For savvy travelers, exchanging currency can be more than a simple transaction—it’s a strategic move that can significantly impact your travel budget. In certain countries, the disparity between official and unofficial exchange rates, often referred to as the “black market,” can be substantial, offering a considerable advantage for those exchanging Euros or Dollars. Imagine boosting your travel funds by up to 50% simply by knowing where and how to exchange your currency.

My own experience in Burundi vividly illustrated this point. Prior to my trip, seasoned travelers advised me to rely on cash rather than bank transactions. Initially skeptical, armed with a no-foreign-transaction-fee Mastercard, I carried a mere $300 in cash. This proved to be a miscalculation. In Burundi, exchanging Euros for the local currency on the parallel market yielded rates as high as 3000 Burundian Francs (BIF) per Euro, dwarfing the official rate of 2100 BIF/EUR. The few instances where I was compelled to use my card due to insufficient cash felt like an unnecessary financial drain.

This striking difference stems from the existence of parallel exchange markets, operating outside formal banking systems in numerous countries. These unofficial markets present an opportunity for travelers to secure more favorable exchange rates. This article delves into the world of black market exchange rates, focusing on countries where exchanging Euros or Dollars on the unofficial market can provide a significant financial edge.

A bustling street scene representing informal markets

A bustling street scene representing informal markets

Understanding the Euro to Dollar Black Market Exchange Rate

The term “black market exchange rate,” sometimes also known as a parallel or unofficial rate, describes the exchange rate for currencies traded outside a country’s official banking and financial institutions. This phenomenon typically arises due to a combination of factors, including strict government regulations on currency, capital controls, and broader economic instability. Often, the official exchange rate mandated by the government doesn’t accurately reflect the currency’s real market value or fail to meet market demand. This gap creates fertile ground for a parallel market to flourish, where individuals and businesses engage in informal currency exchange to obtain more competitive rates. For travelers holding Euros or Dollars, understanding this disparity is key to maximizing their spending power abroad.

Russia provides a compelling case study. Following the escalation of the conflict in Ukraine, the Russian Ruble experienced dramatic devaluation, plummeting from 80 RUB per EUR to as low as 150 RUB per EUR. This depreciation doubled the cost of imported goods for Russian citizens, while conversely, visitors holding Euros or Dollars found their purchasing power significantly enhanced. However, the Russian government intervened, artificially manipulating the official exchange rate to around 60 RUB per EUR, attempting to stabilize the perceived currency value through official channels.

This intervention inadvertently fostered a thriving parallel market. While banks adhered to the artificial 60 RUB per EUR rate, hotels, restaurants, bars, and private individuals were willing to exchange Euros at rates reaching 150 RUB per EUR. This stark contrast highlights the potential benefits of understanding and navigating the black market when exchanging Euros or Dollars.

Legality, Benefits, and Risks for Euro and Dollar Travelers

Navigating the black market exchange rate operates within a legally ambiguous zone. While some nations outlaw it, others tacitly accept its presence due to its broader economic implications. For travelers exchanging Euros or Dollars, the primary benefit is clear: receiving more local currency for their Euros or Dollars, effectively stretching their travel budget further. However, this advantage comes with inherent risks. The black market can be a breeding ground for counterfeit currency and scams. To mitigate these risks and ensure secure and advantageous transactions when exchanging Euros or Dollars, it’s crucial to deal with trustworthy individuals or utilize reputable, albeit unofficial, currency exchange services.

TRAVELER’S TIP: Engaging with the black market doesn’t necessarily involve clandestine back-alley deals. In many locations, these transactions occur in plain sight at private exchange bureaus, hotels, and even restaurants. Discretion and local knowledge are your best assets.

