The Covid-19 pandemic sent shockwaves across the globe, disrupting not only health systems and daily life but also the intricate dynamics of the world economy. Among the most visible impacts were the fluctuations in currency exchange rates, particularly the closely watched euro to dollar rate. Understanding these shifts is crucial for businesses, investors, and anyone engaging in international transactions, even when considering seemingly small amounts like 19 Euro Dollars. This article delves into how the pandemic fundamentally altered the determinants of the euro to dollar exchange rate, providing insights into a volatile financial landscape.

1. Decoding the Euro to Dollar Exchange Rate in a Pre-Pandemic World

Before the unprecedented global health crisis, the euro to dollar exchange rate operated under a different set of influences. Economic indicators, interest rate differentials set by the European Central Bank (ECB) and the Federal Reserve (FED), and the general health of the global economy were primary drivers. The stock market, particularly the S&P 500, along with commodity prices like oil and gold, also played roles, but their influence was within established patterns. Analyzing this pre-Covid era provides a vital baseline for understanding the dramatic changes that ensued.

1.1. Pre-Covid Determinants: A Landscape of Relative Stability

Prior to 2020, the euro to dollar exchange rate, while subject to daily fluctuations, exhibited a degree of predictability based on macroeconomic fundamentals. For instance, stronger economic data from the Eurozone compared to the US might lead to euro appreciation. Conversely, expectations of rising US interest rates would typically strengthen the dollar. These relationships were relatively well-understood and incorporated into financial models. Even events causing market jitters, like geopolitical tensions, had somewhat predictable impacts, often leading to temporary shifts towards safe-haven currencies.

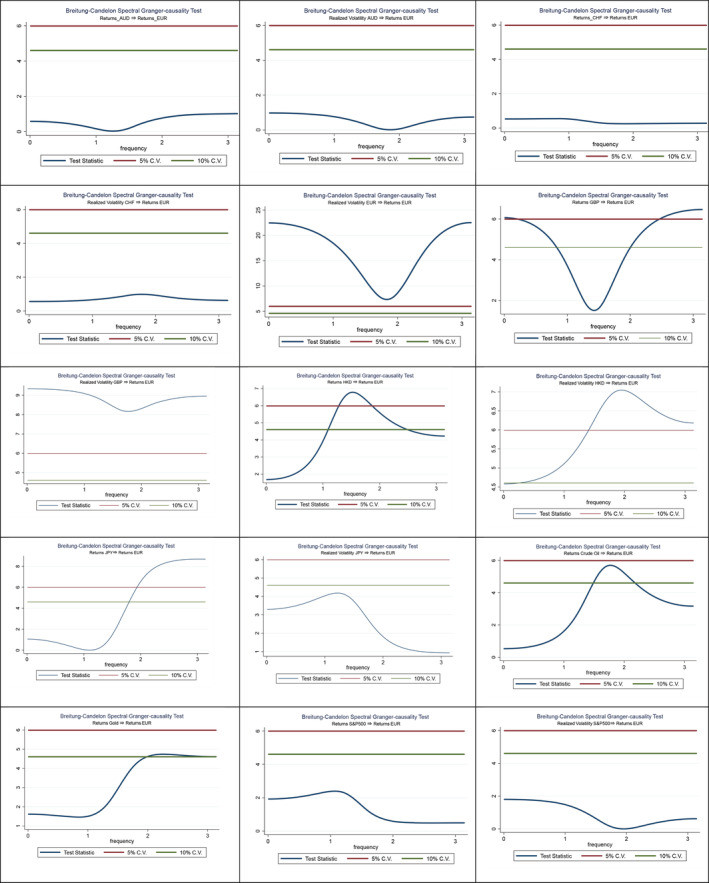

1.2. The Spectral Causality Lens: Unveiling Pre-Pandemic Influences

To rigorously identify the drivers of the euro to dollar exchange rate before Covid-19, advanced statistical methods like spectral non-causality tests are invaluable. These tests, applied to pre-pandemic data, reveal which economic variables truly influenced the exchange rate’s movements. Analysis using these methods indicated that, in the pre-Covid era, the euro exchange rate was significantly influenced by its own realized volatility, along with the volatility of the British pound and Hong Kong dollar. Furthermore, returns on the Hong Kong dollar, Japanese yen, British pound, crude oil, and gold were also identified as significant causal factors.

FIGURE 1

FIGURE 1

Figure 1: Spectral non-causality tests for the Euro to Dollar exchange rate, pre-Covid-19 era. This chart visually represents the frequencies at which different financial variables causally influenced the EUR/USD exchange rate before the pandemic, highlighting the key pre-existing market dynamics.

This pre-pandemic analysis highlights a market where established currency relationships and traditional financial assets played a dominant role in shaping the euro to dollar exchange rate.

