The US dollar and the euro stand as the two dominant currencies in the global market, renowned for their significant value and stability. The foreign exchange market, commonly known as Forex, witnesses daily transactions involving the buying and selling of currencies from various nations. This massive market is largely controlled by the dollar and the euro, yet a particular currency surpasses both in price, even exceeding their combined value in currencies like the Mexican Peso.

Let’s delve into this. The 200-day average for the dollar’s value has hovered around 20.18 Mexican pesos per unit, while the euro averaged 22.89 pesos per unit. Combined, these two major currencies amount to approximately 43.07 Mexican pesos. However, the Kuwaiti dinar stands out, frequently trading at 66.06 Mexican pesos per unit, demonstrably higher than the sum of the euro and dollar.

The Niche Role of the Kuwaiti Dinar

Within Mexico, the dinar holds minimal practical application. It is primarily utilized within Kuwait and its surrounding region. While it lacks widespread liquidity, the dinar serves as a benchmark, particularly within the international petroleum market.

The dinar’s strength is anchored to Kuwait’s substantial oil production, a key player in the Middle Eastern energy sector. Major importers of Kuwaiti exports include South Korea, China, India, and Japan.

Kuwait, an Arab nation situated near the Persian Gulf, boasts a small population of around 2 million inhabitants and a land area of 17,820 square kilometers. Despite its modest size, its currency holds the title of the world’s most valuable. Kuwait is geographically positioned in a region marked by conflict and has experienced two wars within the last three decades. Its GDP in 2016 was approximately $110 billion USD, compared to Mexico’s $1.15 trillion USD.

Despite these factors, the Kuwaiti dinar holds the HVCU (High Value Custom Unit) designation in the currency market. It is uniquely positioned as the only currency unit capable of purchasing more than one unit of any other global currency.

Japanese Yen and the Essence of Stability

Despite its high price, the dinar isn’t commonly used in stock market transactions. Geopolitical instability and regional conflicts breed investor distrust. Investors typically favor currencies backed by reliable and stable economies. This is why the dollar and euro are international benchmarks. Why would investors opt for a currency from a volatile region when they can invest in the stability of dollars or euros?

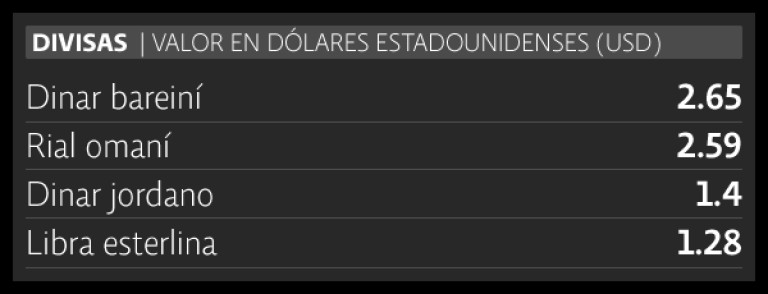

Similar to the Kuwaiti dinar, other currencies exhibit high values but lack international appeal. Consider the Bahraini dinar, the Omani rial, and the Jordanian dinar—all priced higher than the British pound sterling.

Currency exchange rate chart showing Euro and Dollar comparison

Currency exchange rate chart showing Euro and Dollar comparison

In contrast, the Japanese yen trades at a much lower value, approximately 112.80 yen per dollar. However, following the euro and the dollar, the yen is the third most utilized currency by investors globally. Japan’s economic stability and strength are paramount to its currency’s role in international finance.

When discussing currencies, it’s essential to distinguish between price and true value. While some currencies may command a higher price, the underlying value, driven by economic stability and global trust, dictates a currency’s true significance in the international financial landscape.