It can be confusing to understand how profits and losses are calculated in forex trading, especially when using demo platforms. If you’re wondering how to accurately determine the dollar profit from pip movements, particularly for a smaller position size like 2500 EUR/USD, this guide is for you. We’ll break down how to calculate your potential earnings clearly and simply.

Understanding Pip Value in Forex Trading

The key to calculating profit in forex lies in understanding pip value. A “pip” (percentage in point) is the smallest unit of price movement in a currency pair. The dollar value of one pip varies depending on the currency pair traded, the size of your position, and the exchange rate. Knowing the pip value allows you to easily convert pip gains or losses into your account currency, typically USD.

Determining Pip Value for a 2500 EUR/USD Trade

For a EUR/USD position in a USD-denominated account, the pip value is conveniently fixed. Specifically, for every 1 lot (100,000 units) of EUR/USD, one pip is worth $10. This scales down proportionally for smaller positions.

Here’s the breakdown:

- 1 Standard Lot (100,000 units EUR/USD): $10 per pip

- 1 Mini Lot (10,000 units EUR/USD): $1 per pip

- 1 Micro Lot (1,000 units EUR/USD): $0.10 per pip

- 1 Unit of Currency: $0.0001 per pip

Therefore, for a 2,500 unit EUR/USD position, the pip value calculation is straightforward:

$0.0001 (pip value per unit) x 2,500 units = $0.25 per pip

This means that for every pip the EUR/USD price moves in your favor, you gain $0.25, and for every pip it moves against you, you lose $0.25.

Example: Calculating Profit on a 20-Pip Gain with 2500 EUR/USD

Let’s say you open a 2500 unit EUR/USD position and close it with a profit of 20 pips. To calculate your dollar profit, simply multiply the pip value by the number of pips gained:

$0.25 (pip value) x 20 pips = $5.00 profit

Therefore, a 20-pip profit on a 2500 EUR/USD position will result in a $5.00 profit in your USD-denominated account.

Utilizing a Pip Value Calculator for Other Currency Pairs

While the EUR/USD pip value is straightforward in USD accounts, calculating pip value for other currency pairs, such as USD/JPY, requires considering the current exchange rate. Fortunately, there are readily available tools to simplify this process.

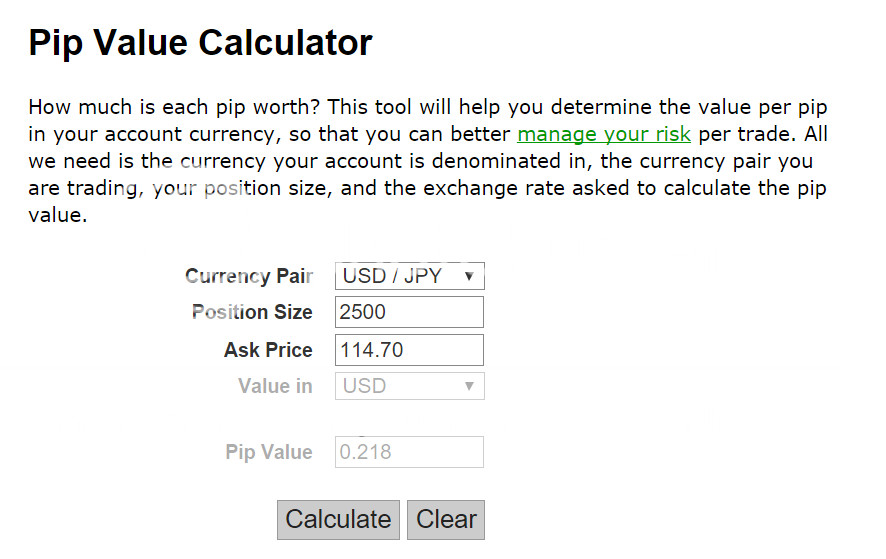

A Pip Value Calculator is a useful online tool that automatically calculates the pip value for any currency pair based on your account currency, the currency pair you are trading, and your position size.

For example, if we use the metrics from a USD/JPY trade with a 2,500 unit position, the Pip Value Calculator can quickly determine the pip value.

Pip Value Calculator Example for 2500 USD JPY Position: See how to calculate pip value for a 2500 unit USD/JPY trade using this forex calculator tool.

As illustrated in the example above, for a 2,500 unit USD/JPY position, the pip value is calculated to be approximately $0.218 per pip. Therefore, a 20-pip profit on this USD/JPY trade would be:

$0.218 (pip value) x 20 pips = $4.36 profit

You can access a Pip Value Calculator here to calculate pip values for various currency pairs and position sizes.

Conclusion: Simple Profit Calculation for Forex Traders

Calculating profit in forex trading doesn’t have to be complicated. By understanding the concept of pip value, especially for common pairs like EUR/USD, and utilizing tools like Pip Value Calculators, you can easily determine the potential dollar profit or loss of your trades. This knowledge is essential for effectively managing your risk and understanding your trading performance, whether you are trading with 2500 EUR/USD or any other position size.