Understanding the difference between Euros and dollars is crucial for anyone involved in international trade, travel, or investment, especially when considering agricultural solutions. At eurodripusa.net, we recognize the importance of this knowledge, particularly for our customers seeking high-quality European drip irrigation systems in the USA. By exploring exchange rates, historical context, and economic impacts, we aim to provide a comprehensive overview that aids in making informed decisions about drip irrigation and water management solutions.

1. What Are the Key Differences Between the Euro and the US Dollar?

The euro (EUR) and the US dollar (USD) are two of the world’s most influential currencies, but their origins, governance, and usage differ significantly. The Euro is used by 19 of the 27 member states of the European Union and is managed by the European Central Bank (ECB), while the US Dollar is the official currency of the United States and is managed by the Federal Reserve (also known as The Fed). Here’s a breakdown of the key differences:

| Feature | Euro (EUR) | US Dollar (USD) |

|---|---|---|

| Issuing Authority | European Central Bank (ECB) | Federal Reserve (The Fed) |

| Area of Use | Eurozone (19 EU countries) plus several others | United States and its territories, plus some others |

| Introduction | Financial markets: January 1, 1999 | Coinage Act of 1792 |

| Coins/Banknotes: January 1, 2002 | ||

| Symbol | € | $ |

| ISO 4217 Code | EUR (num. 978) | USD |

| Amount in Circulation | Approximately €915 billion | Over $800 billion |

| Nicknames | The single currency, local names | Buck, greenback |

These distinctions influence exchange rates, economic policies, and the overall financial landscape, especially for businesses like eurodripusa.net that deal with international markets.

2. How Do the Origins of the Euro and US Dollar Differ?

The Euro and the US Dollar have distinct historical roots reflecting their respective regions’ economic and political developments. The US dollar, established by the Coinage Act of 1792, was designed to standardize the fledgling nation’s monetary system and promote economic stability.

On the other hand, the euro emerged from a decades-long effort to integrate European economies, culminating in its introduction to financial markets in 1999 and physical circulation in 2002. According to a 2023 report by the European Central Bank, the euro aimed to foster trade, investment, and price stability across member states.

Understanding these origins provides context for the currencies’ roles in the global economy, particularly for businesses like eurodripusa.net involved in transatlantic trade.

3. What Role Does Central Banking Play in Managing the Euro and US Dollar?

Central banking is crucial in managing the Euro and the US Dollar, influencing monetary policy, inflation, and economic stability. The European Central Bank (ECB) manages the Euro, setting interest rates and controlling the money supply to maintain price stability across the Eurozone.

Conversely, the Federal Reserve (The Fed) manages the US Dollar, with similar goals of price stability and full employment in the United States. According to research from the Federal Reserve Bank of New York in 2024, The Fed uses tools like open market operations and the federal funds rate to influence economic conditions.

For eurodripusa.net, understanding these central banking functions is vital, as they directly impact exchange rates and the cost of importing European drip irrigation technology to the USA.

4. How Does the Amount of Money in Circulation Compare Between the Euro and US Dollar?

The amount of money in circulation for both the Euro and the US Dollar reflects their significance in the global economy, but the figures are subject to change based on economic conditions. As of September 2012, the Euro had more than €915 billion in circulation, making it the currency with the highest combined value of banknotes and coins in circulation worldwide.

The US government maintains over $800 billion in cash in circulation. While these numbers provide a snapshot, they don’t fully represent the total money supply, which includes credit and digital forms of currency. These figures, however, highlight the scale of these currencies in facilitating global transactions.

For eurodripusa.net, understanding the scale of these currencies helps in managing financial risks and opportunities in international trade.

5. What Factors Influence the Exchange Rate Between Euros and Dollars?

Several factors influence the exchange rate between Euros and Dollars, creating a dynamic relationship that businesses must monitor to ensure financial stability.

- Economic Performance: Strong economic growth in the US can strengthen the dollar, while similar growth in the Eurozone can bolster the Euro.

- Interest Rate Differentials: Higher interest rates in the US can attract foreign investment, increasing demand for the dollar and raising its value against the Euro.

- Inflation Rates: Lower inflation in the US can enhance the dollar’s purchasing power, making it more attractive to investors.

- Political Stability: Political instability in either region can lead to currency devaluation as investors seek safer havens.