2. The Covid-19 Earthquake: Reshaping Exchange Rate Dynamics

The arrival of Covid-19 marked a dramatic turning point. Lockdowns, travel restrictions, and unprecedented economic stimulus packages fundamentally altered global financial markets. The euro to dollar exchange rate, like other financial instruments, entered a period of heightened volatility and shifted drivers. The established pre-pandemic relationships were disrupted, and new factors came to the fore.

2.1. Pandemic-Induced Volatility: A New Era of Uncertainty

The pandemic triggered a surge in uncertainty. Stock markets experienced sharp declines, oil prices plummeted, and investors scrambled for safe-haven assets. Central banks responded with massive monetary easing and fiscal stimulus, actions that, while necessary to cushion the economic blow, also had profound effects on currency markets. The euro to dollar exchange rate became more sensitive to news related to the pandemic’s progression, vaccine development, and the varying economic responses across countries.

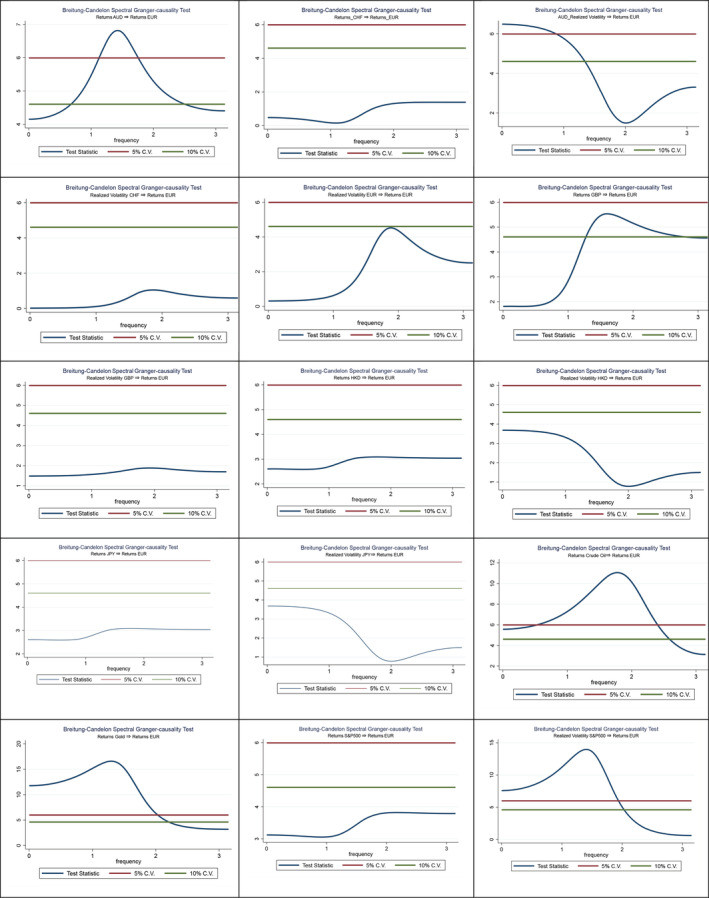

2.2. Spectral Causality in the Covid-19 Era: A Shift in Determinants

Applying the same spectral non-causality tests to data from the Covid-19 era reveals a striking shift in the determinants of the euro to dollar exchange rate. Notably, the realized volatility of the S&P 500 stock market index emerged as a significant causal factor, a relationship not observed in the pre-pandemic period. Furthermore, the returns on crude oil and gold prices became dominant drivers, influencing the euro to dollar rate for extended periods throughout the pandemic.

FIGURE 2

FIGURE 2

Figure 2: Spectral non-causality tests for the Euro to Dollar exchange rate, Covid-19 era. This figure illustrates the altered landscape of causal influences during the pandemic, with new drivers like S&P 500 volatility and commodity returns becoming prominent in shaping EUR/USD movements.

This analysis underscores a fundamental change. The euro to dollar exchange rate during Covid-19 was no longer primarily driven by the same factors as before. Stock market volatility, reflecting overall market uncertainty, and safe-haven assets like gold, gained significant influence, reflecting a flight to safety and a reassessment of risk.

3. Markov-Switching Insights: Regime Shifts and Volatility Persistence

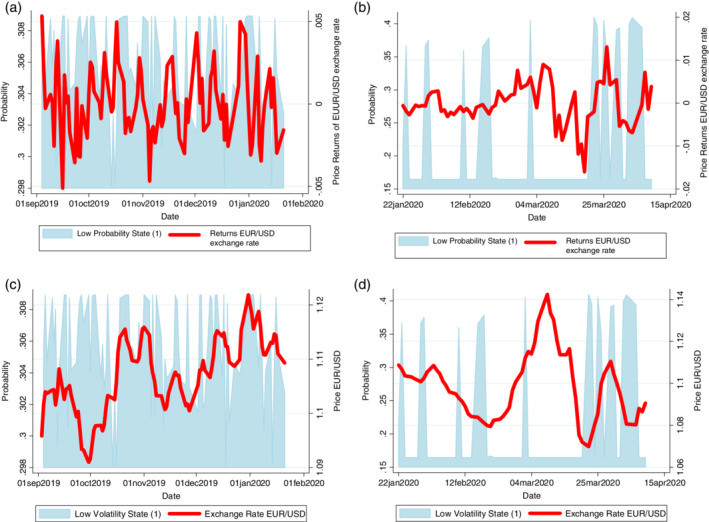

Beyond identifying causal factors, understanding the nature of exchange rate volatility is critical. Markov-Switching (MS) models are powerful tools for analyzing regime shifts in financial time series, allowing us to distinguish between periods of high and low volatility and to understand the transitions between these states.

