7 Euros To Pounds represents the conversion of seven euros into its equivalent value in British pounds, influenced by real-time exchange rates; explore its relevance in international transactions and discover quality European irrigation products at eurodripusa.net, providing innovative solutions to optimize water use and promote sustainable agriculture. We will also share with you expert insights and practical tips for utilizing irrigation systems, saving you money and resources while increasing crop yields.

1. What Is the Current Exchange Rate for 7 Euros to Pounds?

The exchange rate between the Euro (EUR) and the British Pound (GBP) fluctuates constantly, reflecting economic factors and market sentiment. This means that the value of 7 Euros in Pounds Sterling will vary from moment to moment. As of today, you can find the most up-to-date exchange rate using online currency converters, financial websites, or your bank. This is important in order to get an exact number.

To understand how this works, consider a hypothetical exchange rate:

- Example: If 1 EUR = 0.85 GBP, then 7 EUR = 7 x 0.85 GBP = 5.95 GBP.

This calculation shows that 7 Euros would be equivalent to 5.95 British Pounds at this specific exchange rate. However, it’s crucial to remember that this rate is subject to change. Factors influencing the EUR/GBP exchange rate include:

- Economic Indicators: Inflation rates, GDP growth, and employment figures in both the Eurozone and the United Kingdom.

- Interest Rates: Decisions made by the European Central Bank (ECB) and the Bank of England (BoE) regarding interest rates.

- Political Events: Major political events, such as elections or referendums, can create uncertainty and impact currency values.

- Market Sentiment: Investor confidence and speculation can also drive currency movements.

Given these dynamic factors, it’s always best to check a reliable source for the current exchange rate before making any financial decisions involving EUR to GBP conversions. For instance, financial institutions like Barclays, HSBC, and NatWest provide currency exchange services and up-to-date exchange rates. Websites like XE.com and Google Finance also offer real-time currency conversion tools.

Understanding the current exchange rate is essential for anyone dealing with international transactions, whether for personal travel, business, or investment purposes.

2. Why Is Knowing the EUR to GBP Exchange Rate Important?

Knowing the EUR to GBP exchange rate is crucial for several reasons, impacting various aspects of finance, trade, and personal transactions. Here’s a detailed look at why this exchange rate matters:

- For Travelers: If you’re traveling from a Eurozone country to the United Kingdom, or vice versa, understanding the exchange rate helps you budget effectively. Knowing how much your Euros are worth in Pounds allows you to plan your expenses, from accommodation and meals to transportation and shopping. Without this knowledge, you risk overspending or not having enough funds for your trip.

- For Businesses: Companies engaged in international trade between the Eurozone and the UK need to monitor the EUR/GBP exchange rate closely. Fluctuations can significantly impact the cost of goods and services, affecting profit margins. Businesses use this information to price their products competitively, manage currency risk, and make informed decisions about when to buy or sell currency.

- For Investors: Investors who hold assets in both Euros and Pounds need to understand the exchange rate to assess the value of their investments. Currency movements can either enhance or erode returns, so staying informed about the EUR/GBP rate is vital for making strategic investment decisions. This includes decisions about hedging currency risk or diversifying portfolios.

- For Sending Money Internationally: Individuals who need to send money between the Eurozone and the UK, whether for remittances, gifts, or other purposes, need to be aware of the exchange rate to ensure the recipient receives the correct amount. Different services offer varying exchange rates and fees, so it’s important to compare options to find the most cost-effective solution.

- Economic Analysis: Economists and policymakers use the EUR/GBP exchange rate as an indicator of economic health and stability. Significant movements in the exchange rate can signal shifts in economic conditions, such as changes in trade balances, investor sentiment, or monetary policy. This information is used to make informed decisions about economic policy and forecasting.

Accurate and timely information about the EUR/GBP exchange rate empowers individuals and organizations to make informed financial decisions, manage risks, and optimize their transactions.

3. How Can I Get the Best EUR to GBP Exchange Rate?

Getting the best EUR to GBP exchange rate requires careful planning and research. Here are several strategies to maximize your currency exchange:

- Compare Exchange Rates: Different providers offer varying exchange rates, so it’s essential to compare options before making a transaction. Banks, currency exchange services, and online platforms all have different rates and fees. Websites like XE.com, Google Finance, and others provide real-time exchange rate comparisons.

