When you hear “Eurodollar,” you might immediately think about currency exchange rates between the Euro and the US Dollar. However, in the world of finance, Eurodollars represent something quite different and play a significant role in the global money market. This article delves into the Eurodollar market, explaining what it is, how it functions, and crucially, addresses the question of How Much Is A Euro Dollar in the context of bank funding and interest rates.

LSE_2015_eurodollar_cipriani_450_art

LSE_2015_eurodollar_cipriani_450_art

In essence, Eurodollars are US dollar deposits held in banks outside of the United States. Despite their name, they have less to do with Europe specifically today and more to do with dollar-denominated deposits held internationally. Originating after World War II in Europe, the Eurodollar market has evolved into a global phenomenon, with transactions occurring in major financial centers worldwide. Key players in this market include money market funds, corporations, foreign central banks, and various official institutions acting as lenders.

The US-Based Eurodollar Market Explained

While Eurodollars are defined by their offshore location, a substantial market operates within the United States, particularly in New York City. U.S.-based banks, including U.S. branches of Foreign Banking Organizations (FBOs), actively engage in Eurodollar borrowing. They achieve this by accepting Eurodollar deposits through their offshore branches, often located in the Caribbean (like the Bahamas and Cayman Islands), and then channeling these funds back into their U.S. operations. Although these transactions are officially booked offshore, the deals are typically negotiated by traders within the U.S., and the capital is frequently utilized to finance domestic activities.

Another avenue for U.S. banks to access Eurodollar deposits domestically is through International Banking Facilities (IBFs). However, the Eurodollar activity through Caribbean branches tends to be significantly larger than that of IBFs due to regulatory differences. IBFs face restrictions, such as limitations on accepting deposits solely from foreign institutions and specific conditions for foreign corporate depositors. In contrast, Caribbean branches of U.S. banks can accept deposits from both U.S. and foreign institutions and encounter fewer restrictions on foreign corporate deposits.

Interestingly, the regulatory landscape in the U.S. treats Eurodollars and federal funds in a similar vein. Federal funds, as per Regulation D, are exempt from reserve requirements. While the Federal Reserve possesses the authority to impose reserve requirements on net Eurodollar deposits of U.S.-based banks, they have maintained a zero reserve requirement since 1990. This effectively levels the playing field between Eurodollars and fed funds from a regulatory cost perspective. Consequently, U.S.-based banks view funding via fed funds and Eurodollars as closely interchangeable options. A key distinction, however, lies in accessibility: the fed funds market is limited to depository institutions, government-sponsored enterprises, and a select few eligible entities as lenders, while a broader spectrum of institutions can invest in Eurodollar deposits.

Understanding Eurodollar Rates and Market Volumes

The Federal Reserve diligently monitors the Eurodollar market due to its critical role as an overnight funding source for U.S. banks. Historically, the Fed has gathered fed funds data from U.S.-based brokers and expanded this to include Eurodollar data from the same brokers starting in 2010. Data from these brokers indicates that the overnight brokered Eurodollar market is substantially larger, approximately three to four times the size of the overnight brokered fed funds market. In the past year, the average daily volume of overnight Eurodollar borrowing through brokers has hovered around $140 billion, exhibiting remarkable stability throughout the days, except for quarter-end periods.

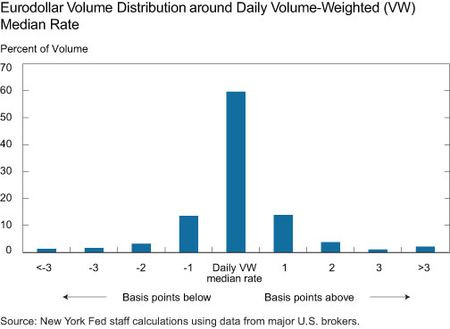

The distribution of Eurodollar borrowing rates reveals that most activity clusters tightly around the volume-weighted median rate, with over 80 percent of daily volumes transacting within a mere basis point. Unlike the fed funds market, where some institutions might borrow at rates considerably above the average, even surpassing the interest rate paid by the Fed on excess reserves, the Eurodollar market shows less dispersion. This difference likely stems from the limited access of smaller institutions to the Eurodollar market, leading them to rely on the fed funds market for interbank borrowing.

