Will the euro weaken further against the dollar, especially concerning the adoption of European drip irrigation products in the US? While short-term fluctuations are possible, further significant weakening beyond current levels is unlikely, with eurodripusa.net offering premium European drip irrigation solutions tailored to the American market. Our products ensure efficiency, water conservation, and cost-effectiveness, all critical for modern agriculture and gardening.

1. What Factors Influence the Euro’s Strength Against the Dollar?

Several factors influence the euro’s strength against the dollar. Interest rate differentials, central bank policies, and economic performance are primary drivers. Political events and energy prices can also significantly impact the exchange rate. Monitoring these factors is essential for understanding currency movements.

The euro’s strength against the dollar is influenced by a complex interplay of economic, financial, and geopolitical factors. Here are some of the key elements:

- Interest Rate Differentials: The interest rate policies of the European Central Bank (ECB) and the Federal Reserve (Fed) in the United States play a crucial role. Higher interest rates in the US tend to attract capital inflows, increasing demand for the dollar and strengthening it against the euro. Conversely, lower interest rates in the US can weaken the dollar.

- Central Bank Policies: Apart from interest rates, other policies adopted by central banks, such as quantitative easing (QE) or tightening, can influence currency values. For example, if the ECB engages in QE while the Fed does not, it could lead to a weaker euro.

- Economic Performance: The relative economic health of the Eurozone and the US is a significant determinant. Stronger economic growth in the US typically supports a stronger dollar, while stronger growth in the Eurozone supports the euro. Indicators such as GDP growth, employment rates, and inflation levels are closely watched.

- Political Stability and Events: Political uncertainty or instability in either the Eurozone or the US can impact currency values. Events such as elections, referendums, or political crises can lead to increased volatility and shifts in investor sentiment.

- Trade Balance: The balance of trade between the Eurozone and the US can also affect currency values. A trade surplus in the Eurozone (i.e., exports exceeding imports) can increase demand for the euro, strengthening it. Conversely, a trade deficit can weaken the euro.

- Market Sentiment and Investor Flows: Market sentiment and investor flows can significantly impact currency values, especially in the short term. Factors such as risk appetite, speculation, and safe-haven demand can drive currency movements.

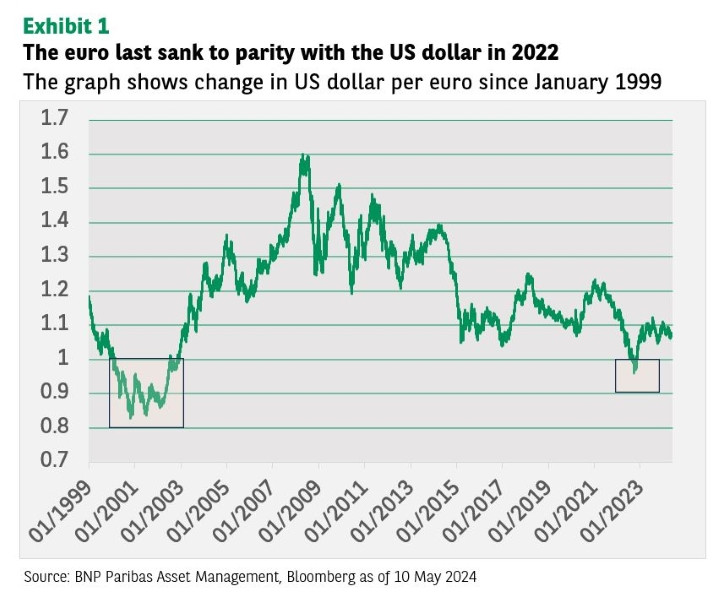

- Energy Prices: As seen in 2022, higher energy prices can significantly weaken the euro, particularly if the Eurozone is heavily reliant on energy imports. The US, being a net fossil fuel exporter, tends to benefit from higher energy prices, which can strengthen the dollar.

