Introduction

The COVID-19 pandemic, originating in Wuhan, China, rapidly became a global crisis, impacting nearly every facet of life as it spread across borders (Liu, Gayle, Wilder‐Smith, & Rocklöv, 2020). The sheer scale of confirmed cases and tragic loss of life underscored the pandemic’s severity (World Health Organization, 2020). Governments and policymakers worldwide responded with stringent lockdown measures aimed at curbing the virus’s spread. However, these measures inadvertently triggered significant disruptions across microeconomic, macroeconomic, and financial landscapes. In our interconnected world, the pandemic’s global shockwaves were undeniable, profoundly affecting international trade and financial relationships (Lee & McKibbin, 2004).

The pandemic’s impact on the global economy can be broadly categorized into three key areas. Firstly, widespread lockdowns and isolation measures implemented globally by governments dramatically impacted international trade. The World Trade Organization projected a substantial decrease in global trade volume for 2020, ranging from 13% to 32% (Trade Forecast Press‐Conference, April 2020). Adding to the economic turmoil, political events exacerbated crude oil price volatility, leading to unprecedented price drops and prompting political intervention from major oil-producing nations like Saudi Arabia and Russia (Albulescu, 2020).

Secondly, financial markets, particularly stock markets, felt the pandemic’s heavy hand. Major stock exchanges globally experienced significant value declines, with some losing approximately 20% of their initial worth (Segal & Gerstel, 2020). In response to these economic headwinds, central banks like the European Central Bank (ECB) and the Federal Reserve Bank (FED) introduced substantial stimulus packages for the Eurozone and the US economies, respectively. Interest rates were slashed to near-zero levels in an attempt to mitigate the economic fallout from lockdowns.

These multifaceted impacts of the pandemic undeniably altered the fundamental dynamics governing exchange rates, especially for major currency pairs like the euro to dollar exchange rate. Understanding how these dynamics shifted during such a critical period is crucial for investors, policymakers, and businesses operating in the global market.

This leads us to a critical question: How has the COVID-19 pandemic reshaped the dynamics of currency exchange rates, specifically the euro to dollar exchange rate (Euro.to.dollar)? Historically, periods of crisis have diverse effects on major currencies such as the US dollar and the euro. For example, during the 2007-2009 global financial crisis, both currencies appreciated against others like the Japanese yen, Canadian dollar, and Australian dollar (Kohler, 2010). However, this pattern was not consistent in previous crises, such as the 1997-1998 Asian financial crisis or the subsequent Russian crisis. This variation suggests complex underlying factors are at play. A “safe-haven” effect might drive investors towards perceived stable currencies during crises, while interest rate differentials could also significantly influence exchange rate movements. These factors likely contribute to structural shifts in the determinants of exchange rate dynamics, potentially increasing the importance of activities like carry trades (Kohler, 2010).

