The euro stands as the second most traded currency worldwide as of 2022, wielding significant influence over the global economic landscape. For businesses and nations alike, it presents a robust alternative to the US dollar, fostering healthy competition and stability within the often-volatile foreign exchange markets. The euro’s strength is intrinsically linked to the eurozone, a powerful economic bloc comprising nations that have embraced the euro as their common currency. Understanding Where Are Euros Used is key to grasping its global impact.

For businesses operating within the eurozone, the advantages of a unified currency are clear. Trade becomes streamlined, eliminating complexities and costs associated with currency conversion. International businesses benefit from reduced exposure to exchange rate fluctuations when transacting in euros. A strong euro bolsters the European Union’s global standing, empowering it to champion its economic interests and play a pivotal role in shaping international financial regulations.

This guide will delve into the journey of the euro, from its inception to its widespread adoption, and pinpoint exactly where you can find the euro in use today.

A Brief History of the Euro

The euro is the official currency of the eurozone, encompassing 20 of the 27 member states within the European Union. The vision of a single European currency gained momentum with the Werner Report in 1970, though its initial ambition of a monetary union by 1980 was not realized. The Maastricht Treaty, a landmark agreement signed in 1992, formally laid out the criteria for adopting a single currency. Subsequently, in 1994, the European Monetary Institute was established to foster collaboration among EU central banks and pave the way for the European Central Bank (ECB) and the euro.

On January 1, 1999, the European Union marked a significant milestone by introducing the euro as an “invisible” currency, initially for electronic transactions and accounting purposes. National currencies remained in use for cash transactions during this transitional phase. However, on January 1, 2002, euro banknotes and coins entered circulation, replacing the former currencies of 12 member states in what remains the largest cash changeover in history. The legacy national currencies soon ceased to be legal tender.

The global financial crisis of 2008, followed by European debt crises, exposed vulnerabilities within the eurozone’s economic framework. In response, the EU implemented measures such as the European Stability Mechanism (ESM) to provide financial support and stability to member states facing financial challenges.

Despite these challenges, the eurozone continued to expand as new EU members successfully met the Maastricht economic criteria for entry. Slovenia joined in 2007, followed by Malta in 2008, Slovakia in 2009, Estonia in 2011, Latvia in 2014, and Lithuania in 2015. Croatia became the most recent addition, adopting the euro in 2023, further solidifying the euro’s reach across Europe.

The Global Importance of the Euro

- Trade Facilitation: The euro significantly simplifies trade both within the eurozone and with countries around the globe. By eliminating the complexities and costs of currency exchange, the euro fosters price transparency and lowers transaction expenses, making international commerce more efficient.

- Economic Integration Catalyst: The adoption of the euro has fostered greater alignment of economic policies and regulations among member states. This integration creates a more predictable and stable economic environment across Europe, which is highly conducive to business planning and long-term investments.

- Global Reserve Currency Status: The euro is recognized as a major global reserve currency, held by numerous central banks and financial institutions as part of their foreign exchange reserves. This status grants the euro considerable influence over global exchange rates and monetary policies, reflecting its importance in international finance.

- Influence on Global Markets: The eurozone’s monetary policy, steered by the ECB, exerts considerable influence on global financial markets. Decisions concerning interest rates or quantitative easing within the eurozone can trigger significant shifts in global capital flows, investment strategies, and broader economic conditions far beyond European borders.

- Promoting EU Cooperation: The euro serves as a potent symbol of European unity and shared identity. Its management necessitates close cooperation among member states, fostering regional political integration and stability, particularly crucial during periods of economic or political uncertainty.

- Attractive Investment Hub: The eurozone represents a vast and appealing market for investors worldwide. The euro provides investors with access to a large, integrated market, mitigating the risks associated with currency fluctuations that might otherwise exist between smaller, individual national markets, making it a more secure and attractive investment destination.

