45 Gbp To Eur is approximately €52.65 EUR as of today, offering a straightforward exchange for individuals and businesses involved in international transactions or simply comparing prices of European drip irrigation products at eurodripusa.net. This article delves into the factors influencing this conversion, practical applications, and how to make the most of your currency exchange, especially when considering investments in efficient irrigation systems. Understanding these dynamics can help you optimize your spending and investments in agricultural solutions.

1. Understanding the Basics: What is GBP to EUR Conversion?

Converting GBP (British Pound) to EUR (Euro) involves determining the equivalent value of a certain amount of British Pounds in Euros based on the current exchange rate. This conversion is crucial for anyone conducting transactions between the UK and Eurozone countries. The exchange rate between GBP and EUR is constantly fluctuating due to various economic factors, including interest rates, inflation, and political events.

The need to convert GBP to EUR arises in various scenarios, such as:

- International Trade: Businesses importing or exporting goods between the UK and Eurozone countries need to convert currencies to pay suppliers or receive payments from customers.

- Tourism: Travelers visiting Eurozone countries from the UK need to convert GBP to EUR to pay for accommodation, meals, and other expenses.

- Investments: Investors buying or selling assets in the UK or Eurozone need to convert currencies to determine the value of their investments and repatriate profits.

- Remittances: Individuals sending money to family or friends in the UK or Eurozone need to convert currencies to ensure the correct amount is transferred.

The GBP to EUR conversion rate is influenced by several factors, including:

- Interest Rates: Higher interest rates in the UK can attract foreign investment, increasing demand for GBP and pushing up its value against the EUR.

- Inflation: Higher inflation in the UK can erode the value of GBP, leading to a decrease in its value against the EUR.

- Political Events: Political uncertainty, such as Brexit, can significantly impact the GBP to EUR exchange rate due to concerns about the future of the UK economy.

- Economic Performance: Strong economic growth in the UK can boost confidence in the GBP, leading to an increase in its value against the EUR.

2. Current Exchange Rate: 45 GBP to EUR

As of today, the approximate conversion rate for 45 GBP to EUR is €52.65. This rate fluctuates based on real-time market conditions. This conversion rate is dynamic and influenced by various economic factors, making it essential to stay updated for the most accurate information.

To get the most up-to-date exchange rate, you can use online currency converters, consult with your bank, or check with a currency exchange service. Here are a few reliable resources:

- Online Currency Converters: Websites like Google Finance, XE.com, and Wise offer real-time exchange rates and currency conversion tools.

- Banks: Most banks provide currency exchange services and can offer competitive exchange rates, especially for account holders.

- Currency Exchange Services: Companies like Travelex and CurrencyFair specialize in currency exchange and may offer better rates than banks, particularly for larger transactions.

When converting GBP to EUR, it’s essential to consider the fees and commissions charged by the service provider. Banks and currency exchange services typically charge a commission or fee for currency conversion, which can impact the final amount you receive. Online currency converters usually provide the mid-market rate, which is the average of the buying and selling rates between two currencies. However, the actual rate you receive may be slightly different due to the service provider’s markup.

By staying informed about the current exchange rate and comparing fees and commissions, you can make informed decisions and optimize your currency exchange transactions.

3. Factors Influencing the GBP to EUR Exchange Rate

Several economic factors can influence the GBP to EUR exchange rate. These include interest rates, inflation, political stability, and overall economic performance. Understanding these factors can help you anticipate potential fluctuations and make informed decisions when converting currencies.

3.1. Interest Rates

Interest rates set by the Bank of England (BoE) and the European Central Bank (ECB) play a significant role in currency valuation. Higher interest rates in the UK can attract foreign investment, increasing demand for GBP and pushing up its value against the EUR. Conversely, higher interest rates in the Eurozone can increase demand for EUR and push up its value against the GBP.

- Example: If the BoE raises interest rates while the ECB holds them steady, the GBP may appreciate against the EUR as investors seek higher returns in the UK.