- Global Economic Conditions: Broad global economic trends and conditions can also influence the euro-dollar exchange rate. For example, a global economic slowdown can lead to increased demand for safe-haven currencies like the dollar, strengthening it.

Understanding these factors and their interplay is crucial for assessing the potential future movements of the euro against the dollar.

2. What is the Current Market Sentiment Regarding the Euro and the Dollar?

Current market sentiment suggests a strong consensus in favor of the dollar. However, this stretched positioning may limit further dollar strength. Market participants are closely watching economic data and central bank announcements for future direction.

The current market sentiment regarding the euro and the dollar is multifaceted, influenced by various economic indicators, central bank policies, and global events. Here’s a breakdown of the prevailing sentiment:

- Dollar Strength: Recent trends indicate a general preference for the dollar due to several factors. The US economy has shown resilience, with steady growth and a robust labor market. Expectations that the Federal Reserve (Fed) might delay interest rate cuts have further bolstered the dollar, as higher interest rates typically attract foreign investment.

- Euro Weakness: The euro, on the other hand, has faced headwinds. The Eurozone’s economic recovery has been slower compared to the US. Concerns about energy security, particularly reliance on imports, have also weighed on the euro. The European Central Bank (ECB) is expected to cut interest rates sooner than the Fed, adding downward pressure on the euro.

- Market Positioning: Market positioning plays a crucial role. There is evidence of a strong consensus in favor of the dollar, with many investors holding long positions (betting on the dollar to appreciate). This crowded positioning can limit further dollar strength, as there may be fewer new buyers to push the dollar higher.

- Economic Data: Market sentiment is heavily influenced by economic data releases. Strong US economic data, such as employment figures and GDP growth, tend to support the dollar. Conversely, weak Eurozone data can weaken the euro. Inflation figures are also critical, as they influence central bank policies.

- Central Bank Announcements: Central bank announcements regarding monetary policy are closely scrutinized. Any signals from the Fed that it may delay or reduce the extent of interest rate cuts can boost the dollar. Similarly, indications from the ECB that it will aggressively cut rates can weaken the euro.

- Geopolitical Factors: Geopolitical risks, such as trade tensions and political instability, can also impact market sentiment. In times of uncertainty, investors often seek safe-haven currencies like the dollar, increasing demand and driving up its value.

- Investor Expectations: Investor expectations about future economic conditions and policy changes are a key driver of market sentiment. These expectations are often reflected in currency forward rates and options markets, which provide insights into how investors are positioning themselves for future currency movements.

Overall, the current market sentiment is cautiously optimistic about the dollar while remaining wary of the euro’s prospects. However, market sentiment can change rapidly based on new information and events, so continuous monitoring is essential.

3. How Do Interest Rate Differentials Affect the EUR/USD Exchange Rate?

Interest rate differentials significantly impact the EUR/USD exchange rate. Widening differentials favoring the dollar tend to strengthen the dollar against the euro. Conversely, narrowing differentials can support the euro.

Interest rate differentials between the Eurozone and the United States are a primary driver of the EUR/USD exchange rate. Here’s how they affect the exchange rate:

- Capital Flows: Interest rate differentials influence capital flows between the two regions. When the US offers higher interest rates than the Eurozone, investors tend to move their capital to the US to take advantage of the higher returns. This increased demand for the dollar strengthens its value against the euro.

- Investment Attractiveness: Higher interest rates make the US a more attractive destination for foreign investment. This increased investment can lead to greater demand for the dollar, further boosting its value.

- Carry Trade: Interest rate differentials also drive carry trade activities. Investors borrow funds in a currency with low interest rates (like the euro) and invest in a currency with high interest rates (like the dollar). This activity increases demand for the higher-yielding currency, strengthening it.

- Central Bank Influence: The interest rate policies of the European Central Bank (ECB) and the Federal Reserve (Fed) directly impact these differentials. If the Fed raises interest rates while the ECB holds steady or cuts rates, the differential widens, favoring the dollar.