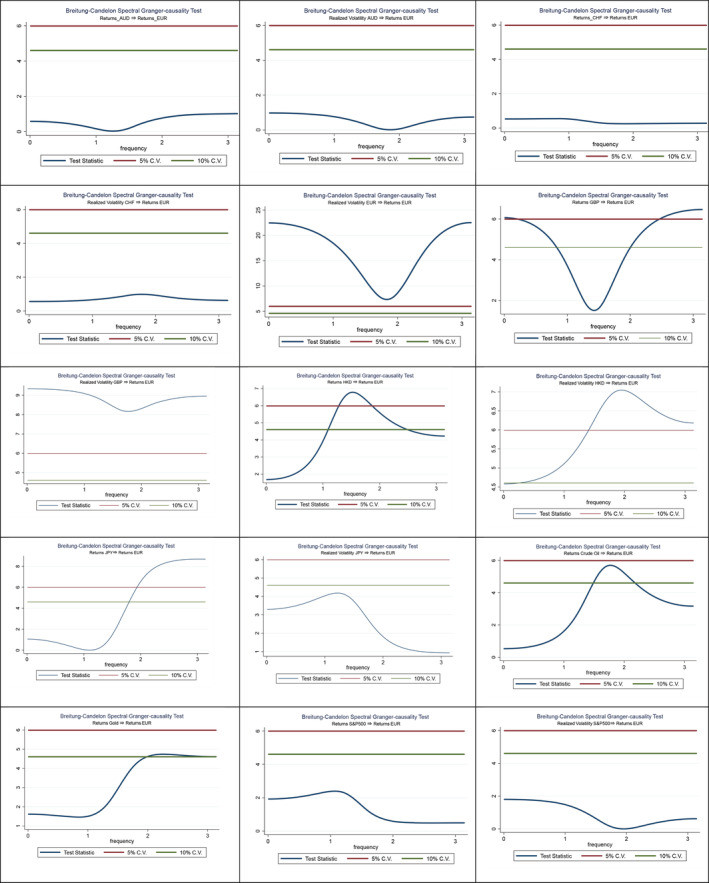

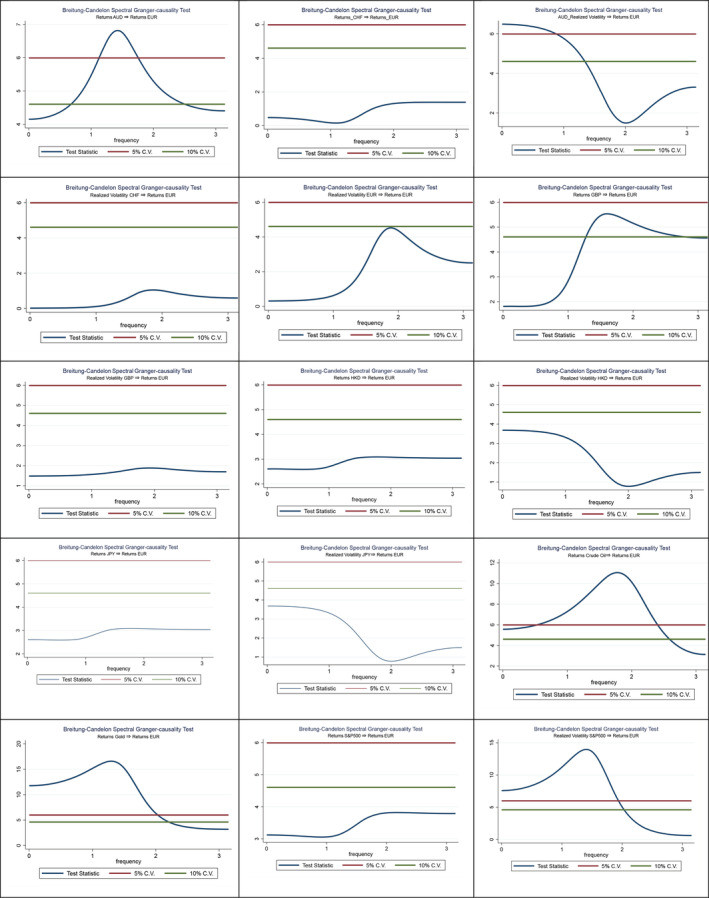

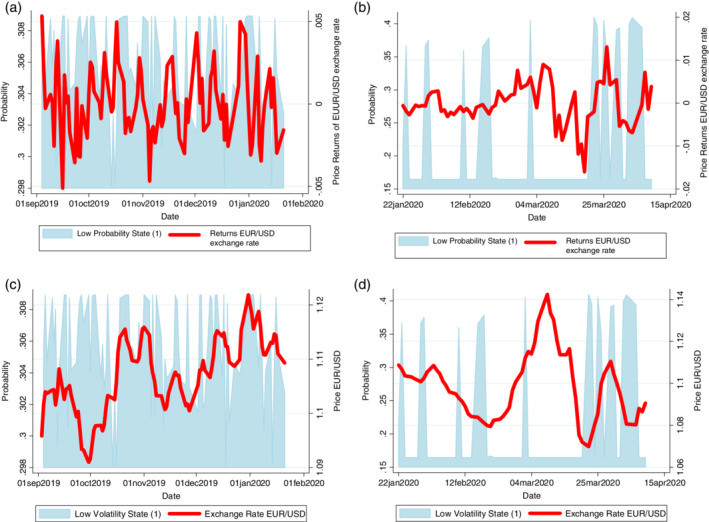

To investigate these shifts, this analysis utilizes spectral (non-)causality tests to pinpoint the factors influencing the euro to dollar exchange rate. We analyze data spanning both the pre-COVID-19 period and the COVID-19 era itself. Our analysis considers the exchange rate movements of other major currencies, the S&P 500 stock market index, and the prices of oil and gold, along with their respective realized volatilities. Furthermore, we employ a Markov-Switching (MS) model with two distinct regimes to delve deeper into the changes in euro to dollar exchange rate behavior before and after the pandemic’s onset. By analyzing these shifts, we aim to provide valuable insights into the evolving dynamics of the euro to dollar exchange rate in a world increasingly shaped by global crises.

FIGURE 1

FIGURE 1

FIGURE 2

FIGURE 2

FIGURE 3

FIGURE 3