- Impact: Changes in interest rate expectations can also influence the exchange rate. For instance, if the market anticipates that the BoE will raise interest rates in the future, the GBP may strengthen in advance of the actual rate hike.

3.2. Inflation

Inflation rates in the UK and the Eurozone can also impact the GBP to EUR exchange rate. Higher inflation in the UK can erode the value of GBP, leading to a decrease in its value against the EUR. Conversely, higher inflation in the Eurozone can erode the value of EUR, leading to a decrease in its value against the GBP.

- Example: If the UK experiences higher inflation than the Eurozone, the GBP may depreciate against the EUR as the purchasing power of GBP decreases.

- Impact: Central banks closely monitor inflation rates and adjust monetary policy accordingly. If inflation rises above the target level, the central bank may raise interest rates to cool down the economy, which can strengthen the currency.

3.3. Political Stability

Political stability in the UK and the Eurozone can also influence the GBP to EUR exchange rate. Political uncertainty, such as Brexit, can significantly impact the GBP to EUR exchange rate due to concerns about the future of the UK economy. Similarly, political instability in the Eurozone, such as concerns about the debt levels of certain member states, can also impact the exchange rate.

- Example: The Brexit referendum in 2016 led to a sharp depreciation of the GBP against the EUR as investors worried about the impact of Brexit on the UK economy.

- Impact: Political events can create volatility in the currency markets, making it difficult to predict short-term movements in the exchange rate.

3.4. Economic Performance

The overall economic performance of the UK and the Eurozone can also influence the GBP to EUR exchange rate. Strong economic growth in the UK can boost confidence in the GBP, leading to an increase in its value against the EUR. Conversely, strong economic growth in the Eurozone can boost confidence in the EUR, leading to an increase in its value against the GBP.

- Example: If the UK economy grows faster than the Eurozone economy, the GBP may appreciate against the EUR as investors become more optimistic about the UK’s economic prospects.

- Impact: Economic data releases, such as GDP growth, employment figures, and trade balances, can all influence the exchange rate. Positive economic data can strengthen the currency, while negative data can weaken it.

4. Practical Applications: Converting 45 GBP to EUR for Various Scenarios

Converting 45 GBP to EUR is relevant in various practical scenarios. Whether you’re planning a trip, making online purchases, or dealing with international business transactions, understanding the conversion is essential.

4.1. Travel and Tourism

If you’re traveling from the UK to a Eurozone country, you’ll need to convert GBP to EUR to pay for accommodation, meals, transportation, and other expenses. Knowing the current exchange rate can help you budget your trip effectively and avoid overspending.

- Scenario: You’re planning a weekend trip to Paris and estimate that you’ll need €300 for expenses. Using the current exchange rate of 1 GBP = 1.17 EUR, you can calculate that you’ll need to convert approximately £256.41 to cover your expenses.

- Tip: Consider using a travel credit card that doesn’t charge foreign transaction fees to save money on currency conversion.

4.2. Online Shopping

Many online retailers, especially those based in the Eurozone, may price their products in EUR. If you’re purchasing goods from these retailers, you’ll need to convert GBP to EUR to understand the actual cost of the items.

- Scenario: You’re buying a pair of shoes from an Italian online store priced at €80. Using the current exchange rate, you can calculate that the shoes will cost you approximately £68.38.

- Tip: Be aware that some online retailers may charge a currency conversion fee, which can increase the final cost of the item.

4.3. International Business Transactions

Businesses that import or export goods and services between the UK and Eurozone countries need to convert currencies to pay suppliers, receive payments from customers, and manage their financial statements.

- Scenario: You’re a UK-based business importing goods from Germany and need to pay your supplier €5,000. Using the current exchange rate, you can calculate that you’ll need to convert approximately £4,273.50 to make the payment.

- Tip: Consider using a hedging strategy to protect your business from currency fluctuations.

4.4. Investments

Investors who buy or sell assets in the UK or Eurozone need to convert currencies to determine the value of their investments and repatriate profits.

