Is knowing the exact USD equivalent of 119.60 euros important to you? At eurodripusa.net, we understand the need for accurate currency conversions, especially when sourcing European drip irrigation products for your farm, garden, or landscape project. This guide provides a comprehensive overview of the euro to USD exchange, its implications, and how to get the best value for your money. Drip irrigation efficiency, water conservation, and sustainable agriculture are key.

1. What is the Current Exchange Rate for 119.60 Euros to USD?

The current exchange rate for 119.60 Euros To Usd fluctuates constantly, but you can easily find it using a reliable online currency converter, but you can roughly expect around $128 USD based on recent rates. These tools provide real-time conversions, ensuring you get the most up-to-date information.

Understanding Exchange Rates

Exchange rates are determined by a multitude of factors, reflecting the economic health and stability of the Eurozone and the United States. These factors influence the supply and demand for each currency, leading to fluctuations in their relative values. Here are some key factors:

- Economic Indicators: Economic growth, inflation rates, unemployment figures, and trade balances all play a significant role. Positive economic data typically strengthens a currency.

- Interest Rates: Higher interest rates can attract foreign investment, increasing demand for a currency and pushing its value up.

- Political Stability: Political uncertainty or instability can weaken a currency as investors seek safer havens.

- Market Sentiment: Speculation and investor confidence can also drive exchange rate movements.

- Central Bank Policies: Actions taken by central banks, such as adjusting interest rates or implementing quantitative easing, can have a major impact on currency values.

Where to Find Real-Time Exchange Rates

Many reliable sources provide real-time euro to USD exchange rates:

- Online Currency Converters: Websites like Google Finance, XE.com, and Bloomberg offer up-to-the-minute exchange rates.

- Financial News Websites: Major financial news outlets such as Reuters, CNBC, and the Wall Street Journal provide currency market updates.

- Bank Websites: Most major banks offer currency conversion tools on their websites.

- Mobile Apps: Numerous mobile apps are available for both iOS and Android that track exchange rates and allow for easy conversions.

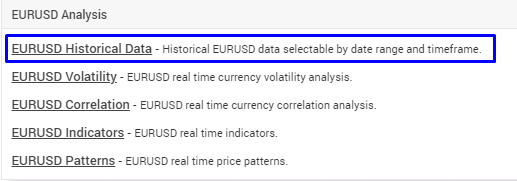

EURUSD Forex History Data

EURUSD Forex History Data

Alt: EURUSD Forex History Data showing historical exchange rates between Euro and US Dollar.

2. How Can You Calculate the USD Equivalent of 119.60 Euros Manually?

To calculate the USD equivalent of 119.60 euros manually, multiply 119.60 by the current EUR/USD exchange rate. For example, if the exchange rate is 1.07 USD per 1 EUR, then 119.60 EUR is equal to 119.60 x 1.07 = $128 approximately.

Step-by-Step Calculation

Let’s break down the manual calculation process:

- Find the Current Exchange Rate: Obtain the most recent EUR/USD exchange rate from a reliable source. For this example, let’s assume the rate is 1.07 USD per 1 EUR.

- Multiply: Multiply the amount in euros (119.60) by the exchange rate (1.07).

-

- 60 EUR x 1.07 USD/EUR = 128.00 USD (approximately)

-

- Result: This calculation shows that 119.60 euros is approximately equal to $128.00 USD.

Understanding the Formula

The formula for converting euros to USD is straightforward:

USD = EUR amount * EUR/USD exchange rate

By plugging in the relevant values, you can easily determine the equivalent amount in USD.

Example Calculation

Let’s consider another example with a different exchange rate. Suppose the EUR/USD exchange rate is 1.10 USD per 1 EUR:

- Exchange Rate: 1.10 USD/EUR

- Multiply: 119.60 EUR x 1.10 USD/EUR = 131.56 USD

- Result: In this case, 119.60 euros would be equal to $131.56 USD.

Factors Affecting the Accuracy of Manual Calculations

While manual calculations can provide a good estimate, several factors can affect their accuracy:

- Exchange Rate Fluctuations: Exchange rates change constantly, so the rate you use for your calculation might not be the same as the rate at the time of the actual transaction.

- Fees and Commissions: Banks and exchange services often charge fees or commissions, which can reduce the amount of USD you receive.

- Rounding Errors: Rounding the exchange rate or the final result can introduce small errors in the calculation.

To mitigate these issues, always use the most up-to-date exchange rate available and factor in any potential fees or commissions.