- Use Online Currency Exchange Platforms: Online platforms often offer more competitive exchange rates than traditional banks or currency exchange services. Companies like TransferWise (now Wise), Revolut, and CurrencyFair provide transparent pricing and lower fees. These platforms leverage technology to reduce overhead costs, passing the savings on to customers.

- Avoid Airport and Hotel Exchange Services: Currency exchange services at airports and hotels typically offer the worst exchange rates due to high overhead costs and captive customers. It’s best to avoid these options if possible.

- Consider Using a Credit or Debit Card: When traveling, using a credit or debit card can be a convenient way to make purchases. However, be aware of foreign transaction fees, which can add to the cost. Look for cards with no foreign transaction fees to minimize expenses.

- Negotiate with Your Bank: If you’re exchanging a large sum of money, it may be possible to negotiate a better exchange rate with your bank. Contact your bank in advance and inquire about the possibility of a preferential rate.

- Monitor Exchange Rate Trends: Keeping an eye on exchange rate trends can help you identify favorable times to exchange currency. If you anticipate needing to exchange Euros for Pounds in the future, track the EUR/GBP rate and make your transaction when the rate is most advantageous.

- Use Limit Orders: Some online platforms allow you to set limit orders, which automatically execute a currency exchange when your desired exchange rate is reached. This can be a useful tool for taking advantage of favorable rate movements.

- Be Aware of Fees and Commissions: In addition to the exchange rate, be mindful of any fees or commissions charged by the service provider. These fees can significantly impact the overall cost of the transaction. Always ask for a breakdown of all charges before proceeding.

- Check for Promotional Offers: Some currency exchange services offer promotional rates or discounts for new customers. Take advantage of these offers to save money on your currency exchange.

By following these strategies, you can increase your chances of securing a favorable EUR to GBP exchange rate and minimizing the cost of your currency transactions.

4. What Are the Fees Associated With Currency Exchange?

Currency exchange services typically charge fees that can affect the overall cost of converting EUR to GBP. Understanding these fees is essential for making informed decisions. Here are the common types of fees associated with currency exchange:

- Commission Fees: Many currency exchange services charge a commission fee, which is a percentage of the total amount being exchanged. This fee can vary depending on the service provider and the size of the transaction.

- Transaction Fees: Some services charge a fixed transaction fee for each currency exchange, regardless of the amount being exchanged. This fee can be more significant for smaller transactions.

- Service Charges: Banks and other financial institutions may charge service fees for currency exchange services, particularly if you are not a customer or if you are using a specialized service.

- Hidden Fees: Some currency exchange services may not disclose all fees upfront, leading to unexpected charges. Always ask for a detailed breakdown of all fees before proceeding with the transaction.

- Credit Card Fees: If you use a credit card to exchange currency, you may be charged a cash advance fee or a foreign transaction fee. These fees can be substantial, so it’s best to avoid using a credit card for currency exchange if possible.

- Debit Card Fees: Similar to credit cards, using a debit card for currency exchange may incur fees, particularly if you are using a foreign ATM. Check with your bank to understand the fees associated with debit card transactions.

- Exchange Rate Markup: Currency exchange services often add a markup to the exchange rate, which is the difference between the rate they offer and the interbank rate (the rate at which banks trade with each other). This markup is a form of fee, as it reduces the amount of currency you receive.

- Delivery Fees: If you are having currency delivered to your home or office, you may be charged a delivery fee. This fee can vary depending on the delivery method and the location.

To minimize fees, it’s important to compare the total cost of currency exchange from different providers, including all fees and markups. Online currency exchange platforms often offer more transparent pricing and lower fees than traditional banks or currency exchange services.

5. How Does the EUR to GBP Exchange Rate Impact International Trade?

The EUR to GBP exchange rate plays a significant role in international trade between the Eurozone and the United Kingdom. Fluctuations in this exchange rate can have a profound impact on businesses engaged in importing and exporting goods and services. Here’s how:

- Impact on Export Competitiveness: A weaker Euro (EUR) relative to the British Pound (GBP) makes Eurozone exports more competitive in the UK market. This is because UK buyers can purchase Eurozone goods and services at a lower cost in Pounds. Conversely, a stronger Euro makes Eurozone exports more expensive for UK buyers, reducing their competitiveness.

