The Euro Stoxx 50 Index stands as the premier blue-chip index for the Eurozone, meticulously tracking the performance of supersector leaders within the region. This widely recognized benchmark provides a comprehensive snapshot of the Eurozone’s equity market, encompassing a diverse and highly liquid portfolio of leading companies.

The index’s methodology is grounded in free-float market capitalization weighting, ensuring that the representation of each constituent accurately reflects its economic significance. To maintain diversification and prevent undue concentration, a maximum weight of 10 percent is applied to each individual constituent within the EURO STOXX 50 index.

This robust and well-structured index serves as the underlying benchmark for over 25 billion euros in Exchange Traded Fund (ETF) assets, highlighting its pivotal role in investment strategies across Europe and globally. Furthermore, the futures and options contracts linked to the EURO STOXX 50 are among the most actively traded equity index derivatives on the Eurex exchange, underscoring its importance for trading and risk management. The EURO STOXX 50 is also linked to over 160,000 structured products, demonstrating its broad utilization in various financial instruments.

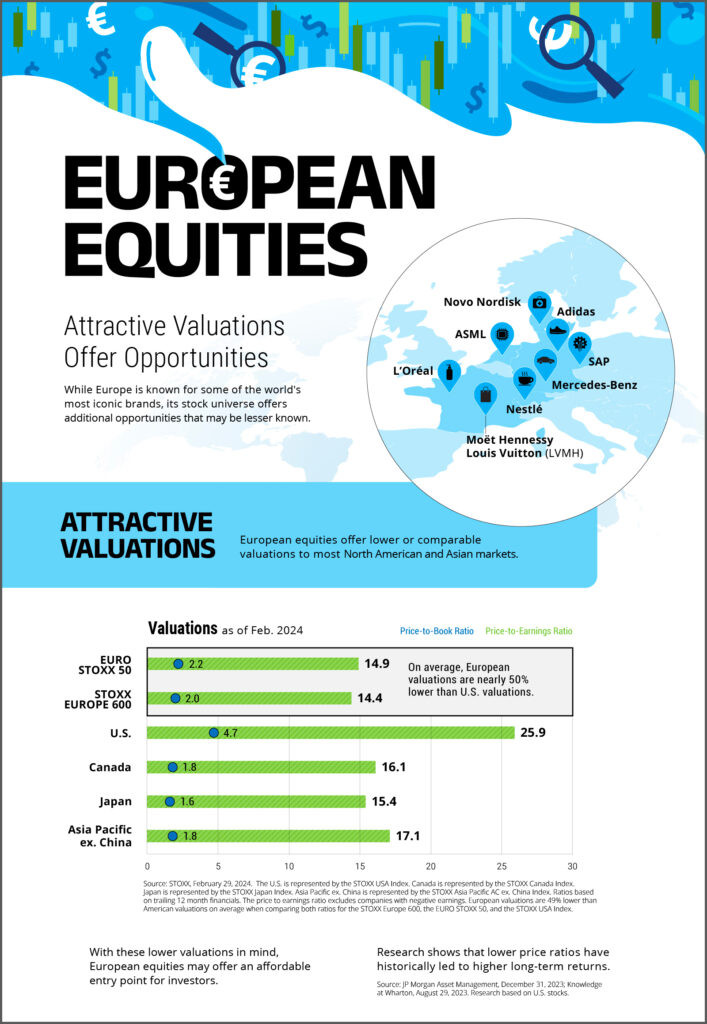

Infographic depicting EURO STOXX 50 index composition, key benefits, and performance data, highlighting its role as a leading European equity benchmark.

Infographic depicting EURO STOXX 50 index composition, key benefits, and performance data, highlighting its role as a leading European equity benchmark.

Key Benefits of the EURO STOXX 50 Index

The EURO STOXX 50 index offers a range of compelling benefits for investors and financial professionals:

Tradeability: The index’s composition is driven by liquidity, making it exceptionally tradeable. This deep liquidity is crucial for designing a wide array of financial products, from ETFs and derivatives to structured products, and for serving as a reliable benchmark for portfolio performance.

Balanced Diversification: The EURO STOXX 50 delivers balanced representation across the Eurozone economy by incorporating companies from diverse Industry Classification Benchmark (ICB) supersectors. This diversification mitigates sector-specific risks and provides a more stable and representative investment baseline.

Current Market Relevance: To ensure the index remains current and reflective of market dynamics, the EURO STOXX 50 undergoes quarterly rebalancing and an annual review. A fast-exit rule is also in place to promptly remove companies that no longer meet the index criteria, ensuring timely adaptation to market changes.

Precision and Customization: Beyond the headline index, investors can access a range of derived sub-indices tailored to specific needs. These include ex-financials versions, excluding financial sector companies, and single-country derived indices, allowing for more precise exposure to specific market segments.

Sustainable Investing Option: Recognizing the growing importance of ESG considerations, the EURO STOXX 50® ESG Index offers a sustainable investment option. This ESG-focused variant allows investors to align their portfolios with responsible investment principles while still tracking leading Eurozone companies.

Accessibility: The EURO STOXX 50 index is highly accessible to investors through a substantial universe of existing financial products that track its performance. This widespread availability makes it easy for both institutional and individual investors to gain exposure to the leading companies of the Eurozone.

EURO STOXX 50 Index Details

The EURO STOXX 50 is calculated in realtime during the trading day, disseminated between 09:00 and 18:00 CET. It is identified by the symbol SX5E on exchanges and via Bloomberg under the ticker SX5E Index, with the ISIN EU0009658145. As of recent data, the index value stands at 5,520.49. Performance metrics highlight its robust year-to-date change of 12.25% and a 52-week change of 12.82%, demonstrating strong overall growth. The index has fluctuated between a daily low of 5409.93 and a high of 5533.18 recently, with a 52-week low at 4571.6 (August 5, 2024) and a 52-week high of 5540.6899 (March 3, 2025).

Top 10 Components of EURO STOXX 50

The EURO STOXX 50 index is composed of leading companies across various Eurozone countries. Among its top 10 constituents are:

| Company | Country |

|---|---|

| SAP | DE |

| ASML HLDG | NL |

| LVMH MOET HENNESSY | FR |

| SIEMENS | DE |

| ALLIANZ | DE |

| SCHNEIDER ELECTRIC | FR |

| TOTALENERGIES | FR |

| DEUTSCHE TELEKOM | DE |

| SANOFI | FR |

| AIR LIQUIDE | FR |

These top components represent a selection of the largest and most influential companies in the Eurozone, spanning key sectors and contributing significantly to the index’s overall performance.

Disclaimer: Data as of December 2023 for ETF assets. Source for structured products: Structured Retail Products.