The EURO STOXX 50® Index stands as the Eurozone’s premier blue-chip index, representing the region’s supersector leaders. This widely recognized benchmark offers a diversified and liquid portfolio, making it a cornerstone of the European equity market. The index operates with a weighting methodology based on free-float market capitalization, ensuring that no single constituent exceeds a 10 percent weight, thus promoting balance and diversification.

Euro STOXX 50 Index Display on Desktop

Euro STOXX 50 Index Display on Desktop

The significance of the Euro Stoxx 50 Index Companies is underscored by the substantial financial products linked to it. It underpins over 25 billion euros in ETF assets, demonstrating its importance for exchange-traded funds. Furthermore, the futures and options contracts based on this index are the most actively traded equity index derivatives on Eurex, highlighting its crucial role in the derivatives market. The index’s reach extends to structured products, with over 160,000 such products linked to the EURO STOXX 50, showcasing its broad adoption across various investment vehicles.

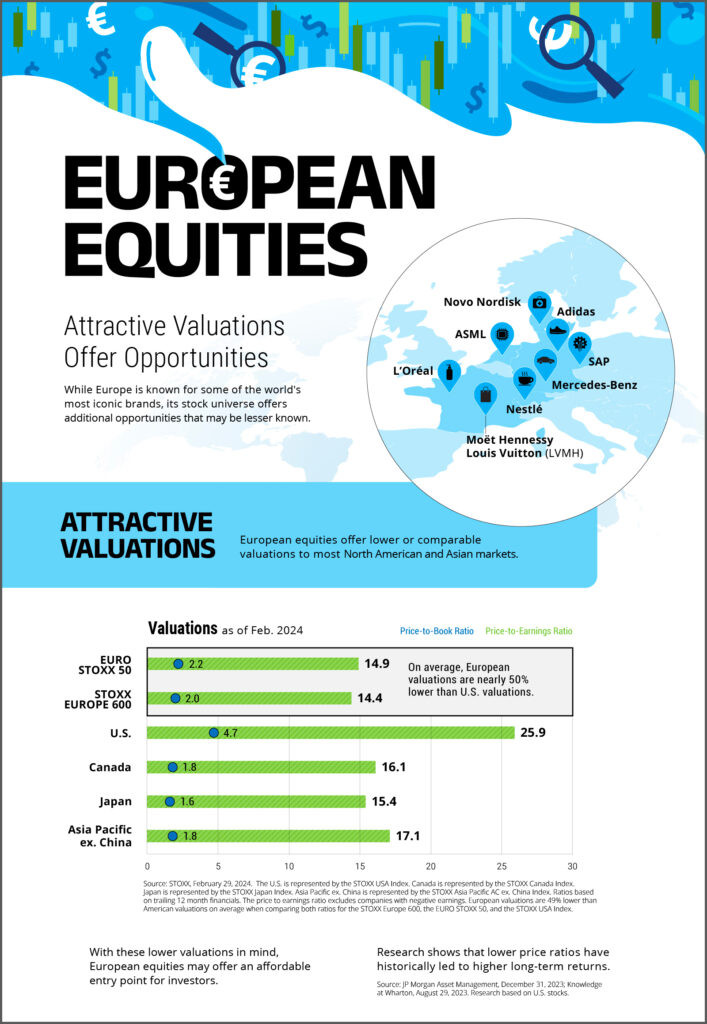

View full infographic

Infographic excerpt showcasing EURO STOXX 50 Index details and key benefits

Infographic excerpt showcasing EURO STOXX 50 Index details and key benefits

Key Benefits of Investing in EURO STOXX 50 Index Companies

Investing in products tracking the EURO STOXX 50 index offers several key advantages for investors looking at the European market.

Tradeability and Liquidity

The index composition is driven by liquidity, making it exceptionally tradeable. This characteristic is crucial for designing financial products and serves as a reliable benchmark for portfolio performance. The high liquidity ensures that investors can easily enter and exit positions, reducing transaction costs and enhancing investment flexibility.