- Impact on Import Costs: A stronger Euro increases the cost of importing goods and services from the UK into the Eurozone. This is because Eurozone buyers need to spend more Euros to purchase the same amount of UK goods. Conversely, a weaker Euro reduces the cost of importing goods from the UK.

- Profit Margins: Exchange rate fluctuations can significantly impact the profit margins of businesses engaged in international trade. A favorable exchange rate can boost profits, while an unfavorable rate can erode them.

- Pricing Strategies: Businesses need to consider the exchange rate when setting prices for their products in foreign markets. They may need to adjust prices to remain competitive or to maintain profit margins.

- Currency Risk Management: Businesses engaged in international trade face currency risk, which is the risk that exchange rate fluctuations will negatively impact their financial performance. Companies use various strategies to manage currency risk, such as hedging with currency derivatives or invoicing in their own currency.

- Trade Balances: The EUR to GBP exchange rate can influence the trade balance between the Eurozone and the UK. A weaker Euro may lead to an increase in Eurozone exports to the UK and a decrease in imports from the UK, improving the Eurozone’s trade balance.

- Investment Decisions: Exchange rate expectations can influence investment decisions. Companies may choose to invest in countries with favorable exchange rates or to delay investments in countries with unfavorable rates.

Understanding the impact of the EUR to GBP exchange rate is crucial for businesses engaged in international trade between the Eurozone and the UK. By monitoring exchange rate trends and implementing effective currency risk management strategies, companies can mitigate the negative impacts of exchange rate fluctuations and capitalize on opportunities created by favorable rate movements.

6. What Are the Key Factors That Influence the EUR to GBP Exchange Rate?

The EUR to GBP exchange rate is influenced by a complex interplay of economic, political, and market factors. Understanding these factors is crucial for predicting exchange rate movements and making informed financial decisions. Here are some of the key factors that influence the EUR to GBP exchange rate:

- Economic Growth: The relative economic growth rates of the Eurozone and the United Kingdom play a significant role in determining the exchange rate. Higher economic growth in one region tends to attract investment, increasing demand for its currency and causing it to appreciate.

- Inflation Rates: Differences in inflation rates between the Eurozone and the UK can impact the exchange rate. Higher inflation in one region erodes the purchasing power of its currency, causing it to depreciate relative to the currency of a region with lower inflation.

- Interest Rates: Interest rate decisions made by the European Central Bank (ECB) and the Bank of England (BoE) can significantly influence the exchange rate. Higher interest rates tend to attract foreign investment, increasing demand for the currency and causing it to appreciate.

- Government Debt: High levels of government debt in either the Eurozone or the UK can undermine investor confidence and lead to currency depreciation. Investors may become concerned about the government’s ability to repay its debts, leading them to sell the currency.

- Political Stability: Political stability is an important factor in determining the exchange rate. Political uncertainty or instability can lead to capital flight, causing the currency to depreciate.

- Trade Balances: The trade balance between the Eurozone and the UK can impact the exchange rate. A trade surplus (exports exceeding imports) tends to increase demand for a currency, causing it to appreciate, while a trade deficit (imports exceeding exports) tends to decrease demand for a currency, causing it to depreciate.

- Market Sentiment: Market sentiment, or the overall mood of investors, can also influence the exchange rate. Positive sentiment towards a region can lead to increased investment and currency appreciation, while negative sentiment can lead to capital flight and currency depreciation.

- Global Events: Global events, such as economic crises, political conflicts, or natural disasters, can have a significant impact on the EUR to GBP exchange rate. These events can create uncertainty and volatility in financial markets, leading to rapid currency movements.

By monitoring these key factors, individuals and businesses can gain a better understanding of the forces driving the EUR to GBP exchange rate and make more informed decisions about currency transactions.

