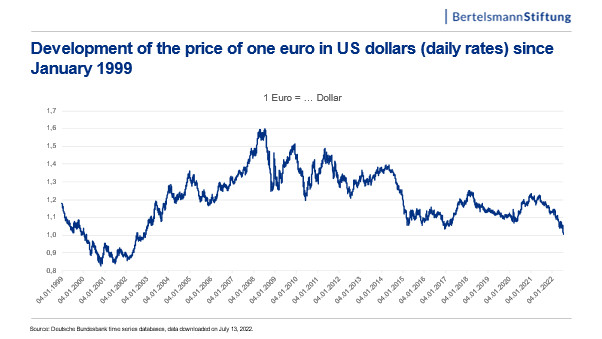

The euro has experienced a significant decline in value against the US dollar recently. In the summer of 2021, one euro was valued at $1.20. However, by mid-July 2022, the euro’s value had plummeted to just one dollar, marking the lowest exchange rate in two decades. While a weaker euro can benefit European companies exporting to the US, it also presents considerable disadvantages for the EU, particularly in the current economic climate, primarily by exacerbating inflation within the euro area.

Unpacking the Reasons Behind Euro Weakness

Several factors contribute to the euro’s current weakness.

Firstly, the economies within the Eurozone are disproportionately affected by the Ukraine war compared to the United States. This disparity arises partly from the EU’s stronger economic ties with Russia in contrast to the US. Furthermore, Europe is more vulnerable to the surge in fossil fuel prices due to its greater reliance on energy imports, unlike the US, which benefits from being a major fossil fuel producer. The US economy experiences a mixed effect, offsetting losses as an energy consumer with gains as an energy producer.

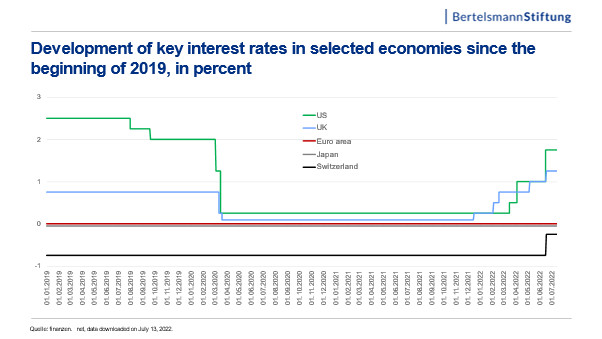

Secondly, the US Federal Reserve’s aggressive approach to combating inflation, with three key interest rate hikes this year, has significantly increased interest rates in the US. This increase attracts capital inflows into the US seeking higher returns, thereby strengthening demand for the dollar and causing its appreciation.

Thirdly, during times of global economic instability, investors tend to seek “safe haven” assets to protect their investments. The US dollar, as the world’s dominant reserve currency, is widely perceived as the ultimate safe haven, further bolstering its demand and value.

These combined factors have resulted in the euro losing value against the dollar.

Euro vs Dollar exchange rate showing parity in July 2022

Euro vs Dollar exchange rate showing parity in July 2022

The Upside of a Depreciated Euro: Export Boost

A primary economic advantage of a weak euro lies in enhanced export competitiveness. European goods become more affordable in dollar terms for US buyers. For example, a German car priced at 10,000 euros would cost $12,500 when the exchange rate is $1.25 per euro.

However, at a one-to-one exchange rate, the dollar price drops to $10,000. This price reduction can stimulate demand for European products among American consumers. This principle extends to countries using the dollar or currencies pegged to the dollar.

Increased export demand can lead to higher production levels for European companies, provided they have sufficient capacity. This often translates to job creation and wage growth, effectively acting as an economic stimulus, fostering stronger domestic economic growth.

Unfortunately, these export-driven benefits are counterbalanced by considerable disadvantages for European economies.

The Downside of a Depreciated Euro: Inflationary Pressures

The downside of improved export prospects is the increased cost of imports priced in dollars. This affects not only US goods but also most raw materials traded globally, which are typically denominated in dollars.

At an exchange rate of $1.25 per euro, one dollar costs 0.80 euros. American sneakers priced at $100 would cost 80 euros. If the exchange rate moves to one-to-one, the same sneakers would cost 100 euros. Therefore, euro depreciation directly translates to higher prices for imported goods in Europe, exacerbating the already elevated inflation rates across the continent.

