The EURO STOXX 50® stands as the Eurozone’s premier blue-chip index, representing the 50 largest and most liquid stocks within the Eurozone. For investors globally, especially those in the U.S., understanding its value in USD is crucial. This index isn’t just a measure of European market health; it’s a gateway to Eurozone’s leading companies, making the Euro 50 To Usd conversion rate a relevant factor when considering investment performance and portfolio diversification.

EURO STOXX 50 Index Banner: The Eurozone's Leading Blue-Chip Index for Global Investors

EURO STOXX 50 Index Banner: The Eurozone's Leading Blue-Chip Index for Global Investors

The EURO STOXX 50 index is designed to track supersector leaders across the Eurozone, ensuring a diversified and liquid investment portfolio. Its methodology is based on free-float market capitalization, which means the index weights constituents according to their market cap available for public trading, with a cap of 10 percent for any single constituent. This weighting approach ensures that the index truly reflects the most significant companies in the Eurozone economy.

Key Benefits of the EURO STOXX 50

Investing in or tracking the EURO STOXX 50 offers several key advantages:

Tradeability and Liquidity

The index’s composition is driven by liquidity, making it highly tradeable. This is essential for designing financial products, such as ETFs and derivatives, and for serving as a reliable benchmark for investment performance. The high liquidity ensures ease of entry and exit for investors.

Balanced Sector Representation

The EURO STOXX 50 provides diversified exposure across various sectors as defined by the Industry Classification Benchmark (ICB) supersectors. This balance reduces concentration risk and offers a broad view of the Eurozone economy.

Up-to-Date Market Relevance

The index is rebalanced quarterly and undergoes an annual review, incorporating a fast-exit rule to ensure it remains current with market developments. This dynamic approach helps the index accurately reflect the evolving economic landscape.

Precision and Customization

Beyond the broad index, there are derived sub-indices, such as ex-financials or single-country versions, offering more precise investment tools for specific strategies.

Sustainable Investment Options

For environmentally and socially conscious investors, the EURO STOXX 50® ESG Index provides a sustainable option, aligning with responsible investment principles.

Accessibility for Investors

A wide range of existing financial products are already tracking the EURO STOXX 50, providing accessible routes for investors to gain exposure to this leading index.

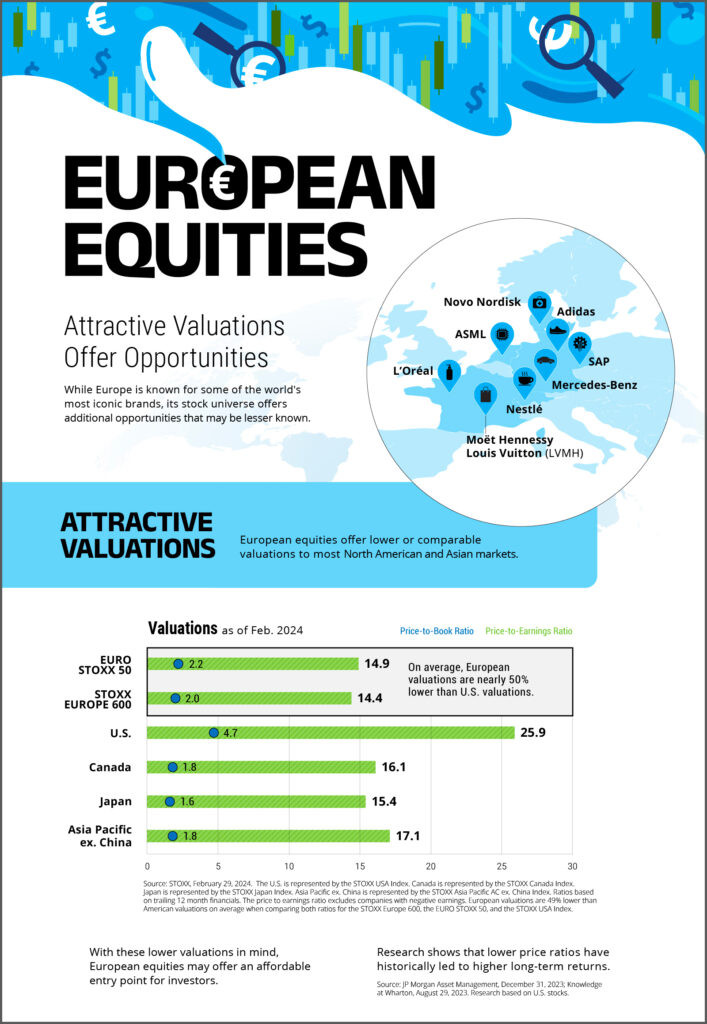

EURO STOXX 50 Index Performance and Key Metrics: Explore the Infographic for Detailed Insights

EURO STOXX 50 Index Performance and Key Metrics: Explore the Infographic for Detailed Insights

View full infographic

EURO STOXX 50: Index Details

| Detail | Value |

|---|---|

| Symbol | SX5E |

| Calculation | Realtime |

| Dissemination Period | 09:00-18:00 CET |

| ISIN | EU0009658145 |

| Bloomberg | SX5E Index |

| Last Value | 5,463.54 -9.02 (-0.16%) |

| Week to Week Change | 0.18% |

| 52 Week Change | 11.62% |

| Year to Date Change | 11.10% |

| Daily Low | 5411.54 |

| Daily High | 5463.54 |

| 52 Week Low | 4571.6 — 5 Aug 2024 |

| 52 Week High | 5533.84 — 18 Feb 2025 |

Data

Factsheet

Top 10 Components

The index is composed of leading European companies across various sectors. The top 10 components include:

| Company | Country |

|---|---|

| ASML HLDG | NL |

| SAP | DE |

| LVMH MOET HENNESSY | FR |

| SIEMENS | DE |

| SCHNEIDER ELECTRIC | FR |

| TOTALENERGIES | FR |

| ALLIANZ | DE |

| DEUTSCHE TELEKOM | DE |

| SANOFI | FR |

| AIR LIQUIDE | FR |

Conclusion

For investors monitoring global markets and considering the Eurozone, the EURO STOXX 50 is an essential benchmark. Understanding the euro 50 to usd exchange rate adds another layer of insight for U.S. based investors, allowing for a clearer picture of potential returns when translated back to USD. This index offers a robust, diversified, and liquid way to participate in the Eurozone’s leading economies. For the most current data and deeper analysis, refer to the official EURO STOXX 50 data page.