The EURO STOXX 50® index stands as the Eurozone’s premier blue-chip benchmark, meticulously tracking the performance of 50 of the region’s largest and most liquid stocks. This index is not just a number; it’s a representation of the Eurozone economy’s supersector leaders, providing a diversified and robust portfolio for investors worldwide. Built upon a foundation of free-float market capitalization weighting, with a single constituent cap at 10 percent, the EURO STOXX 50 ensures a balanced and representative view of the market.

EURO STOXX 50 Index Performance Overview

EURO STOXX 50 Index Performance Overview

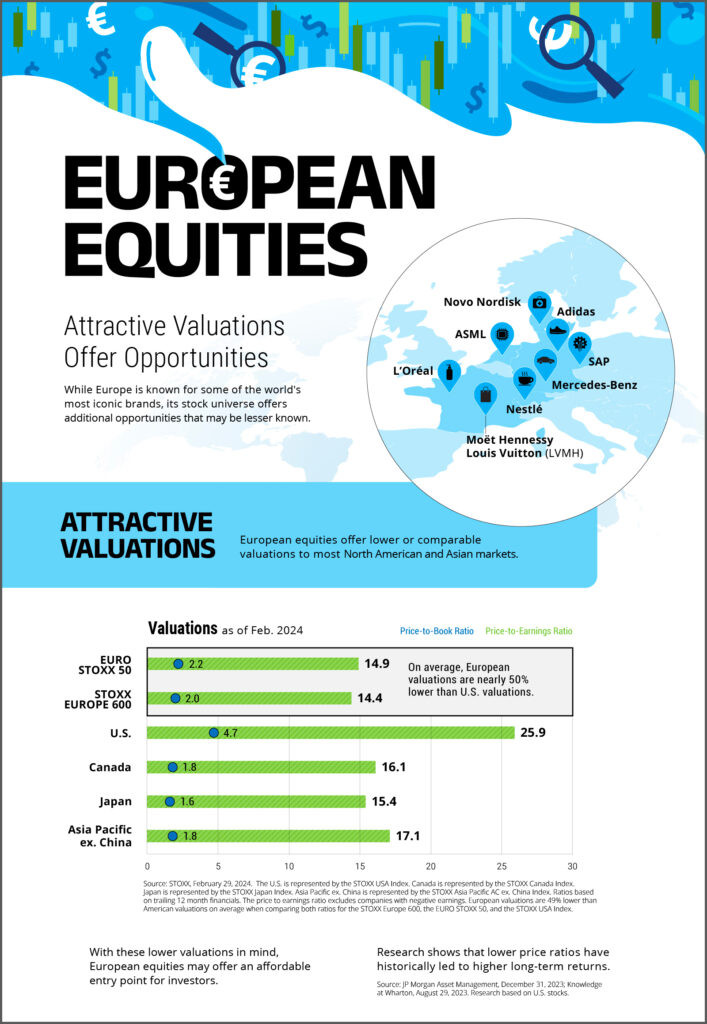

For those looking to understand the pulse of the European market, or perhaps considering an investment, even starting with a modest amount like 50 Dollars Euros, understanding the EURO STOXX 50 is crucial. This index underpins a massive financial ecosystem, with over 25 billion euros in Exchange Traded Fund (ETF) assets benchmarked against it. Furthermore, the futures and options contracts linked to the EURO STOXX 50 are the most actively traded equity index derivatives on Eurex, highlighting its importance in the trading world. It’s also the foundation for over 160,000 structured products, demonstrating its versatility and widespread use in financial instruments.

View full infographic

EURO STOXX 50 Index Key Features and Benefits Infographic

EURO STOXX 50 Index Key Features and Benefits Infographic

Key Advantages of the EURO STOXX 50

Highly Tradeable and Liquid

The EURO STOXX 50’s composition is driven by liquidity, making it exceptionally tradeable. This characteristic is vital for designing financial products, ensuring efficient trading, and providing a reliable benchmark for performance comparison. Whether you are managing a large portfolio or starting with an accessible investment around the 50 dollars euros mark, the liquidity of the underlying assets is a significant advantage.

Diversification Across Supersectors

The index offers a balanced representation across various sectors, classified by the Industry Classification Benchmark (ICB) supersectors. This diversification is key to mitigating risk and capturing broad market movements, rather than being overly exposed to a single industry.

Up-to-Date Market Reflection

With quarterly rebalancing, an annual review, and a fast-exit rule, the EURO STOXX 50 remains current and responsive to market changes. This dynamic approach ensures that the index accurately reflects the current economic landscape and leading companies within the Eurozone.

Precision with Sub-Indices

For investors seeking more specific exposure, the EURO STOXX 50 family includes derived sub-indices. These can be ex-financials indices, excluding financial sector companies, or single-country indices, allowing for tailored investment strategies.

Sustainable Investing Option

For those prioritizing responsible investing, the EURO STOXX 50 ESG Index offers a sustainable alternative. This allows investors to align their investments with environmental, social, and governance (ESG) principles while still tracking leading Eurozone companies.

Broad Accessibility for Investors

The EURO STOXX 50 is highly accessible, with a wide array of existing financial products tracking its performance. This accessibility makes it straightforward for investors, even those starting with smaller amounts like 50 dollars euros, to gain exposure to the Eurozone’s top companies through ETFs, structured products, and more.

Index Details

| Symbol | SX5E |

| Calculation | Realtime |

| Dissemination Period | 09:00-18:00 CET |

| ISIN | EU0009658145 |

| Bloomberg | SX5E Index |

| Last Value | 5,463.54 -9.02 (-0.16%) As of 05:50 pm CET |

| Week to Week Change | 0.18% |

| 52 Week Change | 11.62% |

| Year to Date Change | 11.10% |

| Daily Low | 5411.54 |

| Daily High | 5463.54 |

| 52 Week Low | 4571.6 — 5 Aug 2024 |

| 52 Week High | 5533.84 — 18 Feb 2025 |

Data

Factsheet

Top 10 Components

| Country | |

|---|---|

| ASML HLDG | NL |

| SAP | DE |

| LVMH MOET HENNESSY | FR |

| SIEMENS | DE |

| SCHNEIDER ELECTRIC | FR |

| TOTALENERGIES | FR |

| ALLIANZ | DE |

| DEUTSCHE TELEKOM | DE |

| SANOFI | FR |

| AIR LIQUIDE | FR |

Featured indices

No Results Found

Try a different search term or browse all our indices

Data as of December 2023. Source: Structured Retail Products.