The EURO STOXX 50® stands as the Eurozone’s premier blue-chip index, a vital gauge of the region’s economic health and market sentiment. This index meticulously tracks the performance of the 50 largest and most liquid stocks within the Eurozone, representing supersector leaders across various industries. Its design ensures a diversified and liquid portfolio, making it a cornerstone for investors seeking exposure to the Eurozone’s equity market. Weighting within the index is determined by free-float market capitalization, with a cap of 10 percent on any single constituent, further promoting diversification and balanced representation.

EURO STOXX 50®: The Eurozone’s leading blue-chip index

EURO STOXX 50®: The Eurozone’s leading blue-chip index

The significance of the EURO STOXX 50 extends beyond a mere market indicator. It serves as the foundation for over 25 billion euros in Exchange Traded Fund (ETF) assets, highlighting its role as a key investment vehicle. Furthermore, futures and options contracts based on the index are the most actively traded equity index derivatives on Eurex, demonstrating its importance in risk management and trading strategies. The index’s broad appeal is further evidenced by its linkage to over 160,000 structured products, showcasing its versatility and integration within diverse financial instruments.

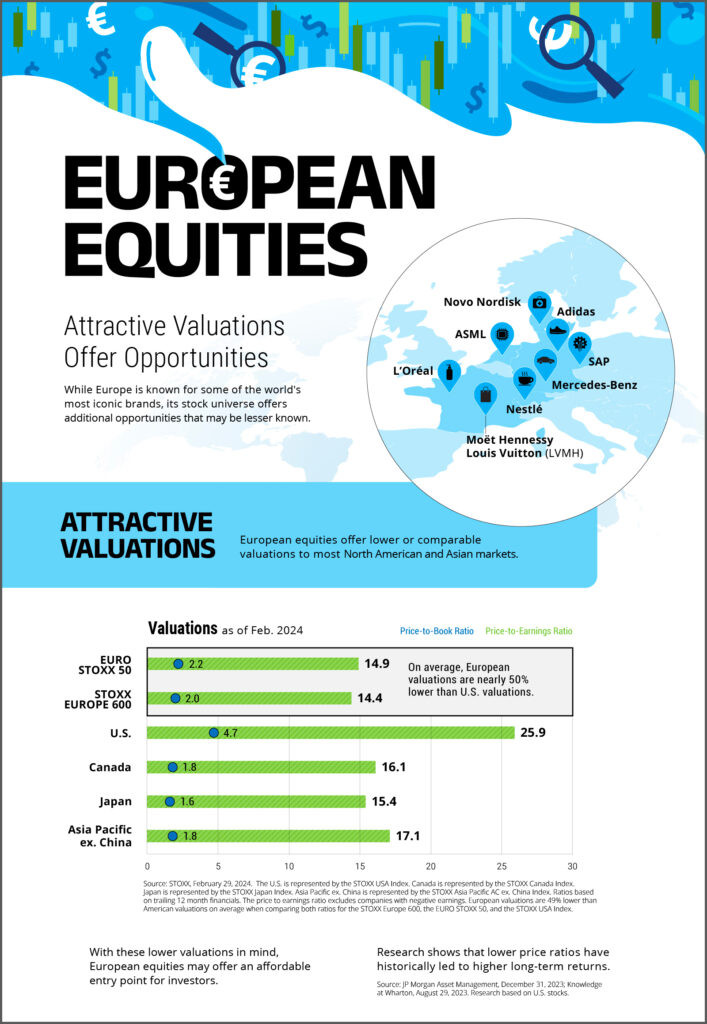

Infographic of EURO STOXX 50 and European Equities

Infographic of EURO STOXX 50 and European Equities

Key Advantages of the EURO STOXX 50

The EURO STOXX 50 index offers several compelling benefits for investors and financial professionals:

- Tradability: Its liquidity-driven composition ensures ease of trading, making it ideal for designing financial products and serving as a reliable benchmark for performance comparison.

- Balance: The index achieves diversified representation across various sectors, utilizing the Industry Classification Benchmark (ICB) supersectors to ensure a balanced portfolio.

- Up-to-date: With quarterly rebalancing, an annual review, and a fast-exit rule, the index remains current, reflecting the latest market developments and ensuring timely adjustments to its composition.

- Precision: Investors can access sub-indices derived from the EURO STOXX 50, such as ex-financials or single-country variations, allowing for more targeted investment strategies.

- Sustainability Focus: For those prioritizing responsible investing, the EURO STOXX 50® ESG Index offers a sustainable option, aligning with environmental, social, and governance principles.

- Accessibility: A wide array of existing financial products already track the EURO STOXX 50, providing investors with numerous avenues to gain exposure to this leading index.

Index Details and Performance

| Metric | Value |

|---|---|

| Symbol | SX5E |

| Calculation | Realtime |

| Dissemination Period | 09:00-18:00 CET |

| ISIN | EU0009658145 |

| Bloomberg | SX5E Index |

| Last Value | 5,463.54 (-0.16%) |

| Week to Week Change | 0.18% |

| 52 Week Change | 11.21% |

| Year to Date Change | 11.10% |

| Daily Low | 5411.54 |

| Daily High | 5463.54 |

| 52 Week Low | 4571.6 (5 Aug 2024) |

| 52 Week High | 5533.84 (18 Feb 2025) |

Data as of 05:50 pm CET

Data

Factsheet

Top 10 Components

The EURO STOXX 50 index is composed of leading companies across the Eurozone. The top 10 constituents are:

| Company | Country |

|---|---|

| ASML HLDG | NL |

| SAP | DE |

| LVMH MOET HENNESSY | FR |

| SIEMENS | DE |

| SCHNEIDER ELECTRIC | FR |

| TOTALENERGIES | FR |

| ALLIANZ | DE |

| DEUTSCHE TELEKOM | DE |

| SANOFI | FR |

| AIR LIQUIDE | FR |

In conclusion, the EURO STOXX 50 serves as a critical benchmark for the Eurozone economy, offering tradability, diversification, and up-to-date market representation. Its wide adoption in financial products underscores its importance for investors seeking exposure to the leading companies of the Eurozone.