Here are several countries where parallel (black) exchange markets are known to offer significantly better rates when exchanging Euros or Dollars:

Lebanon: Navigating Exchange Rates in Beirut

A vibrant street in Beirut showcasing daily life

A vibrant street in Beirut showcasing daily life

Lebanon’s recent political instability and economic crisis have fueled hyperinflation and a robust parallel currency market. Travelers to Beirut have reported receiving 10 to 15 times more Lebanese Pounds (LBP) by exchanging cash Euros or Dollars compared to official bank withdrawals. While the Lebanese government is working towards economic stabilization, this process is expected to be lengthy. Exchange rates fluctuate, making cash your most reliable asset. Hotels, markets, and even taxi drivers often facilitate Euro or Dollar to LBP exchanges.

- Official Rate (Illustrative): 1 EUR : 16,000 LBP

- Black Market Rate (Illustrative): 1 EUR : 20,000 LBP

Syria: Parallel Markets in Damascus

An aerial view of Damascus highlighting urban density

An aerial view of Damascus highlighting urban density

Despite ongoing challenges, Syria has historically maintained a black market for currency exchange, potentially offering more favorable rates for Euros and Dollars than official channels. Several years prior, the official airport exchange rate was around 435 Syrian Pounds (SYP) per US Dollar, while the black market offered rates as high as 950 SYP per USD. Current information suggests the parallel market remains, though accessibility might be more restricted. Local guides and fixers can be invaluable resources for navigating currency exchange.