- Market Expectations: Market expectations about future interest rate changes are also crucial. If the market anticipates that the Fed will raise rates more aggressively than the ECB, the dollar can strengthen in anticipation of these changes.

- Economic Impact: Interest rate differentials can also reflect underlying economic conditions. Higher interest rates in the US may signal stronger economic growth or higher inflation, making the dollar more attractive to investors.

- Risk Sentiment: The impact of interest rate differentials can be influenced by risk sentiment. During times of economic uncertainty, investors may prefer the safety of the dollar, regardless of interest rate differentials, due to its status as a safe-haven currency.

- Exchange Rate Movements: The EUR/USD exchange rate typically adjusts to reflect these interest rate differentials. If the differential favors the dollar, the EUR/USD rate is likely to decline, indicating a weaker euro and a stronger dollar.

Understanding the dynamics of interest rate differentials is essential for predicting and interpreting movements in the EUR/USD exchange rate.

4. Is There Room for Further Central Bank Repricing Favoring the USD?

Limited scope exists for further central bank repricing favoring the USD. Markets have largely priced in expected rate cuts by both the ECB and the Fed. Significant policy shifts would be needed for additional impact.

The extent to which central banks can further influence the EUR/USD exchange rate through repricing is limited. Here’s why:

- Market Expectations: Financial markets have already priced in a significant amount of expected policy easing from both the European Central Bank (ECB) and the Federal Reserve (Fed). This means that much of the potential impact of interest rate cuts is already reflected in current exchange rates.

- Limited Policy Options: Both central banks have limited room to surprise the market. The ECB is expected to cut rates, but the extent and timing of these cuts are largely anticipated. Similarly, the Fed is expected to ease policy, but the market has already factored in these expectations.

- Asymmetric Responses: The impact of policy changes can be asymmetric. For example, if the ECB cuts rates more aggressively than expected, it could weaken the euro. However, if the Fed surprises with a more hawkish stance (i.e., fewer rate cuts), the dollar might not strengthen significantly due to concerns about economic growth.

- Global Context: Central bank actions are influenced by the global economic context. A coordinated global easing cycle could limit the impact of individual central bank policies on exchange rates.

- Quantitative Easing (QE): The potential for further quantitative easing (QE) is also limited. Both the ECB and the Fed have already engaged in large-scale asset purchases, and the effectiveness of additional QE is uncertain.

- Forward Guidance: Central banks use forward guidance to manage market expectations. If the ECB and the Fed continue to provide clear signals about their policy intentions, there will be less room for surprises and less impact on exchange rates.

- Real Interest Rates: Real interest rates (nominal rates adjusted for inflation) are also important. If inflation remains elevated, real interest rates might not fall significantly even with nominal rate cuts, limiting the impact on currency values.

- Market Positioning: Market positioning can also constrain the impact of central bank repricing. If investors are already heavily positioned for a weaker euro or a stronger dollar, there may be less room for further adjustments.

In summary, while central bank policies will continue to influence the EUR/USD exchange rate, the potential for significant repricing is limited due to market expectations, policy constraints, and global economic conditions.

5. How Does the Eurozone’s Economic Pickup Influence the EUR/USD Pair?

The Eurozone’s economic recovery can support the euro. If the Eurozone outperforms expectations, it could reduce pressure on the ECB to cut rates aggressively, potentially strengthening the euro against the dollar.

The Eurozone’s economic pickup has a significant impact on the EUR/USD exchange rate. Here’s how:

- Economic Growth: Stronger economic growth in the Eurozone boosts investor confidence in the euro. As the Eurozone economy improves, there is less downward pressure on the European Central Bank (ECB) to implement aggressive monetary easing policies.

- Inflation Dynamics: An improving Eurozone economy can lead to increased inflationary pressures. If inflation rises, the ECB may be less inclined to cut interest rates, which can support the euro.

- Trade Balance: An economic recovery often leads to increased trade activity. If the Eurozone’s exports increase, it can improve the trade balance, increasing demand for the euro and strengthening its value against the dollar.

