The global financial landscape is constantly shifting, influenced by geopolitical events, economic policies, and the ever-changing dynamics of international trade. Recent sanctions imposed on Russia’s central bank have ignited discussions about the future of global reserve currencies and whether major economies might diversify away from the dominance of the US dollar. While seemingly distant from everyday concerns like converting 106 Euros To Dollars, this high-level debate has profound implications for the world economy and even the value you see when making that currency exchange.

For individuals or businesses engaging in international transactions, understanding exchange rates like 106 euros to dollars is crucial. However, beneath the surface of these daily currency conversions lies a deeper question: Will the dollar maintain its long-held position as the world’s reserve currency, or are we witnessing the beginning of a significant shift?

Skeptics have long questioned the dollar’s seemingly unshakeable reign. The Russian situation, however, presents a compelling case study. As economist after economist has pointed out, the alternatives to the dollar are limited. The euro emerges as the most obvious second choice. Yet, in times of international crisis, the likelihood of a unified response from the US and Europe is high. Even without formal governmental action, European financial institutions are acutely aware of the potential repercussions of diverging from US financial policy.

This perspective is echoed by prominent financial analysts like Joseph Politano and Robin Brooks.

[Michael @profplum99

“”The US dollar will likely continue its 70 year reign as global reserve currency” doesn’t get clicks or sell papers, and so it doesn’t get written or shared. But that doesn’t make it any less true.” — @JosephPolitano illuminating as always ](https://twitter.com/profplum99/status/1507734264627925004?s=20&t=s6xIt1ohR8-exwBS0u5ggA)

Politano, in his insightful analysis, argues that the dollar’s entrenchment in trade finance and global credit markets is simply too deep to easily dismantle. The infrastructure, the habits, and the sheer scale of dollar-denominated transactions create significant inertia.

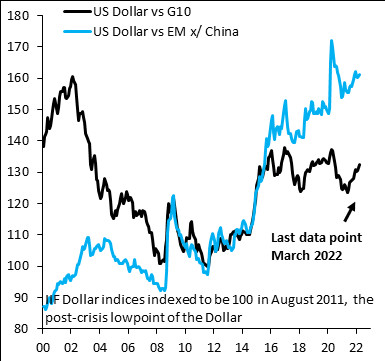

Brooks, focusing on capital flows, observes no weakening of the dollar’s position during the current crisis. Instead, he notes the dollar’s continued strength, contradicting any narratives of a “stealth erosion” of its reserve currency status.

[Robin Brooks @RobinBrooksIIF

There’s chatter that Russia’s invasion of Ukraine and ensuing US sanctions are causing a “stealth” erosion of US reserve currency status. This chatter is a long way from the reality in markets, where the Dollar is near record strength. There is no erosion of Dollar dominance…

Image](https://twitter.com/RobinBrooksIIF/status/1508344870058004483?s=20&t=EdNbyPZOBOVcmwSb07ZcEQ)

Image](https://twitter.com/RobinBrooksIIF/status/1508344870058004483?s=20&t=EdNbyPZOBOVcmwSb07ZcEQ)

The Eichengreen Perspective: A Nuanced View on Dollar Dominance

However, the debate is far from settled. Barry Eichengreen, a highly respected international economic historian, recently offered a counterpoint, suggesting a “stealth erosion of dollar dominance.” Eichengreen’s voice carries significant weight in the field of international finance.

Eichengreen has consistently challenged the notion that the dollar’s dominance is immutable. His 2017 book, “How Global Currencies Work: Past, Present, and Future,” co-authored with ECB economists, argues against the “winner-take-all” theory of reserve currencies. This traditional view posits that only one currency can truly dominate the global stage due to powerful network effects.

Eichengreen’s historical research reveals a more complex picture. Analyzing central bank reserves from the 1910s to the 1970s, he and his colleagues found that multiple reserve currencies can coexist. The interwar period saw both the British pound and the US dollar functioning as major reserve currencies. Even before World War I, the French franc and German mark played significant roles alongside the dominant sterling.

This historical perspective suggests that the mid to late 20th century, with the dollar’s near-monopoly, was an anomaly driven by a lack of viable alternatives. Eichengreen argues that we may be returning to a more multi-polar currency world.

“From this vantage point, it is the second half of the 20th century that is the anomaly, when an absence of alternatives allowed the dollar to come closer to monopolizing this international currency role,” Eichengreen and his co-authors argue.

He and his co-authors anticipate a decline in the dollar’s share of global reserves, potentially sooner rather than later, with the euro and the Chinese yuan emerging as key contenders for increased prominence.

Quartz spoke to Eichengreen in London on what to expect if the dollar loses its hold over global financial markets.

Quartz: This book dismantles a long-standing theory about the global currency system. What was wrong with the traditional theory?