- Market Sentiment: Speculative trading and overall market sentiment can cause short-term fluctuations in the exchange rate.

According to a 2024 analysis by the International Monetary Fund (IMF), these factors collectively determine the relative value of the Euro and the US Dollar, impacting international trade and investment.

Understanding these dynamics is crucial for eurodripusa.net, allowing the company to hedge against currency risks and optimize pricing strategies for European drip irrigation systems in the US market.

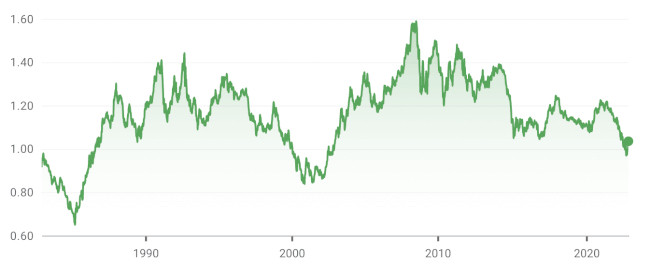

Euro vs Dollar historical exchange rate

Euro vs Dollar historical exchange rate

6. How Does Inflation Differ Between the Eurozone and the United States?

Inflation rates in the Eurozone and the United States can significantly impact the purchasing power of the Euro and the US Dollar, affecting trade and investment decisions. In October 2022, the Eurozone experienced an inflation rate of 10.7%, while the United States had an inflation rate of 7.7%.

These rates reflect the pace at which prices for goods and services are increasing in each region. Higher inflation can erode the value of a currency, potentially leading to changes in monetary policy by central banks.

For eurodripusa.net, understanding these inflationary trends is essential for pricing products competitively and managing costs effectively.

7. What Are the Nicknames for the Euro and US Dollar?

Nicknames for currencies often reflect cultural perceptions and historical contexts, adding a layer of familiarity and identity. The Euro is known as “the single currency,” and has various local nicknames such as “Ege” in Finnish, “Quid” in Hiberno-English, “Teuro” in German, “Ouro” in Galician, “Juró” in Hungarian, and “Ewro” in Maltese.

The US Dollar is commonly referred to as “buck” or “greenback,” the latter referring to the green ink used on its banknotes. These nicknames can influence how people perceive and discuss the currencies, often humanizing them in everyday conversation.

For eurodripusa.net, understanding these cultural nuances can help in marketing and communication strategies, creating a more relatable brand image.

8. How Are Euro and US Dollar Coins and Notes Denominated?

Understanding the denominations of Euro and US Dollar coins and notes is essential for everyday transactions and financial planning. The Euro is issued in coins of 1c, 2c, 5c, 10c, 20c, 50c, €1, and €2, and in notes of €5, €10, €20, €50, €100, €200, and €500.

The US Dollar is issued in coins of 1c, 5c, 10c, 25c, 50c, and $1, and in notes of $1, $5, $10, $20, $50, and $100, with a $2 note that is relatively rare. These denominations cater to a wide range of transactions, from small purchases to large investments.

For eurodripusa.net, familiarity with these denominations helps in processing payments and managing financial transactions efficiently.

9. Which Countries Officially Use the Euro and US Dollar?

The official users of the Euro and US Dollar vary significantly, reflecting their respective economic and political spheres of influence. The Euro is the official currency of the Eurozone, which includes 19 member states of the European Union: Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Portugal, Slovakia, Slovenia, and Spain. Outside the EU, it is also used in Montenegro, Kosovo, several microstates (Andorra, Monaco, San Marino, the Vatican City), and overseas territories of EU states.

The US Dollar is the official currency of the United States and its overseas territories. It is also used as the sole currency in Palau, Micronesia, and the Marshall Islands, and is used in Panama, Ecuador, El Salvador, East Timor, the British Virgin Islands, Turks and Caicos Islands, Bonaire, Sint Eustatius, and Saba. This widespread usage underscores their importance in international finance and trade.

For eurodripusa.net, understanding the geographic distribution of these currencies is crucial for market analysis and international business operations.