- Investment Flows: Stronger economic growth in the Eurozone can attract foreign investment. This increased investment can lead to greater demand for the euro, further boosting its value.

- Market Sentiment: An improving economic outlook can improve market sentiment towards the euro. Positive news and data releases can encourage investors to take long positions in the euro, contributing to its appreciation.

- Policy Divergence: If the Eurozone’s economic recovery outpaces that of the United States, it could lead to a divergence in monetary policy. The ECB might adopt a more hawkish stance, while the Federal Reserve (Fed) might remain dovish, widening the interest rate differential in favor of the euro.

- Risk Appetite: An improving Eurozone economy can also increase global risk appetite. As investors become more willing to take on risk, they may shift away from safe-haven currencies like the dollar and move towards higher-yielding assets in the Eurozone.

- Exchange Rate Expectations: The perception of a recovering Eurozone economy can alter exchange rate expectations. If investors believe that the euro is undervalued, they may start buying the currency, contributing to its appreciation.

In summary, the Eurozone’s economic pickup can provide significant support to the euro, potentially leading to a stronger EUR/USD exchange rate. Monitoring economic indicators and policy responses is crucial for understanding these dynamics.

6. Is US Exceptionalism Fading, and How Does This Affect the Dollar?

The peak of US exceptionalism appears to be either close or behind us. This suggests that the US economy may not continue to outperform other major economies, potentially weakening the dollar as investors look for opportunities elsewhere.

The concept of US exceptionalism, which refers to the belief that the United States is unique and outperforms other nations economically, is showing signs of fading. This shift has implications for the dollar. Here’s how:

- Relative Performance: As other economies, particularly the Eurozone, begin to recover and show signs of growth, the relative outperformance of the US diminishes. This reduces the attractiveness of the dollar as investors look for opportunities in other markets.

- Investment Flows: When the US economy is perceived to be less exceptional, investors may diversify their portfolios by allocating funds to other regions. This can lead to a decrease in demand for the dollar, weakening its value.

- Interest Rate Dynamics: If the US economy slows down relative to other economies, the Federal Reserve (Fed) may be less inclined to raise interest rates or may even consider cutting them. This would reduce the interest rate advantage of the dollar, making it less attractive to foreign investors.

- Trade Balance: A decline in US exceptionalism can also impact the trade balance. If the US economy slows down, imports may decrease, but exports may not increase as much due to weaker global demand. This can lead to a wider trade deficit, putting downward pressure on the dollar.

- Market Sentiment: Market sentiment towards the dollar can deteriorate as US exceptionalism fades. Investors may become more cautious about holding dollar-denominated assets, leading to a decrease in demand and a weaker dollar.

- Policy Adjustments: The perception that US exceptionalism is waning can prompt policy adjustments. The US government may implement measures to stimulate economic growth, but these measures could also lead to increased government debt and inflation, potentially weakening the dollar.

- Global Rebalancing: The fading of US exceptionalism can contribute to a global rebalancing of economic power. As other economies grow and become more competitive, the dominance of the US in the global economy may decrease, leading to a more balanced distribution of economic activity and currency values.

- Currency Valuations: As US exceptionalism fades, currency valuations may adjust to reflect the new economic realities. The dollar, which may have been overvalued due to the perception of US outperformance, could depreciate to more sustainable levels.

In summary, the fading of US exceptionalism can have a significant impact on the dollar, leading to decreased investment, lower interest rates, and a weaker currency. Monitoring relative economic performance and policy responses is crucial for understanding these dynamics.

7. How Do High Energy Costs Influence the EUR/USD Exchange Rate?

High energy costs can significantly weaken the euro. The Eurozone’s reliance on energy imports means higher energy prices deteriorate its terms of trade, weighing heavily on the euro.