Rising import costs erode the purchasing power of household incomes. As EU citizens spend more on imports, they have less disposable income for European-made products. This can lead to reduced demand for domestic goods, potentially contributing to an economic downturn within the EU.

However, the increased cost of American goods can also create opportunities for European businesses. When US products become more expensive, European consumers may shift their demand towards comparable European products, which can help stabilize domestic production and employment.

The weakening European economy is further amplified by one of the drivers of the strong dollar: rising US interest rates.

The Role of US Interest Rate Hikes

The US Federal Reserve’s monetary policy, characterized by increasing interest rates, widens the interest rate differential between the US and the Eurozone.

Comparison of Key Interest Rates: US Fed Funds Rate significantly higher than ECB Main Refinancing Rate in July 2022

Comparison of Key Interest Rates: US Fed Funds Rate significantly higher than ECB Main Refinancing Rate in July 2022

Higher interest rates in the US, coupled with a strong dollar, incentivize capital to flow into the US. From a European perspective, this results in a capital outflow. Consequently, borrowing becomes more expensive and challenging within Europe.

Increased borrowing costs discourage business investment, leading to a decrease in demand for capital goods in the EU. Companies producing these goods may reduce production and potentially resort to layoffs, further hindering economic growth in the EU.

Economic Policy Options for Europe

Given Europe’s heavy reliance on energy imports, the inflationary consequences of a weak euro are likely to dominate in the short to medium term, necessitating effective policy responses.

#1 ECB Key Interest Rate Increase

The European Central Bank (ECB) has announced its intention to raise the key interest rate in July 2022, with an initial expected increase of 25 basis points. This measure aims to achieve two positive outcomes:

- Reduce the interest rate gap: Narrowing the interest rate differential between the US and the Eurozone could encourage capital to remain in or return to the Eurozone. This would increase demand for the euro, potentially leading to its appreciation.

- Anchor inflation expectations: Signaling a commitment to its two percent inflation target through monetary policy can help stabilize inflation expectations and alleviate inflationary pressures.

However, raising interest rates also carries economic drawbacks.

Higher interest rates can dampen investment and consequently slow long-term economic growth. Demand for capital goods may also decline. Furthermore, interest rates constitute a component of production costs, and increased production costs can erode company profits and discourage production.

Combating inflation through interest rate hikes could potentially weaken output and employment within the EU.

#2 Fiscal Policy to Complement Monetary Policy

Elevated energy prices mean a significant portion of European purchasing power is being transferred to energy-exporting nations. This reduction in purchasing power weakens consumer demand in the EU. As previously mentioned, demand for capital goods is also declining. In EU member states with high unemployment, reduced output from domestic firms exacerbates labor market challenges.

Government spending can help offset these demand shortfalls. Investments in ecological transformation are particularly well-suited in this context. They are crucial for addressing climate change and, importantly, reduce dependence on fossil fuel imports in the long run.

However, increased government spending financed by borrowing will inevitably lead to a rise in public debt.

#3 Enhancing Productivity

Boosting productivity enables the production of more goods with existing production capacities. This can help address the current inflationary pressures stemming from supply shortages of raw materials, inputs, and finished products.

Productivity improvements also reduce production costs, making European products more competitive globally. Increased exports subsequently raise demand for the euro.

However, productivity gains take time to materialize. In the interim, managing the supply-demand imbalance driving inflation necessitates demand reduction. This includes curbing demand for fossil fuels, which in turn reduces demand for US dollars, potentially leading to dollar depreciation and euro appreciation.

Outlook for the Coming Months

The timeline for euro strengthening remains uncertain. The high degree of uncertainty surrounding the Ukraine war and potential disruptions to Russian natural gas supplies are dampening production and employment in Europe. Consequently, the euro is likely to remain weak, contributing to inflationary pressures within the Eurozone.

Therefore, it appears probable that a weak euro and the resulting high costs for imported raw materials and intermediate goods will persist throughout 2022.

About the author

Thieß Petersen is Senior Advisor at the Bertelsmann Stiftung, specializing in macro-economic studies and economics. His focus lies on the causes and effects of financial and economic crises as well as the chances and risks of globalization. Most recently, he worked on the effects of carbon pricing and the benefits of a potential global climate club.

Read More on Rising Challenges in the Eurozone Economies

How to Fund Climate Investments in Times of Budget Consolidations

Agriculture Export Disruptions Pose Challenges with High Crisis Potential

Is Europe Threatened by Stagflation?