3.1. Two Regimes: Low vs. High Volatility

Applying a two-state MS model to the euro to dollar exchange rate reveals distinct volatility regimes both before and during the pandemic. In both periods, the model identifies a low-volatility state and a high-volatility state, reflecting the inherent fluctuations in currency markets.

3.2. Pandemic Impact: Prolonged High Volatility and Increased Range

The crucial insight from the MS model is the dramatic change in the duration and intensity of the high-volatility regime during the Covid-19 pandemic. The expected duration of the high-volatility state doubled, increasing from approximately 3 days pre-Covid to around 6 days during the pandemic. Moreover, the range of volatility within the high-volatility state was statistically significantly higher in the Covid-19 era compared to the pre-pandemic period.

This means that not only did periods of high volatility become more frequent during the pandemic, but they also lasted longer and were characterized by more extreme fluctuations. This has significant implications for risk management and investment strategies. Imagine trying to plan a budget or make an investment involving a sum like 19 euro dollars – in a high-volatility regime, the dollar equivalent can change much more significantly and unpredictably within a short period.

FIGURE 3

FIGURE 3

Figure 3: Markov-Switching model fitting for Euro to Dollar exchange rate returns and actual exchange rate, pre- and post-Covid-19. This figure visually demonstrates the model’s ability to capture the low-volatility regime in both periods, highlighting the shift in volatility dynamics caused by the pandemic.

3.3. Transition Probabilities: Stuck in High Volatility?

The transition probabilities within the MS model further illustrate the shift. Pre-Covid, while switches between volatility states occurred, there was a reasonable probability of returning to a low-volatility state. However, during the pandemic, the probabilities shifted towards remaining in the high-volatility state. The likelihood of transitioning out of high volatility into low volatility decreased significantly, indicating a market more prone to persistent turbulence.

4. Policy Implications and Navigating the New Landscape

The profound changes in euro to dollar exchange rate dynamics uncovered by this analysis have significant implications for policymakers and businesses operating in the global economy.

4.1. Understanding Systemic Risk in a Pandemic World

The increased duration and intensity of high-volatility regimes highlight the elevated systemic risk in a pandemic-affected world. Policymakers need to be acutely aware of these heightened risks when designing and implementing economic policies. Traditional models based on pre-pandemic relationships may be inadequate for predicting and managing exchange rate fluctuations in this new environment.

4.2. The Importance of Forex Hedging and Risk Management

For businesses engaged in international trade or investment, especially those dealing with euro-dollar transactions, effective foreign exchange (FOREX) hedging strategies become even more critical. The increased volatility and unpredictable regime shifts necessitate robust risk management frameworks that account for these new dynamics. Even for smaller transactions, like sending or receiving 19 euro dollars, understanding potential exchange rate fluctuations is important for individuals and small businesses.

4.3. Econometric Models for a Volatile Era

The econometric models employed in this analysis, combining spectral causality and Markov-Switching techniques, offer valuable tools for understanding and potentially forecasting exchange rate movements in the Covid-19 era. Policymakers and financial institutions can utilize these approaches to better assess risk, inform policy decisions, and develop more effective risk management strategies. These models, by identifying key determinants and regime shifts, provide a more nuanced understanding of the forces shaping exchange rates in turbulent times.

5. Conclusion: A Lasting Impact on the 19 Euro Dollars Exchange Rate and Beyond

The Covid-19 pandemic has indelibly altered the dynamics of the euro to dollar exchange rate. The shift from pre-pandemic drivers to new influences like stock market volatility and commodity returns, coupled with the prolonged and intensified high-volatility regime, signifies a fundamental change in the market landscape. While this analysis focuses on the euro to dollar rate, the broader implications extend to other currency pairs and financial markets globally. Understanding these shifts is essential for navigating the ongoing economic uncertainties and building resilience in a world shaped by the pandemic.

Further research, incorporating data from subsequent waves of the pandemic and considering factors like vaccination rates and evolving economic policies, will be crucial for refining our understanding of these dynamic shifts and for developing effective strategies to manage exchange rate risk in the years to come. Even when considering a seemingly small amount like 19 euro dollars, the lessons learned from this period of unprecedented volatility are highly relevant in today’s interconnected global financial system.

References

[List of references from the original article would be included here]

Data Availability Statement

Data available on request from the authors. Data sources for further reading: https://www.histdata.com/download-free-forex-data/; https://finance.yahoo.com/; https://github.com/CSSEGISandData/COVID-19