Eurozone terms of trade

Eurozone terms of trade

High energy costs can have a profound impact on the EUR/USD exchange rate due to the Eurozone’s reliance on energy imports. Here’s how:

- Terms of Trade: Higher energy prices deteriorate the Eurozone’s terms of trade. As the Eurozone imports a significant amount of its energy, increased energy costs lead to a higher import bill. This can result in a trade deficit, putting downward pressure on the euro.

- Inflation: Elevated energy prices contribute to higher inflation rates in the Eurozone. This can erode consumer purchasing power and reduce economic growth. To combat inflation, the European Central Bank (ECB) may need to tighten monetary policy, which can have mixed effects on the euro.

- Economic Growth: High energy costs can dampen economic growth in the Eurozone. Increased costs for businesses and consumers can lead to reduced investment and spending, slowing down economic activity.

- Competitiveness: Eurozone businesses may become less competitive compared to those in regions with lower energy costs. This can lead to decreased exports and a further deterioration of the trade balance.

- Currency Valuation: The perception that the Eurozone is vulnerable to high energy costs can lead to a negative sentiment towards the euro. Investors may become less willing to hold euro-denominated assets, leading to a depreciation of the currency.

- Safe-Haven Flows: During times of energy price shocks, investors may seek safe-haven currencies like the dollar. This increased demand for the dollar can further weaken the euro.

- Policy Responses: The Eurozone’s response to high energy costs can also influence the EUR/USD exchange rate. If the Eurozone implements effective policies to reduce its reliance on energy imports, it could improve investor confidence and support the euro.

- Monetary Policy: The ECB’s monetary policy response to high energy costs can have a significant impact. If the ECB tightens policy to combat inflation, it could support the euro. However, if it eases policy to support economic growth, it could weaken the currency.

In summary, high energy costs can significantly weaken the euro due to the Eurozone’s reliance on energy imports, leading to deteriorated terms of trade, higher inflation, and reduced economic growth. Monitoring energy prices and policy responses is crucial for understanding these dynamics.

8. Why is the Dollar Less Vulnerable to High Energy Prices?

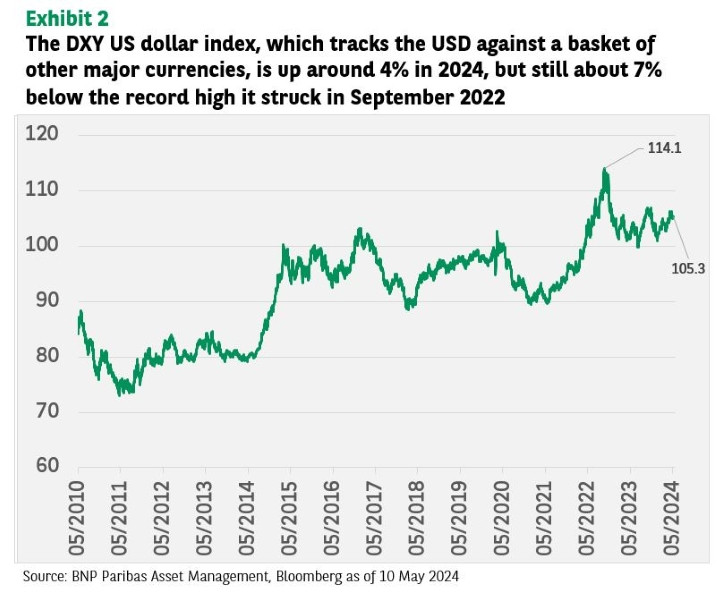

The US is now a net fossil fuel exporter, making it less vulnerable to higher energy prices. In fact, higher energy prices can benefit the USD as they improve the US trade balance.

DXY dollar index performance in 2024

DXY dollar index performance in 2024

The dollar is less vulnerable to high energy prices primarily because the United States has become a net exporter of fossil fuels. This shift has several implications:

- Trade Balance: As a net exporter of fossil fuels, the US benefits from higher energy prices. Increased exports of oil and gas lead to an improved trade balance, which can strengthen the dollar.

