The EURO STOXX 50® stands as the Eurozone’s premier blue-chip index, a benchmark reflecting the performance of supersector leaders within the region. This meticulously constructed index offers a diversified and liquid portfolio, making it a cornerstone of European equity investment. Weighting within the index is determined by free-float market capitalization, ensuring that no single constituent exceeds a 10 percent weight, thus promoting balance and preventing over-concentration.

This blue-chip benchmark is not just a theoretical measure; it underpins a substantial financial ecosystem. Over 25 billion euros in Exchange Traded Fund (ETF) assets are benchmarked against the EURO STOXX 50. Furthermore, futures and options contracts linked to the index are the most actively traded equity index derivatives on Eurex, highlighting its importance in the trading and hedging landscape. The reach of the EURO STOXX 50 extends even further, with over 160,000 structured products linked to its performance, demonstrating its widespread adoption across various investment vehicles.

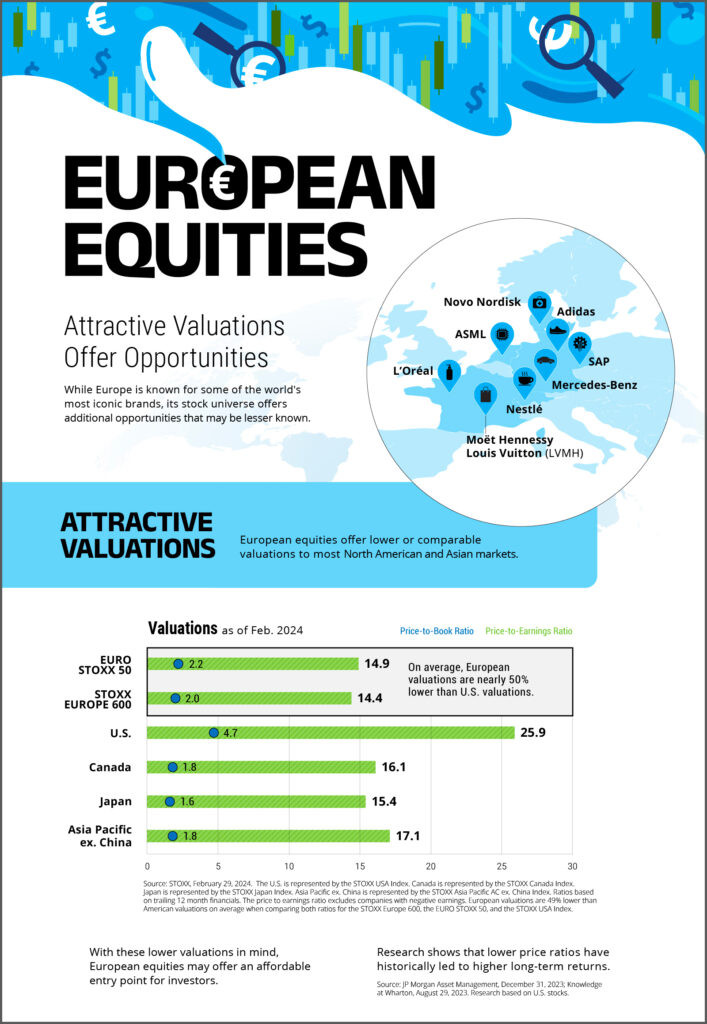

EURO STOXX 50 index performance and key data points, showcasing its role as a leading Eurozone blue-chip benchmark for investors considering European equity exposure and currency exchange implications, such as understanding values in pounds from a euro-denominated index.

EURO STOXX 50 index performance and key data points, showcasing its role as a leading Eurozone blue-chip benchmark for investors considering European equity exposure and currency exchange implications, such as understanding values in pounds from a euro-denominated index.

Key Advantages of the EURO STOXX 50

The EURO STOXX 50 offers several compelling benefits for investors and financial professionals:

Tradeability and Liquidity

The index’s composition is inherently liquidity-driven. This characteristic makes it exceptionally tradeable, a crucial factor for those designing financial products or seeking a reliable benchmark for performance comparison. The deep liquidity ensures efficient trading and reduces transaction costs.

Diversification and Balance

By representing supersector leaders across the Eurozone, the EURO STOXX 50 provides a naturally diversified portfolio. It utilizes the Industry Classification Benchmark (ICB) supersectors to achieve balanced representation across various sectors of the European economy, mitigating sector-specific risks.

Market Relevance and Currency Context

The EURO STOXX 50 is kept current and reflective of market dynamics through quarterly rebalancing, an annual review, and a fast-exit rule for underperforming constituents. For investors considering investments from a UK perspective, understanding the index performance also involves considering currency exchange rates. For example, tracking the value of investments, even notionally starting with an amount like 50 Euros In Pounds, requires awareness of the EUR/GBP exchange rate to gauge returns accurately.

Precision and Customization

Beyond the headline index, investors can access derived sub-indices. These include ex-financials versions or single-country focused indices, allowing for more precise exposure and tailored investment strategies depending on specific market views or risk appetites.

Sustainable Investing Options

For those prioritizing responsible investment, the EURO STOXX 50® ESG Index offers a sustainable alternative. This ESG-focused version allows investors to align their portfolios with environmental, social, and governance principles without sacrificing exposure to leading Eurozone companies.

Accessibility and Product Availability

The EURO STOXX 50 is highly accessible. A wide array of existing financial products, including ETFs, options, futures, and structured products, already track this benchmark. This extensive product suite simplifies investment and provides numerous avenues to gain exposure to the Eurozone’s leading companies.

Index Details at a Glance

| Feature | Detail |

|---|---|

| Symbol | SX5E |

| Calculation | Realtime |

| Dissemination Period | 09:00-18:00 CET |

| ISIN | EU0009658145 |

| Bloomberg | SX5E Index |

| Last Value | 5,499.81 +112.50 (+2.09%) |

| As of | 05:30 pm CET |

| Week to Week Change | -0.51% |

| 52 Week Change | 12.40% |

| Year to Date Change | 11.83% |

| Daily Low | 5409.93 |

| Daily High | 5533.18 |

| 52 Week Low | 4571.6 — 5 Aug 2024 |

| 52 Week High | 5540.6899 — 3 Mar 2025 |

Data

Factsheet

Top 10 Index Constituents

The EURO STOXX 50 is composed of leading companies across various Eurozone countries. The top 10 constituents are:

| Company | Country |

|---|---|

| SAP | DE |

| ASML HLDG | NL |

| LVMH MOET HENNESSY | FR |

| SIEMENS | DE |

| ALLIANZ | DE |

| SCHNEIDER ELECTRIC | FR |

| TOTALENERGIES | FR |

| DEUTSCHE TELEKOM | DE |

| SANOFI | FR |

| AIR LIQUIDE | FR |

Graphical representation of EURO STOXX 50 index performance over various timeframes, illustrating market trends for investors monitoring Eurozone equity markets and considering currency conversion implications when assessing returns in pounds.

Graphical representation of EURO STOXX 50 index performance over various timeframes, illustrating market trends for investors monitoring Eurozone equity markets and considering currency conversion implications when assessing returns in pounds.

Footnotes:

1 Data as of December 2023.

2 Source: Structured Retail Products.