10. How Do Currency Pegs Affect the Euro and US Dollar?

Currency pegs, where a country fixes its exchange rate to another currency, can significantly impact the stability and trade relationships of the Euro and US Dollar. The Euro is pegged by 10 currencies, including the Bosnia & Herzegovina convertible mark, Bulgarian lev, Cape Verdean escudo, Central African CFA franc, CFP franc, Comorian franc, Danish krone (±2.25%), Latvian lats, Lithuanian litas, and West African CFA franc.

The US Dollar is pegged by 23 currencies. These pegs can provide stability for the smaller economies, but also tie their monetary policies to those of the Eurozone or the United States.

According to a 2022 report by the World Bank, currency pegs can reduce exchange rate volatility but also limit a country’s ability to respond to economic shocks. For eurodripusa.net, understanding these currency relationships helps in assessing risks and opportunities in international markets.

11. Who Prints the Euro and US Dollar?

The printing and minting of the Euro and US Dollar are handled by different entities, reflecting their respective governance structures. The Euro is printed, minted, and distributed by the Eurosystem, a network of central banks of member countries. This decentralized approach ensures that each country can manage its currency needs while adhering to ECB policies.

The US Dollar is printed by the Bureau of Engraving and Printing and minted by the United States Mint. These agencies are responsible for producing and distributing the currency throughout the United States and its territories.

For eurodripusa.net, understanding these processes can provide insights into the supply and management of these currencies, affecting financial planning and risk management.

12. What Are the Stock Ticker Symbols for Euro and US Dollar Exchange Rates?

Stock ticker symbols for Euro and US Dollar exchange rates are essential for tracking their performance in financial markets. The most common ticker symbol for the Euro against the US Dollar is EURUSD=X.

Conversely, the ticker symbol for the US Dollar against the Euro is USDEUR=X. These symbols are used by traders, investors, and financial analysts to monitor exchange rates and make informed decisions.

For eurodripusa.net, tracking these ticker symbols is crucial for hedging against currency risks and optimizing international transactions.

13. What Websites Provide Information About the Euro and US Dollar?

Several websites provide valuable information about the Euro and US Dollar, offering data, analysis, and insights for businesses and individuals. The official website of the European Central Bank (ECB) is https://www.ecb.europa.eu, providing information on monetary policy, economic data, and Eurozone developments.

The official website of the Federal Reserve (The Fed) is https://www.federalreserve.gov/, offering similar information for the United States. These websites are essential resources for staying informed about currency trends and economic policies.

For eurodripusa.net, regularly consulting these resources is vital for making informed financial and strategic decisions.

14. How Does the Plural Form of Euro and Dollar Differ?

The plural forms of Euro and Dollar reflect linguistic conventions and usage in different contexts. The plural of Euro is “Euros.”

The plural of Dollar is “Dollars.” While these may seem like minor details, using the correct plural forms enhances clarity and professionalism in financial communications.

For eurodripusa.net, attention to such details is important for maintaining credibility and effective communication with international partners and customers.

15. What Are the ISO Codes for Euro and US Dollar?

The ISO codes for Euro and US Dollar are standardized identifiers used in international finance and trade. The ISO code for the Euro is EUR.

The ISO code for the US Dollar is USD. These codes are essential for ensuring accuracy and consistency in financial transactions, data processing, and international reporting.

For eurodripusa.net, using these ISO codes correctly is vital for smooth and efficient international business operations.

16. How Have Historical Events Shaped the Value of the Euro and US Dollar?

Historical events have significantly shaped the value of the Euro and US Dollar, reflecting their respective economic and political landscapes. The US Dollar’s value has been influenced by events such as the Great Depression, World War II, and various economic policies enacted by the US government.

The Euro’s value has been shaped by the Maastricht Treaty in 1992, the Eurozone sovereign debt crisis in 2008, and ongoing economic integration efforts within the European Union. According to a 2023 analysis by the Council on Foreign Relations, these events have led to fluctuations in exchange rates and shifts in the currencies’ global influence.

For eurodripusa.net, understanding these historical contexts is essential for anticipating and managing future financial risks and opportunities.

17. What Impact Do Global Crises Have on the Euro and US Dollar?

Global crises, such as financial meltdowns and pandemics, can significantly impact the Euro and US Dollar, often leading to shifts in their relative values and roles in the global economy. During the 2008 financial crisis, both currencies experienced volatility as investors sought safe-haven assets. The US Dollar often benefits from its status as a reserve currency during times of global uncertainty, while the Euro can face pressure due to the diverse economic conditions within the Eurozone.