Balanced Sector Representation

The EURO STOXX 50 provides a diversified representation across various sectors, classified by the Industry Classification Benchmark (ICB) supersectors. This balanced approach mitigates sector-specific risks and offers exposure to the leading companies across the Eurozone economy, from technology to consumer goods and energy.

Up-to-Date Market Relevance

To maintain its relevance and reflect current market dynamics, the index undergoes quarterly rebalancing and an annual review. Additionally, a fast-exit rule is in place to promptly remove companies that no longer meet the index criteria. These mechanisms ensure that the index remains current and accurately reflects the leading companies in the Eurozone.

Precision with Sub-Indices

For investors seeking more targeted exposure, the EURO STOXX 50 framework offers precise sub-indices. These include derivations that exclude financials or focus on single countries within the Eurozone, allowing for tailored investment strategies based on specific market views or sector preferences.

Sustainable Investing Options

Reflecting the growing importance of ESG considerations, the EURO STOXX 50® ESG Index provides a sustainable investment option. This ESG variant allows investors to adopt a responsible investment approach while still gaining exposure to the leading Eurozone companies, aligning financial goals with environmental, social, and governance principles.

Accessibility Through Financial Products

The EURO STOXX 50 index is highly accessible to investors through a wide array of existing financial products. These include ETFs, mutual funds, structured products, and derivatives, providing multiple avenues for investors to gain exposure to the performance of the top 50 Eurozone companies.

EURO STOXX 50 Index Details

| Metric | Value |

|---|---|

| Symbol | SX5E |

| Calculation | Realtime |

| Dissemination Period | 09:00-18:00 CET |

| ISIN | EU0009658145 |

| Bloomberg | SX5E Index |

| Last Value | 5,540.69 +77.15 (+1.41%) As of 05:50 pm CET |

| Week to Week Change | 1.59% |

| 52 Week Change | 12.78% |

| Year to Date Change | 12.66% |

| Daily Low | 5434.62 |

| Daily High | 5568.19 |

| 52 Week Low | 4571.6 — 5 Aug 2024 |

| 52 Week High | 5533.84 — 18 Feb 2025 |

Data Source

Factsheet Available

Top 10 EURO STOXX 50 Companies

The EURO STOXX 50 index comprises leading companies from across the Eurozone. The top 10 constituents, reflecting the index’s composition, are:

| Company | Country |

|---|---|

| ASML HLDG | NL |

| SAP | DE |

| LVMH MOET HENNESSY | FR |

| SIEMENS | DE |

| SCHNEIDER ELECTRIC | FR |

| TOTALENERGIES | FR |

| ALLIANZ | DE |

| DEUTSCHE TELEKOM | DE |

| SANOFI | FR |

| AIR LIQUIDE | FR |

These companies represent a diverse range of sectors and are key players in the European and global economies. Their inclusion in the EURO STOXX 50 underscores their significance and influence in the financial landscape.

Index Performance Over Time

The EURO STOXX 50’s performance can be viewed across various timeframes, providing insights into its historical trends and market behavior. Investors often analyze these charts to understand the index’s volatility, growth potential, and overall performance in response to different economic conditions. (Interactive chart data is available on financial platforms and data providers).

Zoom Options: 1D, 5D, 1W, 2W, 1M, 3M, 6M, YTD, 1Y, 3Y, 5Y, 10Y, All

Range: Low to High (Interactive range selection is available on financial platforms)

Featured Indices: (For further exploration of related indices, refer to the STOXX website)

Conclusion

The EURO STOXX 50 index companies represent the core of the Eurozone’s economy, offering investors a benchmark for blue-chip performance and a gateway to European equity markets. Its diversification, liquidity, and range of accessible investment products make it a vital component for portfolio construction and market analysis. Understanding the EURO STOXX 50 is essential for anyone looking to engage with the European stock market.

Data as of December 2023.

Source for structured products data: Structured Retail Products.