7. How Can I Use a Currency Converter to Calculate 7 Euros to Pounds?

Using a currency converter to calculate 7 Euros to Pounds is a straightforward process. Here’s a step-by-step guide:

- Choose a Currency Converter: There are many online currency converters available, such as Google Currency Converter, XE.com, and others. Select one that you find user-friendly and reliable.

- Enter the Amount: In the currency converter, enter the amount you want to convert (in this case, 7) in the “Amount” field.

- Select the Currencies: Choose the source currency (EUR – Euro) and the target currency (GBP – British Pound) from the drop-down menus.

- View the Result: The currency converter will display the equivalent amount in the target currency (Pounds). For example, if the current exchange rate is 1 EUR = 0.85 GBP, the converter will show that 7 EUR = 5.95 GBP.

- Consider Fees: Keep in mind that the exchange rate provided by the currency converter is an indicative rate. Actual exchange rates may vary depending on the service provider and any associated fees.

- Update the Rate: Currency exchange rates fluctuate constantly, so be sure to update the rate if you are making a transaction at a later time.

Currency converters are a useful tool for quickly estimating the value of one currency in terms of another. However, it’s important to remember that the actual exchange rate you receive may differ from the indicative rate shown by the converter due to fees and markups.

8. What Are the Alternatives to Exchanging Currency?

While exchanging currency is a common way to convert EUR to GBP, there are several alternatives that may be more convenient or cost-effective depending on your situation. Here are some options to consider:

- Use a Credit or Debit Card: When traveling, using a credit or debit card can be a convenient way to make purchases in a foreign currency. However, be aware of foreign transaction fees, which can add to the cost. Look for cards with no foreign transaction fees to minimize expenses.

- Withdraw Cash from an ATM: Withdrawing cash from an ATM in the local currency can be a convenient way to access funds when traveling. However, be aware of ATM fees and foreign transaction fees, which can vary depending on your bank and the ATM operator.

- Use a Prepaid Travel Card: Prepaid travel cards allow you to load funds in multiple currencies and use the card to make purchases or withdraw cash. These cards can be a convenient way to manage your travel expenses and avoid foreign transaction fees.

- Use a Mobile Payment App: Mobile payment apps like PayPal, Venmo, and Cash App allow you to send and receive money internationally. These apps can be a convenient way to transfer funds, but be aware of any fees or exchange rate markups.

- Use a Cryptocurrency: Cryptocurrencies like Bitcoin and Ethereum can be used to transfer value internationally. However, cryptocurrencies are volatile and subject to price fluctuations, so they may not be suitable for all transactions.

- Use a Peer-to-Peer Lending Platform: Peer-to-peer lending platforms connect borrowers and lenders directly, allowing them to exchange currency at competitive rates. These platforms can be a cost-effective alternative to traditional currency exchange services.

The best alternative to exchanging currency depends on your individual needs and circumstances. Consider the convenience, cost, and risk associated with each option before making a decision.

9. How Does Brexit Affect the EUR to GBP Exchange Rate?

Brexit, the United Kingdom’s withdrawal from the European Union, has had a significant and ongoing impact on the EUR to GBP exchange rate. Here’s how:

- Increased Uncertainty: Brexit created significant uncertainty about the future relationship between the UK and the EU, leading to volatility in financial markets. This uncertainty has put downward pressure on the value of the British Pound, as investors worried about the economic consequences of Brexit.

- Economic Impact: Brexit has had a negative impact on the UK economy, particularly in the short term. The UK’s departure from the EU has disrupted trade flows, reduced investment, and slowed economic growth. This has further weakened the Pound relative to the Euro.

- Trade Negotiations: The ongoing negotiations between the UK and the EU over trade agreements have also influenced the EUR to GBP exchange rate. Uncertainty about the outcome of these negotiations has created volatility in the currency markets.

- Monetary Policy: The Bank of England (BoE) has responded to Brexit by easing monetary policy, cutting interest rates and implementing quantitative easing measures to support the UK economy. This has put downward pressure on the Pound.

- Investor Sentiment: Investor sentiment towards the UK has been negatively impacted by Brexit. Investors are concerned about the long-term economic prospects of the UK outside the EU, leading them to reduce their investments in the country.