The COVID-19 pandemic also influenced the currencies, with governments and central banks implementing massive stimulus measures that affected inflation and exchange rates. According to a 2024 report by the Peterson Institute for International Economics, understanding how global crises impact these currencies is crucial for businesses engaged in international trade.

For eurodripusa.net, being aware of these impacts helps in making informed decisions about currency hedging and financial planning.

18. How Do Economic Policies in the US and Eurozone Affect Currency Values?

Economic policies in the US and Eurozone play a crucial role in determining the values of the US Dollar and the Euro. Fiscal policies, such as government spending and taxation, can influence economic growth and inflation, thereby affecting currency values. Monetary policies, managed by the Federal Reserve (The Fed) and the European Central Bank (ECB), involve setting interest rates and controlling the money supply.

For instance, if The Fed raises interest rates, the US Dollar may strengthen as it attracts foreign investment. Similarly, if the ECB implements quantitative easing, the Euro may weaken. According to a 2023 study by the Brookings Institution, these policy decisions have a direct and significant impact on exchange rates.

For eurodripusa.net, monitoring these economic policies is essential for predicting currency movements and adjusting business strategies accordingly.

19. What Role Do Trade Balances Play in Euro-Dollar Exchange Rates?

Trade balances, which represent the difference between a country’s exports and imports, play a significant role in influencing Euro-Dollar exchange rates. A country with a trade surplus (exports exceeding imports) typically sees increased demand for its currency, which can lead to appreciation. Conversely, a trade deficit (imports exceeding exports) can weaken a currency.

The United States and the Eurozone have complex trade relationships, and shifts in their trade balances can affect the Euro-Dollar exchange rate. For example, if the Eurozone increases its exports to the US while US exports to the Eurozone remain constant, demand for the Euro may rise, strengthening its value against the Dollar. According to a 2022 report by the Congressional Research Service, understanding these trade dynamics is crucial for assessing currency valuations.

For eurodripusa.net, monitoring trade balances helps in anticipating currency fluctuations and managing the costs of importing European drip irrigation systems.

20. How Does Public Debt in the US and Eurozone Affect Their Currencies?

Public debt levels in the US and Eurozone can significantly influence the perceived stability and value of their respective currencies. High levels of public debt can raise concerns about a country’s ability to meet its financial obligations, potentially leading to currency devaluation. Investors may become wary of holding government bonds denominated in a currency if they fear that the debt is unsustainable.

The US and Eurozone have different approaches to managing public debt, with varying levels of debt-to-GDP ratios. According to a 2024 analysis by the Center for Economic Policy Research, countries with credible fiscal policies and strong economic growth are better positioned to maintain the value of their currencies despite high debt levels.

For eurodripusa.net, monitoring public debt levels and fiscal policies is essential for evaluating the long-term stability of the Euro and US Dollar.

21. What Are the Potential Future Trends for Euro-Dollar Exchange Rates?

Predicting future trends for Euro-Dollar exchange rates involves analyzing a range of economic, political, and social factors. Economic growth differentials, interest rate policies, inflation expectations, and geopolitical events can all influence currency valuations. Technological advancements, such as the rise of digital currencies, could also play a role in reshaping the global financial landscape.

According to a 2025 forecast by the Organisation for Economic Co-operation and Development (OECD), the Euro-Dollar exchange rate will likely remain volatile, influenced by ongoing economic uncertainties and policy adjustments. For eurodripusa.net, staying informed about these potential trends and developing flexible financial strategies is crucial for navigating future challenges and opportunities in the international market.

22. How Can Businesses Hedge Against Euro-Dollar Exchange Rate Risks?

Businesses like eurodripusa.net can employ various strategies to hedge against Euro-Dollar exchange rate risks, protecting their profits and ensuring financial stability.

- Forward Contracts: Agreements to buy or sell a specific amount of currency at a predetermined exchange rate on a future date.

- Currency Options: Contracts that give the right, but not the obligation, to buy or sell currency at a specific exchange rate during a specific period.

- Currency Swaps: Agreements to exchange principal and interest payments on debt denominated in different currencies.

- Natural Hedging: Matching revenues and expenses in the same currency to reduce exposure to exchange rate fluctuations.

