The EURO STOXX 50® stands as the Eurozone’s benchmark blue-chip index, a key indicator of market sentiment and a cornerstone for investors looking at European equities. This index isn’t just a number; it’s a carefully constructed portfolio representing the leaders across various supersectors within the Eurozone economy. For those considering where to place their investments, even starting with a symbolic amount like 50 Euro 50, understanding the EURO STOXX 50 is crucial.

View full infographic

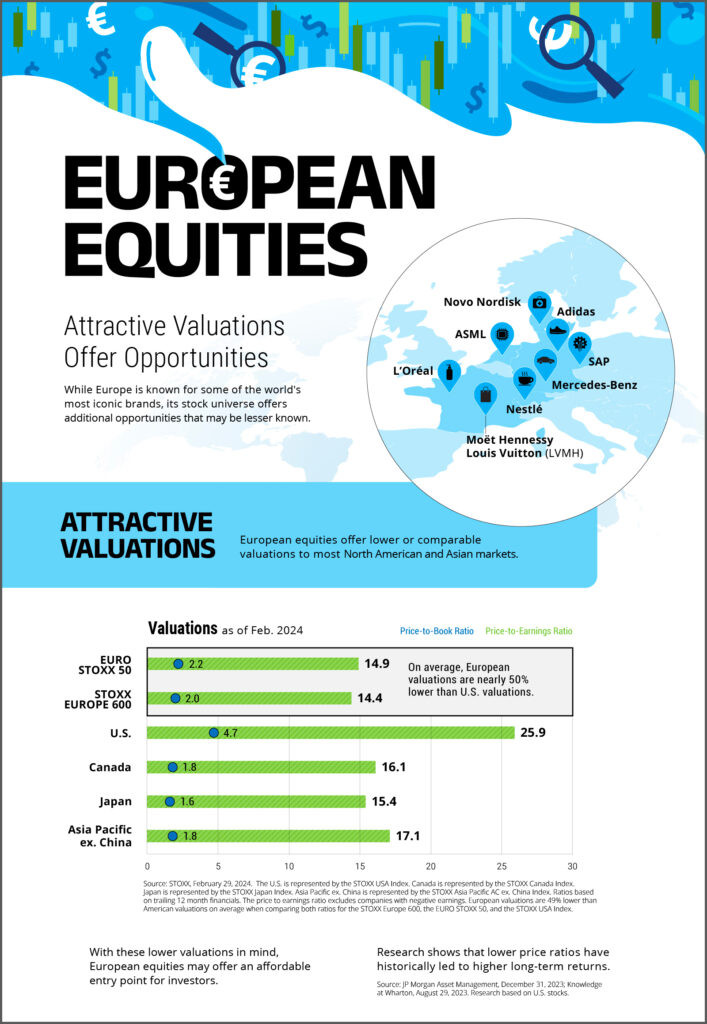

Infographic showing key facts about European Equities and EURO STOXX 50, highlighting its role in the European market and key benefits for investors.

Infographic showing key facts about European Equities and EURO STOXX 50, highlighting its role in the European market and key benefits for investors.

Key Benefits of the EURO STOXX 50

This index offers several compelling advantages for investors, making it a popular choice for various financial products and investment strategies.

Highly Tradeable and Liquid

The EURO STOXX 50’s composition is driven by liquidity, ensuring that the index is readily tradeable. This characteristic is vital for designing financial products, from ETFs to derivatives, and for serving as a reliable benchmark for portfolio performance. Whether you are trading large volumes or considering smaller investments around the 50 euro 50 mark, the liquidity of the underlying assets is a significant advantage.

Diversification Across Supersectors

By tracking supersector leaders, the EURO STOXX 50 provides inherent diversification across various industries within the Eurozone. This balanced representation, based on the Industry Classification Benchmark (ICB), helps mitigate risk and offers exposure to a broad spectrum of the European economy. This diversification is key for investors aiming for balanced growth, regardless of the initial investment size, be it around 50 euro 50 or larger amounts.

Up-to-Date Market Representation

The index is rebalanced quarterly and undergoes an annual review, ensuring it remains current and accurately reflects market developments. The fast-exit rule further enhances its responsiveness to market changes. This dynamic nature means the EURO STOXX 50 is always capturing the current leaders in the Eurozone economy, making it a relevant and timely index for tracking market performance, even for those starting with an investment mindset of 50 euro 50.

Precision and Customization

Beyond the main index, investors can access derived sub-indices, such as ex-financials or single-country versions. This precision allows for tailored investment strategies to meet specific needs and market views. For investors with specific sector preferences or geographical focuses within Europe, these options provide granular control, whether managing a large portfolio or starting with focused investments perhaps symbolically around 50 euro 50 in mind for initial steps.

Sustainable Investment Options

Reflecting the growing focus on ESG considerations, the EURO STOXX 50® ESG Index offers a responsible investment avenue. This sustainable option allows investors to align their financial goals with environmental, social, and governance principles, appealing to the increasingly conscious investor base, including those who might be exploring sustainable investment options starting with amounts like 50 euro 50.

Broad Accessibility

A wide array of existing financial products already track the EURO STOXX 50, making it easily accessible for investors of all types. From ETFs and mutual funds to structured products, numerous avenues exist to invest in this leading index. This accessibility is particularly relevant for new investors or those starting with smaller investment amounts like 50 euro 50, as it provides straightforward entry points into the Eurozone equity market.

Index Details

| Symbol | SX5E |

|---|---|

| Calculation | Realtime |

| Dissemination Period | 09:00-18:00 CET |

| ISIN | EU0009658145 |

| Bloomberg | SX5E Index |

| Last Value | 5,463.54 -9.02 (-0.16%) |

| As of | 05:50 pm CET |

| Week to Week Change | 0.18% |

| 52 Week Change | 11.21% |

| Year to Date Change | 11.10% |

| Daily Low | 5411.54 |

| Daily High | 5463.54 |

| 52 Week Low | 4571.6 — 5 Aug 2024 |

| 52 Week High | 5533.84 — 18 Feb 2025 |

Data Factsheet

Top 10 Components

The EURO STOXX 50 is composed of leading companies from across the Eurozone. The top 10 components give a snapshot of the index’s composition:

| Company | Country |

|---|---|

| ASML HLDG | NL |

| SAP | DE |

| LVMH MOET HENNESSY | FR |

| SIEMENS | DE |

| SCHNEIDER ELECTRIC | FR |

| TOTALENERGIES | FR |

| ALLIANZ | DE |

| DEUTSCHE TELEKOM | DE |

| SANOFI | FR |

| AIR LIQUIDE | FR |

These companies represent a diverse range of sectors and are key players in the European and global economies.

Understanding the EURO STOXX 50 provides valuable insights into the Eurozone market. Whether you are managing a substantial portfolio or just beginning to explore investment options with an initial amount like 50 euro 50, this index serves as an essential benchmark and a gateway to European blue-chip equities.

Footnotes:

1 Data as of December 2023.

2 Source: Structured Retail Products.