- Long-Term Outlook: The long-term impact of Brexit on the EUR to GBP exchange rate is still uncertain. The future relationship between the UK and the EU will play a key role in determining the exchange rate. If the UK and the EU can establish a close trading relationship, the impact on the Pound may be limited. However, if the UK and the EU fail to reach a comprehensive trade agreement, the Pound could weaken further.

Brexit has created significant challenges for the UK economy and has had a negative impact on the value of the British Pound. The EUR to GBP exchange rate is likely to remain volatile in the coming years as the UK and the EU navigate their new relationship.

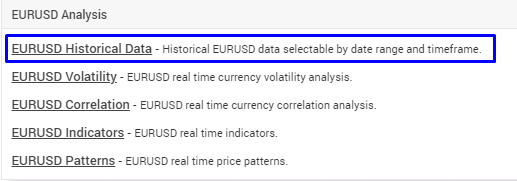

EURUSD Forex History Data

EURUSD Forex History Data

EURUSD Forex History Data

10. Where Can I Find Reliable Information About Currency Exchange?

Finding reliable information about currency exchange is essential for making informed financial decisions. Here are some sources of information that you can trust:

- Financial Websites: Reputable financial websites like Bloomberg, Reuters, and the Financial Times provide up-to-date news, analysis, and data on currency markets. These websites are a valuable resource for staying informed about exchange rate trends and economic factors that influence currency values.

- Bank Websites: Banks like Barclays, HSBC, and NatWest provide information on currency exchange rates, fees, and services. These websites can be a good starting point for comparing exchange rates and understanding the costs associated with currency exchange.

- Currency Converter Websites: Currency converter websites like XE.com and Google Finance provide real-time exchange rates and currency conversion tools. These websites can be useful for quickly estimating the value of one currency in terms of another.

- Government Websites: Government websites like the US Department of the Treasury and the European Central Bank provide information on economic policy and financial regulations. These websites can be a valuable resource for understanding the macroeconomic factors that influence currency values.

- Academic Journals: Academic journals like the Journal of International Economics and the Journal of Finance publish research on currency markets and exchange rate dynamics. These journals can provide in-depth insights into the factors that drive currency movements.

- Financial Advisors: Financial advisors can provide personalized advice on currency exchange and investment strategies. A qualified financial advisor can help you assess your individual needs and develop a plan to manage currency risk and achieve your financial goals.

- International Organizations: International organizations like the International Monetary Fund (IMF) and the World Bank provide data and analysis on global economic trends. These organizations can be a valuable resource for understanding the broader context of currency markets and exchange rate dynamics.

By consulting these reliable sources of information, you can gain a better understanding of currency exchange and make more informed decisions about your financial transactions.

11. What Are the Tax Implications of Currency Exchange?

The tax implications of currency exchange can be complex and vary depending on your individual circumstances and the laws of your country. Here are some general principles to keep in mind:

- Capital Gains Tax: If you make a profit from currency exchange, you may be subject to capital gains tax. This tax applies to the difference between the price at which you bought the currency and the price at which you sold it.

- Income Tax: If you receive income in a foreign currency, you may be required to pay income tax on the value of the income in your home currency. The exchange rate used to calculate the value of the income may be subject to certain rules and regulations.

- Value Added Tax (VAT): In some countries, currency exchange services may be subject to value added tax (VAT). This tax is typically included in the fees charged by the currency exchange service.

- Reporting Requirements: You may be required to report certain currency exchange transactions to your tax authorities. The reporting requirements vary depending on the amount of the transaction and the laws of your country.

- Tax Treaties: Tax treaties between countries can affect the tax implications of currency exchange. These treaties may provide relief from double taxation or reduce the amount of tax you owe.

- Professional Advice: It’s always a good idea to seek professional advice from a tax advisor or accountant to ensure that you are complying with all applicable tax laws and regulations. A qualified professional can help you understand the tax implications of currency exchange and develop a tax-efficient strategy.

The tax implications of currency exchange can be complex and vary depending on your individual circumstances. It’s important to stay informed about the tax laws and regulations in your country and to seek professional advice when needed.