- Diversification: Operating in multiple markets and currencies to spread risk.

According to a 2023 report by the Association for Financial Professionals, implementing a combination of these strategies can effectively mitigate currency risks. For eurodripusa.net, developing a robust hedging strategy is essential for managing the costs of importing European drip irrigation systems and ensuring competitive pricing in the US market.

Euro coins and banknotes

Euro coins and banknotes

23. What Are the Implications of Euro-Dollar Exchange Rates for International Trade?

Euro-Dollar exchange rates have significant implications for international trade, affecting the competitiveness of exports and the cost of imports. A weaker Euro relative to the US Dollar can make Eurozone exports more attractive to US buyers, boosting demand. Conversely, a stronger Euro can make US exports to the Eurozone more competitive.

For businesses like eurodripusa.net, exchange rate fluctuations can impact the cost of importing European drip irrigation technology and the pricing of products in the US market. According to a 2022 study by the National Bureau of Economic Research, understanding these trade dynamics is essential for making informed decisions about sourcing, pricing, and market entry strategies.

For eurodripusa.net, monitoring exchange rates and their implications for international trade is crucial for maintaining a competitive edge.

24. How Do Euro-Dollar Exchange Rates Affect Tourism Between the US and Eurozone?

Euro-Dollar exchange rates can significantly influence tourism between the US and Eurozone, affecting the cost of travel and the attractiveness of destinations. A stronger US Dollar relative to the Euro makes travel to the Eurozone more affordable for American tourists, potentially increasing tourism. Conversely, a weaker US Dollar can make travel to the US more attractive for European tourists.

For businesses in the tourism sector, understanding these currency dynamics is essential for attracting international visitors and managing pricing strategies. According to a 2024 report by the World Tourism Organization, currency fluctuations are a key factor influencing travel decisions. For eurodripusa.net, while the direct impact on tourism may be limited, understanding broader economic trends helps in assessing market conditions and consumer behavior.

25. What is the Impact of Euro-Dollar Exchange Rates on Investment Flows?

Euro-Dollar exchange rates significantly influence investment flows between the US and Eurozone, impacting where investors choose to allocate their capital. A stronger US Dollar can attract foreign investment into the US, as assets become more valuable in foreign currency terms. Conversely, a stronger Euro can attract US investment into the Eurozone.

For businesses, understanding these investment flows is essential for raising capital and expanding operations internationally. According to a 2023 analysis by the United Nations Conference on Trade and Development (UNCTAD), exchange rate stability can promote long-term investment, while volatility can deter investors.

For eurodripusa.net, monitoring these dynamics helps in attracting investment and managing financial risks associated with international expansion.

26. How Do Political Events Influence Euro-Dollar Exchange Rates?

Political events, such as elections, policy changes, and geopolitical tensions, can significantly influence Euro-Dollar exchange rates. Political stability and predictable policy environments tend to support currency values, while uncertainty and conflict can lead to volatility. For example, major elections in the US or Eurozone can trigger currency fluctuations as investors react to potential changes in economic policy.

Geopolitical tensions, such as trade disputes or military conflicts, can also impact exchange rates as investors seek safe-haven currencies. According to a 2022 report by the Council on Foreign Relations, political risks are a key factor in currency valuation.

For eurodripusa.net, staying informed about political events and their potential impact on exchange rates is crucial for managing financial risks and making strategic business decisions.

27. How Do Interest Rate Differentials Affect Euro-Dollar Exchange Rates?

Interest rate differentials between the US and the Eurozone play a crucial role in influencing Euro-Dollar exchange rates. Higher interest rates in the US can attract foreign investment, increasing demand for the US Dollar and leading to its appreciation against the Euro. Conversely, higher interest rates in the Eurozone can attract investment and strengthen the Euro.

Central banks, such as the Federal Reserve (The Fed) and the European Central Bank (ECB), use interest rate policies to manage inflation and stimulate economic growth. According to a 2024 analysis by the International Monetary Fund (IMF), interest rate differentials are a primary driver of currency movements. For eurodripusa.net, monitoring interest rate policies and their impact on exchange rates is essential for managing financial risks and optimizing investment strategies.