3. Why is the EUR to USD Exchange Rate Important for Eurodrip USA Customers?

For eurodripusa.net customers, the EUR to USD exchange rate is crucial because it directly impacts the cost of purchasing European drip irrigation systems and components. Favorable exchange rates can lead to significant savings, making these high-quality products more affordable.

Cost Implications

The EUR to USD exchange rate directly affects the final cost of products imported from Europe. When the euro is strong against the dollar (i.e., one euro buys more dollars), U.S. customers benefit from lower prices. Conversely, a weak euro means higher costs for American buyers.

Budgeting and Planning

Understanding the exchange rate allows customers to accurately budget and plan their purchases. Knowing the approximate USD cost of euro-denominated products helps in making informed decisions and avoiding unexpected expenses.

Competitive Advantage

A favorable exchange rate can provide a competitive advantage for eurodripusa.net customers. Lower costs enable them to invest more in advanced irrigation systems, improving efficiency and productivity in their agricultural operations.

Factors Influencing Purchasing Decisions

The EUR to USD exchange rate is just one of several factors that influence purchasing decisions. Other considerations include:

- Product Quality: European drip irrigation systems are known for their high quality, durability, and advanced technology.

- Water Efficiency: These systems are designed to conserve water, reducing costs and promoting sustainable agriculture.

- Customization: eurodripusa.net offers customized solutions tailored to specific crop and environmental needs.

- Customer Support: Comprehensive customer support ensures that customers get the most out of their investment.

Real-World Example

Consider a farmer in California who wants to purchase a drip irrigation system from eurodripusa.net priced at 10,000 euros. If the EUR/USD exchange rate is 1.10, the system would cost $11,000. However, if the rate drops to 1.05, the cost would be $10,500, saving the farmer $500.

4. What are the Fees Associated with Converting Euros to USD?

When converting euros to USD, be aware of potential fees from banks, exchange services, and credit card companies. These fees can include transaction fees, conversion fees, and markups on the exchange rate.

Types of Fees

- Transaction Fees: These are fixed fees charged per transaction, regardless of the amount being converted.

- Conversion Fees: These are percentages of the total amount being converted.

- Exchange Rate Markups: This is the difference between the mid-market exchange rate and the rate offered by the service provider. Banks and exchange services often add a markup to profit from the conversion.

- ATM Fees: If withdrawing USD from an ATM abroad, you may incur fees from both your bank and the ATM operator.

- Credit Card Fees: Credit card companies may charge foreign transaction fees for purchases made in euros.

Examples of Fees

- Bank Transfers: Banks typically charge a fee for international wire transfers, which can range from $20 to $50 per transaction.

- Currency Exchange Services: Services like currency exchange booths at airports often have high markups and transaction fees.

- Online Platforms: Online platforms like PayPal may charge conversion fees and markups on the exchange rate.

- Credit Card Purchases: Credit card companies may charge a foreign transaction fee of 1% to 3% on purchases made in euros.

Hidden Fees

Some service providers may not explicitly state all fees upfront. Hidden fees can include:

- Poor Exchange Rates: Offering an exchange rate that is significantly worse than the mid-market rate.

- Service Charges: Adding unexpected service charges to the transaction.

- Intermediary Bank Fees: In international wire transfers, intermediary banks may deduct fees, reducing the final amount received.

How to Minimize Fees

- Shop Around: Compare exchange rates and fees from different service providers to find the best deal.

- Use Online Platforms: Online platforms like Wise (formerly TransferWise) often offer lower fees and better exchange rates than traditional banks.

- Avoid Airport Exchange Booths: These typically have the highest fees and worst exchange rates.

- Use a Credit Card with No Foreign Transaction Fees: Some credit cards do not charge foreign transaction fees, which can save you money on international purchases.

- Plan Ahead: Convert currency in advance to avoid last-minute exchange services with high fees.

Understanding the Mid-Market Rate

The mid-market rate, also known as the interbank rate, is the real exchange rate used by banks when trading currencies with each other. This rate is the benchmark for determining the fairness of exchange rates offered to consumers. To ensure you are getting a reasonable deal, compare the rate offered by the service provider to the mid-market rate.

5. How Does the EUR/USD Exchange Rate Affect the Cost of Drip Irrigation Systems?

The EUR/USD exchange rate significantly impacts the cost of drip irrigation systems from eurodripusa.net. A favorable exchange rate reduces the cost, making it more affordable for American farmers and gardeners.