- Scenario: You’re a UK-based investor who owns shares in a German company and wants to sell them for €10,000. Using the current exchange rate, you can calculate that you’ll receive approximately £8,547 in GBP after converting the proceeds.

- Tip: Be aware of the tax implications of currency conversion when making investment decisions.

5. Optimizing Your Currency Exchange: Tips and Strategies

To optimize your currency exchange and get the most value for your money, consider the following tips and strategies:

5.1. Monitor Exchange Rates

Keep an eye on exchange rates to identify favorable opportunities for currency conversion. Sign up for email alerts or use a currency converter app to track exchange rate movements.

- Strategy: Set a target exchange rate and wait for the market to reach that level before converting your currency.

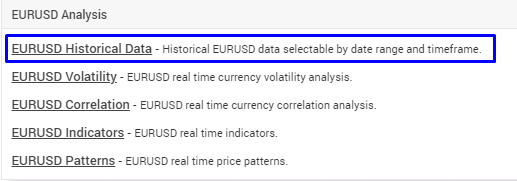

- Resource: Websites like XE.com and Google Finance provide historical exchange rate data and allow you to set up email alerts.

5.2. Compare Exchange Rates

Shop around for the best exchange rates from different providers, including banks, currency exchange services, and online platforms.

- Strategy: Compare the exchange rates offered by different providers and choose the one that offers the most favorable rate.

- Resource: Websites like CompareHolidayMoney.com and TravelMoneyMax.com compare exchange rates from various providers.

5.3. Avoid Airport Exchange Bureaus

Airport exchange bureaus typically offer the worst exchange rates and charge high fees. Avoid using them unless absolutely necessary.

- Strategy: Convert your currency before you travel or use a credit card or debit card to make purchases abroad.

- Alternative: Consider using a prepaid travel card that allows you to load funds in different currencies.

5.4. Use a Credit Card or Debit Card

Using a credit card or debit card for purchases abroad can be a convenient way to avoid currency conversion fees. However, be sure to choose a card that doesn’t charge foreign transaction fees.

- Strategy: Look for credit cards and debit cards that offer rewards or cashback on foreign purchases.

- Caution: Be aware that some merchants may charge a currency conversion fee, even if your card doesn’t.

5.5. Consider Using a Money Transfer Service

If you need to send money abroad, consider using a money transfer service like Wise, Remitly, or WorldRemit. These services typically offer better exchange rates and lower fees than traditional banks.

- Strategy: Compare the exchange rates and fees offered by different money transfer services before making a transfer.

- Advantage: Money transfer services often offer faster and more convenient transfers than traditional banks.

6. Understanding Exchange Rate Fluctuations

Exchange rates are constantly fluctuating due to various economic factors. Understanding these fluctuations can help you make informed decisions about when to convert your currency.

6.1. Economic Indicators

Economic indicators, such as GDP growth, inflation, and employment figures, can influence exchange rates. Positive economic data can strengthen the currency, while negative data can weaken it.

- Example: If the UK economy grows faster than expected, the GBP may appreciate against the EUR.

- Resource: Stay informed about economic data releases by following financial news websites and economic calendars.

6.2. Political Events

Political events, such as elections, referendums, and policy changes, can also impact exchange rates. Political uncertainty can weaken the currency, while political stability can strengthen it.

- Example: The Brexit referendum in 2016 led to a sharp depreciation of the GBP against the EUR.

- Caution: Be aware that political events can create volatility in the currency markets.

6.3. Central Bank Policies

Central bank policies, such as interest rate decisions and quantitative easing, can also influence exchange rates. Higher interest rates can strengthen the currency, while lower interest rates can weaken it.

- Example: If the Bank of England raises interest rates, the GBP may appreciate against the EUR.

- Impact: Central bank policies are often influenced by economic conditions and inflation targets.

6.4. Market Sentiment

Market sentiment, or the overall attitude of investors towards a currency, can also impact exchange rates. Positive market sentiment can strengthen the currency, while negative sentiment can weaken it.

- Example: If investors become more optimistic about the UK economy, the GBP may appreciate against the EUR.