Eichengreen: The traditional view is that international currency status is a winner-take-all game, that there’s room on the global stage for only one true international currency. The argument was that network effects are so strong they create a natural monopoly because it pays to use the same currency in cross-border transactions that everybody else has used. The new view is that financial technology has moved on and network effects are no longer so strong. It’s easier to switch between currencies. It’s similar to how operating systems for personal electronics have transformed. Everyone doesn’t have to use Windows anymore.

Eichengreen’s historical approach offers a valuable framework for understanding the evolution of the global currency system. The post-1945 era, with its dollar hegemony, was indeed unique. The dollar’s continued dominance since the 1970s has been maintained through adaptation and, at times, improvisation. The emergence of the euro as a significant alternative further complicates the picture.

The Euro-Dollar Trap and Diversification Trends

However, the current crisis highlights a crucial point: diversification from dollars to euros may not offer a complete escape, particularly for nations facing sanctions. Russia, for example, finds itself in a “euro-dollar trap,” navigating a financial landscape dominated by dollars, offshore euro-dollars, and euros. This currency triangle underpins the financial hubs of the North Atlantic and East Asia, reinforced by dollar swap lines and similar arrangements with Japan.

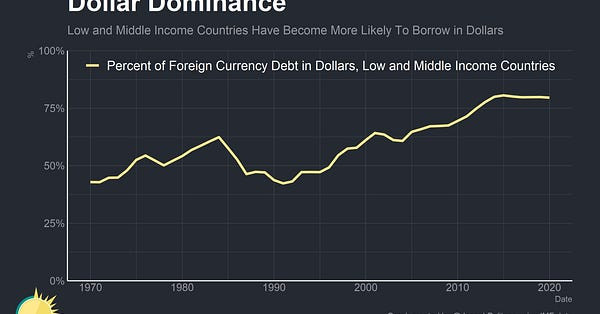

Eichengreen’s recent research with Serkan Arslanalp and Chima Simpson-Bell, published by the IMF, delves deeper into these diversification trends. Their paper, “The Stealth Erosion of Dollar Dominance: Active Diversifiers and the Rise of Nontraditional Reserve Currencies,” reveals compelling data.

Their findings indicate a decline in the dollar’s share of global reserves since the beginning of the 21st century. This isn’t simply due to exchange rate fluctuations or the actions of a few large central banks. It reflects a deliberate portfolio diversification strategy by central bank reserve managers.

Interestingly, this shift away from the dollar hasn’t primarily benefited traditional reserve currencies like the pound sterling, yen, or euro. Instead, the diversification has been twofold: a portion towards the Chinese renminbi and a larger portion towards the currencies of smaller economies.

These smaller economies, including Canada, Australia, Sweden, South Korea, and Singapore, are emerging as beneficiaries of this diversification.

Since 2000, the dollar’s share of global reserves has decreased from 70% to 59% in 2021. This trend, while seemingly gradual, is significant. In the context of sanctions and geopolitical tensions, it raises crucial questions about the future of the dollar’s dominance.

Extended Dollar System or True Diversification?

While reserve managers are indeed diversifying, the question remains: does this diversification represent a fundamental shift in global financial power away from the dollar, or is it something else entirely?

It’s arguable that these “non-traditional” reserve currencies are, in fact, part of an extended dollar system. These nations are closely aligned with the US financial security architecture and benefit from swap lines with the Federal Reserve. In a major global confrontation, their allegiance would likely be clear.

Instead of viewing these currencies as rivals to the dollar, they could be seen as buffers and extensions of the dollar system. They offer diversification options while still operating within the orbit of US financial markets, benefiting from their liquidity and sophistication.

The rise of the renminbi as a reserve currency presents a different set of considerations. While its share of global reserves is increasing, Eichengreen and his colleagues remain cautious. The potential for secondary sanctions against China and the political risks associated with authoritarian regimes raise concerns for central banks considering holding renminbi.

What about faster diversification towards the renminbi? Anyone contemplating moving reserves in that direction will have to consider the possibility that China could become subject to secondary sanctions. Moreover, Putin’s actions are a reminder that authoritarian strongmen can act capriciously when there are few domestic counterweights to restrain them.

Historically, leading reserve currency issuers have been democracies with checks and balances on executive power. This political stability and predictability are crucial for maintaining trust in a currency’s long-term value.

Conclusion: Dollar Dominance in Evolution

In conclusion, while conversions like 106 euros to dollars reflect the daily mechanics of currency exchange, the broader context of global reserve currency dynamics is far more complex. Eichengreen’s research highlights a gradual erosion of dollar dominance, driven by active diversification towards both the renminbi and non-traditional reserve currencies.

However, this diversification may not signify a radical departure from the dollar system. Instead, it could represent an evolution of that system, with the dollar remaining at its core, but with a more distributed periphery of supporting currencies. The dollar’s deep integration into global finance, coupled with the geopolitical realities and the attractiveness of US financial markets, suggests its dominance, while perhaps evolving, is far from over. The question isn’t necessarily if the dollar will be replaced, but rather how its dominance will adapt to a changing world.