Direct Impact on Pricing

When the euro is weak relative to the USD, American buyers can purchase more euros for their dollars, effectively lowering the cost of European-made drip irrigation systems. Conversely, a strong euro increases the cost for U.S. customers.

Example Scenario

Consider a drip irrigation system priced at 5,000 euros.

- Exchange Rate: 1 EUR = 1.10 USD

- Cost in USD: 5,000 EUR x 1.10 USD/EUR = $5,500

- Exchange Rate: 1 EUR = 1.05 USD

- Cost in USD: 5,000 EUR x 1.05 USD/EUR = $5,250

In this scenario, a change in the exchange rate from 1.10 to 1.05 saves the customer $250.

Long-Term Investments

Drip irrigation systems are long-term investments, so even small fluctuations in the exchange rate can have a significant impact over time. Farmers and gardeners should monitor the exchange rate and plan their purchases accordingly.

Strategies to Mitigate Exchange Rate Risk

- Hedging: Use financial instruments like forward contracts to lock in a specific exchange rate for future purchases.

- Timing Purchases: Monitor the exchange rate and make purchases when the euro is relatively weak against the dollar.

- Diversification: Consider sourcing drip irrigation systems from multiple suppliers in different countries to reduce reliance on a single currency.

- Negotiation: Negotiate prices with eurodripusa.net to account for exchange rate fluctuations.

The Role of eurodripusa.net

eurodripusa.net plays a crucial role in helping customers navigate the complexities of currency exchange. The company provides transparent pricing, expert advice, and flexible payment options to minimize the impact of exchange rate fluctuations.

eurodripusa.net understands the challenges faced by farmers and gardeners in managing costs and maximizing efficiency. By offering high-quality European drip irrigation systems and comprehensive support, eurodripusa.net helps customers achieve sustainable agricultural practices and improve their bottom line.

6. What are the Best Ways to Transfer 119.60 Euros to USD?

There are several ways to transfer 119.60 euros to USD, each with its own advantages and disadvantages. Options include bank transfers, online platforms, and currency exchange services.

Bank Transfers

Bank transfers are a traditional method for converting euros to USD. They are generally reliable but can be more expensive than other options due to fees and exchange rate markups.

- Pros:

- Secure and reliable

- Widely available

- Cons:

- Higher fees

- Less favorable exchange rates

- Slower processing times

Online Platforms

Online platforms like Wise (formerly TransferWise), PayPal, and Revolut offer convenient and often more cost-effective ways to transfer euros to USD. These platforms typically have lower fees and better exchange rates than traditional banks.

- Pros:

- Lower fees

- More favorable exchange rates

- Faster processing times

- Convenient online interface

- Cons:

- May have transaction limits

- Requires an account with the platform

Currency Exchange Services

Currency exchange services, such as those found at airports or in major cities, offer immediate currency conversion. However, they usually have the highest fees and least favorable exchange rates.

- Pros:

- Immediate currency conversion

- Convenient for last-minute exchanges

- Cons:

- Highest fees

- Least favorable exchange rates

Comparison Table

| Method | Fees | Exchange Rate | Speed | Convenience |

|---|---|---|---|---|

| Bank Transfers | High | Less Favorable | Slow | Moderate |

| Online Platforms | Low | More Favorable | Fast | High |

| Currency Exchange Services | Very High | Least Favorable | Immediate | Moderate |

Tips for Choosing the Best Method

- Compare Fees and Exchange Rates: Before making a transfer, compare the fees and exchange rates offered by different service providers.

- Consider Processing Time: If you need the USD quickly, choose a method with fast processing times.

- Check for Transaction Limits: Some platforms have transaction limits, so make sure the limit is sufficient for your needs.

- Read Reviews: Check online reviews to ensure the service provider is reputable and reliable.

- Consider Convenience: Choose a method that is convenient for you, whether it’s an online platform or a local bank.

Special Considerations for eurodripusa.net Customers

For eurodripusa.net customers, it’s essential to choose a method that minimizes fees and provides a favorable exchange rate to maximize the value of their euro-denominated purchases. Online platforms like Wise often provide the best combination of low fees, favorable exchange rates, and fast processing times.

7. What are the Potential Risks Involved in Currency Exchange?

Currency exchange involves several potential risks, including exchange rate fluctuations, fees and commissions, and security concerns. Understanding these risks can help you make informed decisions and minimize potential losses.