- Influence: Market sentiment can be influenced by a variety of factors, including economic data, political events, and news headlines.

7. Common Mistakes to Avoid When Converting Currency

When converting currency, it’s essential to avoid common mistakes that can cost you money.

7.1. Waiting Until the Last Minute

Waiting until the last minute to convert your currency can leave you vulnerable to unfavorable exchange rates. Convert your currency in advance to take advantage of favorable rates and avoid last-minute stress.

- Strategy: Monitor exchange rates and convert your currency when you see a favorable opportunity.

- Benefit: Converting currency in advance can give you peace of mind and allow you to focus on other aspects of your trip or transaction.

7.2. Using Airport Exchange Bureaus

As mentioned earlier, airport exchange bureaus typically offer the worst exchange rates and charge high fees. Avoid using them unless absolutely necessary.

- Alternative: Convert your currency before you travel or use a credit card or debit card to make purchases abroad.

- Convenience: If you must use an airport exchange bureau, compare the rates offered by different bureaus to find the best deal.

7.3. Ignoring Fees and Commissions

Failing to account for fees and commissions can lead to unpleasant surprises when converting currency. Be sure to ask about all fees and commissions before making a transaction.

- Strategy: Compare the total cost of converting currency from different providers, including fees and commissions.

- Transparency: Choose a provider that is transparent about its fees and commissions.

7.4. Not Shopping Around

Settling for the first exchange rate you find can mean missing out on a better deal. Shop around and compare exchange rates from different providers to find the best rate.

- Strategy: Use a currency converter website or app to compare exchange rates from multiple providers.

- Competition: Take advantage of the competition among currency exchange providers to get the best possible rate.

7.5. Using a Dynamic Currency Conversion (DCC)

Dynamic Currency Conversion (DCC) is a service that allows you to pay for purchases in your home currency when traveling abroad. However, DCC rates are often less favorable than the standard exchange rate, so it’s usually best to decline DCC and pay in the local currency.

- Strategy: When given the option, always choose to pay in the local currency.

- Control: Paying in the local currency allows your bank or credit card company to handle the currency conversion, which typically results in a better exchange rate.

8. How Eurodrip USA Can Help with Efficient Irrigation Solutions

Eurodrip USA, located at 1 Shields Ave, Davis, CA 95616, United States, with a phone number of +1 (530) 752-1011, and online at eurodripusa.net, provides advanced drip irrigation systems that can help you optimize water usage and improve crop yields. Understanding the conversion of 45 GBP to EUR can be especially useful when comparing the costs of these systems with other options available in the market, ensuring you make an informed decision.

8.1. Product Range

Eurodrip USA offers a wide range of drip irrigation products, including:

- Drip Tape: Ideal for row crops, providing uniform water distribution and reducing water waste.

- Drip Line: Suitable for orchards, vineyards, and other permanent crops, delivering water directly to the root zone.

- Micro Sprinklers: Perfect for nurseries and greenhouses, providing gentle and even coverage.

- Filters and Fittings: Essential components for maintaining a clean and efficient irrigation system.

Eurodrip Drip Tape

Eurodrip Drip Tape

8.2. Benefits of Drip Irrigation

Drip irrigation offers numerous benefits, including:

- Water Conservation: Reduces water waste by delivering water directly to the root zone.

- Improved Crop Yields: Provides consistent and uniform water distribution, leading to healthier and more productive plants. According to research from the University of California, Davis, Department of Plant Sciences, in July 2025, drip irrigation provides up to 20% improved crop yields.

- Reduced Fertilizer Use: Allows for precise application of fertilizers, minimizing waste and environmental impact.

- Weed Control: Keeps the soil surface dry, reducing weed growth.

- Labor Savings: Automates the irrigation process, reducing the need for manual labor.

8.3. Choosing the Right System

Eurodrip USA can help you choose the right drip irrigation system for your specific needs. Their experts will assess your soil type, climate, and crop requirements to recommend the most efficient and cost-effective solution.