Eurodollar Volume Distribution-around Daily Volume-Weighted Median Rate

Eurodollar Volume Distribution-around Daily Volume-Weighted Median Rate

Image alt text: Distribution of Eurodollar trading volumes around the volume-weighted median rate, illustrating the concentration of trading activity.

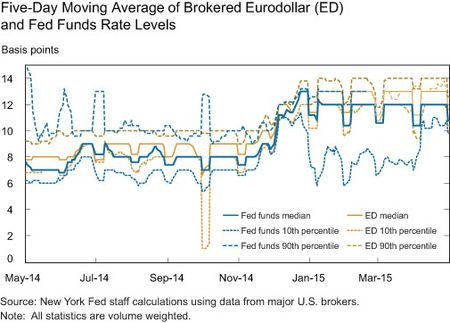

Given that Eurodollars and fed funds serve as close substitutes for funding, their rates, derived from brokered transaction data, typically exhibit a strong correlation. As illustrated in the chart below, overnight Eurodollar rates have recently been slightly elevated compared to fed funds rates. The volume-weighted median Eurodollar rate generally sits about one basis point higher than its fed funds counterpart. These minor rate differentials arise due to the distinct sets of borrowers and lenders active in each market. However, these differences can become more pronounced during periods of financial stress, such as the financial crisis.

Five-Day Moving Average of Brokered Eurodollar

Five-Day Moving Average of Brokered Eurodollar

Image alt text: Five-day moving average comparison of brokered Eurodollar and federal funds rates, highlighting their close tracking and slight recent divergence.

The Role of FR 2420 Data in Eurodollar Market Insight

In April 2014, the Federal Reserve initiated a new data collection, known as the FR 2420 Report of Selected Money Market Rates. This report gathers transaction-level data on borrowing in fed funds, Eurodollars, and certificates of deposit directly from the banks engaged in Eurodollar borrowing. This direct data collection encompasses both transactions facilitated by brokers and those negotiated bilaterally between counterparties. Currently, the FR 2420 captures a segment of U.S.-based Eurodollar deposits, specifically offshore borrowing by U.S. depository institutions, but it does not yet include data from U.S. branches of FBOs or IBFs.

To enhance the coverage of the Eurodollar market, the Fed has proposed revisions to the FR 2420 data collection. The proposed panel of banks for reporting would expand to include ninety-four U.S. depository institutions and seventy-eight FBO branches. Furthermore, U.S. branches of FBOs would be mandated to report Eurodollar borrowing by their offshore branches that they directly manage and control. All reporting institutions would also be required to incorporate Eurodollar borrowings of their IBFs. These anticipated enhancements to the FR 2420 data, expected to be implemented later in the year, promise to deliver a more comprehensive understanding of the U.S.-based Eurodollar market by capturing a larger share of Eurodollar activity.

The enhanced FR 2420 data is slated to be the foundation for a new overnight bank funding rate. This novel rate will boast a broader transaction base compared to the fed funds effective rate, as it will be calculated using both fed funds and U.S.-based Eurodollar transactions. Consequently, it will offer a more encompassing metric of overnight funding costs for U.S.-based banks, serving as a valuable complement to the fed funds rate.

In conclusion, while “how much is a euro dollar” might initially evoke thoughts of currency exchange, in the context of financial markets, it refers to the interest rates and costs associated with borrowing and lending in the Eurodollar market. This market is a vital source of funding for US banks, and understanding its dynamics, particularly the rates and volumes, is crucial for comprehending the broader landscape of bank funding and monetary policy implementation. The improved data collection through FR 2420 will provide even greater transparency and insight into this important market.

Disclaimer: The views expressed in this article are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Image alt text: Marco Cipriani, Research Officer at the Federal Reserve Bank of New York.

Image alt text: Julia Gouny, Policy and Market Analysis Manager at the Federal Reserve Bank of New York.