Exchange Rate Risk

Exchange rate fluctuations can significantly impact the value of your money. If the exchange rate moves against you, you could end up receiving less USD than expected.

- Mitigation Strategies:

- Hedging: Use financial instruments like forward contracts to lock in a specific exchange rate.

- Timing Purchases: Monitor the exchange rate and make transfers when it is favorable.

- Diversification: Hold funds in multiple currencies to reduce risk.

Fees and Commissions Risk

Fees and commissions can eat into the value of your money, reducing the amount of USD you receive.

- Mitigation Strategies:

- Shop Around: Compare fees and exchange rates from different service providers.

- Use Online Platforms: Online platforms often have lower fees than traditional banks.

- Avoid Hidden Fees: Read the fine print and ask about all potential fees before making a transfer.

Security Risk

Currency exchange services can be vulnerable to fraud and scams. It’s essential to choose a reputable and secure service provider to protect your money.

- Mitigation Strategies:

- Choose Reputable Providers: Use well-known and established service providers with a track record of security.

- Check for Security Measures: Ensure the service provider uses encryption and other security measures to protect your data.

- Be Wary of Suspicious Offers: Be cautious of unusually low fees or exchange rates, which could be a sign of a scam.

Regulatory Risk

Currency exchange regulations vary from country to country. Failure to comply with these regulations can result in fines or legal issues.

- Mitigation Strategies:

- Understand Local Regulations: Familiarize yourself with the currency exchange regulations in your country and the country you are transferring money to.

- Use Compliant Service Providers: Choose service providers that comply with all relevant regulations.

- Seek Professional Advice: If you are unsure about any aspect of currency exchange regulations, seek advice from a financial professional.

Liquidity Risk

Liquidity risk refers to the possibility that you may not be able to convert your currency when you need to, or that you may have to accept a less favorable exchange rate due to limited demand.

- Mitigation Strategies:

- Use Major Currencies: Stick to major currencies like USD and EUR, which are highly liquid and easily convertible.

- Plan Ahead: Convert currency in advance to avoid last-minute exchanges when liquidity may be limited.

- Use Reputable Service Providers: Reputable service providers have access to a wide network of currency markets and can ensure liquidity.

How eurodripusa.net Helps Mitigate Risks

eurodripusa.net is committed to providing transparent and secure currency exchange services to its customers. The company works with reputable financial institutions and employs industry-leading security measures to protect customer data and funds. eurodripusa.net also provides expert advice and guidance to help customers navigate the complexities of currency exchange and minimize potential risks.

8. What are the Tax Implications of Converting Euros to USD?

The tax implications of converting euros to USD depend on several factors, including the amount being converted, the purpose of the conversion, and your country of residence. It’s essential to understand these implications to ensure you comply with tax laws.

Capital Gains Tax

If you make a profit from converting euros to USD, you may be subject to capital gains tax. This occurs when the value of the euro increases relative to the USD between the time you acquired the euros and the time you converted them.

- Example: You purchased 119.60 euros when the exchange rate was 1 EUR = 1.00 USD. Later, you converted the euros when the exchange rate was 1 EUR = 1.10 USD. You made a profit of $11.96 (119.60 EUR x 0.10 USD/EUR), which may be subject to capital gains tax.

- Mitigation Strategies:

- Keep Records: Maintain accurate records of all currency exchange transactions, including the dates, amounts, and exchange rates.

- Consult a Tax Professional: Seek advice from a tax professional to understand the specific tax implications in your country.

- Utilize Tax-Advantaged Accounts: Consider using tax-advantaged accounts, such as retirement accounts, to minimize capital gains tax.

Income Tax

If you receive euros as income and then convert them to USD, the converted amount may be subject to income tax. This is common for freelancers, contractors, and businesses that receive payments in euros.

- Example: You are a freelancer based in the U.S. and receive 119.60 euros as payment for your services. You convert the euros to USD. The USD equivalent of the 119.60 euros is considered income and is subject to income tax.

- Mitigation Strategies:

- Report All Income: Report all euro-denominated income on your tax return.

- Deduct Expenses: Deduct any eligible expenses related to earning the euro-denominated income.

- Consult a Tax Professional: Seek advice from a tax professional to understand the specific income tax implications in your country.

Value Added Tax (VAT)

Value Added Tax (VAT) is a consumption tax levied on goods and services. In some cases, currency exchange services may be subject to VAT.

