remains delicately balanced. While geopolitical developments and potential fiscal stimulus like increased defense spending could offer some support to the euro, persistent inflation concerns and the expected dovish stance of the ECB are likely to exert downward pressure. Market participants will be closely monitoring upcoming economic data releases and ECB communications to further refine their outlook on the EUR/USD exchange rate.