- Official Rate (Illustrative): 1 EUR : 800 SYP

- Black Market Rate (Illustrative): 1 EUR : 2,500 SYP

Burundi: Maximizing Euro and Dollar Value in Bujumbura

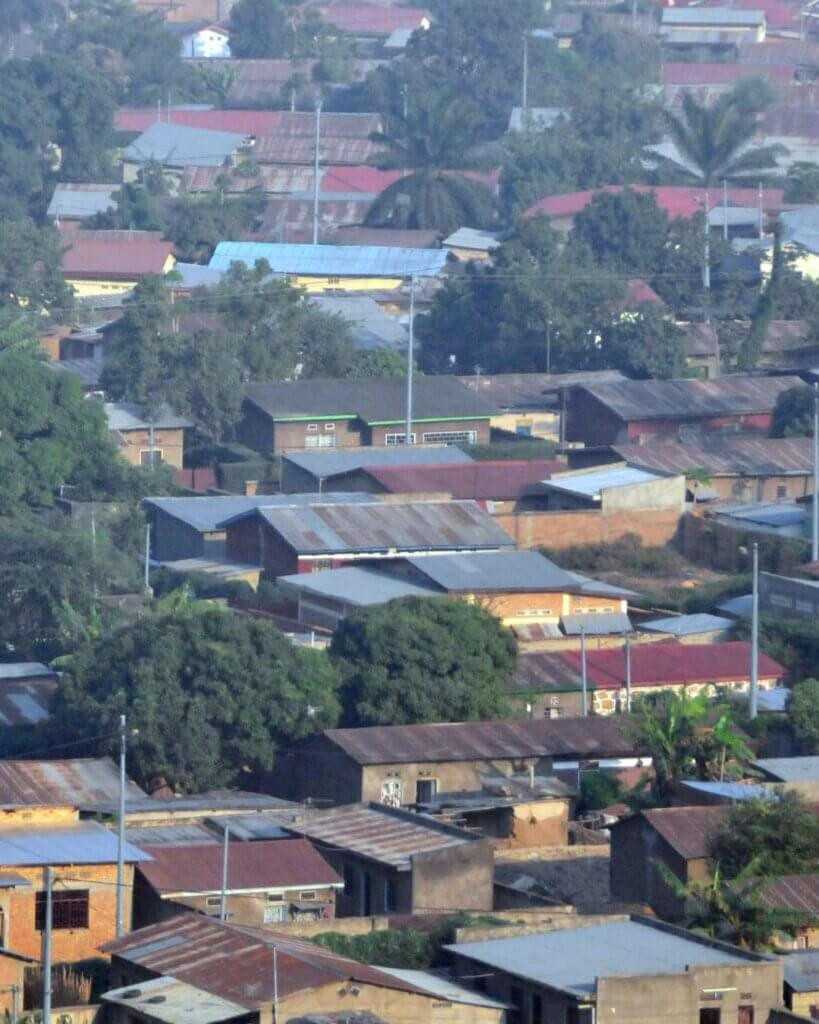

Rooftops of Bujumbura displaying urban landscape

Rooftops of Bujumbura displaying urban landscape

Even with Burundi’s improving economic conditions, a significant parallel market persists, where exchange rate differences can exceed 50%. For Euro and Dollar holders, carrying cash is essential to capitalize on these rates. The unofficial market is relatively accessible; hotels and local guides often facilitate exchanges. Personal accounts indicate even government officials involved in tourism can assist in finding advantageous Euro or Dollar exchange rates.

- Official Rate (Illustrative): 1 EUR : 2,200 BIF

- Black Market Rate (Illustrative): 1 EUR : 3,000 BIF

Ethiopia: Exchanging Euros and Dollars in Addis Ababa

Panoramic view of Addis Ababa showcasing urban sprawl

Panoramic view of Addis Ababa showcasing urban sprawl

Ethiopia has a long-standing history of black market currency exchange. In mid-2023, the disparity between official and unofficial rates surpassed 40%. While official exchanges offered around 45 Ethiopian Birr (ETB) per Euro, the parallel market rate ranged from 90 to 100 ETB per Euro. However, it’s crucial to note that the Ethiopian government has been actively clamping down on black market activities. Official establishments may increasingly require proof of bank withdrawals, potentially complicating transactions using black market-sourced Birr. Smaller transactions and person-to-person exchanges might be less affected. Exchanging Euros or Dollars for Birr is generally easier than obtaining foreign currency like USD in the parallel market, where USD is often hoarded and sold at a premium.

- Official Rate (Illustrative): 1 EUR : 55 ETB

- Black Market Rate (Illustrative): 1 EUR : 100 ETB

Argentina: The “Blue Dollar” in Buenos Aires

Streets of Buenos Aires depicting city life

Streets of Buenos Aires depicting city life

Argentina features an alternative exchange rate known as the “blue dollar,” which, while not strictly a black market, offers rates nearly double the official rate for Euros and Dollars. It’s so prevalent that even Visa has partnered with banks to process credit card transactions at this more favorable rate. For travelers, utilizing the official exchange rate in Argentina is uncommon. While generally considered more accessible and less risky than traditional black markets, caution and reliable exchange sources are still advised to avoid counterfeit currency. While anecdotal reports suggest Telegram groups offer optimal rates, this approach borders on legal gray areas and is best avoided.

- Official Rate (Illustrative): 1 EUR : 250 ARS

- Black Market Rate (Illustrative): 1 EUR : 450 ARS

Russia: Unofficial Euro to Ruble Exchanges in Moscow

Moscow skyline representing urban landscape

Moscow skyline representing urban landscape

As previously mentioned, Russia has seen a resurgence of its black market, particularly relevant for Euro and Dollar exchanges. While still active, current geopolitical circumstances have shifted its primary users to Russians residing and working in Europe who frequently travel back home. According to local sources, official regulations limit the import of foreign currency to around $300 or EUR 300, seemingly more strictly enforced for foreigners than locals.

- Official Rate (Illustrative): 1 EUR : 85 RUB

- Black Market Rate (Illustrative): 1 EUR : 120 RUB

Parallel exchange markets are dynamic and can emerge or disappear rapidly. Countries like Venezuela, Uzbekistan, and Zimbabwe once had prominent parallel markets that no longer exist. Conversely, nations grappling with hyperinflation may witness the rise of significant parallel markets offering dramatically improved rates in short periods.

Remember, the information presented here is subject to change. Black market exchange rates are volatile. For the most up-to-date insights, consult travel forums and reputable news sources closer to your travel dates.

**All Data Based on Information from May 2023*