Countries Officially Using the Euro

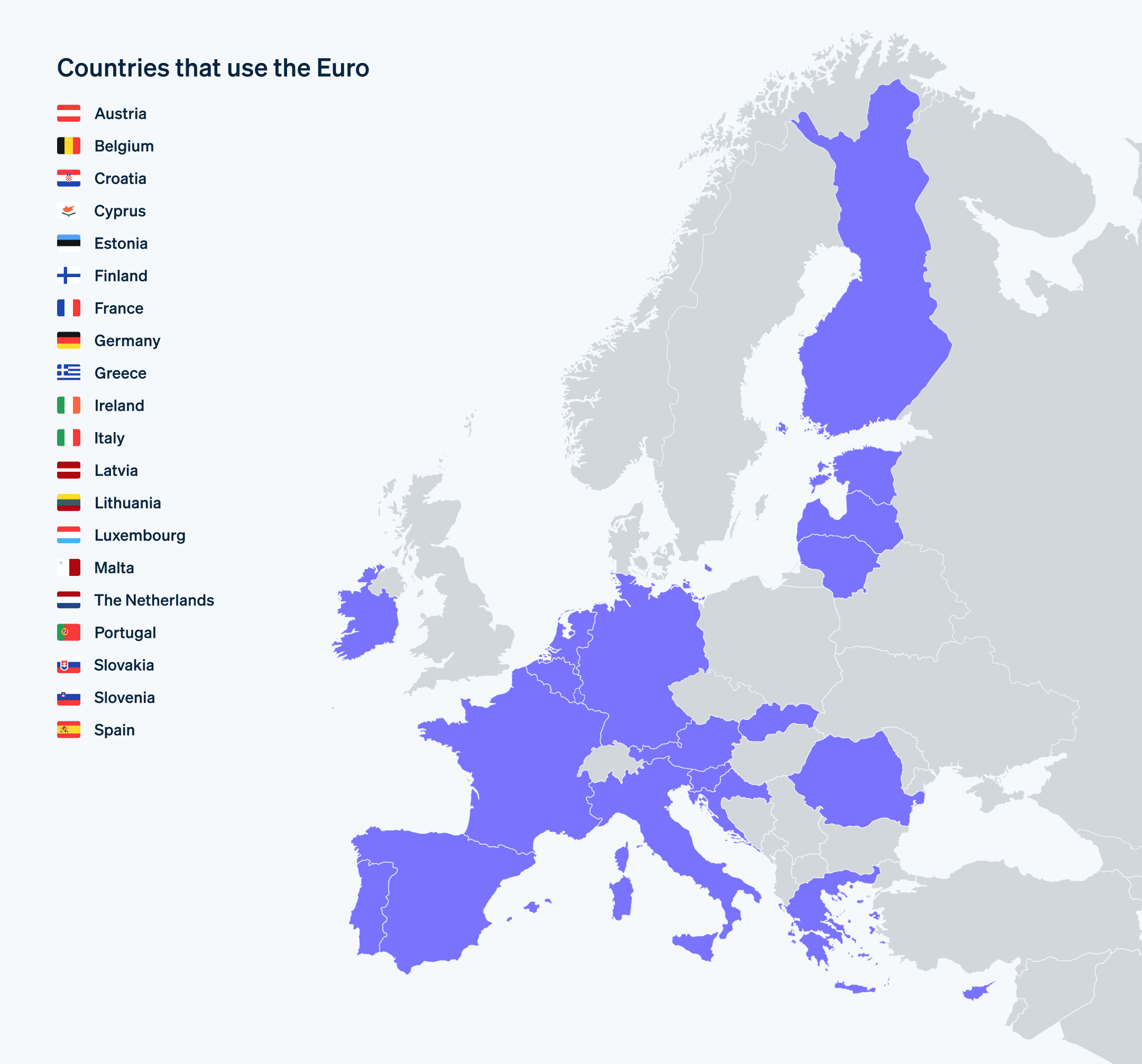

As of May 2024, the euro is the official currency in 20 European nations, used daily by approximately 341 million people. These countries collectively constitute the eurozone:

Austria, Belgium, Croatia, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Portugal, Slovakia, Slovenia, Spain.

Map highlighting countries that use the Euro, showcasing the Eurozone area

Map highlighting countries that use the Euro, showcasing the Eurozone area

Euro Usage Beyond the Eurozone

Beyond the EU member states, several microstates and city-states in Europe also utilize the euro, largely due to their close geographical and economic ties with eurozone countries. Furthermore, some countries that are candidates for EU membership have also adopted the euro. These areas include:

- Andorra: Andorra officially adopted the euro in 2002, solidifying its status as the national currency in 2011.

- Kosovo: Kosovo embraced the euro as its official currency in 2002.

- Monaco: Monaco adopted the euro as its official currency in 2002, further integrating its economy with Europe.

- Montenegro: Montenegro made the euro its official currency in 2002.

- San Marino: San Marino adopted the euro as its official currency in 2002, benefiting from its stability.

- Vatican City: Vatican City adopted the euro as its official currency in 2002, reflecting its close links with Italy and the eurozone.

In these territories, the euro facilitates seamless economic transactions and bolsters local economies by aligning them with a robust and stable currency, demonstrating the widespread reach and influence of the euro beyond the formal boundaries of the Eurozone.

Disclaimer: This article is intended for informational purposes only and does not constitute legal or financial advice.