- Economic Growth: Higher energy prices can stimulate economic growth in the US energy sector. Increased investment and production can create jobs and boost economic activity.

- Inflation Hedge: The dollar can act as an inflation hedge during times of high energy prices. As energy prices rise, the value of US energy exports increases, providing support for the dollar.

- Currency Valuation: The perception that the US is less vulnerable to high energy prices can lead to a positive sentiment towards the dollar. Investors may become more willing to hold dollar-denominated assets, leading to an appreciation of the currency.

- Safe-Haven Flows: During times of energy price shocks, investors may seek the safety of the dollar due to the US’s position as a net energy exporter. This increased demand for the dollar can further strengthen its value.

- Policy Responses: The US government may implement policies to further boost domestic energy production, which can enhance the country’s energy independence and support the dollar.

- Monetary Policy: The Federal Reserve (Fed) may be less inclined to tighten monetary policy in response to high energy prices if the US economy is benefiting from increased energy exports. This can provide additional support for the dollar.

- Geopolitical Factors: The US’s position as a net energy exporter can enhance its geopolitical influence. This can lead to increased demand for the dollar as other countries rely on the US for their energy needs.

In summary, the dollar is less vulnerable to high energy prices due to the US’s status as a net exporter of fossil fuels, leading to improved trade balance, economic growth, and increased investor confidence. Monitoring energy prices and policy responses is crucial for understanding these dynamics.

9. What is the DXY Dollar Index, and What Does Its Performance Indicate?

The DXY dollar index tracks the USD against a basket of other major currencies. Its performance indicates the dollar’s overall strength. A rising DXY suggests a stronger dollar, while a falling DXY suggests a weaker dollar.

The DXY dollar index is a measure of the value of the U.S. dollar relative to a basket of six major currencies. It is widely used to gauge the overall strength of the dollar. Here’s what you need to know:

- Composition: The DXY includes the following currencies and their respective weights:

- Euro (EUR): 57.6%

- Japanese Yen (JPY): 13.6%

- British Pound (GBP): 11.9%

- Canadian Dollar (CAD): 9.1%

- Swedish Krona (SEK): 4.2%

- Swiss Franc (CHF): 3.6%

- Calculation: The DXY is calculated as a weighted geometric average of these currencies relative to the dollar. The weights reflect the relative importance of each currency in international trade.

- Interpretation: A rising DXY indicates that the dollar is strengthening against the basket of currencies, while a falling DXY indicates that the dollar is weakening. The index is often used as a benchmark for assessing the dollar’s performance.

- Factors Influencing the DXY: The DXY is influenced by various factors, including:

- Interest Rate Differentials: Changes in interest rate differentials between the U.S. and other countries can affect the DXY.

- Economic Data: Economic data releases, such as GDP growth, inflation, and employment figures, can impact the DXY.

- Geopolitical Events: Geopolitical events, such as trade tensions and political instability, can also influence the DXY.

- Market Sentiment: Market sentiment and investor flows can significantly impact the DXY.

- Performance: The DXY’s performance provides insights into the overall health and competitiveness of the U.S. economy. A strong DXY can indicate that the U.S. economy is outperforming other major economies.

- Limitations: The DXY has some limitations. It only includes six currencies, which may not fully represent the global currency market. Additionally, the fixed weights may not reflect changes in trade patterns over time.

- Alternative Indices: There are alternative dollar indices that include a broader range of currencies and use different weighting schemes. These indices may provide a more comprehensive view of the dollar’s performance.

In summary, the DXY dollar index is a widely used measure of the dollar’s strength relative to a basket of major currencies. Monitoring the DXY can provide valuable insights into the factors driving currency movements and the overall health of the U.S. economy.

10. How Can EurodripUSA Help Mitigate Risks Associated with Currency Fluctuations?

EurodripUSA offers stable pricing and long-term supply contracts, reducing the impact of currency fluctuations on your investment in European drip irrigation systems. Our expert team also provides tailored solutions to optimize water use and maximize ROI.