- Example: You use a currency exchange service that charges VAT on its fees. The VAT is added to the cost of the currency exchange service.

- Mitigation Strategies:

- Choose VAT-Exempt Services: Look for currency exchange services that are exempt from VAT.

- Claim VAT Refunds: If you are a business, you may be able to claim a refund for VAT paid on currency exchange services.

Reporting Requirements

Many countries have reporting requirements for large currency exchange transactions. Failure to comply with these requirements can result in fines or legal issues.

- Example: In the U.S., you are required to report any currency exchange transaction over $10,000 to the Internal Revenue Service (IRS).

- Mitigation Strategies:

- Understand Reporting Requirements: Familiarize yourself with the currency exchange reporting requirements in your country.

- Report Transactions Accurately: Report all required transactions accurately and on time.

- Consult a Tax Professional: Seek advice from a tax professional to ensure you comply with all reporting requirements.

How eurodripusa.net Helps

eurodripusa.net provides transparent and accurate information about currency exchange transactions to help customers comply with tax laws. The company also recommends consulting with a tax professional to understand the specific tax implications in your country.

9. What are Some Tips for Getting the Best EUR to USD Exchange Rate?

Getting the best EUR to USD exchange rate can save you money on international transactions. Here are some tips to help you maximize your savings:

Shop Around for the Best Rates

Compare exchange rates from different service providers, including banks, online platforms, and currency exchange services. Look for the lowest fees and the most favorable exchange rates.

- Actionable Tip: Use online currency converter tools to compare exchange rates from multiple providers in real-time.

Use Online Platforms

Online platforms like Wise (formerly TransferWise), PayPal, and Revolut often offer better exchange rates and lower fees than traditional banks.

- Actionable Tip: Sign up for an account with an online platform and compare its exchange rates to those offered by your bank.

Avoid Airport Exchange Booths

Airport exchange booths typically have the highest fees and least favorable exchange rates. Avoid using them unless absolutely necessary.

- Actionable Tip: Plan ahead and exchange currency before you travel, or use an ATM at your destination.

Use a Credit Card with No Foreign Transaction Fees

Some credit cards do not charge foreign transaction fees, which can save you money on international purchases.

- Actionable Tip: Research credit cards with no foreign transaction fees and apply for one if you travel or make international purchases frequently.

Consider the Timing of Your Exchange

Exchange rates fluctuate constantly, so consider the timing of your exchange. Monitor the exchange rate and make your transfer when it is most favorable.

- Actionable Tip: Set up alerts on your phone or computer to notify you when the exchange rate reaches a certain level.

Negotiate with Your Bank

If you are making a large currency exchange, try negotiating with your bank for a better exchange rate.

- Actionable Tip: Let your bank know that you have compared rates from other providers and are looking for the best deal.

Use a Limit Order

A limit order allows you to set a specific exchange rate at which you are willing to buy or sell currency. If the exchange rate reaches your desired level, the transaction will be executed automatically.

- Actionable Tip: Use a limit order to take advantage of favorable exchange rate fluctuations.

Be Aware of Hidden Fees

Some service providers may not explicitly state all fees upfront. Be aware of hidden fees, such as service charges and intermediary bank fees.

- Actionable Tip: Read the fine print and ask about all potential fees before making a transfer.

Take Advantage of Promotional Offers

Some service providers offer promotional exchange rates or fee waivers for new customers.

- Actionable Tip: Look for promotional offers and take advantage of them when available.

Special Tip for eurodripusa.net Customers

For eurodripusa.net customers, it’s essential to choose a method that minimizes fees and provides a favorable exchange rate to maximize the value of their euro-denominated purchases. Online platforms like Wise often provide the best combination of low fees, favorable exchange rates, and fast processing times.

10. What is the Future Outlook for the EUR/USD Exchange Rate?

Predicting the future of the EUR/USD exchange rate is challenging due to the complex interplay of economic, political, and social factors. However, understanding these factors can provide insights into potential trends.

Economic Factors

Economic indicators, such as GDP growth, inflation rates, and unemployment figures, play a significant role in determining the strength of a currency. Positive economic data typically strengthens a currency, while negative data weakens it.

- Current Trends:

- Eurozone: The Eurozone economy is currently facing challenges due to high inflation, rising energy prices, and geopolitical uncertainty.

- United States: The U.S. economy is also facing challenges, including high inflation and rising interest rates, but is generally considered to be more resilient than the Eurozone economy.