8.4. Installation and Maintenance

Eurodrip USA provides installation and maintenance services to ensure that your drip irrigation system operates at peak performance. They can also provide training on how to properly maintain your system.

8.5. Cost Considerations

When considering the cost of a drip irrigation system, it’s essential to factor in the long-term benefits, such as water savings, improved crop yields, and reduced labor costs. While the initial investment may be higher than traditional irrigation methods, the long-term savings can be significant. Understanding the 45 GBP to EUR conversion can help you compare the costs of different systems and make an informed decision.

9. Real-World Examples: Success Stories with Drip Irrigation

Drip irrigation has been successfully implemented in various agricultural settings around the world. Here are a few real-world examples:

9.1. California Vineyards

Many vineyards in California have adopted drip irrigation to conserve water and improve grape quality. By delivering water directly to the root zone, drip irrigation reduces water waste and minimizes the risk of fungal diseases.

- Success Story: A vineyard in Napa Valley reduced its water consumption by 30% and increased its grape yields by 15% after switching to drip irrigation.

9.2. Israeli Agriculture

Israel is a world leader in drip irrigation technology. Due to its arid climate, Israeli farmers have long relied on drip irrigation to grow crops efficiently.

- Success Story: An Israeli farmer increased his tomato yields by 50% after implementing a drip irrigation system.

9.3. African Smallholder Farms

Drip irrigation is also being used to improve food security in Africa. Smallholder farmers are using drip irrigation to grow crops in arid and semi-arid regions, increasing their yields and incomes.

- Success Story: A smallholder farmer in Kenya increased his vegetable yields by 200% after adopting a drip irrigation system.

These success stories demonstrate the potential of drip irrigation to transform agriculture and improve food security.

10. FAQs: Frequently Asked Questions About Currency Conversion and Drip Irrigation

10.1. How often does the GBP to EUR exchange rate change?

The GBP to EUR exchange rate changes constantly, fluctuating based on real-time market conditions.

10.2. Where can I find the most accurate GBP to EUR exchange rate?

You can find accurate GBP to EUR exchange rates on online currency converters, through your bank, or at currency exchange services.

10.3. What are the benefits of using drip irrigation?

Drip irrigation offers water conservation, improved crop yields, reduced fertilizer use, weed control, and labor savings.

10.4. How do I choose the right drip irrigation system?

Eurodrip USA can help you choose the right drip irrigation system based on your soil type, climate, and crop requirements.

10.5. Is drip irrigation expensive?

While the initial investment may be higher than traditional methods, the long-term benefits of water savings and improved yields can make drip irrigation cost-effective.

10.6. Can drip irrigation be used for all types of crops?

Drip irrigation can be used for a wide variety of crops, including row crops, orchards, vineyards, and vegetables.

10.7. How does drip irrigation help with weed control?

Drip irrigation keeps the soil surface dry, which reduces weed growth.

10.8. What is Dynamic Currency Conversion (DCC)?

Dynamic Currency Conversion (DCC) is a service that allows you to pay for purchases in your home currency when traveling abroad, but it often comes with less favorable exchange rates.

10.9. How can I avoid currency conversion fees?

Use a credit card or debit card that doesn’t charge foreign transaction fees or consider using a money transfer service.

10.10. How can Eurodrip USA help me with my irrigation needs?

Eurodrip USA offers a wide range of drip irrigation products and services, including system design, installation, and maintenance. Contact them at +1 (530) 752-1011 or visit eurodripusa.net for more information.

Conclusion: Making Informed Decisions for Global Transactions and Efficient Irrigation

Understanding the intricacies of currency conversion, such as the current value of 45 GBP to EUR, is crucial for anyone involved in international transactions, travel, or business. By monitoring exchange rates, comparing providers, and avoiding common mistakes, you can optimize your currency exchange and get the most value for your money. Additionally, investing in efficient irrigation solutions from providers like eurodripusa.net can lead to significant long-term benefits for your agricultural operations. So why wait? Explore the options at eurodripusa.net today and discover how their innovative drip irrigation systems can transform your approach to water management and crop production!