At EurodripUSA, we understand the challenges that currency fluctuations can pose for businesses investing in international products. That’s why we offer several strategies to help mitigate these risks and ensure a stable and predictable investment:

- Stable Pricing: We strive to maintain stable pricing on our European drip irrigation systems, even during periods of currency volatility. This helps our customers budget effectively and avoid unexpected cost increases.

- Long-Term Supply Contracts: We offer long-term supply contracts that lock in pricing for extended periods. This provides our customers with greater certainty and protection against currency fluctuations.

- Hedging Strategies: We employ various hedging strategies to minimize our exposure to currency risk. This allows us to maintain stable pricing for our customers, regardless of currency movements.

- Expert Guidance: Our team of experts provides guidance on currency risk management. We can help our customers understand the potential impact of currency fluctuations on their investments and develop strategies to mitigate these risks.

- Local Support: With a local presence in the USA, we provide timely and responsive support to our customers. This includes assistance with pricing, logistics, and technical support.

- Value-Added Solutions: Our European drip irrigation systems offer significant value in terms of water efficiency, crop yields, and reduced operating costs. These benefits can help offset any potential cost increases due to currency fluctuations.

- Customized Solutions: We work closely with our customers to develop customized drip irrigation solutions that meet their specific needs and budget requirements. This includes optimizing system design, selecting the right products, and providing training and support.

- Financial Solutions: We can also offer flexible financing options to help our customers manage their cash flow and make their investments more affordable.

By partnering with EurodripUSA, you can minimize the risks associated with currency fluctuations and ensure a stable and predictable investment in high-quality European drip irrigation systems. Our commitment to stable pricing, long-term supply contracts, and expert guidance will help you achieve your irrigation goals and maximize your return on investment.

FAQ: Euro and Dollar Exchange Rate

1. Will the Euro Weaken Further Against the Dollar in 2024?

While short-term fluctuations are possible, significant further weakening of the euro against the dollar is unlikely, given current market expectations and economic conditions.

2. What Economic Factors Could Cause the Euro to Weaken?

A significant increase in energy costs or a slowdown in Eurozone economic growth could cause the euro to weaken against the dollar.

3. How Do Interest Rate Decisions Affect the EUR/USD Exchange Rate?

Interest rate decisions by the ECB and the Fed significantly impact the EUR/USD exchange rate; higher US rates typically strengthen the dollar.

4. What Role Does the US Economy Play in the Dollar’s Strength?

The relative strength of the US economy compared to the Eurozone influences the dollar’s strength; outperformance supports the dollar.

5. Can Political Events Impact the Euro-Dollar Relationship?

Yes, political instability or major policy changes in either the Eurozone or the US can impact the euro-dollar exchange rate.

6. Is Investing in European Products Risky Due to Exchange Rates?

EurodripUSA mitigates this risk by offering stable pricing and long-term supply contracts, reducing the impact of currency fluctuations.

7. What Makes the US Dollar a Safe-Haven Currency?

The US dollar is considered a safe-haven currency due to the stability of the US economy and its global reserve currency status.

8. How Can I Stay Informed About EUR/USD Exchange Rate Trends?

Staying informed about economic data releases, central bank announcements, and geopolitical events can help track EUR/USD trends.

9. What is the Impact of Trade Balances on Currency Values?

A trade surplus in the Eurozone can strengthen the euro, while a trade deficit can weaken it; similar effects apply to the US dollar.

10. Where Can I Find Reliable European Drip Irrigation Systems in the USA?

You can find reliable European drip irrigation systems at eurodripusa.net, offering high-quality products and expert support.

Looking for reliable and efficient drip irrigation systems? Visit eurodripusa.net today to explore our range of European-quality products and solutions tailored for the American market. Contact us at +1 (530) 752-1011 or visit our Davis, CA location for expert advice and support. Address: 1 Shields Ave, Davis, CA 95616, United States.