12. How Can Eurodrip USA Help Me With My Irrigation Needs?

At eurodripusa.net, we understand the importance of efficient irrigation, which not only optimizes water use but also promotes sustainable agriculture. Whether you are a farmer, a landscape architect, or a home gardener, we have the right solution for you.

Eurodrip USA specializes in providing high-quality drip irrigation systems and components sourced from Europe. Our products are designed to deliver water directly to the roots of plants, minimizing water waste and maximizing crop yields. Here’s how we can help you with your irrigation needs:

- Wide Range of Products: We offer a wide range of drip irrigation products, including drip tape, drip lines, emitters, filters, and controllers. Our products are suitable for a variety of applications, from small-scale gardens to large-scale agricultural operations.

- Expert Advice: Our team of irrigation experts can provide you with personalized advice and guidance on selecting the right products for your specific needs. We can help you design an efficient irrigation system that meets your water conservation goals and maximizes your crop yields.

- Custom Solutions: We offer custom irrigation solutions tailored to your specific requirements. Whether you need a complete drip irrigation system or a specialized component, we can provide you with a solution that meets your needs.

- Installation Support: We provide installation support and training to help you set up your drip irrigation system correctly. Our team can answer your questions and provide you with the guidance you need to ensure that your system is running efficiently.

- Technical Support: We offer ongoing technical support to help you maintain your drip irrigation system. Our team can troubleshoot any issues you may encounter and provide you with the solutions you need to keep your system running smoothly.

- European Quality: Our products are sourced from leading European manufacturers and are known for their quality, durability, and performance. We are committed to providing you with the best irrigation products on the market.

- Water Conservation: Our drip irrigation systems are designed to conserve water and reduce water waste. By delivering water directly to the roots of plants, our systems minimize evaporation and runoff, helping you save water and reduce your environmental impact.

At eurodripusa.net, we are committed to helping you achieve your irrigation goals. Contact us today to learn more about our products and services and how we can help you optimize your water use and maximize your crop yields.

Are you looking for high-quality drip irrigation solutions from Europe? Visit eurodripusa.net today to explore our products, learn about our technology, and contact us for a consultation. Let us help you optimize your irrigation system and achieve your water conservation goals. Address: 1 Shields Ave, Davis, CA 95616, United States. Phone: +1 (530) 752-1011. Website: eurodripusa.net.

FAQ: 7 Euros to Pounds

-

What does “7 Euros to Pounds” mean?

“7 Euros to Pounds” refers to the process of converting 7 Euros into its equivalent value in British Pounds, based on the current exchange rate.

-

How is the EUR to GBP exchange rate determined?

The EUR to GBP exchange rate is influenced by factors like economic growth, inflation, interest rates, government debt, political stability, trade balances, market sentiment, and global events.

-

Where can I find the current EUR to GBP exchange rate?

You can find the current EUR to GBP exchange rate on financial websites, bank websites, and currency converter websites.

-

Are there fees associated with currency exchange?

Yes, currency exchange services typically charge fees, including commission fees, transaction fees, service charges, and exchange rate markups.

-

How can I minimize fees when exchanging currency?

To minimize fees, compare exchange rates, use online platforms, avoid airport exchanges, consider credit/debit cards with no foreign transaction fees, and negotiate with your bank.

-

How does the EUR to GBP exchange rate impact international trade?

The EUR to GBP exchange rate affects export competitiveness, import costs, profit margins, and pricing strategies for businesses involved in trade between the Eurozone and the UK.

-

What is the impact of Brexit on the EUR to GBP exchange rate?

Brexit has increased uncertainty, negatively impacted the UK economy, and influenced trade negotiations, leading to volatility in the EUR to GBP exchange rate.

-

What are some alternatives to exchanging currency?

Alternatives to exchanging currency include using credit/debit cards, withdrawing cash from ATMs, using prepaid travel cards, and mobile payment apps.

-

How can Eurodrip USA help with my irrigation needs?

Eurodrip USA provides high-quality drip irrigation systems and components sourced from Europe, offering expert advice, custom solutions, installation support, and technical support.

-

What are the tax implications of currency exchange?

Currency exchange may have tax implications, including capital gains tax, income tax, and value added tax (VAT), so it’s essential to seek professional tax advice.