28. How Does Quantitative Easing Affect Euro-Dollar Exchange Rates?

Quantitative easing (QE) is a monetary policy tool used by central banks to stimulate economic growth by increasing the money supply. When the Federal Reserve (The Fed) or the European Central Bank (ECB) implement QE, they purchase government bonds or other assets, injecting liquidity into the financial system. This can lead to a decrease in the value of the currency.

For example, if the ECB engages in QE, the Euro may weaken relative to the US Dollar. Conversely, if The Fed implements QE, the US Dollar may weaken. According to a 2023 report by the Brookings Institution, the impact of QE on exchange rates depends on various factors, including the scale of the program and market expectations. For eurodripusa.net, understanding the effects of QE is crucial for managing currency risks and making informed financial decisions.

29. What Are the Key Economic Indicators to Watch for Euro-Dollar Analysis?

Analyzing Euro-Dollar exchange rates requires monitoring several key economic indicators in both the US and the Eurozone.

- GDP Growth: Reflects the overall health of the economy.

- Inflation Rate: Indicates the pace of price increases.

- Unemployment Rate: Measures the percentage of the labor force that is unemployed.

- Trade Balance: Represents the difference between exports and imports.

- Consumer Confidence: Reflects consumer sentiment about the economy.

- Manufacturing PMI: Indicates the health of the manufacturing sector.

According to a 2022 report by the Congressional Research Service, these indicators provide valuable insights into the economic conditions that drive currency valuations. For eurodripusa.net, tracking these indicators is essential for making informed decisions about currency hedging and international business strategies.

30. How Can Eurodrip USA Help You Navigate Euro-Dollar Exchange Rate Impacts?

At eurodripusa.net, we understand the complexities of Euro-Dollar exchange rates and their impact on businesses engaged in international trade. We are committed to providing our customers with the highest quality European drip irrigation systems while helping them navigate the financial challenges posed by currency fluctuations.

Here’s how we can assist you:

- Expert Guidance: Our team of financial experts can provide insights into currency trends and help you develop strategies to mitigate exchange rate risks.

- Competitive Pricing: We continuously monitor exchange rates to offer competitive pricing on our products, ensuring you get the best value for your investment.

- Flexible Payment Options: We offer a range of payment options to accommodate your financial needs and preferences.

- Hedging Solutions: We can help you explore hedging strategies to protect your profits from currency fluctuations.

- Market Insights: We provide regular updates on market conditions and economic trends to keep you informed and prepared.

Located at 1 Shields Ave, Davis, CA 95616, United States, and reachable by phone at +1 (530) 752-1011, eurodripusa.net is your trusted partner for European drip irrigation solutions in the USA. Contact us today to learn more about how we can help you optimize your irrigation systems and manage your financial risks effectively.

By choosing eurodripusa.net, you gain access to top-quality products, expert guidance, and a commitment to your success in the agricultural sector.

FAQ: Euro vs Dollar Exchange Rate

1. What is the current exchange rate between the Euro and the US Dollar?

The exchange rate between the Euro and the US Dollar fluctuates constantly based on market conditions.

2. How do I find the latest Euro to Dollar exchange rate?

You can find the latest exchange rate on financial websites such as Google Finance, Bloomberg, or XE.com.

3. Why does the Euro to Dollar exchange rate change?

The exchange rate changes due to various factors, including economic performance, interest rates, inflation, and political events.

4. How do exchange rates affect international trade?

Exchange rates impact the competitiveness of exports and the cost of imports, influencing trade balances.

5. What is a good strategy for hedging against Euro-Dollar exchange rate risk?

Strategies include forward contracts, currency options, currency swaps, and natural hedging.

6. How do central banks influence exchange rates?

Central banks influence exchange rates through monetary policies, such as setting interest rates and implementing quantitative easing.

7. What are the key economic indicators to watch for Euro-Dollar analysis?

Key indicators include GDP growth, inflation rate, unemployment rate, and trade balance.

8. How do political events impact the Euro-Dollar exchange rate?

Political events can lead to currency fluctuations as investors react to potential changes in economic policy and geopolitical tensions.

9. What is the role of trade balances in Euro-Dollar exchange rates?

Trade balances affect currency demand, with trade surpluses typically strengthening a currency and trade deficits weakening it.

10. How does public debt affect the value of the Euro and Dollar?

High levels of public debt can raise concerns about a country’s ability to meet its financial obligations, potentially leading to currency devaluation.