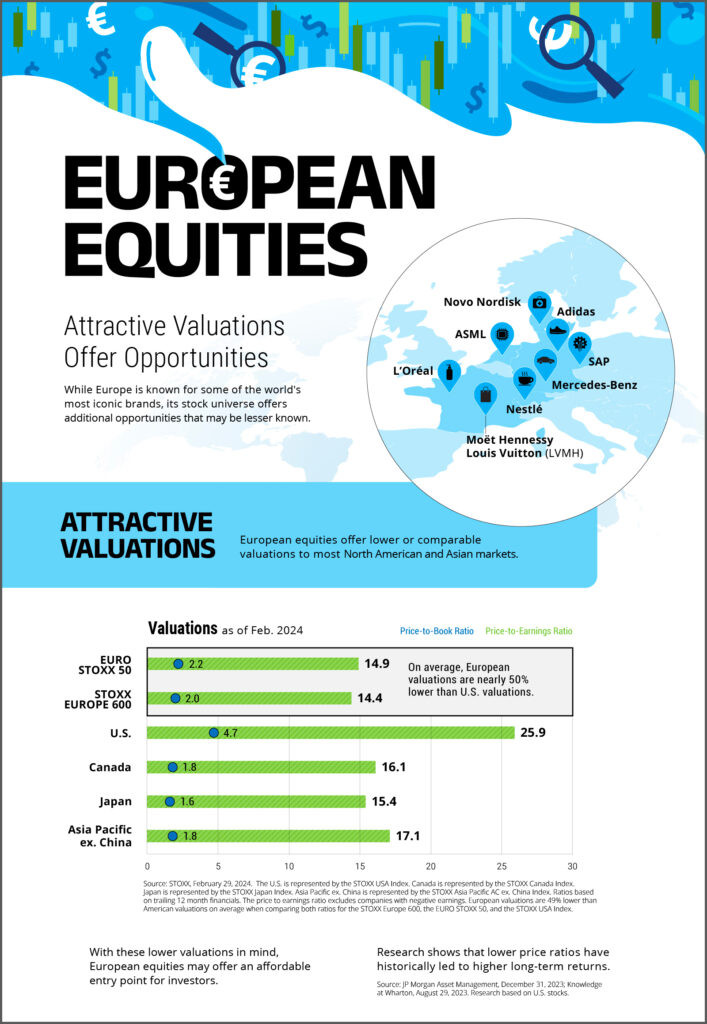

The EURO STOXX 50® stands as the Eurozone’s premier blue-chip index, a key indicator for anyone tracking Euro Stock performance. This index meticulously gathers the leading supersector companies within the Eurozone, creating a diverse and highly liquid portfolio that reflects the strength and breadth of euro stocks. Weighting within the index is determined by free-float market capitalization, ensuring that no single constituent dominates, with a cap of 10 percent on individual holdings.

Euro Stoxx 50 index performance over time

Euro Stoxx 50 index performance over time

This benchmark index is not just a theoretical measure; it underpins a substantial financial ecosystem. Over 25 billion euros in ETF assets are benchmarked against the EURO STOXX 50, highlighting its importance in the investment world for those focused on euro stock. Furthermore, the futures and options contracts linked to the index are the most actively traded equity index derivatives on Eurex, demonstrating its crucial role in trading euro stock derivatives. Its influence extends to structured products, with over 160,000 linked to the EURO STOXX 50, further cementing its status as a core component of the euro stock market landscape.

Key Advantages for Euro Stock Investors

For those interested in euro stock investments, the EURO STOXX 50 offers several key benefits:

Highly Tradeable for Euro Stock Strategies

The index’s composition is driven by liquidity, making it exceptionally tradeable. This is crucial for designing financial products and establishing benchmarks specifically for euro stock focused strategies. The deep liquidity ensures efficient trading and tighter bid-ask spreads, benefiting investors looking to engage with euro stock markets.

Balanced Representation of Eurozone Sectors

The EURO STOXX 50 provides a balanced representation across various sectors within the Eurozone economy, categorized by the Industry Classification Benchmark (ICB) supersectors. This diversification is vital for mitigating risk and gaining exposure to a broad spectrum of euro stock industries, from technology to consumer goods.

Up-to-Date Reflection of Euro Stock Market Trends

With quarterly rebalancing, an annual review, and a fast-exit rule, the index remains current and accurately reflects market developments in the euro stock arena. This dynamic approach ensures that the index constituents are always representative of the leading companies, adapting to the evolving euro stock market.

Precise Euro Stock Sub-Indices Available

Beyond the broad index, investors can access derived sub-indices that offer more precise exposures, such as ex-financials or single-country versions. These options allow for tailored investment strategies within the euro stock universe, catering to specific market views or risk profiles.

Sustainable Euro Stock Investment Options

For investors prioritizing responsible investing in euro stock, the EURO STOXX 50® ESG Index offers a sustainable alternative. This ESG-focused index allows participation in euro stock growth while adhering to environmental, social, and governance principles.

Accessible Route to Invest in Leading Euro Stocks

The widespread adoption of the EURO STOXX 50 means there is a large array of existing financial products tracking the index. This accessibility makes it straightforward for investors to gain exposure to the leading euro stocks through ETFs, funds, and other investment vehicles.

EURO STOXX 50 Index: Key Details

| Detail | Information |

|---|---|

| Symbol | SX5E |

| Calculation | Realtime |

| Dissemination Period | 09:00-18:00 CET |

| ISIN | EU0009658145 |

| Bloomberg | SX5E Index |

| Last Value | 5,540.69 +77.15 (+1.41%) |

| As of | 05:50 pm CET |

| Week to Week Change | 1.59% |

| 52 Week Change | 12.78% |

| Year to Date Change | 12.66% |

| Daily Low | 5434.62 |

| Daily High | 5568.19 |

| 52 Week Low | 4571.6 — 5 Aug 2024 |

| 52 Week High | 5533.84 — 18 Feb 2025 |

Data Factsheet

Top 10 Euro Stocks in the EURO STOXX 50

These are the top 10 components that constitute the EURO STOXX 50, representing some of the most significant euro stocks:

| Company | Country |

|---|---|

| ASML HLDG | NL |

| SAP | DE |

| LVMH MOET HENNESSY | FR |

| SIEMENS | DE |

| SCHNEIDER ELECTRIC | FR |

| TOTALENERGIES | FR |

| ALLIANZ | DE |

| DEUTSCHE TELEKOM | DE |

| SANOFI | FR |

| AIR LIQUIDE | FR |

The EURO STOXX 50 is undeniably the benchmark index for gauging the performance of leading euro stocks. Its comprehensive design, liquidity, and broad market representation make it an indispensable tool for investors and financial professionals navigating the euro stock market.

Data as of December 2023. Source: Structured Retail Products.