A recent headline from the Washington Post proclaimed, “This is historic: The dollar will soon be worth more than the euro.” This bold statement, accompanied by a graph illustrating the euro’s declining value, immediately caught my attention. The implication was clear: the dollar surpassing the euro in value was an event of unprecedented historical significance.

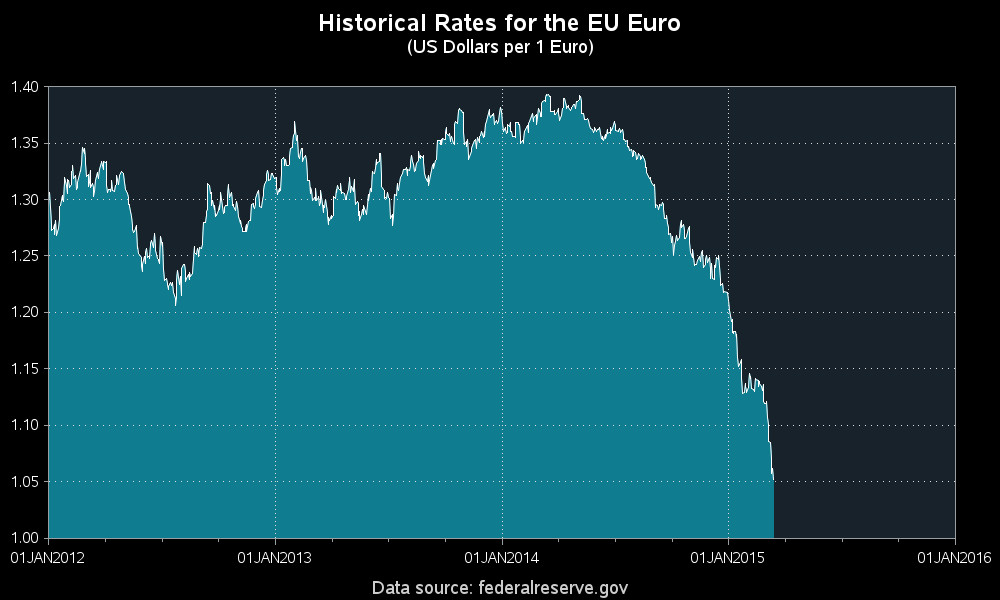

Original graph from Washington Post showing Euro value decline

Original graph from Washington Post showing Euro value decline

Initially, viewing the title and graph alone, one might assume the euro-dollar exchange rate had consistently hovered around 1.25, with a recent dramatic dip towards 1.00, signaling a truly “historic” shift. However, digging deeper into the Washington Post article sparked skepticism. To verify the claim and gain a clearer picture of the Euros Vs Dollars dynamic, I decided to analyze the raw data myself.

Before diving into the data analysis, here’s a visual representation of the currencies we’re discussing – euros and dollars side-by-side.

And now, let’s turn to a data-driven analysis to understand the true story behind the euros vs dollars exchange rate. To begin, I accessed the official exchange rate data from the Federal Reserve website. This reputable source provides historical data on the euro to dollar exchange rate, allowing for an independent assessment of the situation.

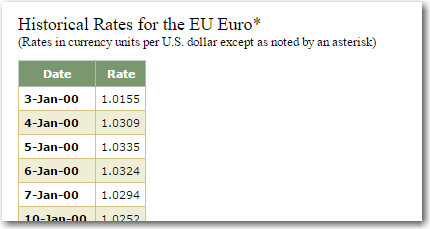

Screenshot of Federal Reserve website table displaying euro to dollar exchange rate data

Screenshot of Federal Reserve website table displaying euro to dollar exchange rate data

The Federal Reserve data is presented in an HTML table. To effectively analyze this information, I utilized SAS software to directly extract and parse the data from the webpage. Subsequently, using Proc Gplot in SAS, I recreated a graph mirroring the Washington Post’s visual representation, both in style and the timeframe covered. Indeed, my replicated graph confirmed their depiction: the exchange rate fluctuated around 1.25 during the depicted period, with a recent downward trend approaching 1.00.

Graph replicating Washington Post's visual, showing Euro vs Dollar exchange rate trend

Graph replicating Washington Post's visual, showing Euro vs Dollar exchange rate trend

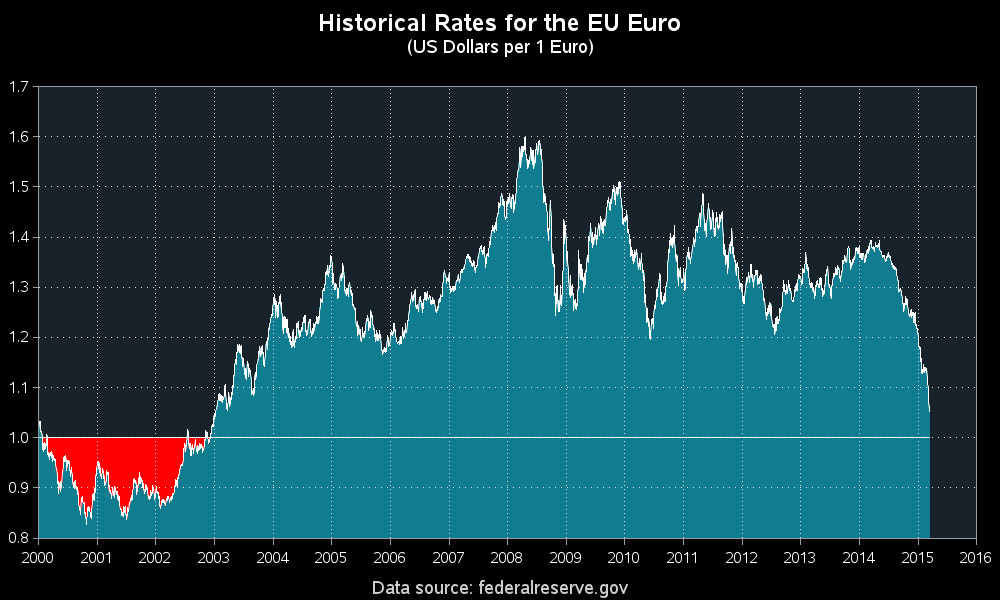

However, driven by natural curiosity and a desire for a more comprehensive understanding of the euros vs dollars relationship, I questioned whether the trend observed from 2012 onwards represented the complete historical context. The Federal Reserve data extended back to the euro’s inception in 2000. By slightly adjusting my SAS code, I broadened the graph’s scope to encompass the entire dataset. The expanded view revealed a crucial insight: between 2000 and 2003, the euro’s value was actually less than the dollar. Therefore, while the recent pace of the euro’s decline might be considered “historic” in its rate of change, a euro being valued lower than a dollar is not a novel occurrence.

Graph showing Euro vs Dollar exchange rate from 2000 onwards, revealing historical context

Graph showing Euro vs Dollar exchange rate from 2000 onwards, revealing historical context

This broader historical perspective challenges the “unprecedented” narrative. The euro’s current weakness, while noteworthy, echoes a period in its early history. This analysis underscores the importance of examining data within a wider historical timeframe to avoid potentially sensationalized interpretations.

Finally, a question for economic experts: Who benefits and who is disadvantaged when the euro’s value depreciates relative to the dollar? Understanding these economic implications is crucial for a complete understanding of the euros vs dollars dynamic.