Interest Rate Differentials

Interest rate differentials between the Eurozone and the United States can also impact the EUR/USD exchange rate. Higher interest rates in one country can attract foreign investment, increasing demand for its currency and pushing its value up.

- Current Trends:

- The U.S. Federal Reserve has been aggressively raising interest rates to combat inflation.

- The European Central Bank (ECB) has also been raising interest rates, but at a slower pace than the Federal Reserve.

Political Factors

Political stability and geopolitical events can also influence the EUR/USD exchange rate. Political uncertainty or instability can weaken a currency, while stability can strengthen it.

- Current Trends:

- The war in Ukraine has created significant geopolitical uncertainty in Europe, weighing on the euro.

- Political developments in the United States, such as the upcoming presidential election, could also impact the EUR/USD exchange rate.

Market Sentiment

Market sentiment, or the overall attitude of investors towards a currency, can also drive exchange rate movements. Positive sentiment can lead to increased demand for a currency, pushing its value up, while negative sentiment can lead to decreased demand and a decline in value.

- Current Trends:

- Market sentiment towards the euro is currently negative due to concerns about the Eurozone economy and geopolitical uncertainty.

- Market sentiment towards the U.S. dollar is generally positive due to its status as a safe-haven currency.

Expert Opinions

Economists and currency analysts offer a range of opinions on the future of the EUR/USD exchange rate. Some predict that the euro will continue to weaken against the dollar, while others believe that it will eventually rebound.

- Consensus: The consensus among experts is that the EUR/USD exchange rate will likely remain volatile in the near term, with potential for both upside and downside movements.

Strategies for Managing Exchange Rate Risk

Given the uncertainty surrounding the future of the EUR/USD exchange rate, it’s essential to have a strategy for managing exchange rate risk.

- Hedging: Use financial instruments like forward contracts to lock in a specific exchange rate for future transactions.

- Diversification: Hold funds in multiple currencies to reduce risk.

- Timing Purchases: Monitor the exchange rate and make purchases when it is most favorable.

How eurodripusa.net Helps

eurodripusa.net provides transparent and accurate information about currency exchange rates and trends to help customers make informed decisions. The company also offers flexible payment options and works with reputable financial institutions to minimize exchange rate risk.

Frequently Asked Questions (FAQ)

- How do I find the most up-to-date EUR to USD exchange rate?

You can find the most up-to-date EUR to USD exchange rate on reputable online currency converter websites like Google Finance, XE.com, or Bloomberg. These sites provide real-time exchange rates. - What factors influence the EUR to USD exchange rate?

The EUR to USD exchange rate is influenced by economic indicators (GDP, inflation), interest rates, political stability, market sentiment, and central bank policies. - Are there fees associated with converting EUR to USD?

Yes, converting EUR to USD can involve fees such as transaction fees, conversion fees, and exchange rate markups. These fees vary depending on the service provider. - What is the mid-market exchange rate, and why is it important?

The mid-market rate is the real exchange rate used by banks when trading currencies with each other. It’s a benchmark to gauge the fairness of exchange rates offered to consumers. - What are the best methods for transferring EUR to USD?

The best methods include bank transfers, online platforms (Wise, PayPal), and currency exchange services. Online platforms often offer lower fees and better exchange rates. - How can I minimize fees when converting EUR to USD?

To minimize fees, shop around for the best rates, use online platforms, avoid airport exchange booths, and use credit cards with no foreign transaction fees. - What are the potential risks involved in currency exchange?

Potential risks include exchange rate fluctuations, fees and commissions, security concerns, regulatory compliance, and liquidity risk. - Are there tax implications when converting EUR to USD?

Yes, converting EUR to USD may have tax implications, including capital gains tax and income tax. It’s essential to consult a tax professional. - How does the EUR/USD exchange rate affect eurodripusa.net customers?

The EUR/USD exchange rate directly impacts the cost of purchasing European drip irrigation systems from eurodripusa.net. A favorable exchange rate can lead to significant savings. - Where can I find reliable drip irrigation products from Europe in the USA?

You can find reliable drip irrigation products from Europe at eurodripusa.net. They offer high-quality systems and components, along with expert advice and support.

Ready to explore efficient and sustainable drip irrigation solutions? Visit eurodripusa.net today to discover our range of European products, get expert advice, and optimize your irrigation system for maximum savings and water conservation. Contact us at Address: 1 Shields Ave, Davis, CA 95616, United States or Phone: +1 (530) 752-1011.